Thought Leadership

Hitting the Mark: Inflationbusting

Welcome to the second edition of Hitting the Mark – a monthly analysis of developments at the intersection of business, marketing, and politics meant for the modern C-Suite. This month’s topic? Inflation.

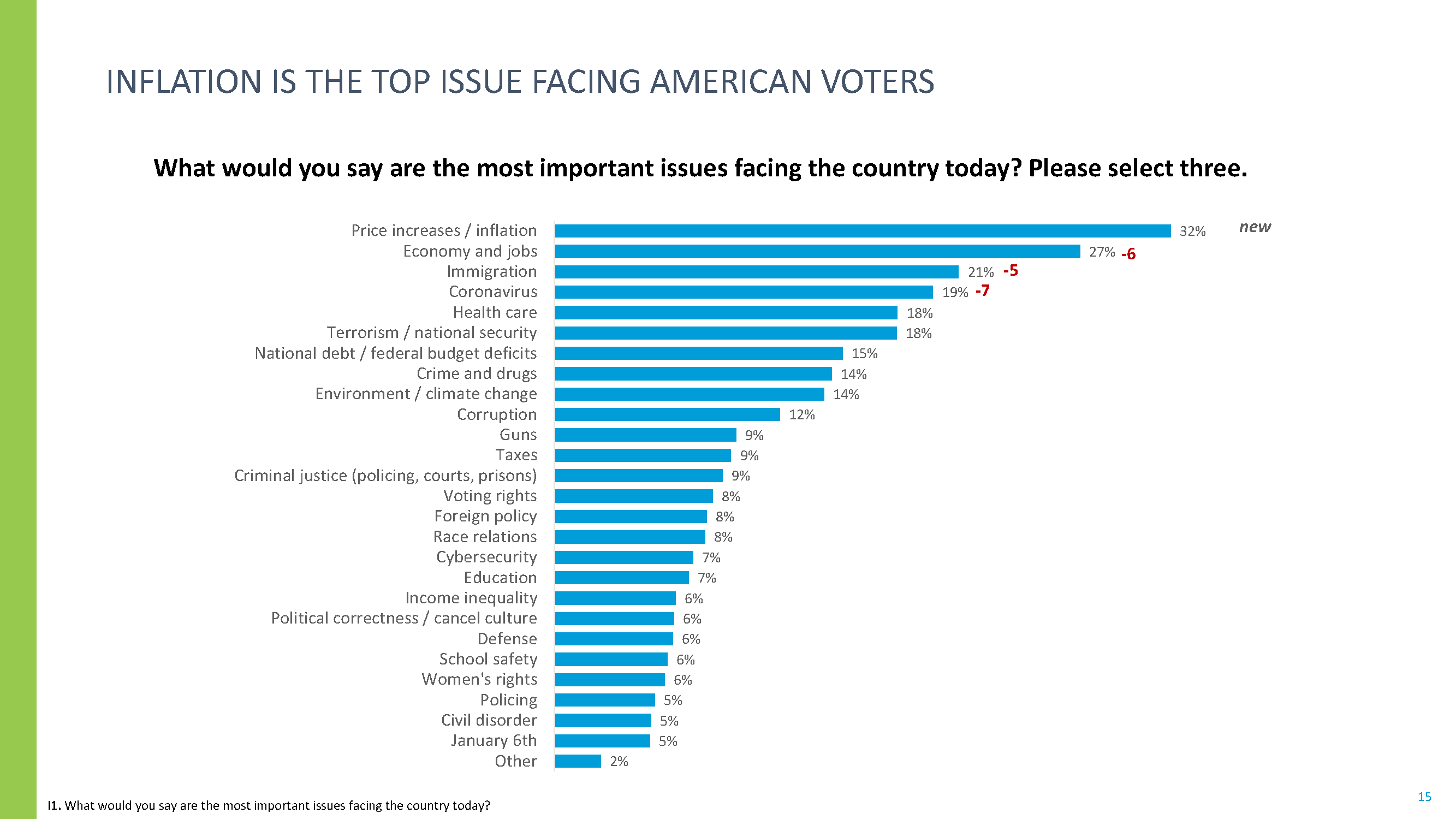

Inflation is in many ways the most pernicious of economic problems because it affects so many people at the same time. Inflation is at its highest rate since the early 1980s, and, as I wrote recently in the New York Times, “Many Americans under 60 have relatively little experience with anything but comparatively low fuel costs, negligible interest rates, and stable prices. Virtually overnight these assumptions have been shaken.” Consumers are already changing their behavior, becoming more cautious and pessimistic about the state of the economy. All of those COVID savings are being eaten up through the mystery of runaway higher prices.

Most marketers have some real choices in how to respond to inflation and the goal is to be on the side of the consumer during these more difficult economic times.

Of course, the easiest solution is simply to raise prices. It’s no longer 10 cents for a pack of gum; one bellwether of higher prices is the cost of treats like chocolate and spearmint. In 1974 a pack of 7 sticks of gum cost 15 cents. That probably does not even cover the sales tax on a package of gum today. Chocolate is a luxury and luxuries have the most elastic pricing, so they generally have the most room to simply pass on cost increases, so don’t expect to pay the same at the Godiva store.

Other companies have tried hard to conceal price increases by simply reducing the quantity. Cereal companies are famous during inflationary times for simply taking an ounce or two out of those cereal boxes. Consumers can easily miss this shrinkage but go too far and expect a backlash.

Perhaps the best way to get on the side of consumers during this time is to offer bigger units at lower prices. This is why Sam’s Club and Costco generally do better during these times, as their business model is all about delivering more value for less.

Inflation is of course great for products that are perceived as keeping pace with inflation. No product is known for holding its value more than gold – expect the airwaves to be filled with ads that sell gold as the one true hedge against rising prices.

Fast food prices and their consumers are super sensitive to inflation. As the McDonald’s dollar menu inches up from $1, to $2, to $2, its competitors have done a great job advertising $5 fill-up boxes that are brimming with food. These “inflation busters” become the perfect partners to penny-pinched consumers. While prices for organic groceries soar, families know they can rely on these restaurants to remain affordable.

What does this mean for marketing?

Growth slows during inflationary times, so marketing will also be more about fighting for market share than selling new products to first-time consumers. This means that effective competitive marketing will be a lot more useful for brands. Especially when consumers are motivated by cost-saving, nothing can be quite as powerful as reminding them of the superior value of your business versus competitors.

It’s important to remember that value is not always the same as cost. I once ran advertising on behalf of Microsoft against Linux. Linux was difficult to compete against because the company was giving away some of its software for free. We created the concept of the “total cost of ownership” and showed that the free offering, over time, would be more costly than paying Microsoft. This campaign labeled “Get the Facts” was a huge success.

Focus is important during inflationary times. The consumer is once again king, and behaving somewhat like a taxpayer, skeptical of companies who are focused on giving their money away for causes because they feel like they are being called upon to finance these programs out of pocket when they buy goods and services. Companies with a heavy focus on social programs should evaluate whether they will now be seen as out of step with the needs of consumers. While helping soup kitchens might still be a popular idea during inflationary times, funding the opera might raise eyebrows, and throwing a huge fashion show might alienate consumers at this time.

Now is the time to stop simply watching inflation worsen and pick the right strategy for your company, whether it is reducing package sizes, creating affordable bundles, raising costs, or digging into competitive advertising to fight for market share. As for me? I have to go load some gold bars into my car…

Up next in our Hitting the Mark column? The pandemic, inflation, the Russia-Ukraine conflict, political crises – all these issues raise the importance (and trickiness) of “brand leadership” in our modern era. As we noted in Stagwell’s 2021 research on brand reputation, those perceived as delivering solutions to the pandemic received a major reputational boost over the past few years. Today, a majority of voters are not confident in either the Biden administration (55%) or the Federal Reserve’s (56%) ability to fight inflation. Brands won’t deliver the silver bullet to America’s inflation woes but adapting strategy to give consumers a lifeline amid economic stress can go a long way towards building reputational capital.

Stagwell’s 2022 Reputation Quotient, our annual ranking of the 100 most visible companies in America, is set to release in late May. I look forward to sharing an updated picture of the state of corporate reputation and brand leadership then.

Mark Penn

Related

Articles

In the News, Press Releases

Jul 09, 2025

STAGWELL LAUNCHES STAGWELL MEDIA PLATFORM (SMP), A CENTRALIZED TEAM OF GLOBAL MEDIA, TECHNOLOGY AND DATA INVESTMENT EXPERTS

In the News, Investments & Financials, Press Releases

Jul 08, 2025

Stagwell (STGW) Schedules Webcast to Discuss Financial Results for the Three Months Ended June 30, 2025

In the News, Investments & Financials, Press Releases, Talent & Awards

Jul 08, 2025

Stagwell (STGW) Advances Executive Team with Four Key Appointments