Contact:

hello@stagwellglobal.com

Yesterday, August 23, marked the first major national moment of the 2024 U.S. presidential election. Looking ahead, Stagwell’s Risk and Reputation Unit expects the next 18 months are going to be politically anti-business – compounded by a fraught calendar filled with potential flashpoints for brands. Ongoing reputational crises make it clear: you need to have your house in order, as your brand could be next on the attack list amongst a wide audience of engaged Americans.

THE MAJOR WEDGE ISSUES GOING INTO 2024

Americans Don’t Believe Economic Reporting

- 59% say current economic conditions are being misrepresented due to the upcoming election cycle

- 53% say the media and news sources discuss the economy inaccurately

- 60% say the economy isn’t as good as the new sources make it to be

(The Harris Poll, America This Week Wave 179)

Past Election Cycle Suggests Future Risk Ahead

- Disney’s trended average political split between Republicans and Democrats went from a nominal 2.6 points in 2019 to highly polarized 19.3 points in 2023 during its legal battle with Florida and Governor Ron DeSantis

- Nike’s political split went from 4.3 in 2019 to 16.3 in 2022 – the most divisive company that year – after the “Satan Shoes” controversy with their Lil Nas X partnership

- Twitter’s political split went from 13 points Democrat favor in 2022 to 11 points Republican favor in response to Musk’s takeover

(2023 Axios Harris Poll 100)

Politics Create Brand Dissonance

- 82% of all Americans say companies are becoming more political than ever

- 71% aren’t interested in supporting companies that have become too political, regardless if they agree with their stances

- 78% wish their preferred brands would stay out of politics

(The Harris Poll, July 2023)

HOW STAGWELL IS HELPING BUSINESS LEADERS SEE AROUND CORNERS

As featured this week in PRovoke, Stagwell’s Risk and Reputation Unit’s bipartisan team of political, financial, and public opinion specialists will prepare brands for the grueling ongoing political cycle and polarized society.

The Unit brings together experts from left-of-center strategic advisory SKDK, right-of-center digital-first agency Targeted Victory, financial communications firm Sloane & Company, insights and research firm The Harris Poll, and Stagwell’s corporate leadership.

This fall, we will host three in-person luncheon briefings for business leaders aimed at unpacking what the next 18 months hold and how brands should prepare themselves. Dates are as follows:

- NEW YORK: September 13, 2023

- WASHINGTON, D.C.: September 20, 2023

- CHICAGO: September 27, 2023

To request a seat at our events, receive a consultation about the risks your brand faces, or join the mailing list for future updates, please reach out to hello@stagwellglobal.com.

Related

Articles

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Augmented Reality

Apr 25, 2024

Playfully Navigating the Google Booth at CES

Google partnered with Left Field Labs to blend its physical…

Newsletter

Sign Up

Originally released on

Revenue of $622 Million

Adjusted EBITDA of $72 million

First Quarter Results in line with Management Expectations

Reaffirms 2023 Full Year Guidance

Announces Share Repurchase Agreement for over 23.3 million Class A Shares in Stagwell Inc.

Aggregate Class A and Class C Shares reduced 8% to 267 million

New York, NY, May 9, 2023 (NASDAQ: STGW) – Stagwell Inc. (“Stagwell”) today announced financial results in line with internal expectations for the three months ended March 31, 2023.

FIRST QUARTER RESULTS:

- Revenue and EBITDA in line with management expectations

- Revenue of $622 million, a decrease of 3% versus the prior year period.

- First quarter net revenue of $522 million, a decrease of 1% versus the prior period.

- Organic net revenue decline of 3%, and excluding advocacy of 1%, versus the prior year period.

- On a two-year growth stack basis, organic net revenue growth of 21%

- First quarter net income attributable to Stagwell Inc. Common Shareholders of $0.4 million versus $13 million in the prior year period.

- First quarter Adjusted EBITDA of $72 million, a decrease of 29% versus the prior year period.

- First quarter Adjusted Earnings Per Share for Stagwell Inc. Common Shareholders of $0.13 versus $0.22 in the prior year period.

- Net new business wins of $53 million in the quarter and $212 million for the trailing twelve months.

“Stagwell is stronger than ever today with the removal of an overhang on the stock and Q1 results in line with management’s expectations, allowing us to reaffirm guidance for another year of significant growth,” said Mark Penn, Chairman and CEO of Stagwell Inc. “This quarter is compared to Q1 2022 which had 24% of organic growth compared to 14% for the year. We expect to return to double-digit growth in the later quarters, especially given strong new business wins within the quarter and after the close. We are moving forward with the Stagwell Marketing Cloud and all investors are invited to try our generative A.I. product at www.PRProphet.ai.”

“We have additionally announced entry into a definitive agreement, approved unanimously by Stagwell’s independent and disinterested directors who were advised by outside counsel and advisers, to repurchase approximately 23.3 million shares of Stagwell Inc. Class A Stock from AlpInvest,” Penn added. “I believe this purchase will help create value for shareholders in the marketplace given our undervalued stock.”

Frank Lanuto, Chief Financial Officer, commented: “Coming off a record Q1 performance in 2022, the Company posted first quarter results in a challenging environment that were in line with management expectations. We are beginning to see positive signs, including strong new business wins, and improving client conditions, which give us confidence about the outlook for the remainder of the year.”

Financial Outlook

2023 financial guidance is as follows:

- Organic Net Revenue growth of 7.5% – 10%

- Organic Net Revenue growth ex-Advocacy of 10% – 14%

- Adjusted EBITDA of $450 million – $490 million

- Free Cash Flow Conversion of 50% – 60%

- Adjusted EPS of $0.90 – $1.05

- Guidance assumes no impact from foreign exchange, acquisitions or dispositions.

|

* The Company has excluded a quantitative reconciliation with respect to the Company’s 2023 guidance under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. See “Non-GAAP Financial Measures” below for additional information. |

Stock Repurchase Program

In the first quarter, the Company repurchased approximately 2.6 million shares of Class A Common Stock at an average price of $6.91 per share for an aggregate value of approximately $18 million. The remaining value of shares permitted to be repurchased was approximately $180 million as of March 31, 2023.

Stock Repurchase Transaction

On May 9, 2023, Stagwell Inc. agreed to repurchase approximately 23.3 million shares from AlpInvest Partners at a share price of $6.43 which is a total value of approximately $150 million. As announced separately, Stagwell Media LP, a shareholder in Stagwell Inc., and AlpInvest are engaged in advanced negotiations to redeem AlpInvest’s remaining interests in Stagwell Media LP., subject to final documentation. Upon completion of these transactions, AlpInvest Partners will no longer be an investor in Stagwell Inc.

Conference Call

Management will host a video webcast and conference call on Tuesday, May 9, 2023, at 8:30 a.m. (ET) to discuss results for Stagwell Inc. for the three months ended March 31, 2023. The video webcast will be accessible at https://stgw.io/Q12023Earnings. An investor presentation has been posted on our website at www.stagwellglobal.com and may be referred to during the conference call.

A recording of the conference call will be accessible one hour after the call and available for ninety days at www.stagwellglobal.com.

Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Contacts

For Investors:

Ben Allanson

Ir@stagwellglobal.com

For Press:

Beth Sidhu

Pr@stagwellglobal.com

Non-GAAP Financial Measures

In addition to its reported results, Stagwell Inc. has included in this earnings release certain financial results that the Securities and Exchange Commission (SEC) defines as “non-GAAP Financial Measures.” Management believes that such non-GAAP financial measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company’s results. Such non-GAAP financial measures include the following:

(1) Organic Revenue: “Organic revenue growth” and “organic revenue decline” refer to the positive or negative results, respectively, of subtracting both the foreign exchange and acquisition (disposition) components from total revenue growth. The acquisition (disposition) component is calculated by aggregating prior period revenue for any acquired businesses, less the prior period revenue of any businesses that were disposed of during the current period. The organic revenue growth (decline) component reflects the constant currency impact of (a) the change in revenue of the partner firms that the Company has held throughout each of the comparable periods presented, and (b) “non-GAAP acquisitions (dispositions), net”. Non-GAAP acquisitions (dispositions), net consists of (i) for acquisitions during the current year, the revenue effect from such acquisition as if the acquisition had been owned during the equivalent period in the prior year and (ii) for acquisitions during the previous year, the revenue effect from such acquisitions as if they had been owned during that entire year (or same period as the current reportable period), taking into account their respective pre-acquisition revenues for the applicable periods, and (iii) for dispositions, the revenue effect from such disposition as if they had been disposed of during the equivalent period in the prior year.

(2) Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period.

(3) Adjusted EBITDA: defined as Net income excluding non-operating income or expense to achieve operating income, plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, and other items. Other items include restructuring costs, acquisition-related expenses, and non-recurring items.

(4) Adjusted Diluted EPS is defined as (i) Net income (loss) attributable to Stagwell Inc. common shareholders, plus net income attributable to Class C shareholders, excluding amortization expense, impairment and other losses, stock-based compensation, deferred acquisition consideration adjustments, discrete tax items, and other items, divided by (ii) (a) the per weighted average number of common shares outstanding plus (b) the weighted average number of Class C shares outstanding, (if dilutive). Other items includes restructuring costs, acquisition-related expenses, and non-recurring items, and subject to the anti-dilution rules.

(5) Free Cash Flow: defined as Adjusted EBITDA less capital expenditures, change in net working capital, cash taxes, interest, and distributions to minority interests, but excludes contingent M&A payments.

(6) Financial Guidance: The Company provides guidance on a non-GAAP basis as it cannot predict certain elements which are included in reported GAAP results.

Included in this earnings release are tables reconciling reported Stagwell Inc. results to arrive at certain of these non-GAAP financial measures.

This document contains forward-looking statements. within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company’s representatives may also make forward-looking statements orally or in writing from time to time. Statements in this document that are not historical facts, including, statements about the Company’s beliefs and expectations, future financial performance and future prospects, business and economic trends, potential acquisitions, and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Forward-looking statements, which are generally denoted by words such as “anticipate,” “assume,” “believe,” “continue,” “could,” “create,” “estimate,” “expect,” “focus,” “forecast,” “foresee,” “future,” “guidance,” “intend,” “look,” “may,” “opportunity,” “outlook,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” or the negative of such terms or other variations thereof and terms of similar substance used in connection with any discussion of current plans, estimates and projections are subject to change based on a number of factors, including those outlined in this section.

Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company. Although the management of the Company believes that the expectations and assumptions on which such forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. The material assumptions upon which such forward-looking statements are based include, among others, assumptions with respect to general business, economic and market conditions, the competitive environment, anticipated and unanticipated tax consequences and anticipated and unanticipated costs. These forward-looking statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any.

Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statements. Such risk factors include, but are not limited to, the following:

- risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients;

- the continued impact of the coronavirus pandemic (“COVID-19”), and evolving strains of COVID-19 on the economy and demand for the Company’s services, which may precipitate or exacerbate other risks and uncertainties;

- inflation and actions taken by central banks to counter inflation;

- the Company’s ability to attract new clients and retain existing clients;

- the impact of a reduction in client spending and changes in client advertising, marketing and corporate communications requirements;

- financial failure of the Company’s clients;

- the Company’s ability to retain and attract key employees;

- the Company’s ability to compete in the markets in which it operates;

- the Company’s ability to achieve its cost saving initiatives;

- the Company’s implementation of strategic initiatives;

- the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration;

- the Company’s ability to manage its growth effectively, including the successful completion and integration of acquisitions that complement and expand the Company’s business capabilities;

- the Company’s ability to develop products incorporating new technologies, including augmented reality, artificial intelligence, and virtual reality, and realize benefits from such products;

- an inability to realize expected benefits of the combination of the Company’s business with the business of MDC;

- adverse tax consequences in connection with the Transactions for the Company, its operations and its shareholders, that may differ from the expectations of the Company, including that future changes in tax law, potential increases to corporate tax rates in the United States and disagreements with the tax authorities on the Company’s determination of value and computations of its attributes may result in increased tax costs;

- the occurrence of material Canadian federal income tax (including material “emigration tax”) as a result of the Transactions;

- the Company’s unremediated material weaknesses in internal control over financial reporting and its ability to establish and maintain an effective system of internal control over financial reporting;

- the Company’s ability to protect client data from security incidents or cyberattacks;

- economic disruptions resulting from war and other geopolitical tensions (such as the ongoing military conflict between Russia and Ukraine), terrorist activities and natural disasters;

- stock price volatility; and

- foreign currency fluctuations.

Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors outlined in more detail in our 2022 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 6, 2023, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings.

Related

Articles

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Augmented Reality

Apr 25, 2024

Playfully Navigating the Google Booth at CES

Google partnered with Left Field Labs to blend its physical…

Newsletter

Sign Up

CONTACT:

New York – Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, announced today it will report financial results for the three and twelve months ended Mar. 31, 2023, on Tuesday, May 9, 2023, before the market open.

Stagwell will host a video webcast to review those results the same day at 8:30 AM (ET). To register and view the webcast, visit https://stgw.io/Q12023Earnings

A replay of the webcast will be available following the event at Stagwell’s website, https://www.stagwellglobal.com/investors/

About Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com

Related

Articles

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Augmented Reality

Apr 25, 2024

Playfully Navigating the Google Booth at CES

Google partnered with Left Field Labs to blend its physical…

Newsletter

Sign Up

CONTACT

hello@stagwellglobal.com

SIGN UP FOR OUR INSIGHTS BLASTS

Stagwell and our partners at Infinite Reality teamed up at SXSW 2023 to explore the ways that fandom, technology and consumers are converging in immersive experiences, helping bring consumers closer to the sports, entertainment, music and games they love. Hear from leaders at United Masters, Napster, AFROPUNK and more about how the consumer imperative for more immersive experiences are shaping early entertainment and commerce in the metaverse. Stream episodes from the SXSW 2023 Podcast Lounge below.

– Alexis Williams, Chief Brand Officer, NA

Talent in the Metaverse

What’s next in connection, community, and commerce for avatars, athletes and artists? Hear from Tracy Benson, CEO and Founder of Obsesh, Nova Han of Nova Han Productions, and Helix Wolfson, President of Metaverse Operations at Infinite Reality. Stream the episode.

Creator Economy and the Metaverse

How are creators and platforms envisioning the future of fandom and engagement in the metaverse and other immersive realities? Maggie Malek, CEO, MMI and John Rough, SVP, Enterprise for Untied Masters, discuss. Stream the episode.

Fandom, Music, and Metaverse

VentureBeat’s Dean Takahashi, Jonathan Vlassopulos, CEO of Napster, and Animal Concerts Executive Producer, Music, Anthony Mazzo discuss how brands can connect with artists, music, platforms and communities in the metaverse. Stream the episode.

Inclusivity in the Metaverse

AFROPUNK founder Jocelyn Cooper and Shelby Larkin, Director, Global Partnership development at SoFi Stadium and Hollywood Park discuss diverse communities can benefit from the Metaverse. Stream the episode.

Related

Articles

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Augmented Reality

Apr 25, 2024

Playfully Navigating the Google Booth at CES

Google partnered with Left Field Labs to blend its physical…

Newsletter

Sign Up

CONTACT

hello@stagwellglobal.com

SIGN UP FOR OUR INSIGHTS BLASTS

As the marketing landscape continues to evolve, Stagwell is proud to lead the charge as the only digital-first marketing services network. Today, we’re excited to announce that 9 of our network agencies have been recognized by the prestigious Webby Awards for their outstanding work in pushing the boundaries of the internet. They include Anomaly, ARound, 72andSunny, Code and Theory, GALE, HUNTER, Instrument, Observatory, and YML.

With a total of 13 Webby Award nominations and 14 honors received to date this year, Stagwell’s agencies are shining bright on the shortlist. It’s a testament to the innovative and creative minds within our network who are driving forward the future of digital marketing. Join us in celebrating this remarkable achievement and cast your vote for Webby’s People Choice Award by Thursday, April 20th.

72andSunny

- Call of Duty Modern Warfare “Squad Up” – Nominee – Video > General Video > Trailer – VOTE HERE

- NFL “We See You” – Honoree – Advertising, Marketing & PR > Advertising Campaign > Corporate Social Responsibility Campaign – VIEW THE WORK

- HubSpot “Success Stories” – Honoree – Advertising, Marketing & PR > Craft > Best Copywriting – VIEW THE WORK

- Bumble “Fall in Love with Dating” – Honoree – Advertising, Marketing & PR > Individual > Video Ad Shortform > VIEW THE WORK

- Google “Helping You Help Them” – Honoree – Advertising, Media & PR – Advertising Campaigns – Best Partnership or Collaboration – VIEW THE WORK

Anomaly

- Make Time for the Life Artois – Nominee – Advertising, Media & PR > Craft > Best Video Editing – VOTE HERE

ARound

- ARound Stadium – Honoree – Apps, dApps and Software > App Features > Best Use of Augmented Reality – VIEW THE WORK

Code and Theory

- Skidmore, Owings & Merrill – Nominee – Websites and Mobile Sites > General Websites and Mobile Sites > Architecture, Art & Design – VOTE HERE

- Code and Theory Inclusive Design & Marketing – Honoree – Video > Branded Entertainment > Diversity, Equity & Inclusion – VIEW THE WORK

- Windows (Consumer) – Honoree – Websites and Mobile Sites > General Websites and Mobile Sites > Web Services & Applications – VIEW THE WORK

- Fatherly – Honoree – Websites and Mobiles Sites > General Websites and Mobile Sites > Travel & Lifestyle – VIEW THE WORK

- Amazon Ads – Honoree – Advertising, Media & PR > Branded Content > Products & Services – VIEW THE WORK

GALE

- 26.2 You’re Gonna Need Milk For That with MilkPEP – Nominee – Advertising, Media & PR > PR Campaigns > Best Event Activation > VOTE HERE

HUNTER

- Johnnie Walker and Lilly Singh Join Forces for Gender Parity in Leadership – Nominee – Video > Branded Entertainment > Corporate Social Responsibility – VOTE HERE

Instrument

Observatory

- “Live From The Upside Down” Netflix Stranger’s Things and Doritos from Observatory & Slap Global – Nominee – Advertising, Media & PR > Branded Content > Media & Entertainment – VOTE HERE

- “Live From The Upside Down” Netflix Stranger’s Things and Doritos from Observatory & Slap Global – Nominee – Video > Branded Entertainment > Media & Entertaniment – VOTE HERE

- “Live From The Upside Down” Netflix Stranger’s Things and Doritos from Observatory & Slap Global – Nominee – Metaverse, Immersive & Virtual > General Virtual Experiences > Entertainment, Sports & Music – VOTE HERE

YML

- YETI Year in Preview: Plan your wildest year yet – Nominee – Websites and Mobile Sites > General Websites and Mobile Sites > Events – VOTE HERE

- Albertsons: Simplifying Grovery Shopping for Millions – Nominee – Apps, dApps and Software > General Apps > Shopping & Retail – VOTE HERE

- Chopt: Building an End-to-End Experience for a Challenger Brand – Nominee – Apps, dApps and Software > General Apps > Food & Drink – VOTE HERE

- FIREWATCH: Using NFTs to Fight California Wildfires – Honoree -Websites and Mobile Sites – Responsible Innovation – VIEW THE WORK

- Albertsons: Simplifying Grocery Shopping for Millions in the Websites and Mobile Sites – Honoree – Best Mobile Visual Design – Function – VIEW THE WORK

- Champion: Evolving an Iconic Brand For a New Generation – Honoree – Websites and Mobile Sites > Shopping & Retail – VIEW THE WORK

- Chopt: Building an End-to-End Experience for a Challenger Brand – Honoree – Apps, dApps and Software > Technical Achievement – VIEW THE WORK

- FIREWATCH: Using NFTs to Fight California Wildfires – Honoree – Websites and Mobile Sites > Sustainable Technology: VIEW THE WORK

Related

Articles

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Augmented Reality

Apr 25, 2024

Playfully Navigating the Google Booth at CES

Google partnered with Left Field Labs to blend its physical…

Newsletter

Sign Up

CONTACT

hello@stagwellglobal.com

SIGN UP FOR OUR INSIGHTS BLASTS

Brand fandom is driving the transformation of marketing. And marketers can’t move fast enough to maximize the potential of community engagement to drive long-term loyalty. Hear how leaders from LEGO, Lenovo, and Infinite Reality are using everything from immersive technologies to branded entertainment to engage with their brand fans. Catch their insights below and visit YouTube to see all of our Content Studio interviews with C-Suite leaders.

– Alexis Williams, Chief Brand Officer, NA

LEGO: Branded Entertainment and Brand Fandom Go Hand in Hand

LEGO Creative Director James Gregson shared his team’s playbook for using brand entertainment content like “The LEGO Movie” to drive long-term brand fandom with Rescout’s Ivan Kayser. Watch the clip.

Lenovo and Infinite Reality: What Is the Most Important Driver of Fandom?

National Research Group’s Jay Kaufman interviews Infinite Reality CMO Hope Frank, Lenovo CMO Gerald Youngblood, NRG CMO Grady Miller and Brand Performance Network’s Shannon Pruitt after their SXSW Session “The Anatomy of a Fan.” Watch the clip

Minnesota Twins: Fan Insights Fuel Better Experiences

Technology is giving sports teams and sports marketers insights into fan behavior that they’ve never had before. Chris Iles, Sr. Director, Innovation and Growth at the Minnesota Twins, caught up with Stagwell at SXSW to chat about how teams like Twins are integrating tech innovation to reach a new generation of fans. Watch the Clip.

Related

Articles

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Augmented Reality

Apr 25, 2024

Playfully Navigating the Google Booth at CES

Google partnered with Left Field Labs to blend its physical…

Newsletter

Sign Up

By

Mark Penn, Chairman and CEO, Stagwell

CONTACT

hello@stagwellglobal.com

SIGN UP FOR OUR INSIGHTS BLASTS

When I launched Stagwell, I promised we would transform marketing with digital strategy and technology innovation, and we are off-to-the-races in 2023 building game-changing AR and AI products to do just that. From pressing our advantage as early-movers in the artificial intelligence and communications technology space, to breaking world records with our augmented reality partners, I’m proud to share an update on the digital innovation efforts underway across Stagwell.

AI is one of the most talked about trends in business in 2023. There’s a lot of buzz, hype, and predictions afoot about what it can and can’t do for advertising. We’re believers in AI as enablement technology — while it can certainly replace around 85% of marketing activity, the final 15% is powered by that intangible human element that makes creative marketing soar.

Our teams are working to help our partners around the world absorb the promises and pitfalls of this new technology. Visit our website to hear more from our experts about this new frontier, and if you have questions about any of the below, please reach out to me to discuss.

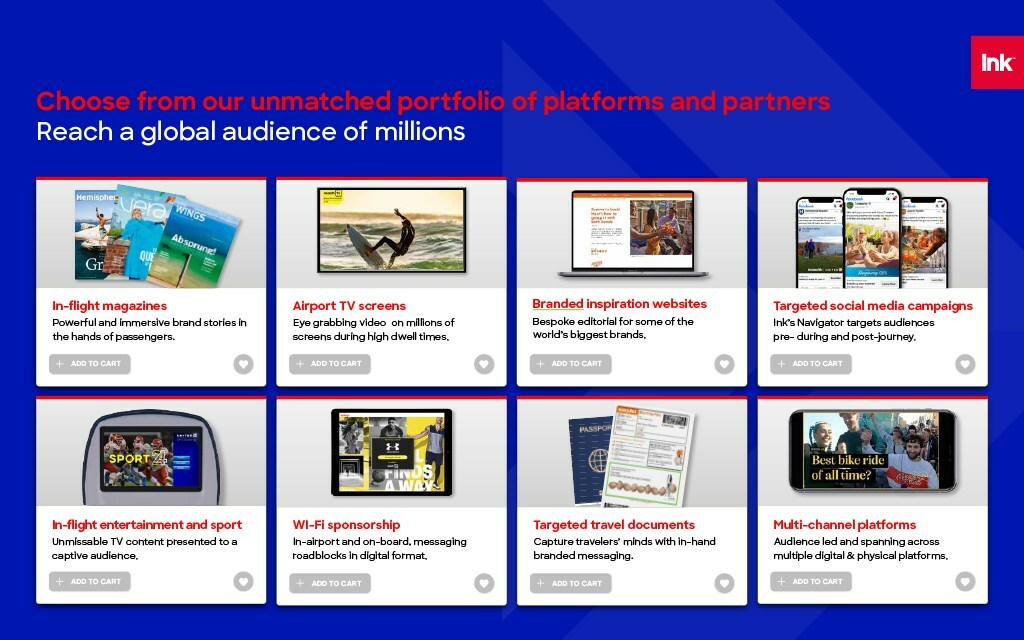

At CES 2023 in January, Stagwell was the only global marketing services network to exhibit on the main convention floor as we focused on showing how we transform marketing through impactful technology. There, we unveiled an exciting new division in the Stagwell Marketing Cloud to build Specialty Media formats that offer brands novel ways to reach, engage, and monetize key consumer segments across sports, travel, retail, news, and dining. The unit currently includes ARound, our shared AR product in use by the Los Angeles Rams; a new QR code powered marketplace for restaurants and bars; and a new travel marketplace from Ink.

Through this tech-focused approach, we are bringing new experiences to consumers, whether at the stadium, in a restaurant, or on an airplane. Along with these experiences comes a wealth of creative marketing opportunities, adding, as Digiday reports, yet another “bow in the quiver” of the Cloud that keeps us at the forefront of new forms of richly targeted media

Related

Articles

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Augmented Reality

Apr 25, 2024

Playfully Navigating the Google Booth at CES

Google partnered with Left Field Labs to blend its physical…

Newsletter

Sign Up

CONTACT

hello@stagwellglobal.com

SIGN UP FOR OUR INSIGHTS BLASTS

Our biggest takeaway from SXSW 2023? Brand fandom is driving the transformation of marketing. And marketers can’t move fast enough to maximize the potential of community engagement to drive long-term loyalty. Here are our top three learnings from the fandom conversation in Austin this year.

FANDOM and COMMUNITY

Throughout 2023, we’ve been talking about the convergence of “community, content, and commerce”. At SXSW, the first C in that clause was on full display as brands built physical communities to connect attendees to their favorite brand elements. Take Roku City; introduced as a dynamic screensaver in 2017, it drives Twitter mentions once every 12 minutes. Roku finally created the city in real life in Austin in partnership with Best Buy, driving attendees through a whimsical entertainment and commerce metropolis.

In Austin, Reddit loomed as the unspoken champion of consumer communities; in a cheeky session, the brand acknowledged that while ChatGPT and its peers are quickly transforming the internet, they won’t usurp community information any time soon. ” “Where do you think they get their answers from?” quipped Reddit’s COO.

So What? Community is an accelerant for brand fandom. Tap into your consumers’ key communities, or otherwise deliver it via your product and services, and you have a long-term platform of ambassadors.

FANDOM and IMMERSIVE EXPERIENCES

Brands traded talk of the metaverse for discussion of “immersive experiences” at SXSW this year. They’re excited what’s possible with personalization in immersive marketing; as well as how brands can use shared moments of interactivity between consumers to build fandom.

Marketers should tap into a toolbox spanning V.R., AR, and interactive activations to build brand ecosystems that empower consumers to customize their interactions with the brand — while being part of a larger community of passionate fans. And don’t discount the power of A.I. to aid here; for example, new features from our partners at Infinite Reality, unveiled at SXSW, make shopping and viewing interactions in the Metaverse more intuitive and personalized for participants.

So What? Shared Experiences + Personal Touches = Fuel for Fandom-Driving Experiences

FANDOM and PROBLEM SOLVING

Brands are in problem-solving mode, bending tech and media to tackle sustainability, hunger, disease, and socioeconomic ails. For brands like Dexcom, which brought a dynamic panel featuring Nick Jonas to life at SXSW with our colleagues at Allison+Partners on the lived experiences of patients with diabetes, becoming a trusted source of safety and support for a consumer set can drive dividends for years to come. Dexcom’s emphasis on improving access and affordability and its marketing efforts at the Super Bowl over recent years allow it to make inroads with massive addressable consumer sets, with 1 in 5 Americans being diagnosed with diabetes.

Consumers reward brands that show a penchant for problem-solving; in our research on brand fandom, consumers ranked innovation as the top driver of fandom, followed by the brand’s ability to create a sense of belonging.

So What? Fandom isn’t all about creating exciting stunts – sometimes it’s about cracking the code on the maximum value your brand can offer to consumers.

The Power of Brand Fandom

Fan culture is what elevates a brand into relevance, power, and popularity.

Our research shows that the value of brand fandom extends beyond the traditional metrics of loyalty and relevance. It creates a fan ecosystem where everyone benefits – brands become core to a consumer’s identity, and fans show up with deep commitment and a desire to advocate for the brand.

Download National Research Group’s report for five things you need to know about brand fandom.

Related

Articles

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Augmented Reality

Apr 25, 2024

Playfully Navigating the Google Booth at CES

Google partnered with Left Field Labs to blend its physical…

Newsletter

Sign Up

Originally released on

FY22 Revenue rises to record $2.7B following sixth-consecutive quarter of double-digit growth; company doubles stock buyback program to $250M

FY22 Revenue rises to record $2.7B following sixth-consecutive quarter of double-digit growth; company doubles stock buyback program to $250M

- FY22 Pro Forma revenue growth of 21%; 16% in Q4

- FY22 Pro Forma organic net revenue growth of 14%; 8% in Q4

- Adjusted EBITDA of $451M in FY22, a 20.3% margin on net revenue

- Adjusted EBITDA of $123M in Q4, a 21.1% margin on net revenue

- FY22 Adjusted net income of $268M; $63M in Q4

- FY22 Adjusted EPS of $0.90; $0.22 in Q4

- FY22 Free Cash Flow of $270M; $268M in Q4

- FY22 Net New Business of $213M; $42M in Q4

- Reduced net debt by $47M versus prior year, ending with a net leverage ratio of 2.17x

- Issues 2023 Organic Net Revenue growth guidance of 7.5%-10% and 10%-14% ex-Advocacy

- Issues 2023 Adjusted EBITDA guidance of $450M-$490M and Free Cash Flow conversion of 50%-60%

New York, NY, March 2, 2023 (NASDAQ: STGW) – Stagwell Inc. (“Stagwell”) today announced financial results for the three months and year ended December 31, 2022.

FOURTH QUARTER AND FULL YEAR HIGHLIGHTS:

- Q4 revenue of $708 million, an increase of 16% versus the prior year period; FY22 revenue of $2,688 million, an increase of 83% versus the prior year period

- Q4 revenue growth of 16% versus the prior year period and 13% ex-Advocacy; Pro Forma FY22 revenue growth of 21% versus the prior year period and 17% ex-Advocacy

- Q4 net revenue of $583 million, an increase of 12% versus the prior period; FY22 net revenue of $2,222 million, an increase of 75% versus the prior year period

- Q4 net revenue growth of 12% versus the prior year period and 10% ex-Advocacy; Pro Forma FY22 net revenue growth of 15% versus the prior year period and 13% ex-Advocacy

- Q4 organic net revenue growth of 8% versus the prior year period and 6% ex-Advocacy; Pro Forma FY22 organic net revenue growth of 14% versus the prior year period and 12% ex-Advocacy

- Q4 Adjusted EBITDA of $123 million, an increase of 19% versus the prior year period; FY22 Adjusted EBITDA of $451 million, an increase of 78% versus the prior year period

- Q4 Adjusted EBITDA growth of 19% versus the prior period and 10% ex-Advocacy; Pro Forma FY22 Adjusted EBITDA growth of 19% versus the prior period and 12% ex-Advocacy

- Q4 Adjusted EBITDA Margin of 21.1% on net revenue; FY22 Adjusted EBITDA Margin of 20.3% on net revenue

- Q4 net loss of $28 million versus net income of $5 million in the prior year period; FY22 net income of $66 million versus $36 million in the prior year period

- Q4 net loss attributable to Stagwell Inc. common shareholders of $6 million versus net income of $1 million in the prior year period; FY22 net income attributable to Stagwell Inc. common shareholders of $27 million versus $21 million in the prior year period

- Q4 Adjusted net income of $63 million; FY22 Adjusted net income of $268 million

- Q4 Adjusted earnings per share for Stagwell Inc. common shareholders of $0.22; FY22 Adjusted earnings per share of $0.90

- Q4 net new business of $42 million; FY22 net new business of $213 million

“Stagwell closed out 2022 with industry-leading double-digit growth, strong margin expansion, record free cash flow, record earnings per share, and a net debt ratio significantly below our target. We promised to transform marketing, and we have built game-changing AI and AR-driven products as we continue to grow and transform both our business and the industry,” said Mark Penn, Chairman and CEO, Stagwell. “We look forward to another year of double-digit growth outside of our advocacy businesses in 2023, continuing our momentum.”

Frank Lanuto, Chief Financial Officer, commented: “The Company reported a record $708 million of revenue in the fourth quarter, a 16% increase over the prior year and Adjusted EBITDA of $123 million. Adjusted EBITDA margin as a percentage of net revenue rose to 21.1% for the quarter and 20.3% for the year as a result of careful cost management. Free cash flows rose to $270 million driving down the Company’s net leverage ratio to 2.17x.”

Financial Outlook

2023 financial guidance is as follows:

- Organic Net Revenue growth of 7.5% – 10%

- Organic Net Revenue growth ex-Advocacy of 10% – 14%

- Adjusted EBITDA of $450 million – $490 million

- Free Cash Flow Conversion of 50% – 60%

- Adjusted EPS of $0.90 – $1.05

- Guidance assumes no impact from foreign exchange, acquisitions or dispositions.

|

* The Company has excluded a quantitative reconciliation with respect to the Company’s 2023 guidance under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. See “Non-GAAP Financial Measures” below for additional information. |

Stock Repurchase Program

On March 1, 2023, the Board authorized an extension and a $125,000,000 increase in the size of our previously approved stock repurchase program (the “Repurchase Program”). Under the Repurchase Program, as amended, we may repurchase up to an aggregate of $250,000,000 of shares of our outstanding Class A Common Stock, with any previous purchases under the Repurchase Program continuing to count against that limit. The Repurchase Program will expire on March 1, 2026.

Conference Call

Management will host a video webcast and conference call on Thursday, March 2, 2023, at 8:30 a.m. (ET) to discuss results for Stagwell Inc. for the three months and year ended December 31, 2022. The video webcast will be accessible at https://stgw.io/Q4andFYEarnings. An investor presentation has been posted on our website at www.stagwellglobal.com and may be referred to during the conference call.

A recording of the conference call will be accessible one hour after the call and available for ninety days at www.stagwellglobal.com.

Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Contacts

For Investors:

Jason Reid

Ir@stagwellglobal.com

For Press:

Beth Sidhu

Pr@stagwellglobal.com

Basis of Presentation

The acquisition of MDC Partners (MDC) by Stagwell Marketing Group (SMG) was completed on August 2, 2021. The results of MDC are included within the Statements of Operations for the period beginning on the date of the acquisition through the end of the respective period presented and the results of SMG are included for the entirety of all periods presented.

Non-GAAP Financial Measures

In addition to its reported results, Stagwell Inc. has included in this earnings release certain financial results that the Securities and Exchange Commission (SEC) defines as “non-GAAP Financial Measures.” Management believes that such non-GAAP financial measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company’s results. Such non-GAAP financial measures include the following:

Pro Forma Results: The Pro Forma amounts presented for each period were prepared by combining the historical standalone statements of operations for each of legacy MDC and SMG. The unaudited pro forma results are provided for illustrative purposes only and do not purport to represent what the actual consolidated results of operations or consolidated financial condition would have been had the combination actually occurred on the date indicated, nor do they purport to project the future consolidated results of operations or consolidated financial condition for any future period or as of any future date. The Company has excluded a quantitative reconciliation of Adjusted Pro Forma EBITDA to net income under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K.

(1) Organic Revenue: “Organic revenue growth” and “organic revenue decline” refer to the positive or negative results, respectively, of subtracting both the foreign exchange and acquisition (disposition) components from total revenue growth. The acquisition (disposition) component is calculated by aggregating prior period revenue for any acquired businesses, less the prior period revenue of any businesses that were disposed of during the current period. The organic revenue growth (decline) component reflects the constant currency impact of (a) the change in revenue of the partner firms that the Company has held throughout each of the comparable periods presented, and (b) “non-GAAP acquisitions (dispositions), net”. Non-GAAP acquisitions (dispositions), net consists of (i) for acquisitions during the current year, the revenue effect from such acquisition as if the acquisition had been owned during the equivalent period in the prior year and (ii) for acquisitions during the previous year, the revenue effect from such acquisitions as if they had been owned during that entire year (or same period as the current reportable period), taking into account their respective pre-acquisition revenues for the applicable periods, and (iii) for dispositions, the revenue effect from such disposition as if they had been disposed of during the equivalent period in the prior year.

(2) Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period.

(3) Adjusted EBITDA: defined as Net income excluding non-operating income or expense to achieve operating income, plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, and other items. Other items include restructuring costs, acquisition-related expenses, and non-recurring items.

(4) Adjusted Diluted EPS is defined as (i) Net income (loss) attributable to Stagwell Inc. common shareholders, plus net income attributable to Class C shareholders, excluding amortization expense, impairment and other losses, stock-based compensation, deferred acquisition consideration adjustments, discrete tax items, and other items, divided by (ii) (a) the per weighted average number of common shares outstanding plus (b) the weighted average number of Class C shares outstanding (if dilutive). Other items includes restructuring costs, acquisition-related expenses, and non-recurring items, and subject to the anti-dilution rules.

(5) Free Cash Flow: defined as Adjusted EBITDA less capital expenditures, change in net working capital, cash taxes, interest, and distributions to minority interests, but excludes contingent M&A payments.

(6) Financial Guidance: The Company provides guidance on a non-GAAP basis as it cannot predict certain elements which are included in reported GAAP results.

Included in this earnings release are tables reconciling reported Stagwell Inc. results to arrive at certain of these non-GAAP financial measures.

This document contains forward-looking statements. within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company’s representatives may also make forward-looking statements orally or in writing from time to time. Statements in this document that are not historical facts, including, statements about the Company’s beliefs and expectations, future financial performance and future prospects, business and economic trends, potential acquisitions, and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Forward-looking statements, which are generally denoted by words such as “anticipate,” “assume,” “believe,” “continue,” “could,” “create,” “estimate,” “expect,” “focus,” “forecast,” “foresee,” “future,” “guidance,” “intend,” “look,” “may,” “opportunity,” “outlook,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” or the negative of such terms or other variations thereof and terms of similar substance used in connection with any discussion of current plans, estimates and projections are subject to change based on a number of factors, including those outlined in this section.

Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company. Although the management of the Company believes that the expectations and assumptions on which such forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. The material assumptions upon which such forward-looking statements are based include, among others, assumptions with respect to general business, economic and market conditions, the competitive environment, anticipated and unanticipated tax consequences and anticipated and unanticipated costs. These forward-looking statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any.

Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statements. Such risk factors include, but are not limited to, the following:

- risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients;

- inflation and actions taken by central banks to counter inflation;

- the Company’s ability to attract new clients and retain existing clients;

- the impact of a reduction in client spending and changes in client advertising, marketing and corporate communications requirements;

- financial failure of the Company’s clients;

- the Company’s ability to retain and attract key employees;

- the Company’s ability to compete in the markets in which it operates;

- the Company’s ability to achieve its cost saving initiatives;

- the Company’s implementation of strategic initiatives;

- the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration;

- the Company’s ability to manage its growth effectively, including the successful completion and integration of acquisitions that complement and expand the Company’s business capabilities;

- the Company’s ability to develop products incorporating new technologies, including augmented reality, artificial intelligence, and virtual reality, and realize benefits from such products;

- an inability to realize expected benefits of the combination of the Company’s business with the business of MDC; (the “Business Combination” and, together with the related transactions, the “Transactions”);

- adverse tax consequences in connection with the Transactions for the Company, its operations and its shareholders, that may differ from the expectations of the Company, including that future changes in tax law, potential increases to corporate tax rates in the United States and disagreements with the tax authorities on the Company’s determination of value and computations of its attributes may result in increased tax costs;

- the occurrence of material Canadian federal income tax (including material “emigration tax”) as a result of the Transactions;

- the Company’s unremediated material weaknesses in internal control over financial reporting and its ability to establish and maintain an effective system of internal control over financial reporting;

- the Company’s ability to protect client data from security incidents or cyberattacks;

- economic disruptions resulting from war and other geopolitical tensions, terrorist activities and natural disasters;

- stock price volatility; and

- foreign currency fluctuations.

Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors outlined in more detail in our 2021 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 17, 2022, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings.

Related

Articles

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Augmented Reality

Apr 25, 2024

Playfully Navigating the Google Booth at CES

Google partnered with Left Field Labs to blend its physical…

Newsletter

Sign Up

NEW YORK, Feb. 22, 2023 /PRNewswire/ — Stagwell (NASDAQ: STGW) today expanded its digital transformation and engineering network Code and Theory with the addition of Silicon Valley-born digital product and design agency YML (Y Media Labs). The Code and Theory Network now includes six agencies: flagship shop Code and Theory, Kettle, Mediacurrent, Rhythm, Truelogic, and YML. The move creates a truly differentiated integrated network boasting nearly 2,000 people with 50% engineers and 50% creative talent, equipping client partners with teams purpose-built to solve digital-first end-to-end business challenges.

“Stagwell believes a digital-first approach drives holistic business transformation and marketing innovation,” said Mark Penn, chairman and CEO, Stagwell. “Stagwell is accelerating our investment in scaled digital transformation and engineering capabilities by aligning a truly impressive set of agencies to support our global client partners.”

Stagwell’s Code and Theory Network now boasts approximately 800 engineers who can execute 24/7 development cycles utilizing onshore, nearshore, and offshore engineering. YML’s arrival adds key offshore scale in India and award-winning native app development capabilities.

“We are excited to expand the Code and Theory Network with the addition of YML and the opportunities this will unlock for our clients and our talent,” said Dan Gardner, co-founder and executive chairman, Code and Theory Network. “Modern business is digital business. We now have both the scale of technology services and the balance of excellent creativity to deliver end-to-end services across the customer journey, which our competitors in traditional agencies or consultancies simply don’t have.”

Dan Gardner, along with Mike Treff, CEO of Code and Theory, will lead the Code and Theory Network. YML will continue to be led by CEO and Co-Founder Ashish Toshniwal. And, as part of this network expansion, Lauren Kushner has been promoted to CEO of Kettle.

“I could not be more excited for YML’s next chapter as we join the Code and Theory network. Building on our momentum, this move will bring our clients a new roster of resources, technology partnerships and near-shore global reach with engineering scale in Latin America,” said Toshniwal.

All agencies within the network will continue to operate under their individual brands, consistent with Stagwell’s focus on collaboration between complementary groups versus agency consolidation. Brands within the network will retain their cultures and unique capability sets, while scaling through more integrated work.

About Code and Theory Network

The Code and Theory Network is the digital-first creative and technology group within Stagwell, built to partner with businesses to navigate the complexity of changing consumer behaviors and emerging technologies. With a global footprint and the capabilities to work cross the entire consumer journey, we crave the hardest problems to solve. The network includes the flagship agency Code and Theory as well as Kettle, MediaCurrent, Rhythm, TrueLogic, and YML.

About YML

YML (Y Media Labs) is a design and technology agency bringing Silicon Valley to the world by creating award-winning digital products and experiences. YML has launched mobile apps, websites and other digital experiences for a range of clients including PayPal, Google, Universal Music Group, The Home Depot, Yeti and Polestar. Its work has been recognized by Steve Jobs (ya, that Steve Jobs) and featured by TED Talks, in The Wall Street Journal (“YML is one of the most innovative companies in Silicon Valley”), Forbes, Ad Age, ABC, CNBC and more. Founded in 2009, YML is now home to 500+ innovative designers, strategists, and engineers around the globe. To learn more please visit yml.co.

About Stagwell

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com

Related

Articles

Augmented Reality, In the News, Marketing Frontiers

Apr 26, 2024

Legacy Brand, Meet Next-Gen Commerce: Bomb Pop Takes Roblox

Bomb Pop is the most popular ice pop that nobody…

Artificial Intelligence, In the News

Apr 25, 2024

Embracing Comfort Unapologetically with First-Ever AI-Powered La-Z-Boy ‘Decliner’

Building the first-ever AI-powered recliner for the brand that invented…

Augmented Reality

Apr 25, 2024

Playfully Navigating the Google Booth at CES

Google partnered with Left Field Labs to blend its physical…

![Stagwell_CES_OnePager_RCC bls[13]1024_1](https://www.stagwellglobal.com/wp-content/uploads/2023/03/Stagwell_CES_OnePager_RCC-bls131024_1.jpeg)