Weekly Data

WHAT THE DATA SAY: 80% making $200,000+ have used a credit card in past three months because they ran out of cash

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from Stagwell. Among the highlights of our weekly consumer sentiment tracking:

4 TRENDS REWRITING HOLIDAY SHOPPING

Six of 10 consumers say value for money is the top purchase driver this holiday season, based on our Harris Poll research with Mastercard. Four trends:

- Intentional holiday shopping: 82% of Americans are prioritizing low cost and high impact when it comes to gift-giving this year. That includes 86% who compare prices across retailers, 84% who read reviews, and nearly half who pay with credit cards that earn rewards they can use later.

- Gen Z wants an experience: 81% of Gen Z say they receive inspiration from in-store displays.

- Algorithms over elves: 51% of Gen Z and 55% of Millennials are relying on AI to deliver unique gift recommendations – more than they trust themselves.

- Joy and self-indulgence: 6 in 10 of all consumers are buying gifts for themselves – with 61% doing so to reach free shipping minimums.

‘RICH’ AMERICANS ARE STRUGGLING TO SURVIVE

1 in 3 Americans making more than $200,000 describe themselves as financially distressed, and 2 in 3 six-figure earners say their pay is no longer a sign of wealth, according to our Harris Poll Income Paradox Survey.

- 26% of Americans say they are “stretched” today – only able to cover the basics – with 22% of those making $100,000 and 19% of those making $200,000+ saying the same.

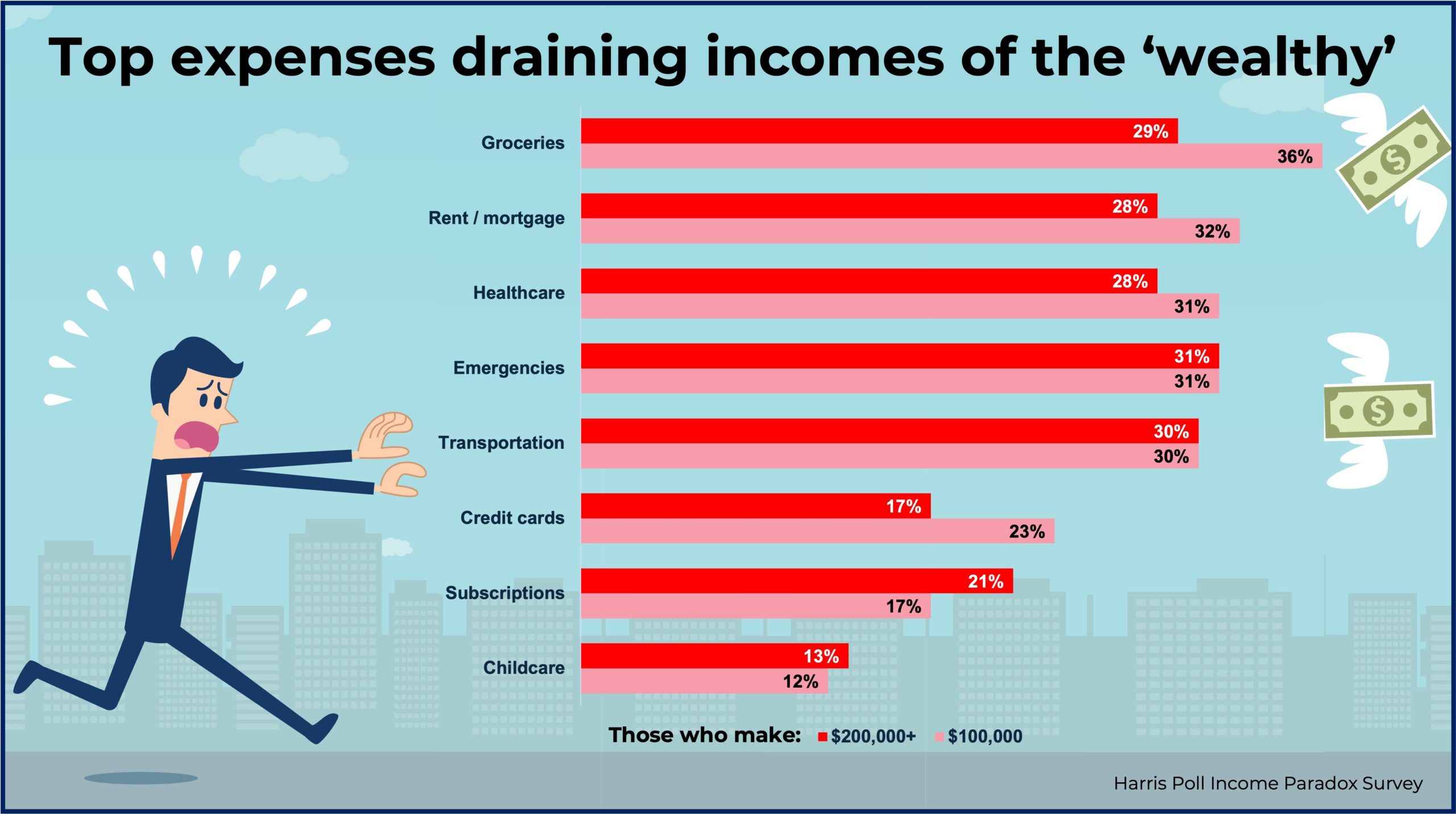

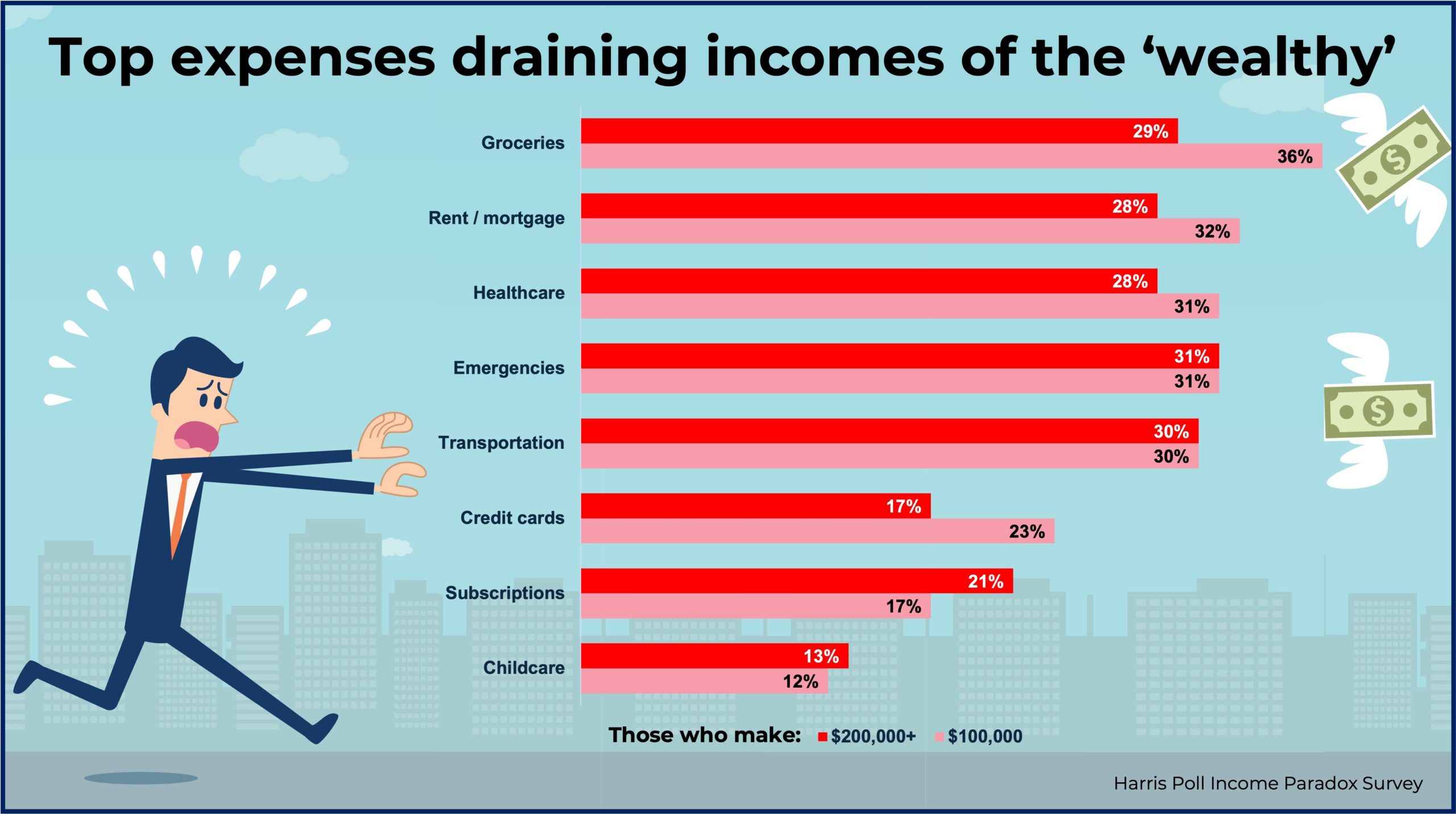

- Top expenses draining income: groceries (36% for those making $100,000, 29% of those making $200,000+), rent/mortgage (32% for those making $100,000, 28% for high-earners) and health insurance/medical costs (31% for those making $100,000, 28% for high-earners).

- To make ends meet: 58% of those making $100,000 and 64% of those making $200,000+ have used credit card reward points to cover expenses during the last 12 months; 53% and 51% have checked bank balances before grocery shopping; and 43% and 49% have avoided a social event to avoid splitting the bills.

- 80% of those making $200,000+ have used a credit card in the past three months because they ran out of cash, not to collect points.

- See also: Going into debt for holiday spending? You’re not alone

YOUNG PEOPLE NOT BIG ON OPEN ENROLLMENT

65% of young Americans trust AI more than themselves when choosing healthcare plans, according to our Harris Poll report with Justworks.

- 23% of Gen Z and Millennials would rather wait at the DMV than go through healthcare open enrollment.

- 62% have used AI for medical and insurance information – compared with 29% of Gen X/Boomers.

- 44% say they don’t put much thought into choosing their insurance plan.

- 59% say they spend an hour or less researching and selecting their plan.

- 26% say cost and affordability are their biggest concerns.

ICYMI: In case you missed it, check out the thought-leadership and happenings around Stagwell making news:

Newsletter

Sign Up

Related

Articles

Weekly Data

Nov 20, 2025

WHAT THE DATA SAY: 80% making $200,000+ have used a credit card in past three months because they ran out of cash

Events, In the News, Press Releases

Nov 20, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Keynote The Wall Street Journal’s 2025 CEO Council Summit

In the News, Press Releases, Talent & Awards

Nov 20, 2025

STAGWELL (STGW) APPOINTS JAMES DENTON-CLARK TO CHIEF GROWTH & CLIENT OFFICER, EUROPE