In the News

WHAT THE DATA SAY: Majority of Gen Alpha (12 and younger) want to get back to IRL (in real life)

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from Stagwell. Among the highlights of our weekly consumer sentiment tracking:

GEN ALPHA WANTS TO BE IRL

Contrary to their online upbringing, Gen Alpha (those 12 and younger) prefer to do things in real life (IRL) more than any other generation, according to our National Research Group report.

- 59% of Gen Alpha say they enjoy watching movies in theatres more than at home (compared with 48% of Gen Z, 45% of Millennials and 46% of Gen X).

- In fact, Gen Alpha shows a distinct preference for all live entertainment experiences over in-home alternatives, with the exception of music.

- 50% of Gen Alpha would rather watch sports in person, 50% would rather play video games in person with friends, and 58% would rather dine out. However, 51% of Gen Alpha would prefer to listen to music at home versus attending concerts.

- Gen Alpha also wants movie lengths at the theater to be shorter (2 hours, 7 minutes, compared with 2 hours, 14 minutes for Gen Z and Millennials).

- The top reasons Gen Alpha goes to the movies are to spend time with friends and family (68%), make seeing the movies feel like a special event (64%) and better picture (63%) and audio (60%) quality.

- 55% of Gen Alpha prefers going to the movies with a large group of friends, compared to 31% of Millennials and 40% of Gen Z.

- Action sequences (46%) and humor (44%) are the top factors making Gen Alpha interested in new movies.

- Nearly half (47%) prefer watching movies in a busier theater than a quiet one (37%).

- See also: New poll shows kids want more freedom and less screen time

DEBT ON THE RISE

Americans across all income levels are struggling with debt, as finances deteriorate, according to our Harris Poll survey with the National Foundation for Credit Counseling.

- 53% of Americans report a negative change to their personal finances in the past six months, up from 49% in the spring.

- 13% paid off less than the required minimum on their credit card this month, up from 8% in the spring.

- 30% of high-income earners are concerned about having enough money to cover unexpected expenses.

- 20% are concerned about making timely debt payments.

- See also: Concerns rise among Americans with student loans

UNSTABLE SOCIAL SECURITY?

Most Americans are now concerned Social Security funds will be exhausted by the time they retire, according to our Harris Poll research with Transamerica Institute.

- 53% of retirees say Social Security will be their primary source of income throughout retirement.

- Women (36%) are more likely than men (27%) to expect Social Security will be their expected primary source of retirement income.

- 71% who are not yet retired are concerned that Social Security will not be available when they retire.

ICYMI: In case you missed it, check out the thought-leadership and happenings around Stagwell making news:

- America’s Great Wealth Transfer

- U.S. tariffs have made mortgage decisions harder for Canadians

- Gen Z is adopting ‘career minimalism,’ killing off the ladder for a ‘lily pad’ mentality

Newsletter

Sign Up

Related

Articles

Weekly Data

Feb 19, 2026

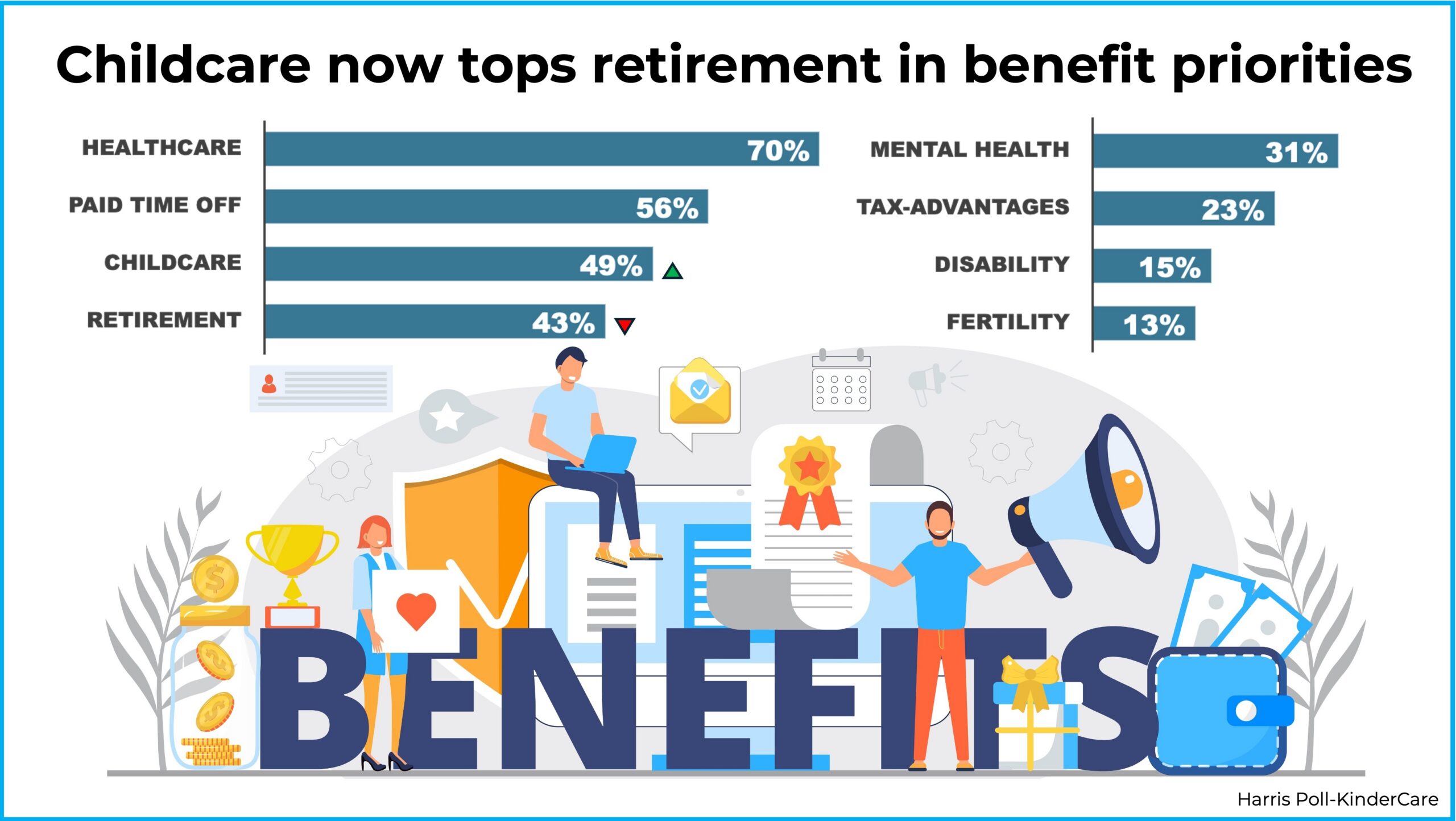

WHAT THE DATA SAY: 79% would be more loyal if employers better supported parents

Childcare has overtaken retirement benefits in the workplace, and most…

In the News, Press Releases

Feb 18, 2026

The Numbers are Clear: Latest Iteration of Stagwell’s News Advertising Study Shows Germans Love Their News