Weekly Data

WHAT THE DATA SAY: 1 in 3 workers willing to quit over CEO's political views

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from Stagwell. Among the highlights of our weekly consumer sentiment tracking:

FINANCIAL INSECURITY HIGHEST IN A DECADE

American financial insecurity is at its highest point in at least a decade, according to our Harris Poll research with Northwestern Mutual.

- 33% of Americans say they don’t feel financially secure, up from 27% in 2023. It’s the highest concern level seen going back to 2012.

- The reason for the concern: the high cost of living. In fact, 54% expect price pressures to increase this year.

- Only 9% say their household income is outpacing inflation.

- A third think inflation will stay where it is, and fewer than one in five expect it to fall.

- 54% predict a recession this year, down from 66% in 2023 – yet higher among Gen Z (62%) and Millennials (59%).

- 45% consider themselves “disciplined financial planners,” down from 65% in 2020.

- While most are focused on cutting costs and saving, 59% said they will either spend the same amount or more this year on restaurants, vacations and entertainment.

- Gen Z (36%) is most likely to engage in more discretionary spending overall this year, compared with Millennials (28%), Gen X (24%) and Boomers (20%).

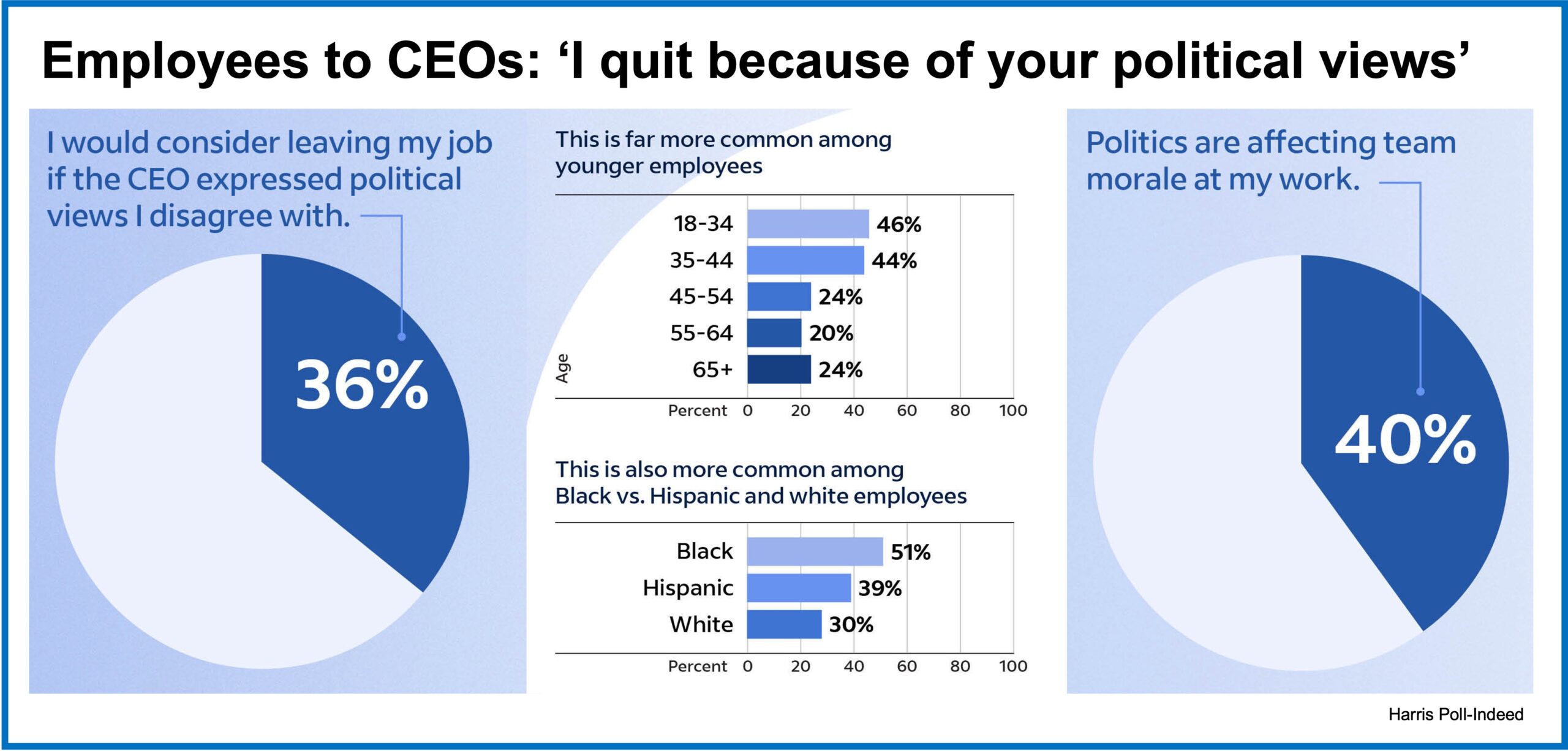

EMPLOYEES WILLING TO QUIT OVER CEO’S POLITICS

A third (36%) of U.S. workers say they would consider quitting if their CEO expressed political views they don’t agree with, based on a new Harris Poll survey with Indeed.

- Among younger employees, 46% of 18- to 34-year-olds and 44% of 35- to 44-year-olds would consider quitting.

- 43% have heard colleagues talking about politics in the office.

- 56% of employees say talking politics in meetings makes them uncomfortable – even higher for women (62%).

- 18% admit to avoiding coworkers with different political opinions.

- 40% say politics has affected team morale – higher among for 18- to 44-year-olds (47%) versus those 55 and older (28%).

HEALTH CARE RECEIVES WEAK REPORT CARD

Two years ago during COVID, The Harris Poll found the health worker shortage was real for Americans. Today, it has become even worse, according to our new poll with the PAN Foundation.

- Overall, the state of healthcare access among patients with a chronic health condition received a grade of “C,” or 75.8. Looking specifically at five key categories in the scorecard: Access to Care = C+ (78.8); Relationship with Healthcare Professionals = B (84.2); Affordability of Prescription Medications = B- (82.3); Access to Treatment through Healthcare Plans = D- (62.8); and Financial Toxicity = C- (70.7).

- 48% of patients face logistical barriers to care, including trouble getting appointments (18%) and financial difficulties paying for needed care (13%).

- People of color (57%), younger patients (70% Gen Z and Millennials) and LGBTQIA+ patients (77%) are more likely to report logistical barriers to care.

- 36% of patients taking prescription medications said they had taken at least one financially related action to afford their needed prescription medication(s): reducing spending in other areas (15%); dipping into retirement or other savings (13%): exploring discount saving apps (12%); taking on credit card debt (11%); or delaying payment of other bills (10%).

THE CHECK NO LONGER IS IN THE MAIL

Digital payments are universal, and paper checks are nearly a thing of the past. Our National Research Group’s 2024 Payouts Landscape study with Onbe found that 97% of U.S. consumers use at least one form of digital or electronic payment every month.

- Top digital payment methods include debit cards (57%), credit cards (55%), electronic bank transfers (40%) and payment apps (38%).

- 52% will not select any physical payment method, like paper checks or cash.

- Check use is down to 22%, and money orders have declined to 8%.

- Arguments against paper checks: takes too long to arrive (47%), inconvenient to deposit at a bank or ATM (45%), too long for funds to show up in an account (34%) and don’t know how to deposit it (16%).

- Paper checks are becoming so rare that 31% of consumers accidentally have thrown away or lost a check before cashing it.

- When it comes to security, digital also wins. When asked which types of payments are most secure, 53% say digital/electronic, and 47% say physical.

- Looking ahead, mobile wallets and peer-to-peer payment apps are set to continue growing in popularity, with 67% (mobile wallets) and 73% (payment apps) of consumers expecting to use these services as much or more in 2024 as they did in 2023.

- 21% expect to use cash less often this year.

- 56% expect that they will use paper checks less frequently or not at all.

ICYMI

In case you missed it, check out some of the thought-leadership and happenings around Stagwell making news:

- Name bias at work is real and employees of color are most impacted by it

- 1 in 5 Gen Zers haven’t had a single conversation with someone over 50 in their workplace in the last year

- Who Is Optimistic About Buying a Home? Not Younger Americans

- Nearly 3 in 4 Gen Z Hourly Workers Love/Like Their Job

- Guardant Health exposes colorectal cancer screening gap with new Harris Poll report

Related

Articles

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

In the News, Press Releases, Talent & Awards

May 19, 2025

Stagwell (STGW) Appoints Connie Chan as Chief Growth Officer for Asia Pacific