Originally released on

Revenue of $632 million

Net revenue of $539 million

Q2 net new business of $75 million, bringing LTM net new business to record $256 million

International revenue grew 9% led by particularly strong growth in Asia-Pacific of 17%

Adjusts full-year outlook

NEW YORK, Aug. 8, 2023 /PRNewswire/ — (NASDAQ: STGW) – Stagwell Inc. (“Stagwell”) today announced financial results for the three and six months ended June 30, 2023.

SECOND QUARTER AND SIX MONTHS HIGHLIGHTS:

- Q2 revenue of $632 million, a decrease of 6% versus the prior year period; YTD revenue of $1,255 million, a decrease of 5% versus the prior year period

- Q2 net revenue of $539 million, a decrease of 3% versus the prior period; YTD net revenue of $1,061 million, a decrease of 2% versus the prior year period

- Q2 organic net revenue declined 5% versus the prior year period and 4% ex-Advocacy; YTD organic net revenue declined 4% versus the prior year period and 3% ex-Advocacy. This follows 16% organic net revenue growth in 2022

- Q2 net loss of $10 million versus net income of $25 million in the prior year period; YTD net loss of $15 million versus net income of $58 million in the prior year period

- Q2 net loss attributable to Stagwell Inc. common shareholders of $5 million versus net income of $10 million in the prior year period; YTD net loss attributable to Stagwell Inc. common shareholders of $4 million versus net income of $23 million in the prior year period

- Q2 Adjusted EBITDA of $91 million, a decrease of 18% versus the prior year period; YTD Adjusted EBITDA of $163 million, a decrease of 23% versus the prior year period

- Q2 Adjusted EBITDA Margin of 17% on net revenue; YTD Adjusted EBITDA Margin of 15% on net revenue

- Q2 loss per share attribute to Stagwell Inc. common shareholders of $0.04

- Q2 Adjusted earnings per share attributable to Stagwell Inc. common shareholders of $0.16; YTD Adjusted earnings per share of $0.29

- Q2 net new business of $75 million; YTD net new business of $128 million

“Stagwell posted sequential quarter-over-quarter improvements in revenue, EBITDA and margin, and our new business wins hit a quarter billion dollars in the last 12 months as they accelerated to record levels,” said Mark Penn, Chairman and CEO of Stagwell. “We remain bullish about H2 2023 and 2024 and we expect to see significant growth across all metrics throughout the rest of the year,” he added. “It is clear, however, that our industry is facing headwinds caused by economic uncertainty and especially tech client reorganizations, the effects of which we believe are temporary.”

“We are beginning to see a return to a more normal business environment, and the emergence of Generative AI is providing a runway for future work that we believe will explode in the next 12 to 18 months,” Penn said. “We are already in the market with Generative AI products, and our Stagwell Marketing Cloud Group revenue was nearly $50 million this quarter as we push the frontiers of technology in marketing AI and AR.”

Frank Lanuto, Chief Financial Officer, commented: “Management responded appropriately, adjusting costs to align with our revenue structure as we continue to strengthen our balance sheet, cash flow generation, and initiatives to centralize our shared service platform, all of which will result in stronger margins over the next couple of quarters. We believe we are coming off the bottom of an economic and political cycle.”

Financial Outlook

2023 financial guidance is as follows:

- Organic Net Revenue growth of 0% – 2%

- Adjusted EBITDA of $410 million – $440 million

- Free Cash Flow Conversion of 50% – 60%

- Adjusted EPS of $0.76 – $0.85

- Guidance assumes no impact from foreign exchange, acquisitions or dispositions.

* The Company has excluded a quantitative reconciliation with respect to the Company’s 2023 guidance under the “unreasonable efforts” exception in item 10(e)(1)(i)(B) of Regulation S-K. See “Non-GAAP Financial Measures” below for additional information.

Video Webcast

Management will host a video webcast on Tuesday, August 8, 2023, at 8:30 a.m. (ET) to discuss results for Stagwell Inc. for the three and six months ended June 30, 2023. The video webcast will be accessible at https://stgw.io/Q2Earnings. An investor presentation has been posted on our website at www.stagwellglobal.com and may be referred to during the webcast.

A recording of the webcast will be accessible one hour after the webcast and available for ninety days at www.stagwellglobal.com.

Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Contacts

For Investors:

Ben Allanson

Ir@stagwellglobal.com

For Press:

Beth Sidhu

Pr@stagwellglobal.com

Non-GAAP Financial Measures

In addition to its reported results, Stagwell Inc. has included in this earnings release certain financial results that the Securities and Exchange Commission (SEC) defines as “non-GAAP Financial Measures.” Management believes that such non-GAAP financial measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company’s results. Such non-GAAP financial measures include the following:

(1) Organic Revenue: “Organic revenue growth” and “organic revenue decline” refer to the positive or negative results, respectively, of subtracting both the foreign exchange and acquisition (disposition) components from total revenue growth. The acquisition (disposition) component is calculated by aggregating prior period revenue for any acquired businesses, less the prior period revenue of any businesses that were disposed of during the current period. The organic revenue growth (decline) component reflects the constant currency impact of (a) the change in revenue of the partner firms that the Company has held throughout each of the comparable periods presented, and (b) “non-GAAP acquisitions (dispositions), net”. Non-GAAP acquisitions (dispositions), net consists of (i) for acquisitions during the current year, the revenue effect from such acquisition as if the acquisition had been owned during the equivalent period in the prior year and (ii) for acquisitions during the previous year, the revenue effect from such acquisitions as if they had been owned during that entire year (or same period as the current reportable period), taking into account their respective pre-acquisition revenues for the applicable periods, and (iii) for dispositions, the revenue effect from such disposition as if they had been disposed of during the equivalent period in the prior year.

(2) Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period.

(3) Adjusted EBITDA: defined as Net income excluding non-operating income or expense to achieve operating income, plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, and other items. Other items include restructuring costs, acquisition-related expenses, and non-recurring items.

(4) Adjusted Diluted EPS is defined as (i) Net income (loss) attributable to Stagwell Inc. common shareholders, plus net income attributable to Class C shareholders, excluding amortization expense, impairment and other losses, stock-based compensation, deferred acquisition consideration adjustments, discrete tax items, and other items, divided by (ii) (a) the per weighted average number of common shares outstanding plus (b) the weighted average number of Class C shares outstanding, (if dilutive). Other items includes restructuring costs, acquisition-related expenses, and non-recurring items, and subject to the anti-dilution rules.

(5) Free Cash Flow: defined as Adjusted EBITDA less capital expenditures, change in net working capital, cash taxes, interest, and distributions to minority interests, but excludes contingent M&A payments.

(6) Financial Guidance: The Company provides guidance on a non-GAAP basis as it cannot predict certain elements which are included in reported GAAP results.

Included in this earnings release are tables reconciling reported Stagwell Inc. results to arrive at certain of these non-GAAP financial measures.

This document contains forward-looking statements. within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company’s representatives may also make forward-looking statements orally or in writing from time to time. Statements in this document that are not historical facts, including, statements about the Company’s beliefs and expectations, future financial performance and future prospects, business and economic trends, potential acquisitions, and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Forward-looking statements, which are generally denoted by words such as “anticipate,” “assume,” “believe,” “continue,” “could,” “create,” “estimate,” “expect,” “focus,” “forecast,” “foresee,” “future,” “guidance,” “intend,” “look,” “may,” “opportunity,” “outlook,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” or the negative of such terms or other variations thereof and terms of similar substance used in connection with any discussion of current plans, estimates and projections are subject to change based on a number of factors, including those outlined in this section.

Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company. Although the management of the Company believes that the expectations and assumptions on which such forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. The material assumptions upon which such forward-looking statements are based include, among others, assumptions with respect to general business, economic and market conditions, the competitive environment, anticipated and unanticipated tax consequences and anticipated and unanticipated costs. These forward-looking statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any.

Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statements. Such risk factors include, but are not limited to, the following:

- risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients;

- the continued impact of the coronavirus pandemic (“COVID-19”), and evolving strains of COVID-19 on the economy and demand for the Company’s services, which may precipitate or exacerbate other risks and uncertainties;

- inflation and actions taken by central banks to counter inflation;

- the Company’s ability to attract new clients and retain existing clients;

- the impact of a reduction in client spending and changes in client advertising, marketing and corporate communications requirements;

- financial failure of the Company’s clients;

- the Company’s ability to retain and attract key employees;

- the Company’s ability to compete in the markets in which it operates;

- the Company’s ability to achieve its cost saving initiatives;

- the Company’s implementation of strategic initiatives;

- the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration;

- the Company’s ability to manage its growth effectively, including the successful completion and integration of acquisitions that complement and expand the Company’s business capabilities;

- the Company’s ability to develop products incorporating new technologies, including augmented reality, artificial intelligence, and virtual reality, and realize benefits from such products;

- an inability to realize expected benefits of the combination of the Company’s business with the business of MDC Partners Inc. (the “Transactions”) and other completed, pending, or contemplated acquisitions;

- adverse tax consequences in connection with the Transactions for the Company, its operations and its shareholders, that may differ from the expectations of the Company, including that future changes in tax law, potential increases to corporate tax rates in the United States and disagreements with the tax authorities on the Company’s determination of value and computations of its attributes may result in increased tax costs;

- the occurrence of material Canadian federal income tax (including material “emigration tax”) as a result of the Transactions;

- the Company’s unremediated material weaknesses in internal control over financial reporting and its ability to establish and maintain an effective system of internal control over financial reporting;

- the Company’s ability to protect client data from security incidents or cyberattacks;

- economic disruptions resulting from war and other geopolitical tensions (such as the ongoing military conflict between Russia and Ukraine), terrorist activities and natural disasters;

- stock price volatility; and

- foreign currency fluctuations.

Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors outlined in more detail in our 2022 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 6, 2023, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings.

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud, Talent & Awards

May 06, 2024

PRophet, a Stagwell (STGW) Company, Takes Home Two Big Wins at the 2024 Innovation SABRE Awards and 28th Annual Webby Awards

PRophet's AI-driven platform clinches two prestigious awards for innovation and…

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Newsletter

Sign Up

Originally released on

Revenue of $622 Million

Adjusted EBITDA of $72 million

First Quarter Results in line with Management Expectations

Reaffirms 2023 Full Year Guidance

Announces Share Repurchase Agreement for over 23.3 million Class A Shares in Stagwell Inc.

Aggregate Class A and Class C Shares reduced 8% to 267 million

New York, NY, May 9, 2023 (NASDAQ: STGW) – Stagwell Inc. (“Stagwell”) today announced financial results in line with internal expectations for the three months ended March 31, 2023.

FIRST QUARTER RESULTS:

- Revenue and EBITDA in line with management expectations

- Revenue of $622 million, a decrease of 3% versus the prior year period.

- First quarter net revenue of $522 million, a decrease of 1% versus the prior period.

- Organic net revenue decline of 3%, and excluding advocacy of 1%, versus the prior year period.

- On a two-year growth stack basis, organic net revenue growth of 21%

- First quarter net income attributable to Stagwell Inc. Common Shareholders of $0.4 million versus $13 million in the prior year period.

- First quarter Adjusted EBITDA of $72 million, a decrease of 29% versus the prior year period.

- First quarter Adjusted Earnings Per Share for Stagwell Inc. Common Shareholders of $0.13 versus $0.22 in the prior year period.

- Net new business wins of $53 million in the quarter and $212 million for the trailing twelve months.

“Stagwell is stronger than ever today with the removal of an overhang on the stock and Q1 results in line with management’s expectations, allowing us to reaffirm guidance for another year of significant growth,” said Mark Penn, Chairman and CEO of Stagwell Inc. “This quarter is compared to Q1 2022 which had 24% of organic growth compared to 14% for the year. We expect to return to double-digit growth in the later quarters, especially given strong new business wins within the quarter and after the close. We are moving forward with the Stagwell Marketing Cloud and all investors are invited to try our generative A.I. product at www.PRProphet.ai.”

“We have additionally announced entry into a definitive agreement, approved unanimously by Stagwell’s independent and disinterested directors who were advised by outside counsel and advisers, to repurchase approximately 23.3 million shares of Stagwell Inc. Class A Stock from AlpInvest,” Penn added. “I believe this purchase will help create value for shareholders in the marketplace given our undervalued stock.”

Frank Lanuto, Chief Financial Officer, commented: “Coming off a record Q1 performance in 2022, the Company posted first quarter results in a challenging environment that were in line with management expectations. We are beginning to see positive signs, including strong new business wins, and improving client conditions, which give us confidence about the outlook for the remainder of the year.”

Financial Outlook

2023 financial guidance is as follows:

- Organic Net Revenue growth of 7.5% – 10%

- Organic Net Revenue growth ex-Advocacy of 10% – 14%

- Adjusted EBITDA of $450 million – $490 million

- Free Cash Flow Conversion of 50% – 60%

- Adjusted EPS of $0.90 – $1.05

- Guidance assumes no impact from foreign exchange, acquisitions or dispositions.

|

* The Company has excluded a quantitative reconciliation with respect to the Company’s 2023 guidance under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. See “Non-GAAP Financial Measures” below for additional information. |

Stock Repurchase Program

In the first quarter, the Company repurchased approximately 2.6 million shares of Class A Common Stock at an average price of $6.91 per share for an aggregate value of approximately $18 million. The remaining value of shares permitted to be repurchased was approximately $180 million as of March 31, 2023.

Stock Repurchase Transaction

On May 9, 2023, Stagwell Inc. agreed to repurchase approximately 23.3 million shares from AlpInvest Partners at a share price of $6.43 which is a total value of approximately $150 million. As announced separately, Stagwell Media LP, a shareholder in Stagwell Inc., and AlpInvest are engaged in advanced negotiations to redeem AlpInvest’s remaining interests in Stagwell Media LP., subject to final documentation. Upon completion of these transactions, AlpInvest Partners will no longer be an investor in Stagwell Inc.

Conference Call

Management will host a video webcast and conference call on Tuesday, May 9, 2023, at 8:30 a.m. (ET) to discuss results for Stagwell Inc. for the three months ended March 31, 2023. The video webcast will be accessible at https://stgw.io/Q12023Earnings. An investor presentation has been posted on our website at www.stagwellglobal.com and may be referred to during the conference call.

A recording of the conference call will be accessible one hour after the call and available for ninety days at www.stagwellglobal.com.

Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Contacts

For Investors:

Ben Allanson

Ir@stagwellglobal.com

For Press:

Beth Sidhu

Pr@stagwellglobal.com

Non-GAAP Financial Measures

In addition to its reported results, Stagwell Inc. has included in this earnings release certain financial results that the Securities and Exchange Commission (SEC) defines as “non-GAAP Financial Measures.” Management believes that such non-GAAP financial measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company’s results. Such non-GAAP financial measures include the following:

(1) Organic Revenue: “Organic revenue growth” and “organic revenue decline” refer to the positive or negative results, respectively, of subtracting both the foreign exchange and acquisition (disposition) components from total revenue growth. The acquisition (disposition) component is calculated by aggregating prior period revenue for any acquired businesses, less the prior period revenue of any businesses that were disposed of during the current period. The organic revenue growth (decline) component reflects the constant currency impact of (a) the change in revenue of the partner firms that the Company has held throughout each of the comparable periods presented, and (b) “non-GAAP acquisitions (dispositions), net”. Non-GAAP acquisitions (dispositions), net consists of (i) for acquisitions during the current year, the revenue effect from such acquisition as if the acquisition had been owned during the equivalent period in the prior year and (ii) for acquisitions during the previous year, the revenue effect from such acquisitions as if they had been owned during that entire year (or same period as the current reportable period), taking into account their respective pre-acquisition revenues for the applicable periods, and (iii) for dispositions, the revenue effect from such disposition as if they had been disposed of during the equivalent period in the prior year.

(2) Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period.

(3) Adjusted EBITDA: defined as Net income excluding non-operating income or expense to achieve operating income, plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, and other items. Other items include restructuring costs, acquisition-related expenses, and non-recurring items.

(4) Adjusted Diluted EPS is defined as (i) Net income (loss) attributable to Stagwell Inc. common shareholders, plus net income attributable to Class C shareholders, excluding amortization expense, impairment and other losses, stock-based compensation, deferred acquisition consideration adjustments, discrete tax items, and other items, divided by (ii) (a) the per weighted average number of common shares outstanding plus (b) the weighted average number of Class C shares outstanding, (if dilutive). Other items includes restructuring costs, acquisition-related expenses, and non-recurring items, and subject to the anti-dilution rules.

(5) Free Cash Flow: defined as Adjusted EBITDA less capital expenditures, change in net working capital, cash taxes, interest, and distributions to minority interests, but excludes contingent M&A payments.

(6) Financial Guidance: The Company provides guidance on a non-GAAP basis as it cannot predict certain elements which are included in reported GAAP results.

Included in this earnings release are tables reconciling reported Stagwell Inc. results to arrive at certain of these non-GAAP financial measures.

This document contains forward-looking statements. within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company’s representatives may also make forward-looking statements orally or in writing from time to time. Statements in this document that are not historical facts, including, statements about the Company’s beliefs and expectations, future financial performance and future prospects, business and economic trends, potential acquisitions, and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Forward-looking statements, which are generally denoted by words such as “anticipate,” “assume,” “believe,” “continue,” “could,” “create,” “estimate,” “expect,” “focus,” “forecast,” “foresee,” “future,” “guidance,” “intend,” “look,” “may,” “opportunity,” “outlook,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” or the negative of such terms or other variations thereof and terms of similar substance used in connection with any discussion of current plans, estimates and projections are subject to change based on a number of factors, including those outlined in this section.

Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company. Although the management of the Company believes that the expectations and assumptions on which such forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. The material assumptions upon which such forward-looking statements are based include, among others, assumptions with respect to general business, economic and market conditions, the competitive environment, anticipated and unanticipated tax consequences and anticipated and unanticipated costs. These forward-looking statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any.

Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statements. Such risk factors include, but are not limited to, the following:

- risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients;

- the continued impact of the coronavirus pandemic (“COVID-19”), and evolving strains of COVID-19 on the economy and demand for the Company’s services, which may precipitate or exacerbate other risks and uncertainties;

- inflation and actions taken by central banks to counter inflation;

- the Company’s ability to attract new clients and retain existing clients;

- the impact of a reduction in client spending and changes in client advertising, marketing and corporate communications requirements;

- financial failure of the Company’s clients;

- the Company’s ability to retain and attract key employees;

- the Company’s ability to compete in the markets in which it operates;

- the Company’s ability to achieve its cost saving initiatives;

- the Company’s implementation of strategic initiatives;

- the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration;

- the Company’s ability to manage its growth effectively, including the successful completion and integration of acquisitions that complement and expand the Company’s business capabilities;

- the Company’s ability to develop products incorporating new technologies, including augmented reality, artificial intelligence, and virtual reality, and realize benefits from such products;

- an inability to realize expected benefits of the combination of the Company’s business with the business of MDC;

- adverse tax consequences in connection with the Transactions for the Company, its operations and its shareholders, that may differ from the expectations of the Company, including that future changes in tax law, potential increases to corporate tax rates in the United States and disagreements with the tax authorities on the Company’s determination of value and computations of its attributes may result in increased tax costs;

- the occurrence of material Canadian federal income tax (including material “emigration tax”) as a result of the Transactions;

- the Company’s unremediated material weaknesses in internal control over financial reporting and its ability to establish and maintain an effective system of internal control over financial reporting;

- the Company’s ability to protect client data from security incidents or cyberattacks;

- economic disruptions resulting from war and other geopolitical tensions (such as the ongoing military conflict between Russia and Ukraine), terrorist activities and natural disasters;

- stock price volatility; and

- foreign currency fluctuations.

Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors outlined in more detail in our 2022 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 6, 2023, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings.

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud, Talent & Awards

May 06, 2024

PRophet, a Stagwell (STGW) Company, Takes Home Two Big Wins at the 2024 Innovation SABRE Awards and 28th Annual Webby Awards

PRophet's AI-driven platform clinches two prestigious awards for innovation and…

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Newsletter

Sign Up

CONTACT:

New York – Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, announced today it will report financial results for the three and twelve months ended Mar. 31, 2023, on Tuesday, May 9, 2023, before the market open.

Stagwell will host a video webcast to review those results the same day at 8:30 AM (ET). To register and view the webcast, visit https://stgw.io/Q12023Earnings

A replay of the webcast will be available following the event at Stagwell’s website, https://www.stagwellglobal.com/investors/

About Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud, Talent & Awards

May 06, 2024

PRophet, a Stagwell (STGW) Company, Takes Home Two Big Wins at the 2024 Innovation SABRE Awards and 28th Annual Webby Awards

PRophet's AI-driven platform clinches two prestigious awards for innovation and…

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Newsletter

Sign Up

NEW YORK, March 9, 2023 /PRNewswire/ — Stagwell Inc. (Nasdaq: STGW) (“Stagwell” or the “Company”), the challenger network built to transform marketing, today announced the pricing of its previously announced underwritten public offering of an aggregate of 16,000,000 shares of its Class A common stock, par value $0.001 per share (the “Class A Common Stock”), by entities affiliated with The Stagwell Group LLC and Goldman Sachs (collectively, the “Selling Stockholders”) at a public offering price of $6.75 per share. The offering is expected to close on or about March 14, 2023, subject to satisfaction of customary closing conditions. The Selling Stockholders also granted the underwriters a 30-day option to purchase up to an additional 2,400,000 shares of Class A Common Stock at the public offering price, less underwriting discounts and commissions. The Company will not receive any proceeds from the sale of shares in the offering.

Morgan Stanley and Goldman Sachs & Co. LLC are acting as joint lead book-running managers and as representatives of the underwriters for the offering, SVB Securities LLC and Wells Fargo Securities, LLC are also acting as joint book-running managers for the offering. Rosenblatt Securities Inc. is acting as co-manager for the offering.

The Company has filed a registration statement (including a base prospectus) and a preliminary prospectus supplement with the U.S. Securities and Exchange Commission (“SEC”) for the offering to which this communication relates and will file a final prospectus supplement relating to the offering. The offering is being made only by means of a prospectus supplement and the accompanying prospectus. Before investing, prospective investors should read the prospectus supplement, accompanying prospectus and documents incorporated by reference therein for more complete information about Stagwell and the offering. You may obtain these documents for free by visiting the SEC’s website at http://www.sec.gov or by contacting: Morgan Stanley, Attention: Prospectus Department, 180 Varick Street, 2nd Floor, New York, NY 10014; or Goldman Sachs & Co. LLC, Attention: Prospectus Department, 200 West Street, New York, NY 10282, by telephone at (866) 471-2526, or by email at Prospectus-ny@ny.email.gs.com.

This press release does not constitute an offer to sell or a solicitation of an offer to buy these securities, nor does it constitute an offer, solicitation or sale of these securities in any jurisdiction in which such offer, solicitation or sale is unlawful prior to the registration or qualification under the securities laws of any such state or other jurisdiction.

About Stagwell

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements in this press release that are not historical facts constitute forward-looking statements. Forward-looking statements in this press release include, but are not limited to, the expected completion of the offering.

These forward-looking statements are subject to various risks and uncertainties, many of which are outside Stagwell’s control. Important factors that could cause actual results and expectations to differ materially from those indicated by such forward-looking statements include, without limitation, the Company’s and the Selling Stockholders’ ability to satisfy the conditions to closing and consummate the transaction and other risks and uncertainties discussed in the prospectus supplement related to the offering, Stagwell’s Annual Report on Form 10-K for the year ended December 31, 2022 and its other reports filed from time to time with the SEC. Unless required by law, Stagwell undertakes no obligation to publicly update or revise any forward-looking statements to reflect circumstances or events after the date they are made.

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud, Talent & Awards

May 06, 2024

PRophet, a Stagwell (STGW) Company, Takes Home Two Big Wins at the 2024 Innovation SABRE Awards and 28th Annual Webby Awards

PRophet's AI-driven platform clinches two prestigious awards for innovation and…

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Newsletter

Sign Up

Originally released on

FY22 Revenue rises to record $2.7B following sixth-consecutive quarter of double-digit growth; company doubles stock buyback program to $250M

FY22 Revenue rises to record $2.7B following sixth-consecutive quarter of double-digit growth; company doubles stock buyback program to $250M

- FY22 Pro Forma revenue growth of 21%; 16% in Q4

- FY22 Pro Forma organic net revenue growth of 14%; 8% in Q4

- Adjusted EBITDA of $451M in FY22, a 20.3% margin on net revenue

- Adjusted EBITDA of $123M in Q4, a 21.1% margin on net revenue

- FY22 Adjusted net income of $268M; $63M in Q4

- FY22 Adjusted EPS of $0.90; $0.22 in Q4

- FY22 Free Cash Flow of $270M; $268M in Q4

- FY22 Net New Business of $213M; $42M in Q4

- Reduced net debt by $47M versus prior year, ending with a net leverage ratio of 2.17x

- Issues 2023 Organic Net Revenue growth guidance of 7.5%-10% and 10%-14% ex-Advocacy

- Issues 2023 Adjusted EBITDA guidance of $450M-$490M and Free Cash Flow conversion of 50%-60%

New York, NY, March 2, 2023 (NASDAQ: STGW) – Stagwell Inc. (“Stagwell”) today announced financial results for the three months and year ended December 31, 2022.

FOURTH QUARTER AND FULL YEAR HIGHLIGHTS:

- Q4 revenue of $708 million, an increase of 16% versus the prior year period; FY22 revenue of $2,688 million, an increase of 83% versus the prior year period

- Q4 revenue growth of 16% versus the prior year period and 13% ex-Advocacy; Pro Forma FY22 revenue growth of 21% versus the prior year period and 17% ex-Advocacy

- Q4 net revenue of $583 million, an increase of 12% versus the prior period; FY22 net revenue of $2,222 million, an increase of 75% versus the prior year period

- Q4 net revenue growth of 12% versus the prior year period and 10% ex-Advocacy; Pro Forma FY22 net revenue growth of 15% versus the prior year period and 13% ex-Advocacy

- Q4 organic net revenue growth of 8% versus the prior year period and 6% ex-Advocacy; Pro Forma FY22 organic net revenue growth of 14% versus the prior year period and 12% ex-Advocacy

- Q4 Adjusted EBITDA of $123 million, an increase of 19% versus the prior year period; FY22 Adjusted EBITDA of $451 million, an increase of 78% versus the prior year period

- Q4 Adjusted EBITDA growth of 19% versus the prior period and 10% ex-Advocacy; Pro Forma FY22 Adjusted EBITDA growth of 19% versus the prior period and 12% ex-Advocacy

- Q4 Adjusted EBITDA Margin of 21.1% on net revenue; FY22 Adjusted EBITDA Margin of 20.3% on net revenue

- Q4 net loss of $28 million versus net income of $5 million in the prior year period; FY22 net income of $66 million versus $36 million in the prior year period

- Q4 net loss attributable to Stagwell Inc. common shareholders of $6 million versus net income of $1 million in the prior year period; FY22 net income attributable to Stagwell Inc. common shareholders of $27 million versus $21 million in the prior year period

- Q4 Adjusted net income of $63 million; FY22 Adjusted net income of $268 million

- Q4 Adjusted earnings per share for Stagwell Inc. common shareholders of $0.22; FY22 Adjusted earnings per share of $0.90

- Q4 net new business of $42 million; FY22 net new business of $213 million

“Stagwell closed out 2022 with industry-leading double-digit growth, strong margin expansion, record free cash flow, record earnings per share, and a net debt ratio significantly below our target. We promised to transform marketing, and we have built game-changing AI and AR-driven products as we continue to grow and transform both our business and the industry,” said Mark Penn, Chairman and CEO, Stagwell. “We look forward to another year of double-digit growth outside of our advocacy businesses in 2023, continuing our momentum.”

Frank Lanuto, Chief Financial Officer, commented: “The Company reported a record $708 million of revenue in the fourth quarter, a 16% increase over the prior year and Adjusted EBITDA of $123 million. Adjusted EBITDA margin as a percentage of net revenue rose to 21.1% for the quarter and 20.3% for the year as a result of careful cost management. Free cash flows rose to $270 million driving down the Company’s net leverage ratio to 2.17x.”

Financial Outlook

2023 financial guidance is as follows:

- Organic Net Revenue growth of 7.5% – 10%

- Organic Net Revenue growth ex-Advocacy of 10% – 14%

- Adjusted EBITDA of $450 million – $490 million

- Free Cash Flow Conversion of 50% – 60%

- Adjusted EPS of $0.90 – $1.05

- Guidance assumes no impact from foreign exchange, acquisitions or dispositions.

|

* The Company has excluded a quantitative reconciliation with respect to the Company’s 2023 guidance under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. See “Non-GAAP Financial Measures” below for additional information. |

Stock Repurchase Program

On March 1, 2023, the Board authorized an extension and a $125,000,000 increase in the size of our previously approved stock repurchase program (the “Repurchase Program”). Under the Repurchase Program, as amended, we may repurchase up to an aggregate of $250,000,000 of shares of our outstanding Class A Common Stock, with any previous purchases under the Repurchase Program continuing to count against that limit. The Repurchase Program will expire on March 1, 2026.

Conference Call

Management will host a video webcast and conference call on Thursday, March 2, 2023, at 8:30 a.m. (ET) to discuss results for Stagwell Inc. for the three months and year ended December 31, 2022. The video webcast will be accessible at https://stgw.io/Q4andFYEarnings. An investor presentation has been posted on our website at www.stagwellglobal.com and may be referred to during the conference call.

A recording of the conference call will be accessible one hour after the call and available for ninety days at www.stagwellglobal.com.

Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Contacts

For Investors:

Jason Reid

Ir@stagwellglobal.com

For Press:

Beth Sidhu

Pr@stagwellglobal.com

Basis of Presentation

The acquisition of MDC Partners (MDC) by Stagwell Marketing Group (SMG) was completed on August 2, 2021. The results of MDC are included within the Statements of Operations for the period beginning on the date of the acquisition through the end of the respective period presented and the results of SMG are included for the entirety of all periods presented.

Non-GAAP Financial Measures

In addition to its reported results, Stagwell Inc. has included in this earnings release certain financial results that the Securities and Exchange Commission (SEC) defines as “non-GAAP Financial Measures.” Management believes that such non-GAAP financial measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company’s results. Such non-GAAP financial measures include the following:

Pro Forma Results: The Pro Forma amounts presented for each period were prepared by combining the historical standalone statements of operations for each of legacy MDC and SMG. The unaudited pro forma results are provided for illustrative purposes only and do not purport to represent what the actual consolidated results of operations or consolidated financial condition would have been had the combination actually occurred on the date indicated, nor do they purport to project the future consolidated results of operations or consolidated financial condition for any future period or as of any future date. The Company has excluded a quantitative reconciliation of Adjusted Pro Forma EBITDA to net income under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K.

(1) Organic Revenue: “Organic revenue growth” and “organic revenue decline” refer to the positive or negative results, respectively, of subtracting both the foreign exchange and acquisition (disposition) components from total revenue growth. The acquisition (disposition) component is calculated by aggregating prior period revenue for any acquired businesses, less the prior period revenue of any businesses that were disposed of during the current period. The organic revenue growth (decline) component reflects the constant currency impact of (a) the change in revenue of the partner firms that the Company has held throughout each of the comparable periods presented, and (b) “non-GAAP acquisitions (dispositions), net”. Non-GAAP acquisitions (dispositions), net consists of (i) for acquisitions during the current year, the revenue effect from such acquisition as if the acquisition had been owned during the equivalent period in the prior year and (ii) for acquisitions during the previous year, the revenue effect from such acquisitions as if they had been owned during that entire year (or same period as the current reportable period), taking into account their respective pre-acquisition revenues for the applicable periods, and (iii) for dispositions, the revenue effect from such disposition as if they had been disposed of during the equivalent period in the prior year.

(2) Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period.

(3) Adjusted EBITDA: defined as Net income excluding non-operating income or expense to achieve operating income, plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, and other items. Other items include restructuring costs, acquisition-related expenses, and non-recurring items.

(4) Adjusted Diluted EPS is defined as (i) Net income (loss) attributable to Stagwell Inc. common shareholders, plus net income attributable to Class C shareholders, excluding amortization expense, impairment and other losses, stock-based compensation, deferred acquisition consideration adjustments, discrete tax items, and other items, divided by (ii) (a) the per weighted average number of common shares outstanding plus (b) the weighted average number of Class C shares outstanding (if dilutive). Other items includes restructuring costs, acquisition-related expenses, and non-recurring items, and subject to the anti-dilution rules.

(5) Free Cash Flow: defined as Adjusted EBITDA less capital expenditures, change in net working capital, cash taxes, interest, and distributions to minority interests, but excludes contingent M&A payments.

(6) Financial Guidance: The Company provides guidance on a non-GAAP basis as it cannot predict certain elements which are included in reported GAAP results.

Included in this earnings release are tables reconciling reported Stagwell Inc. results to arrive at certain of these non-GAAP financial measures.

This document contains forward-looking statements. within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company’s representatives may also make forward-looking statements orally or in writing from time to time. Statements in this document that are not historical facts, including, statements about the Company’s beliefs and expectations, future financial performance and future prospects, business and economic trends, potential acquisitions, and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Forward-looking statements, which are generally denoted by words such as “anticipate,” “assume,” “believe,” “continue,” “could,” “create,” “estimate,” “expect,” “focus,” “forecast,” “foresee,” “future,” “guidance,” “intend,” “look,” “may,” “opportunity,” “outlook,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” or the negative of such terms or other variations thereof and terms of similar substance used in connection with any discussion of current plans, estimates and projections are subject to change based on a number of factors, including those outlined in this section.

Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company. Although the management of the Company believes that the expectations and assumptions on which such forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. The material assumptions upon which such forward-looking statements are based include, among others, assumptions with respect to general business, economic and market conditions, the competitive environment, anticipated and unanticipated tax consequences and anticipated and unanticipated costs. These forward-looking statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any.

Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statements. Such risk factors include, but are not limited to, the following:

- risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients;

- inflation and actions taken by central banks to counter inflation;

- the Company’s ability to attract new clients and retain existing clients;

- the impact of a reduction in client spending and changes in client advertising, marketing and corporate communications requirements;

- financial failure of the Company’s clients;

- the Company’s ability to retain and attract key employees;

- the Company’s ability to compete in the markets in which it operates;

- the Company’s ability to achieve its cost saving initiatives;

- the Company’s implementation of strategic initiatives;

- the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration;

- the Company’s ability to manage its growth effectively, including the successful completion and integration of acquisitions that complement and expand the Company’s business capabilities;

- the Company’s ability to develop products incorporating new technologies, including augmented reality, artificial intelligence, and virtual reality, and realize benefits from such products;

- an inability to realize expected benefits of the combination of the Company’s business with the business of MDC; (the “Business Combination” and, together with the related transactions, the “Transactions”);

- adverse tax consequences in connection with the Transactions for the Company, its operations and its shareholders, that may differ from the expectations of the Company, including that future changes in tax law, potential increases to corporate tax rates in the United States and disagreements with the tax authorities on the Company’s determination of value and computations of its attributes may result in increased tax costs;

- the occurrence of material Canadian federal income tax (including material “emigration tax”) as a result of the Transactions;

- the Company’s unremediated material weaknesses in internal control over financial reporting and its ability to establish and maintain an effective system of internal control over financial reporting;

- the Company’s ability to protect client data from security incidents or cyberattacks;

- economic disruptions resulting from war and other geopolitical tensions, terrorist activities and natural disasters;

- stock price volatility; and

- foreign currency fluctuations.

Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors outlined in more detail in our 2021 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 17, 2022, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings.

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud, Talent & Awards

May 06, 2024

PRophet, a Stagwell (STGW) Company, Takes Home Two Big Wins at the 2024 Innovation SABRE Awards and 28th Annual Webby Awards

PRophet's AI-driven platform clinches two prestigious awards for innovation and…

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Newsletter

Sign Up

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from The Harris Poll, a Stagwell agency.

Among the highlights of our weekly consumer sentiment tracking (fielded Jan. 6-8):

ECONOMIC WORRIES MODERATE:

Today, 84% of Americans are concerned about the economy and inflation – down 4 points from last week.

- 81% worry about a potential U.S. recession (down 3 points)

- 80% about U.S. crime rates (down 4 points)

- 77% about political divisiveness (no change)

- 72% about affording their living expenses (down 3 points)

- 72% about the War on Ukraine (down 1 point)

- 60% about a new COVID-19 variant (down 1 point)

- 50% about losing their jobs (down 4 points)

IN-PERSON SHOPPERS RETURN:

Nearly half of Americans are looking for a bargain – and more are planning to shop in person this year versus last. Those are among the insights in our survey with DailyPay and Dollar Tree.

- 44% are more likely to prioritize shopping for bargains in store compared to last year.

- Overall, 67% of Americans plan to spend either the same or more in 2023 as they did in 2022 on retail purchases.

- 73% plan to shop the same or more in person this year.

- When it comes to Americans’ preferences regarding purchasing items in-store versus online: 81% prefer in-store for furniture, 69% in-store for home goods, 65% in-store for apparel, 65% in-store for sporting goods and 59% in-store for electronics.

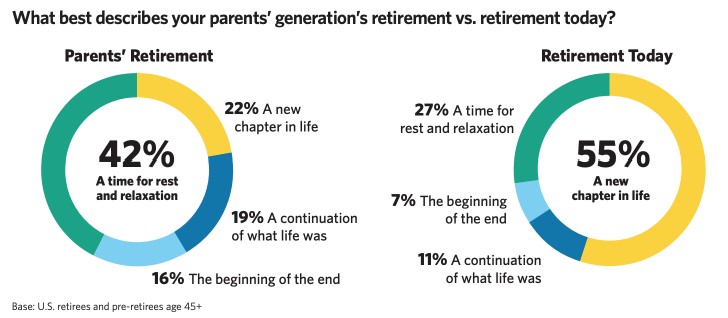

NOT YOUR PARENTS’ RETIREMENT:

To most Americans, retirement is not their parents’ retirement. Rather than a destination, it’s become a new journey, based on our survey with Edward Jones and Age Wave.

- 55% of pre-retirees and retirees ages 45 and older say that retirement today is best described as “a new chapter in life” versus the 27% who view it as “a time for relaxation.”

- When asked how today’s retirees view their parents’ retirement, 42% said it was “a time for relaxation” and only 22% described it as “a new chapter in life.”

- Half of retirees say they are “reinviting themselves in their retirement,” particularly women (53% versus men at 47%).

- 72% say they are now “able to realize their hopes and dreams.”

- At the same time, retirement isn’t without worries: Pre-retirees and retirees ages 45+ are worried about their physical health (49%), healthcare costs (34%), unexpected expenses (32%) and economic conditions (32%).

DRY JANUARY GROWS:

Dry January continues to grow in popularity – with better health and weight loss the prime motivators, according to our survey with Go Brewing.

- 79% of Americans who consume alcohol said they considered participating in Dry January this year.

- The top motivators include a desire to be healthier (52%), lose weight (35%) and the ability to focus better on personal or work goals (33%).

AIR TRAVEL TURBULENCE:

Southwest Airlines has some work to do to repair its reputation after cancelling flights during the busy holiday travel season, our survey with AdAge

- 45% of Americans have a worse opinion of the airline since before the meltdown.

- That dissatisfaction rises to 52% among people who have recently traveled with Southwest.

- 41% of respondents say they are less likely to travel with Southwest now compared to before the mass cancellations

ICYMI:

In case you missed it, check out some of the thought-leadership and happenings around Stagwell making news:

- Zillow CEO: Traditional offices are as outdated as typewriters. Employers need to adapt. (based on Harris Poll data)

- Quick Quitting: A New Trend Among Deskless Workers?

- Most employers would sack workers for improper social media posts: Poll

- 2023 predictions for communicators (#2)

As always, if helpful, we would be happy to provide more info on any of these data or insights. Please do not hesitate to reach out.

Thank you.

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud, Talent & Awards

May 06, 2024

PRophet, a Stagwell (STGW) Company, Takes Home Two Big Wins at the 2024 Innovation SABRE Awards and 28th Annual Webby Awards

PRophet's AI-driven platform clinches two prestigious awards for innovation and…

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Newsletter

Sign Up

NEW YORK, Jan. 6, 2023 /PRNewswire/ — Stagwell (NASDAQ: STGW) announced today that Chairman and CEO Mark Penn will present at the upcoming 25th Annual Needham Growth Conference on Wednesday, Jan. 11, 2022, from 2:15 to 2:55 PM ET. Penn will also be available for 1:1 investor meetings. To schedule a meeting, please reach out to ir@stagwellglobal.com.

Visit this page to view upcoming investor events and programming from Stagwell, and this page for the latest news and announcements from Stagwell.

About Stagwell

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

For more information on Stagwell, please visit www.stagwellglobal.com

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud, Talent & Awards

May 06, 2024

PRophet, a Stagwell (STGW) Company, Takes Home Two Big Wins at the 2024 Innovation SABRE Awards and 28th Annual Webby Awards

PRophet's AI-driven platform clinches two prestigious awards for innovation and…

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Newsletter

Sign Up

By: Ray Day

CONTACT:

- JOB, COST-OF-LIVING WORRIES UP AGAIN: Today, 86% of Americans are concerned about the economy, inflation and jobs – moderating from last week. Yet worries about affording living expenses and losing a job are on the rise again.

- 86% are concerned about the economy and inflation (down 4 points from last week)

- 82% about a potential U.S. recession (down 4 points)

- 81% about U.S. crime rates (down 1 point)

- 73% about political divisiveness (down 1 point)

- 73% about affording their living expenses (up 1 point)

- 73% about the War on Ukraine (no change)

- 57% about a new COVID-19 variant (down 2 points)

- 48% about losing their jobs (up 3 points)

- 47% about the Monkeypox outbreak (up 2 points)

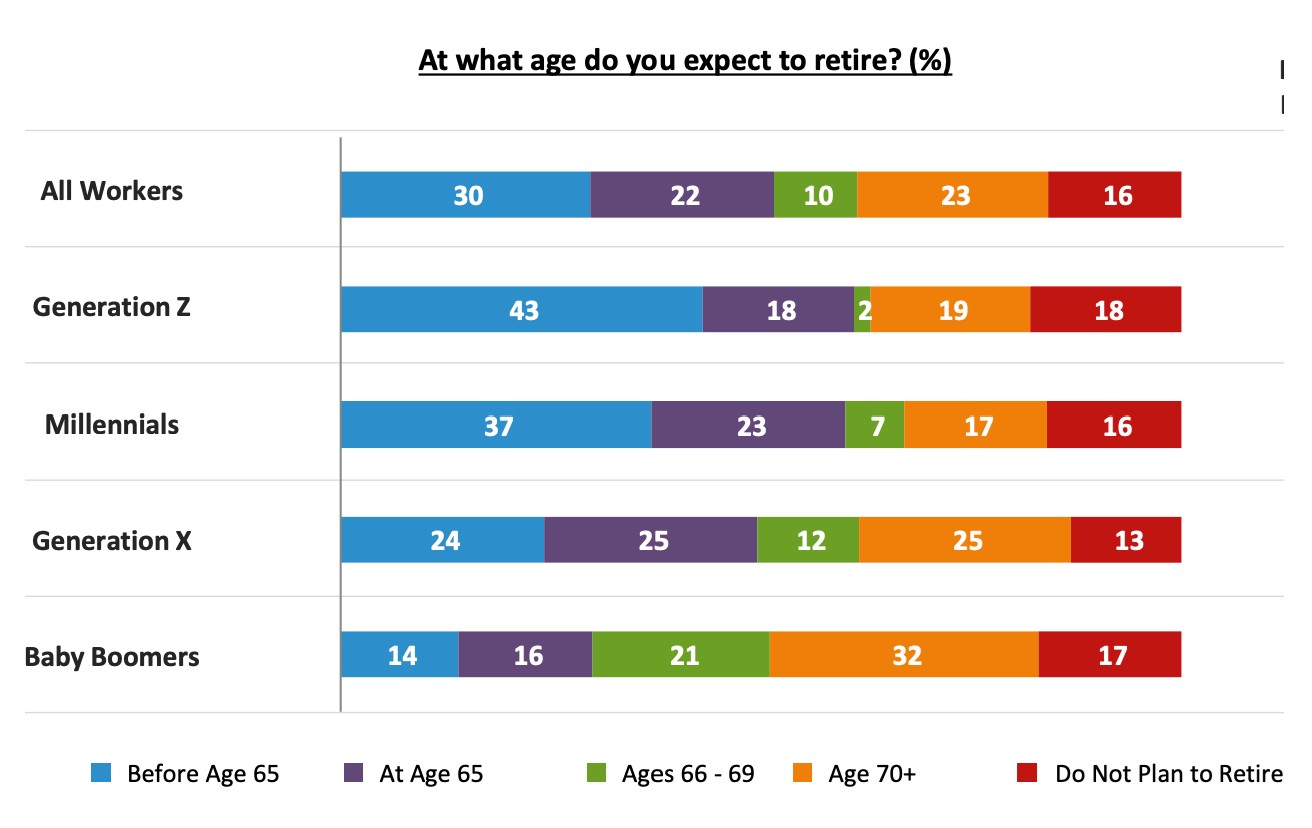

- GEN Z NOT BANKING ON SOCIAL SECURITY: Of the four generational groups currently in the working world, Gen Z is the least likely to depend on Social Security to fund their retirement – and the most likely to retire early. That’s according to the “Emerging From the COVID-19 Pandemic: Four Generations Prepare for Retirement” survey released this week with the Transamerica Center for Retirement Studies.

- Gen Z workers (43%) are more likely than older generations to expect to retire before age 65 (versus 30% of all workers expecting to retire before age 65, 37% for Millennials, 24% for Gen X and 14% for Baby Boomers).

- 67% of Gen Z workers are saving for retirement through employer-sponsored 401(k) or similar retirement plans or outside the workplace.

- The median age at which Gen Z is starting to save – 19 years old – is much younger than the median starting age for Millennials (age 25), Gen X (30) and Boomers (35).

- Among Gen Z and Millennials, 73% said they are concerned that Social Security will not be there when they are ready to retire.

- That compares with 40% of Boomers who expect Social Security to be their primary source of retirement income.

- Gen X workers have the least faith in Social Security, with 78% saying they are concerned that Social Security will not be there for them when they are ready to retire.

- HIGH SCHOOLERS WANT MORE CAREER HELP: High school students across the country are frustrated with the lack of support they are receiving in preparing for a future career. Our survey with the Data Quality Campaign and Kentucky Student Voice Team found:

- 54% say the pandemic has changed how they think about what they might do after graduation.

- Only 35% say their school informed them of which postsecondary or career paths are available to them.

- 80% of students agree they would feel more confident about their career path if they had better access to information to determine their options after graduation.

- This lack of career preparation already is showing up in the workplace. Of Gen Z members who interned or started a job this past year, 49% say that they did not feel like their training and onboarding were done well.

- 58% of interns also report feeling lost at work without anyone to reach for questions and support.

- LESS THAN HALF OF VOTING AMERICA WATCHES TRADITIONAL TV: When it comes to reaching Americans this election season, less than half of voters (49%) have a traditional TV, according to a new HarrisX survey with Samba TV.

- 1 in 4 of those who do still have traditional TV plan to cancel in the next six months.

- Independents (42%) are the least likely to have traditional TVs.

- Millennial and Gen Z voters are more than twice as likely to stream than they are to have a traditional linear subscriptions today. The gap is even wider for younger voters in battleground states.

- Facebook remains the most used platform by registered voters nationally but has less of an impact in key battleground states.

- Democrat voters are significantly more likely to use TikTok than Republicans nationally –with 37% of Democratic voters using it weekly compared with 27% of Republican voters.

- MANY WOMEN STILL MISS DEADLY BREAST CANCER SIGNS: October is National Breast Cancer Awareness Month, and most women are unaware of the unusual symptoms of a particularly aggressive and deadly form of the disease, according to our survey with The Ohio State University Comprehensive Cancer Center.

- The good news: 78% of women recognize a lump in the breast as a sign of breast cancer.

- However, less than half of women would flag redness of the breast (44%), pitting/thickening of the skin (44%) or one breast feeling warmer or heavier than the other (34%) as possible symptoms of breast cancer – specifically the rare and highly aggressive form of the disease known as inflammatory breast cancer.

- ICYMI: In case you missed it, check out some of the thought-leadership and happenings around Stagwell making news:

As always, if helpful, we would be happy to provide more info on any of these data or insights. Please do not hesitate to reach out.

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud, Talent & Awards

May 06, 2024

PRophet, a Stagwell (STGW) Company, Takes Home Two Big Wins at the 2024 Innovation SABRE Awards and 28th Annual Webby Awards

PRophet's AI-driven platform clinches two prestigious awards for innovation and…

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Newsletter

Sign Up

Challenger marketing services network will report financial results for the three months ended Sept. 30, 2022

NEW YORK – Oct. 7, 2022 – Stagwell, the challenger network built to transform marketing, today announced it will report financial results for the three months ended Sept. 30, 2022, on Thursday, Nov. 3, before market open.

Stagwell will host a webcast to review those results the same day at 8:30 a.m. ET. To register and view the webcast, visit this link.

A replay of the webcast will be available following the event on Stagwell’s investor website: https://www.stagwellglobal.com/investors/

About Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

IR Contact:

Michaela Pewarski

ir@stagwellglobal.com

646-429-1812

PR Contact:

Beth Sidhu

pr@stagwellglobal.com

202-423-4414

Related

Articles

In the News, Press Releases, Stagwell Marketing Cloud, Talent & Awards

May 06, 2024

PRophet, a Stagwell (STGW) Company, Takes Home Two Big Wins at the 2024 Innovation SABRE Awards and 28th Annual Webby Awards

PRophet's AI-driven platform clinches two prestigious awards for innovation and…

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Newsletter

Sign Up

CONTACTS

PR Contact

Beth Sidhu

pr@stagwellglobal.com

202-423-4414

IR Contact

Michaela Pewarski

ir@stagwellglobal.com

646-429-1812

New York – Sept. 15, 2022 – Stagwell (NASDAQ: STGW) announced today that Chairman and CEO Mark Penn will present at the upcoming Sidoti Small-Cap Virtual Conference on Thursday, September 22, 2022 at 10:45 AM ET. Penn will be available for 1:1 investor meetings. To schedule a meeting, please reach out to ir@stagwellglobal.com.

Visit this page to view upcoming investor events and programming from Stagwell.

About Stagwell

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Related

Articles

Investments & Financials, Press Releases

May 08, 2024

Stagwell Inc. (STGW) Reports Equity Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)

Stagwell Inc. announced today the grant of equity inducement awards.

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…