Weekly Data

WHAT THE DATA SAY: 58% say student loans are biggest financial stressors

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from Stagwell. Among the highlights of our weekly consumer sentiment tracking:

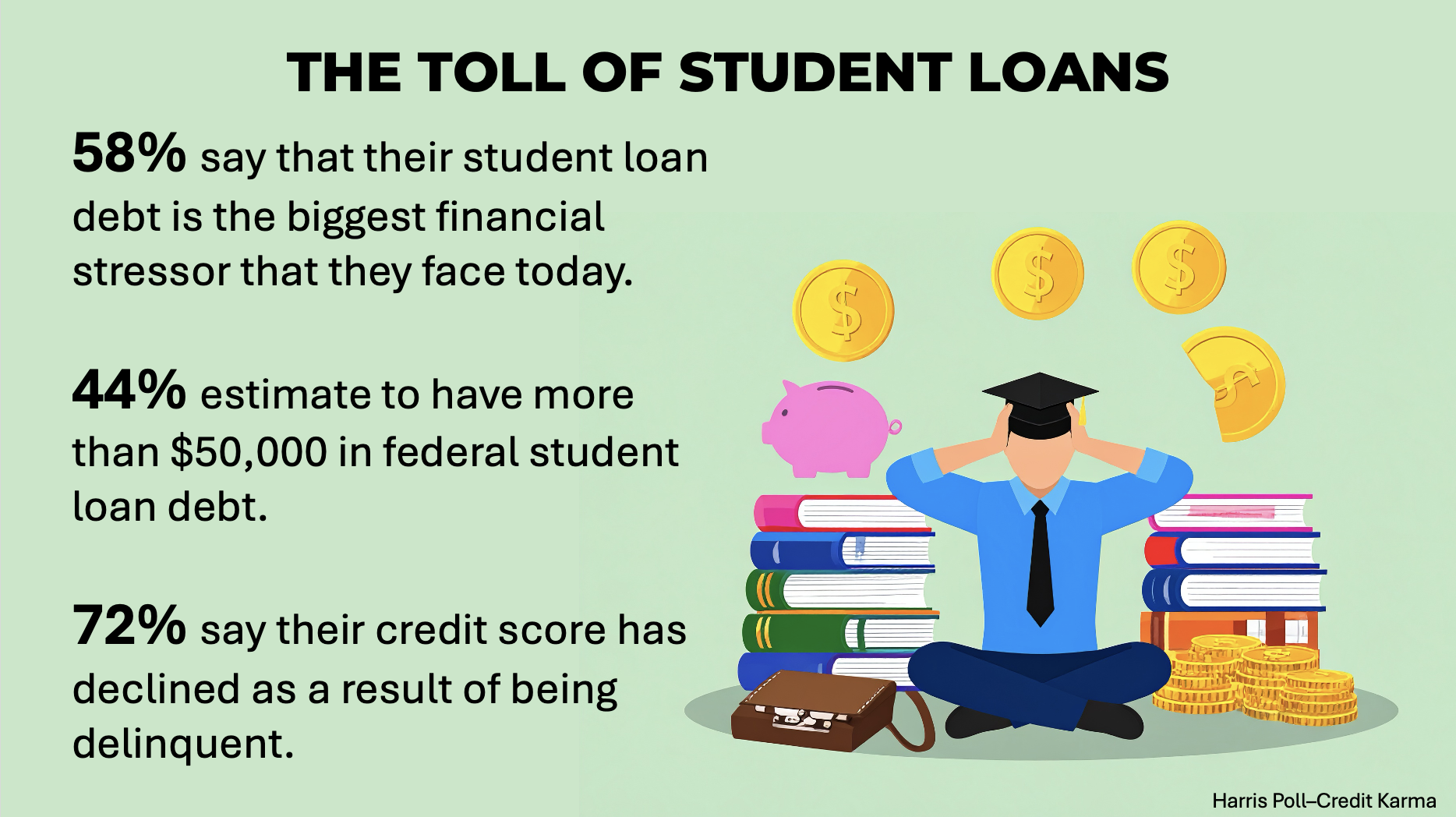

THE TOLL OF STUDENT LOANS

The burden of student loans affects much more than just borrowers’ credit scores, according to our Harris Poll report with Credit Karma.

- 7 million Credit Karma members with federal student loans are delinquent.

- 58% say that their student loan debt is the biggest financial stressor that they face today.

- 44% estimate to have more than $50,000 in federal student loan debt.

- 72% say their credit score has declined as a result of being delinquent.

- 68% who are delinquent or in default on their loans say their current income is not sufficient to cover both their living expenses and student loan payments.

- 25% say they’ve been threatened to have their wages or government benefits garnished because of unpaid student loan debt.

- 67% of those who are delinquent or in default say it has caused them significant anxiety and/or depression.

- 91% are taking steps to make payments: taking on additional work to increase income (32%), decreasing non-essential spending (30%), applying for an income-driven repayment (28%) and applying for forbearance or deferment (25%) are the top steps.

SIDE HUSTLE CULTURE

More workers are looking for additional sources of income to combat financial anxiety, according to our Harris Poll survey with the American Staffing Association.

- 64% of workers say they’re likely to get a second job or side hustle in the next year.

- 75% of workers with children said they were likely to seek additional work (55% without children).

- 28% of workers who rent said they’d have less than a month of savings as a financial cushion (14% for homeowners).

- 19% said their savings could cover less than a month of expenses.

TRENDS OF GEN Z

Gen Z shoppers are trend-driven, embracing social media and AI tools, according to our Harris Poll survey by QuestDIY.

- 40% of Gen Z shoppers report buying new products based on trends.

- 33% participated in live shopping events on social media.

- 21% relied on AI-powered product recommendations.

- 33% used chatbots for customer service.

- 27% shopped using voice assistants.

- 33% are willing to pay 5-10% more for sustainable products.

ICYMI: In case you missed it, check out the thought-leadership and happenings around Stagwell making news:

- The Harris Poll and Quad: The Return of Touch Report

- New Madison Logic Survey By Harris Poll Finds 96% of B2B Marketing Leaders Polled Are Changing Their Marketing Strategies Due to the Current Economic Climate

- The PR Week Podcast: Jonathan Heit, Allison

- Mondelēz leverages Harris Poll insights to lead the conversation in snacking

- Decoding the Paradoxes of Trust

- Cannes Lions 2025 takeaways and insights from ad executives

Newsletter

Sign Up

Related

Articles

Weekly Data

Jul 24, 2025

WHAT THE DATA SAY: Americans’ interest in soccer growing ahead of 2026 World Cup

Soccer (football) is experiencing a surge in fandom and culture…