By

Stagwell’s Risk and Reputation Unit

Welcome to the RiskRep Radar, a biweekly newsletter from Stagwell’s Risk and Reputation Unit leaders on what brands need to know at the intersection of business and politics. Every edition will feature key data and news roundups with early access to Risk and Rep Unit-led polling when available.

Live from CES: When Should Brands Speak Out?

The pendulum has swung back around. Five years ago, brands were encouraged to speak out a lot, but now C-suites are asking whether they should retrench and stay out of politics.

Ray Day and John Gerzema from the Risk and Reputation Unit were at CES 2024 talking to CCOs about how companies should navigate the political cycle, stick to their values and avoid dividing their audience. Watch their Content Studio interview for their advice.

Toxic Words and Acronyms

Words matter and today acronyms are the main troublemakers. That’s according to the Harris Poll’s first-of-its-kind assessment of the most commonly used words in business and not what they mean, but how they’re interpreted. Highlights from the results, which were featured in Axios Communicators:

- 49% of Americans find “ESG” a divisive term

- 38% find “DEI” divisive

- ESG is nearly twice as polarizing a term as “sustainability”

- The top three most divisive terms were “cancel culture” (78%), “woke” (66%) and “underrepresented” (62%)

The key takeaway: Businesses should remain committed to diversity efforts, which other Harris Poll data shows commands overwhelming support – but avoid the acronyms, which have become overly politicized.

Reputation Case Study: Boeing’s Latest Mishap

Stagwell CEO Mark Penn’s Harvard Business Review piece last month dove into the increasing severity of corporate crises that are centered on politics rather than competence or governance issues. That article featured Boeing as a company that successfully navigated the Crisis U: its reputation took a hit after multiple 737 Max crashes, but it recovered within 2-3 years by proving its core competency. Now after the terrifying 737 Max 9 incident earlier this month, Boeing will have to win back people’s trust all over again.

Mark Your Calendar: February Risk & Rep Webinar

The Risk and Reputation Unit will be releasing a steady stream of content throughout 2024 to prepare brands for the contentious election cycle. In addition to our biweekly newsletters, stay tuned for our monthly webinar series: 30-minute deep dives for communication leaders into key topics from employee activists to misinformation to geopolitics.

To RSVP to our first webinar on Thursday, February 22, 12:00-12:30 pm EST, email Alexis Williams.

ICYMI: Risk and Reputation Unit in the News

Related

Articles

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Augmented Reality

Apr 25, 2024

Playfully Navigating the Google Booth at CES

Google partnered with Left Field Labs to blend its physical…

Newsletter

Sign Up

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from Stagwell. Among the highlights of our weekly consumer sentiment tracking:

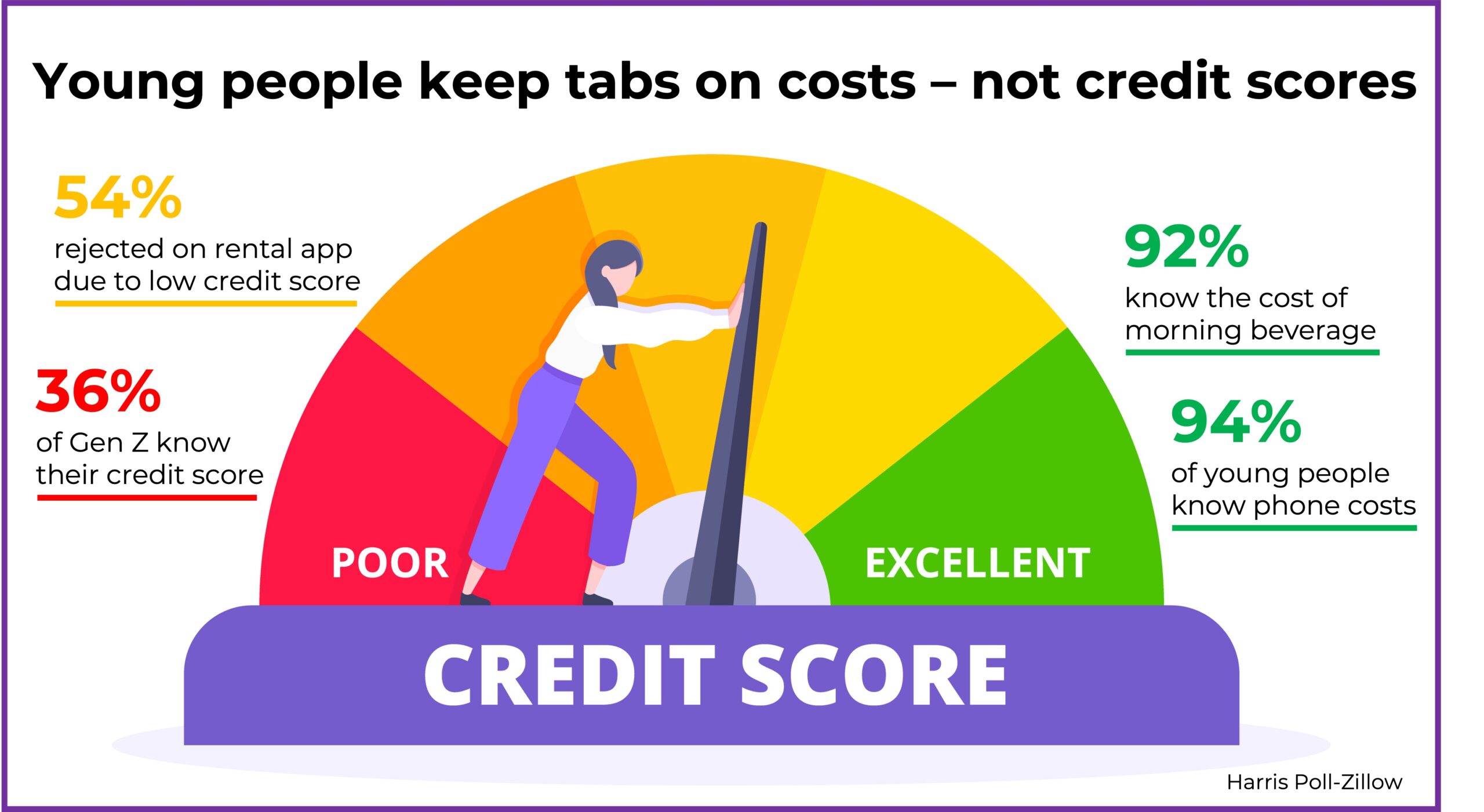

MOST YOUNG PEOPLE DON’T KNOW THEIR CREDIT SCORE

A lack of credit score awareness among young people is a barrier to achieving their financial goals, according to our Harris Poll survey with Zillow.

- Gen Z (23%) and Millennials (35%) are pivotal players in the rental market.

- Yet 54% of Gen Z and Millennial renters report a rental application being denied due to a low credit score – and many are surprised.

- 94% of Gen Z and Millennial renters feel confident they know their monthly cell phone bill, 93% know their favorite streaming service’s subscription cost, and 92% know the price of their regular morning beverage.

- Only 45% are “very confident” they know their credit score – 36% among Gen Z and 49% among Millennial renters.

COMMS LEADERS WORRY ABOUT GEOPOLITICS, POLARIZATION, MISINFORMATION

New surveys by the Harris Poll and Page identify geopolitics as the primary risk to business in the year ahead, closely followed by concerns about political polarization – as well as key areas of focus for business leaders to tackle in 2024.

- In a survey of chief communications officers across North America, Europe and the Middle East, 45% highlighted international conflicts and elections as the paramount critical risk demanding businesses’ attention in 2024.

- 32% express concerns about political polarization.

- 14% cite mis/disinformation and employee issues as areas of significant apprehension.

- Another global survey with The Harris Poll focused on consumer perceptions about confidence in businesses.

- 80% say it is crucial for companies to address seven key issues in the year ahead: economic growth, job creation or skill development, environmental concerns, corruption, mental health, income inequality and trust in key societal institutions.

- At the same time, the confidence in companies’ ability to make a positive impact on these issues is in question, with only 56% expressing faith in responsible business practices.

- Economic growth, job creation and workplace skills development garnered the highest public confidence (60%) compared with issues like corruption (50%).

- Environmental issues (59%) and mental health (56%) are viewed as the top business opportunities, suggesting potential areas for businesses to focus their efforts and build public trust.

TAYLOR SWIFT DRIVES FEMALE INTEREST IN NFL

Women make up nearly half (46%) of the NFL’s growing fanbase – and we can thank Taylor Swift, in part, according to Harris Poll data.

- Young women’s (Millennial and Gen Z adults) interest in the NFL jumped after Taylor Swift took an interest in the game last September.

- At the end of December, NFL interest among young women reached 46.6. This is up from 37.0 a year earlier.

NEW PRIVACY RULES IN EUROPE

On March 6, the European Union’s Digital Markets Act (DMA) goes into effect. Similar to 2018’s GDPR (General Data Protection Regulation), it has important consequences for businesses doing marketing and advertising.

- Stagwell’s Assembly has created the Privacy Solutions Handbook to help companies navigate the road ahead and understand how Google is changing its services to accommodate the DMA.

ICYMI

In case you missed it, check out some of the thought-leadership and happenings around Stagwell making news:

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud, Talent & Awards

May 06, 2024

PRophet, a Stagwell (STGW) Company, Takes Home Two Big Wins at the 2024 Innovation SABRE Awards and 28th Annual Webby Awards

PRophet's AI-driven platform clinches two prestigious awards for innovation and…

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Newsletter

Sign Up

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from Stagwell. Among the highlights of our weekly consumer sentiment tracking:

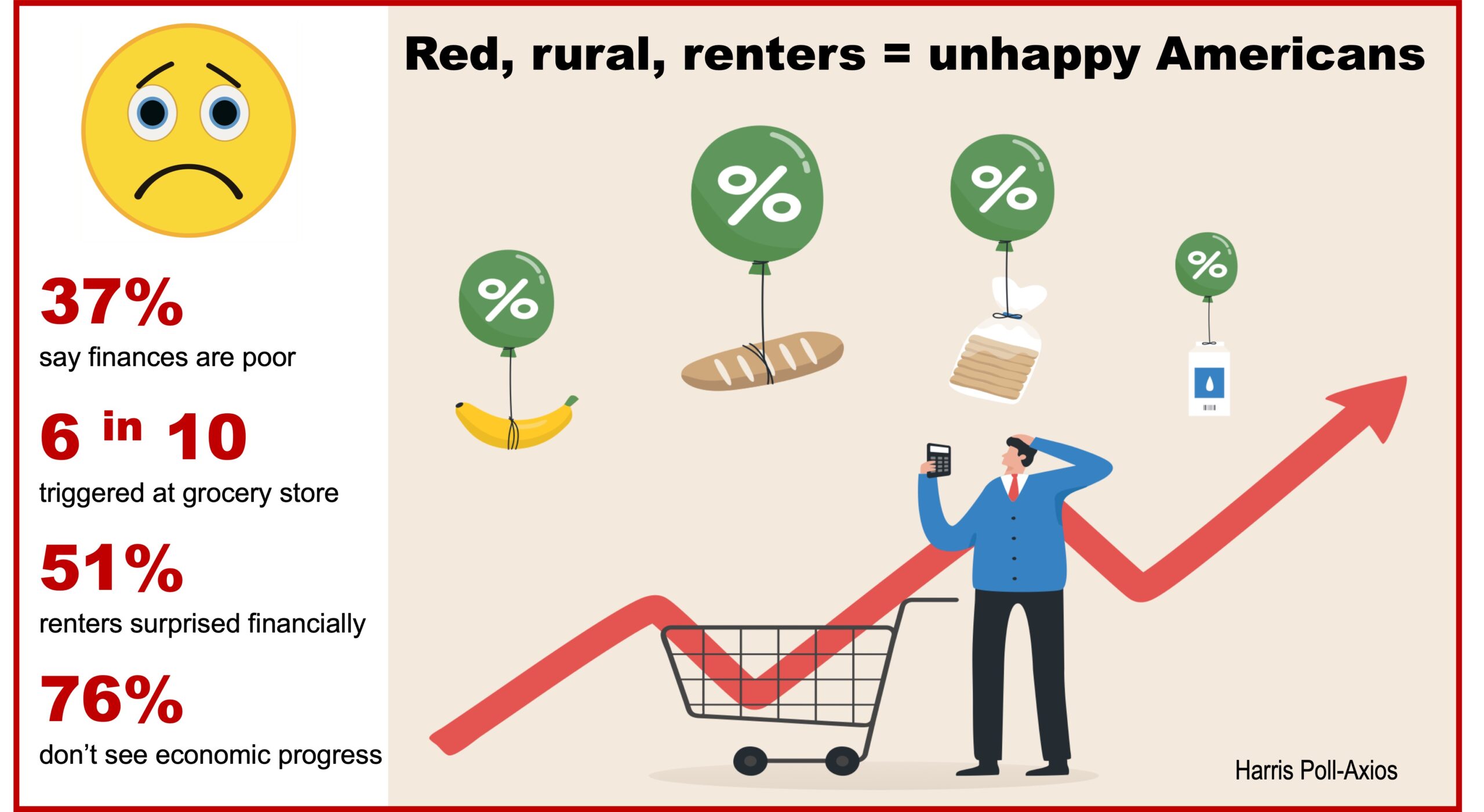

RED, RURAL AND RENTING = ☹

Republicans, rural residents, renters, women and singles are the most unhappy Americans financially, according to our Harris Poll survey with Axios.

- While inflation dipped in recent months, it remains top of mind for Americans – with 6 in 10 saying they are “triggered” by trips to the grocery store.

- 37% of Americans rate their financial situation as poor – 42% for Republicans, 43% for women, 46% for rural residents, 47% for singles and 57% for renters.

- In comparison, 32% of respondents in relationships and 28% of Democrats say their financial situation is poor.

- 25% of Americans say they’re falling behind financially, compared with 30% of women and Republicans, 33% of rural residents and 36% of renters.

- 41% of Americans say their finances are worse today than they would have predicted if asked pre-COVID to imagine the future. That climbs to 51% for renters, 53% for rural residents and 55% for Republicans.

- Grocery purchases (72%) are the top way Americans say they feel inflation in their daily lives, followed by gas prices (56%).

- 88% say “gas, groceries and housing costs – not stocks – are the real economic indicators I care about.”

- 76% – climbing to 82% of Republican and Hispanic respondents – believe “economists say things are getting better, but we’re not feeling it where I live.”

HIRING BOOST IN NEXT 6 MONTHS

Employers are ringing in the new year with an optimistic hiring outlook and plan to increase their employee count in the first half of 2024, according to our Harris Poll survey with Express Employment Professionals.

- 79% of U.S. hiring managers feel positive about employment opportunities at their companies this year.

- 63% say their company plans to increase the number of employees through June 30 – continuing a positive trajectory now reaching its highest point since the survey began in 2020.

- The need for hiring stems from increased work volume (51%), filling newly created positions (45%) and employee turnover (43%).

- Some companies are looking for ways to avoid hiring, such as training and promoting from within. In fact, 71% of hiring managers say they would prefer to reskill current employees for new roles than hire new.

QUIET QUITTING TURNS INTO QUIET SHOPPING

Young professional women are taking quiet quitting to the next level with “quiet shopping,” according to our Harris Poll survey with Rakuten.

- Nearly 30% of women say they find themselves shopping online between 1 and 5 p.m. – in the middle of the workday.

- 41% of Gen Z women admit to quiet shopping, compared with 24% of Millennial women and 23% of Gen X women.

- Social media has played a part in accelerating quiet shopping, especially TikTok Shop and Instagram Shopping.

- Finding shopping recommendations online is top of mind for 30% percent of women overall – 40% for Gen Z women, 34% for Millennial women and 23% for Gen X women.

VIEWS FROM CES

Several of our Stagwell experts and leaders have been on the ground this week at CES in Las Vegas. Check out their insights:

- Harris Poll Live From The Floor At CES 2024

- Stagwell launches SmartAssets AI tool at CES

- Stagwell Content Studios talks with leaders about trends at CES

ICYMI

In case you missed it, check out some of the thought-leadership and happenings around Stagwell making news:

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud, Talent & Awards

May 06, 2024

PRophet, a Stagwell (STGW) Company, Takes Home Two Big Wins at the 2024 Innovation SABRE Awards and 28th Annual Webby Awards

PRophet's AI-driven platform clinches two prestigious awards for innovation and…

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Newsletter

Sign Up

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from Stagwell. Among the highlights of our weekly consumer sentiment tracking:

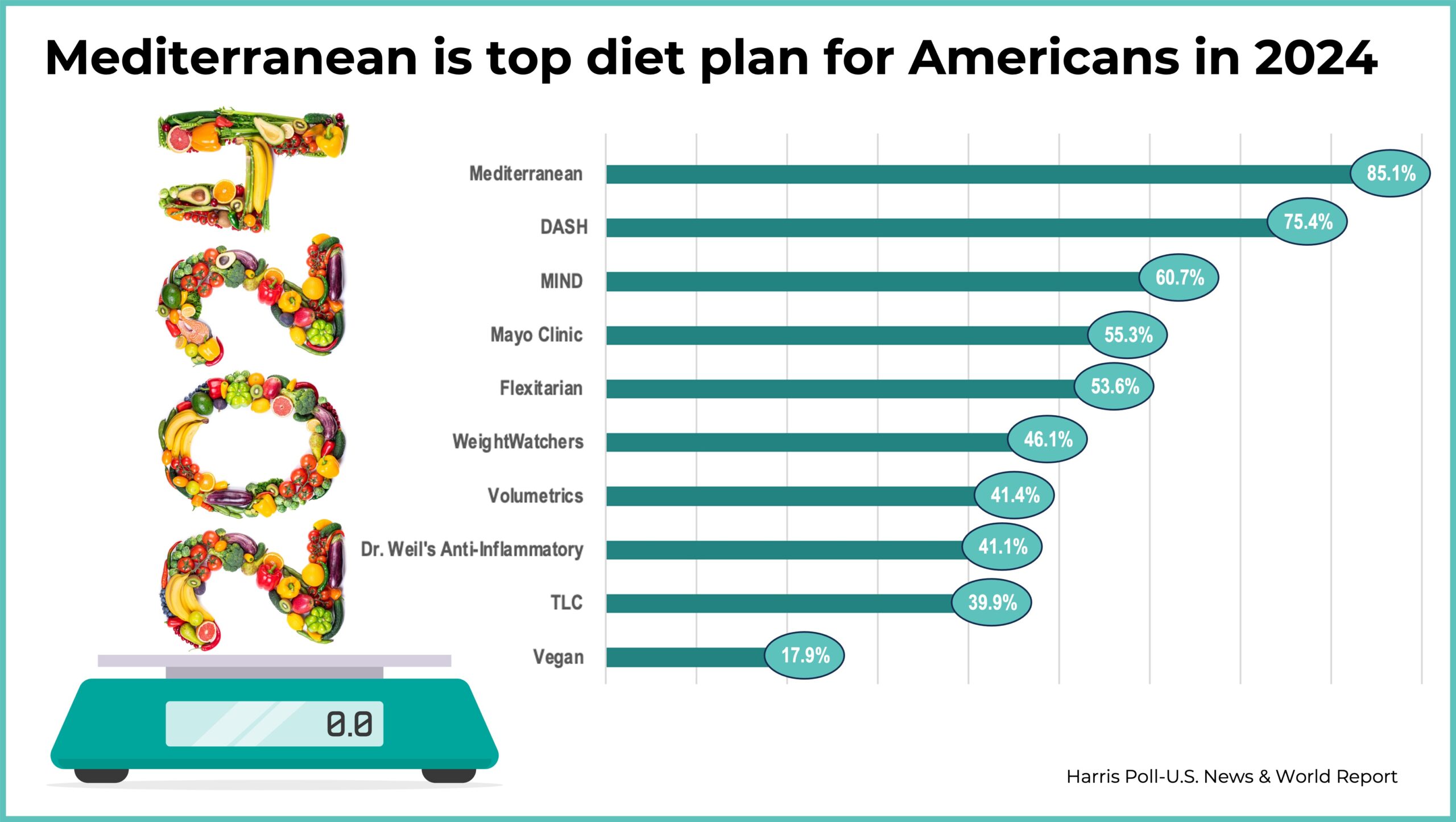

BEST DIETS FOR 2024

The Mediterranean diet remains the favorite health plan for 2024, according to our new Harris Poll survey with U.S. News & World Report.

- For the seventh consecutive year, the Mediterranean diet (85.1% in popularity) takes the No. 1 spot with its focus on diet quality rather than a single nutrient or food group and a daily consumption of fruits, vegetables, whole grains, beans, nuts, legumes, olive oil, herbs and spices.

- Rounding out the top 10 are the DASH diet (75.4%), MIND diet (60.7%), Mayo Clinic diet (55.3%), Flexitarian diet (53.6%), WeightWatchers (46.1%), Volumetrics diet (41.4%), Dr. Weil’s Anti-Inflammatory diet (41.1%), TLC diet (39.9%) and Vegan diet (17.9%).

- Six newly evaluated diets make the list this year: Vegan diet, Dukan diet, Herbalife Nutrition, HMR Program, Profile Plan and Plantstrong.

FUTURE OF TRANSPORTATION

The next decade will mark significant changes in the transportation experience – from driverless cars to better urban transit – according to our Harris Poll study with MITRE.

- 40% of Americans believe their transportation experience will improve in the next 10 years, with 23% saying it will get worse.

- When thinking about the future of transportation, 90% want to see improved safety, 83% lower costs, 79% better data privacy, 78% more predictability and 77% environmental sustainability.

- Boomers (62%) rate safety as the highest priority for transportation improvements, while Gen X (47%) cites cost as the top priority.

- 85% of Gen Z believe it is important to increase environmental sustainability during the next 10 years – 11 points higher than other generations.

- At the same time, Gen Z is the most skeptical about the role of AI and automation in transportation (40% for Gen Z versus 27% of others who say AI will have a detrimental impact).

- 40% of Americans expect to use driverless cars, taxis, ridesharing vehicles and delivery vehicles in their lifetime.

- 60% expect to use driverless taxis in urban areas.

JOB HUNTERS WANT BALANCE VERSUS A TITLE

As we head into the new year, job seekers are putting more focus on personal fulfillment and work-life balance, according to our Harris Poll survey with Express Employment Professionals.

- 83% of job seekers say it’s more important to have a meaningful job than a high-level job title.

- 80% define success more by work-life balance than climbing the corporate ladder.

- Hiring managers appear to agree, with 85% saying it’s more important for workers to have a meaningful job than a high-level job title.

- 84% of hiring managers say employees now define success by work-life balance rather than climbing the ladder – especially compared with three years ago.

8 QUALITIES AMERICANS WANT FROM LEADERS

Americans today feel that good leaders are in short supply and that modern leadership begins and ends with trust, based on our Harris Poll survey with U.S. News & World Report.

- 86% of Americans are “largely disappointed” by leaders in society today.

- 72% said political leaders aren’t trustworthy.

- When asked how “leaders can earn trust,” more than 1,000 Americans responded and ranked their advice for leaders:

- Be Honest

- Put People First

- Be Transparent and Communicate

- Be Reliable

- Be a Team Player

- Take Action and Get Results

- Show Some Ethics

- Be Respectful

READY TO TALK REPUTATION AND RISK AT CES?

We have spent a lot of time focusing on risk and reputation in 2023, and Stagwell has been sharing what we’re seeing through our expanded crisis team. This includes addressing when companies should speak out, the role of corporate purpose today and the major wedge issues to expect during the 2024 U.S. election cycle.

- As a next step in sharing our research and insights, we are continuing the reputation and risk discussion at CES on Wednesday, Jan. 10.

- Let us know if you would like to be included by reaching out at ces2024@stagwellglobal.com.

ICYMI

In case you missed it, check out some of the thought-leadership and happenings around Stagwell making news:

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud, Talent & Awards

May 06, 2024

PRophet, a Stagwell (STGW) Company, Takes Home Two Big Wins at the 2024 Innovation SABRE Awards and 28th Annual Webby Awards

PRophet's AI-driven platform clinches two prestigious awards for innovation and…

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Newsletter

Sign Up

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from Stagwell. Among the highlights of our weekly consumer sentiment tracking:

2 IN 5 STILL FINISHING HOLIDAY SHOPPING

Holiday shopping is in the home-stretch – and this weekend’s Super Saturday is expected to be a banner day. What are we buying? Clothing and accessories are at the top, followed closely by gift cards, according to our Harris Poll survey with Retail Brew.

- Among shoppers polled this past week, 2 in 5 still were shopping for all or most of their gifts.

- What are they shopping for? Clothes and accessories are at top (60%), followed by gift cards (58%), toys (44%), personal care and beauty items (38%), electronics (37%), books, video games and media (36%), and food and beverages (35%).

- The people who procrastinated rely on retailers’ websites (63%), directly from brands (43%) and social media (31%).

- Overall this season, 19% said they exclusively shopped online, and 8% only shopped in stores.

ECONOMIC VIEW DIPS BACK

Americans are slightly more negative on the economy and its outlook versus a month ago, according to our most recent poll with the Center for American Political Studies at Harvard University.

- 32% say the country is on the right track (down from 35% a month ago), and 33% say the economy is on the right track (down from 35% a month ago).

- A third of the country (33%, up 3 points from the prior month) list price increases and inflation as the country’s top issue, followed by immigration (28%, up 3 points), economy and jobs (23%), guns (18%) and crime and drugs (18%). Concerns about the Israel-Hamas conflict is at 7%, down 5 points from the prior month.

2023’S TOP SURVEY TRENDS

From a boom in pre-nuptial agreements and tuning out news coverage for mental health to the significant rise in the influence of grandmothers, Americans voted with their voices, actions and opinions in 2023.

- The Harris Poll looked at the top 12 research trends this year at this link.

- Stagwell’s National Research Group – in the spirit of the new year and unpacking “What’s NEXT” – contextualized some of the existential questions at the cultural forefront at this link.

READY TO TALK REPUTATION AND RISK AT CES?

We have spent a lot of time focusing on risk and reputation this year, and Stagwell has been sharing what we’re seeing through our expanded crisis team. This includes addressing when companies should speak out, the role of corporate purpose today and the major wedge issues to expect during the 2024 U.S. election cycle.

- As a next step in sharing our research and insights, we are continuing the reputation and risk discussion at CES on Wednesday, Jan. 10.

- Let us know if you would like to be included by reaching out at ces2024@stagwellglobal.com.

ICYMI

In case you missed it, check out some of the thought-leadership and happenings around Stagwell making news:

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud, Talent & Awards

May 06, 2024

PRophet, a Stagwell (STGW) Company, Takes Home Two Big Wins at the 2024 Innovation SABRE Awards and 28th Annual Webby Awards

PRophet's AI-driven platform clinches two prestigious awards for innovation and…

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Newsletter

Sign Up

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from Stagwell. Among the highlights of our weekly consumer sentiment tracking:

LOSS OF FAITH IN UNIVERSITY LEADERS

Americans are experiencing a crisis of faith in college and university leaders amid a volatile moment for the higher education sector – with more than half not trusting them to do the right thing for students, according to our Harris Poll research with U.S. News & World Report.

- 80% of Americans say that higher education institutions are more worried about their endowment than creating leaders of tomorrow.

- 60% believe they prioritize donors, the press and other external factors over students.

- 60% believe higher education leaders are failing students rather than developing them and that one of the barriers is that they themselves aren’t good examples of leaders.

- 80% believe that, if colleges and universities don’t become more accessible to all people and emphasize diversity, the leaders of tomorrow will all be the same.

- In a separate Harris Poll survey, 60% of Americans would fire university leaders for poor leadership amid the Israel-Hamas conflict.

SOCIAL MEDIA IS HOW AMERICA GETS ITS NEWS

Two thirds of Americans use social media to get their daily news – and not just young people, according to our Harris Poll.

- 66% of Americans have used social media to seek out news and information.

- Social media as a news source is highest among Gen Z (82%) yet nearly just as high for Millennials (78%) and Gen X (72%) (versus Boomers at 44%).

- YouTube (62%) and Facebook (60%) are the most frequently used platforms for news and information, followed by Instagram (44%), TikTok (39%) and X (35%).

- While trust is highest in YouTube (24%) and Facebook (18%), it is low across the board.

MUSHROOMS WILL BE BIG IN 2024

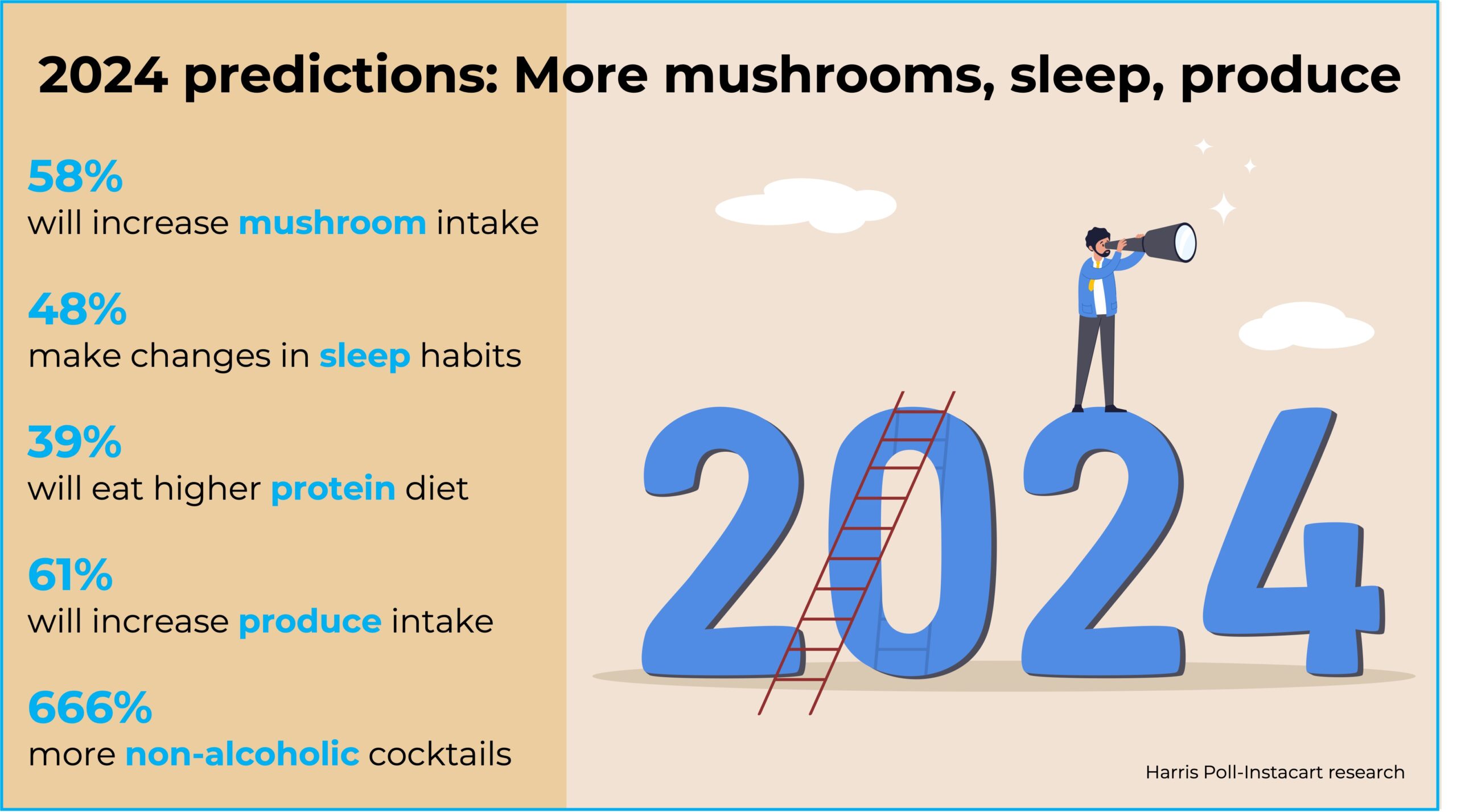

Among the top predictions for 2024 are a mushroom boom, a boost in produce choices, a higher protein intake and drinking in moderation. That’s according to our Harris Poll research with Instacart. The top five predictions:

- More people will realize the health benefits of mushrooms: 40% of Americans are aware that consuming fresh mushrooms and mushroom supplements can improve cognitive function, and 58% express their likelihood to consume mushroom supplements and increase their mushroom intake to reap these health benefits.

- People will put a premium on sleep health: 48% of Americans want to make changes to their sleep habits and quality in the new year. On Instacart’s platform, the share of carts containing magnesium supplements is up 19%, sleep masks increased 56%, and sleep and sound machines jumped 134%. In parallel, 33% will improve sleep habits by reducing caffeine intake and/or consuming gentler types of caffeine, such as matcha (which grew 20% in Instacarts in the past year).

- Higher protein intake is on the rise: Of those who plan to make dietary changes in the new year, 39% want to eat a higher protein diet. This includes cottage cheese (up 8% in carts), Greek and Icelandic yogurt (up 3%), protein drinks (up 10% in carts) and meat jerky (up 16% in carts).

- Produce is more popular than ever: Prepare to witness a shift in people not just aiming to eat more produce but actively embracing a diverse and colorful array of fruits and vegetables. In 2024, 61% plan to increase their fresh produce intake. New to the shopping list: red dragonfruit (+201% growth), yellow passionfruit (+201%), mangosteen (+158%), Mayan melons (+31%), microgreens (+50%), broccoli sprouts (+32%), purple broccoli (+32%) and purple asparagus (+18%).

- Alcohol moderation becomes a movement: We’ve already witnessed the popularity of drinks without booze – with the share of Instacarts containing non-alcoholic cocktails growing 666%. In 2024, expect to see people embrace drinking in moderation by restricting alcohol consumption to weekends or one to two days a week. Also, look for continued growth in liver support supplements (+ 114%) and electrolyte drink powder (+19%).

ICYMI

In case you missed it, check out some of the thought-leadership and happenings around Stagwell making news:

- Corporate Crises — and Reputational Recovery — Have Changed

- Americans Are Down on Society’s Leaders – Especially in Politics

- Most HR pros see disconnect between their job title and the actual work they do

- 55% of U.S. Adults Plan to Prioritize Travel Over Other Luxuries Despite Economic Uncertainty

- 3 Harris Poll strategies to capitalize on shopping preferences of boomers, Gen X, millennials and Gen Z

- How Agencies Stand Out Amid Clients’ Interest in AI Capabilities

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud, Talent & Awards

May 06, 2024

PRophet, a Stagwell (STGW) Company, Takes Home Two Big Wins at the 2024 Innovation SABRE Awards and 28th Annual Webby Awards

PRophet's AI-driven platform clinches two prestigious awards for innovation and…

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Newsletter

Sign Up

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from Stagwell. Among the highlights of our weekly consumer sentiment tracking:

STOCKINGS STUFFED WITH STRESS

Americans feel joyous yet overwhelmed this holiday season, according to our latest Harris Poll research with the American Psychological Association.

- 89% of Americans say that not having enough money, missing loved ones and anticipating family conflict cause stress at this time of year.

- 43% report that the stress of the holidays interferes with their ability to enjoy them and that the holidays feel like a competition (36%).

- 72% report that the holiday season can feel bittersweet.

- Also, a fifth of those who celebrate traditionally Jewish holidays (23%) and those who celebrate other non-Christian holidays (20%) say they experience stress because the season doesn’t reflect their culture, religion or traditions.

YOUNGER CONSUMERS = BEST TIPPERS

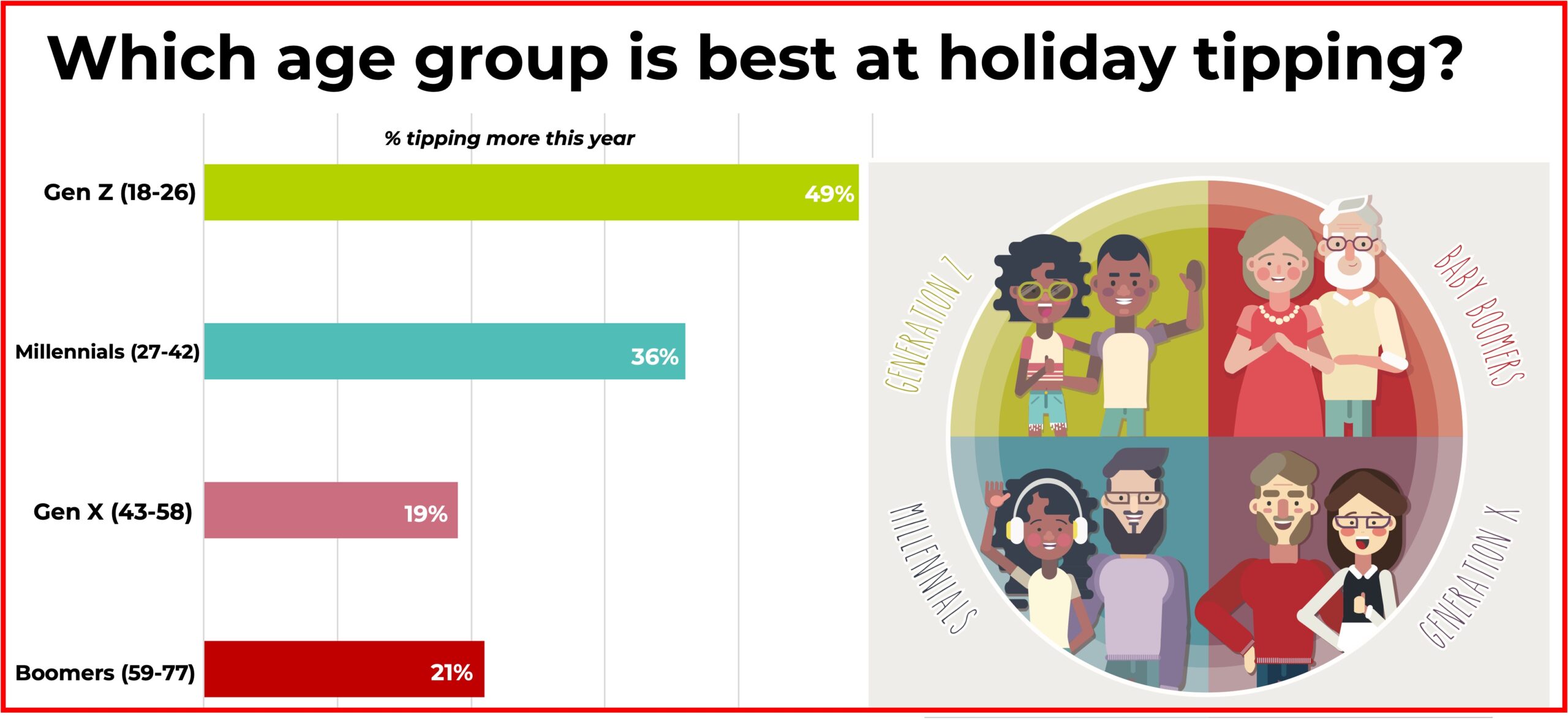

If you’re a tipped worker, which age of customer is most likely to reward you? Go with the youngest, according to our Harris Poll survey with DailyPay.

- The good news: 59% of Americans say they give bigger tips during the holiday season compared with the rest of the year.

- Even better news: 49% of Gen Z say they are tipping more often than they did last year. That compares with 36% of Millennials, 19% of Gen X and 21% of Boomers.

- On the other hand: 37% find themselves unable to tip because they do not have cash on hand.

- For those receiving tips, 88% believe that employees should receive the tips they have earned immediately/the same day – versus waiting for the next payroll period.

RESOLUTIONS FOR BETTER FINANCES

Two thirds of Americans admit financial regrets during the last year, and three fourths say the regrets will lead to new resolutions in 2024, according to our Harris Poll research with NerdWallet.

- The top regret: 23% did not save enough for their financial goals in 2023, and 21% regret not saving for emergencies.

- 22% regret overspending on entertainment, 11% regret overspending on travel, and 11% regret overspending on a big event, such as a wedding or party.

- Equal shares of Americans (16%) regret not paying off their credit card debt and taking on too much credit card debt.

- Lowest on the regret list: combining finances with a partner (7%), not making student loan payments during the federal pause (6%) and taking out a mortgage (4%).

SOCIAL MEDIA FINANCIAL PLANNERS

Social media has become a key channel for financial advice. Yet, in our Harris Poll survey with Nationwide, misinformation is tripping investors up, especially younger ones.

- 42% of Gen Z and 38% of Millennial investors say they are heavily accessing financial information, guidance and advice through social media (versus 16% of Gen X and 5% of Boomers).

- 17% of Gen Z and 21% of Millennials are likely to turn to generative AI for financial information and guidance and would trust a financial professional more if they leveraged AI to streamline daily tasks (40% for Gen Z and 36% for Millennials).

- Yet 41% of Gen Z and 34% of Millennial investors have acted upon financial information they saw online or on social media that turned out to be misleading or factually incorrect.

ICYMI

In case you missed it, check out some of the thought-leadership and happenings around Stagwell making news:

- After a year with ChatGPT, here’s my creative director dos and don’ts

- 4 Gen Z marketing trends from 2023

- Celebrity, social media and the true currency of America’s digital economy

- What Marketers Can Learn from the Recession that Never Came

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud, Talent & Awards

May 06, 2024

PRophet, a Stagwell (STGW) Company, Takes Home Two Big Wins at the 2024 Innovation SABRE Awards and 28th Annual Webby Awards

PRophet's AI-driven platform clinches two prestigious awards for innovation and…

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Newsletter

Sign Up

As the year comes to an end, it’s time for business leaders to take stock and realize the recession many of us feared this year did not hit. In fact, with consumers still spending healthily and sitting on lots of disposable income, now marks a bigger marketing opportunity than ever. In the December 2023 edition of Hitting the Mark – originally published in Barron’s – I share what leaders need to learn from the recession that never came.

As always, if you have questions or comments, please reach out to me.

Companies Cut Marketing as If a Recession Was Coming. It Didn’t.

Fears of a recession drove too many companies’ executive decisions this year. They hunkered down and cut marketing spending and maybe digital innovation, too. Then the news came that there was no recession—in fact consumers were spending on all sorts of consumables. Companies that bet on recession lost out.

The old, trusted brands faced little competition, since their nemeses pulled back. Consumers turned to familiar faces, and so the big companies pocketed market-share gains. Those chief financial officer-driven orders looked good on paper—in reality they cost businesses tremendously. Consumer timing outside of a recession is as impossible as stock market timing. Consumers often defy logic and expectations – and this year they were spending.

Pulling back wasn’t entirely irrational. This time last year just about everyone was scared of a looming recession. Reuters polled economists in Oct. 2022 and found 65% thought a recession would occur within the next year. In Dec. 2022, 80% of Americans thought the country was either already in a recession or would be in the following year, according to the Harvard CAPS/Harris poll.

But the recession never came. After steady growth all year the economy grew by 4.9% in the third quarter of 2023, driven primarily by consumers. Consumer spending increased 4% for the quarter and was responsible for 2.7 percentage points of the total GDP increase—signs of a strong economy.

Consumers Keep Spending…and Spending

Consumers turned out to have more money to spend than ever. Thanks to Covid-era stimulus bills and shutdowns, median net worth rose 37% from 2019 to 2022. Americans still have an estimated extra $1.7 trillion in savings. Even in the third quarter of 2023, disposable net income grew 3.8%, nearly triple what economists were forecasting. With the economy mostly returning to a post-pandemic normal, consumers are eager to spend on experiences.

Consumers went on a shopping spree this summer. Spending at movie theaters, restaurants, sporting events, and casinos all rose in August. Spending on international travel and airline transportation shot up in September. Overall last quarter, the consumer spending increase was spread almost evenly across goods and services.

It’s not just wealthy consumers who are opening their wallets. Retail sales have risen six months in a row. The holiday season is already off to a good start. Online spending for Black Friday was up 7.5% this year, according to Adobe. That’s right in line with a forecast of 7-9% for e-commerce holiday sales growth this year. Overall holiday season sales are estimated to rise 3-4%, less than the pandemic years, but that’s still a healthy increase.

The Challenger Imperative

So challenger companies that pulled back on spending wasted a whole year not getting their name out there and putting up a fight for new customers. Smaller brands suffer disproportionately when everyone cuts their marketing budgets. People will fall back on what they know rather than try new, unfamiliar things.

Companies need to recognize their mistake of pulling back in fear of the recession that wasn’t. The lesson for 2024 is to resist that fear again and think twice about cutting back on marketing and other engines of growth. Consumers are still sitting on lots of disposable income and the percentage of Americans who think the country will avoid a recession entirely has nearly doubled in the past twelve months. The Fed is holding rates steady and is hopefully done with its policy of economic blood-letting.

The established companies want the upstarts to keep doing nothing and giving away market share for free, but challengers must keep their foot on the gas pedal. They have even more ground to make up after this lost year. The recession never came, but the consequences were real and serious. Hopefully those trying to predict consumer trends will learn the lesson that many stock-market timers have learned—you pull back from advancing in the marketplace at your own peril.

Until next time,

Mark Penn

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud

May 16, 2024

Stagwell (STGW) and Nexxen Partner to Accelerate Seamless Audience Discovery for Marketers

Stagwell and its customers to leverage Nexxen's unified, proprietary data…

Events, In the News, Press Releases, Risk & Reputation

May 15, 2024

Stagwell (STGW) Releases News Advertising Study Revealing It is Safe for Brands to Advertise Adjacent to Quality News Content Despite Overblown Fears

Groundbreaking 50,000-respondent survey shows ads placed adjacent to stories covering…

Investments & Financials, Press Releases

May 08, 2024

Stagwell Inc. (STGW) Reports Equity Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)

Stagwell Inc. announced today the grant of equity inducement awards.

Newsletter

Sign Up

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from Stagwell. Among the highlights of our weekly consumer sentiment tracking:

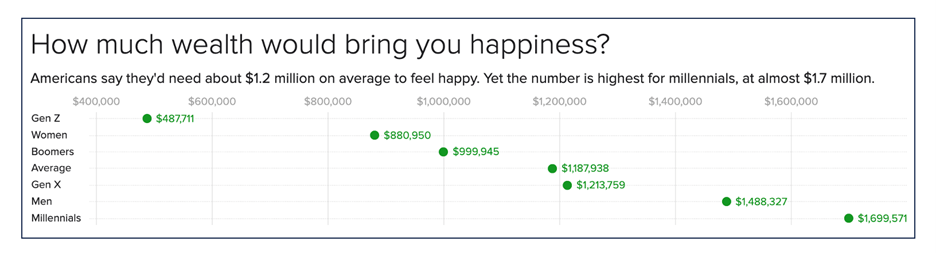

$1.2 MILLION WOULD BUY HAPPINESS FOR MOST

Americans are convinced their lives would improve if only they could climb a few rungs on the pay ladder, based on our survey with Empower.

- 59% of Americans believe money can buy happiness – even higher with 67% of Gen Z and 72% of Millennials.

- 71% agree that “having more money would solve most of my problems,” including those with salaries of $200,000 or more.

- Respondents think they need to earn roughly $284,000 each year to achieve happiness (versus the U.S. median household income of $74,000 annually).

- How much wealth would buy happiness? 59% overall say it’s $1.2 million – climbing to $1.7 million for Millennials.

- The majority of Americans define financial happiness as paying bills on time and in full (67%) and living debt-free (65%).

- For 42% of Americans, even $25,000 would boost their financial happiness for six months.

SHOPPERS SPLURGING THIS HOLIDAY SEASON – ON THEMSELVES

With holiday shopping in high gear, younger consumers say they’re willing to splurge, according to our Holiday Shopping Trends report.

- 81% of Gen Z and Millennial shoppers say they’re ready to spend this holiday season, despite 62% saying they’re not financially prepared.

- 44% of Gen Z and Millennials previously went into debt to pay for gifts, and 63% said they tend to be impulsive when holiday shopping.

- Two thirds say they see the holidays as an excuse to indulge in personal gifts and luxury items for themselves. In fact, 46% would rather spend more money on themselves than others.

- 57% of Gen Z and Millennials are allocating a significant portion of their budget to pet gifts, and 10% are willing to spend more than $100 on pets.

POINT-OF-SALE DONATION REQUESTS IRK SHOPPERS

While Americans strongly support charities, most don’t like being asked to donate to charities at the cash register/point of sale, based on research with NerdWallet.

- 67% do not like being asked to donate to charity at the cash register/point of sale.

- Gen Z (84%) is most likely to donate to charity at the register compared with 75% of Millennials, 67% of Gen X and 58% of Boomers.

- 25% say they give at the register because small donations don’t feel as costly.

- 33% who donate at the register say they would not donate to charity at all if they didn’t donate there.

- 13% say they donate to charity at the register because they feel guilty if they don’t, 10% say it’s easier than saying no, and 8% are embarrassed to say no.

COMING UP: ETHISPHERE AND STAGWELL DISCUSS RISK AND REPUTATION

Ethisphere and Stagwell will present new research and answer questions on “Seeing Around Corners: How Business Should Prepare for the Next 12 Months” during a Dec. 13 one-hour free webinar.

- The conversation will include fresh consumer and business data from The Harris Poll on when to speak out and when not to; the role of ESG and Purpose today; the key wedge issues driving the election cycle – and company narratives; and what it takes to build a strong reputation today.

- Register using this link.

ICYMI

In case you missed it, check out some of the thought-leadership and happenings around Stagwell making news:

- Even a joyous holiday season can cause stress for most Americans

- The Economy Is Up But the Middle Class Is Down: Big Take Podcast

- Employee Confidence in Senior Leadership, Culture, and Engagement Soars When Leaders Communicate Effectively About the Middle East Conflict, New Research Finds

- How to track communications ROI

- The Future of Reputation

- How AI Is Shaping the Newsroom of the Future

- The Fifth Industrial Revolution is Emerging. Here Are the Opportunities At Hand

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud, Talent & Awards

May 06, 2024

PRophet, a Stagwell (STGW) Company, Takes Home Two Big Wins at the 2024 Innovation SABRE Awards and 28th Annual Webby Awards

PRophet's AI-driven platform clinches two prestigious awards for innovation and…

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Newsletter

Sign Up

By

Mark Penn, Chairman and CEO, Stagwell

CONTACT

hello@stagwellglobal.com

SIGN UP FOR OUR INSIGHTS BLASTS

Stagwell believes AI is a quantum leap for creativity and productivity, and we are organizing our offerings around the “Three E’s of AI”: enablement across operations, efficiency in marketing and engagement with customers. We have taken a number of steps in the past quarter as we look to lead the AI-based transformation of marketing services, and we are heading into 2024 with one mission: to help clients embrace this new chapter of value creation.

I’m proud to share an update on digital innovation at Stagwell over the past quarter. If you have questions about any of the below, please reach out to me to discuss. We will also be at CES in January 2024 hosting a series of conversations and experiences at the intersection of business, marketing and impactful technology; check our website for opportunities to connect.

In a move that will accelerate our product development capabilities in the Stagwell Marketing Cloud, we have entered a unique partnership with Google Cloud to develop generative AI marketing solutions for our clients. This collaboration will accelerate our ability to identify, build and scale AI products, getting market-shifting technology in the hands of our partners faster than ever. We are united with Google in our aim to democratize access to the value large language models and gen AI tools can bring to enterprise. We will begin development immediately on solutions spanning brand campaigns, data analytics and insights, and a proprietary Stagwell LLM purpose-built for our clients. Read more in this Digiday exclusive.

Bringing Research-as-a-Service and AI-Powered Influencer Management to Clients with SMC

We launched significant enhancements to SMC’s AI-driven marketing tools in Q3, beginning with the debut of Harris Quest, a suite of integrated AI-based marketing research products including self-service polling and other “instant information” SaaS solutions. AI is an enabler for more performative business intelligence, and through HarrisQuest, we’re arming modern leaders with on-demand “research-as-a-service,” helping them keep ahead of the breakneck pace of consumer opinion. Elsewhere in the Cloud, we bolstered PRophet, our AI tool for communicators, with new influencer discovery and campaign management capabilities, as well as machine-learning based news monitoring. With PRophet, we’re quickly building a viable competitor to the integrated comms tech suites in the market today.

Adding to AI Capabilities with Left Field Labs Acquisition

Stagwell’s network grew in Q3 with the acquisition of Left Field Labs, a digital agency with expertise in AI and cutting-edge consumer experiences. Left Field Labs has built a 15-year track record of developing digital experiences never imagined before for blue-chip clients across tech, telecoms and business services, including Google, Meta, Amazon, Uber and Cisco. The agency’s major projects include helping Verizon to define and commercialize its 5G services and game engine Unity to reimagine remote entertainment with EDM music. Left Field Labs will join the Constellation Network to develop a bench of solutions integrating AI, immersive experiences and enterprise transformation. Read more about the acquisition in Ad Age.

Leading on Out-of-Home with Goodstuff and Assembly’s OVO Energy Campaign

Outside the realm of AI, our agencies are working with clients on unique technology integrations to major brand efforts. In the digital out of home space, our media firms Goodstuff and Assembly collaborated to help OVO Energy in the U.K. launch a series of digital billboards that only appear when the National Grid is running on renewable energy. So that the billboards update data in real time, Goodstuff and Assembly established a programmatic buying technology that auto-bids when the grid is greener. The project builds on OVO’s “Power Move” platform, which rewards customers for shifting energy use to off-peak times when the grid is powered by renewables. The high-tech campaign appeared across more than 2600 screens and garnered big attention across the U.K. marketing industry. Read more in Campaign UK.

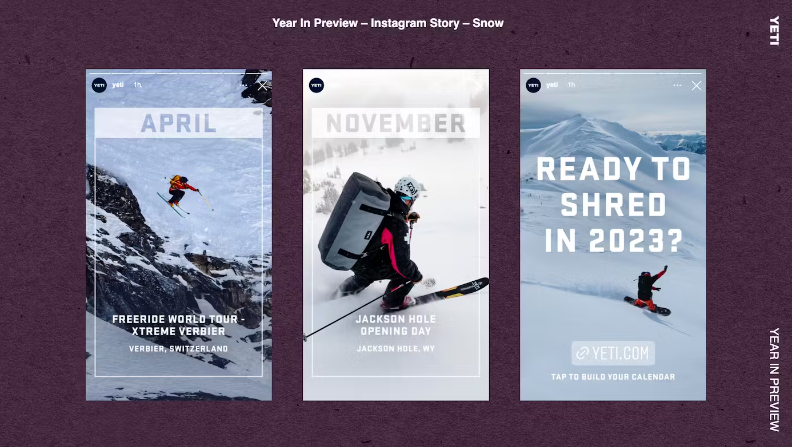

Winning Awards for Digital Transformation

Finally, our digital transformation network Code and Theory, which includes Kettle and Mediacurrent, is picking up recognition after recognition for its remarkable digital experiences. In the past quarter, Code and Theory won six coveted W3 awards, recognizing the best in digital experiences, content and creativity. The awards – 3 Gold and 3 Silver – reflect client work for YETI, Tipico, Departures and the Georgia Department of Agriculture. We’re especially proud of Code’s work for YETI, “Year in Preview,” which was a first-of-its-kind interactive experience that allowed users to personalize a calendar of over 135 events spanning hunting, surfing, rodeo and other active communities. In addition to its W3 wins, the work received recognition in Fast Company’s Innovation by Design awards this year.

Related

Articles

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Augmented Reality

Apr 25, 2024

Playfully Navigating the Google Booth at CES

Google partnered with Left Field Labs to blend its physical…