The Stagwell News Network launches in partnership with eight premier publishers

New study of 7,000+ U.S. adults finds rising news consumption and greater ad lift among the most engaged news audiences, reinforcing the value of advertising in news.

Research to be built upon throughout Future of News programming at Cannes Lions

NEW YORK, June 13, 2025 /PRNewswire/ — Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, today announced the launch of the Stagwell News Network, a private marketplace (PMP) associated with its Future of News initiative. As Stagwell continues to drive greater investment into news by bringing together leaders from marketing and news media around data and forward-looking discussions, the News Network will give Stagwell clients unique access to publishers – strengthening Stagwell’s ability to deliver premium news inventory and performance-driven solutions for clients.

The News Network’s launch partners are Newsweek, Nexstar, NPR, Ozone, RealClear Politics, The Associated Press, The Washington Post, and TIME.

This announcement coincides with Stagwell and the Future of News initiative’s expanded presence at the Cannes Lions International Festival of Creativity 2025. Leading up to the festival, Stagwell today unveiled new ad performance-based research, conducted by Stagwell’s research consultancy HarrisX among 7,126 U.S. adults, that reveals a clear loss in campaign reach and effectiveness when foregoing news advertising.

Key findings from the study include:

News Consumers are High-Impact Audiences

- News Junkies — roughly 80.4 million U.S. adults who follow the news ‘very closely’ — view brands more positively than less engaged audiences across seven key brand and reputation metrics, including purchase intent, favorability, likelihood to recommend, and trustworthiness.

- Among News Junkies, a key target group for advertisers, the average purchase intent for 20 brand ads tested across technology, travel/hospitality, CPG, financial services, and automotive, was 66%— compared to 50% among the rest of the general population.

- 13.8% of U.S. adults, or approximately 36.8 million individuals, are Exclusive News Junkies, defined as those who follow the news ‘very closely’ but do not closely follow sports or entertainment.

- Exclusive New Junkies show greater post-ad exposure lift than the rest of the general population, making it clear they are an underserved advertising audience who responds to ads.

News Engagement is Growing

- Since 2024, Exclusive News Junkies have grown in population size by approximately 7.2 million U.S. adults, now making up 13.8% of the general population compared to 11.1% a year ago.

- Nearly 60% of News Junkies and Exclusive News Junkies now follow the news more closely than they did a year ago.

- News Junkies and Exclusive News Junkies are now paying particularly more attention to political, international, and economic news than a year ago.

“This research shows that campaigns including news in the media mix consistently outperform those that forego news, and as the population of Exclusive News Junkies expands, brands that ignore news advertising are missing the opportunity to drive real results,” said Stagwell Chairman and CEO Mark Penn.

Since beginning news-focused testing in the second half of 2023, Stagwell has seen 2024 campaigns deliver three times the average return on ad spend (ROAS). According to Stagwell agency Assembly’s Media Mix Model, news delivers commercial impact, with three times higher ROAS than other paid media channels, and 136% transaction growth for a leading global logistics business.

“We’re turning insight into action–from debuting new research for Cannes that proves the power of news audiences, to launching the Stagwell News Network with eight leading publishers, and hosting the first-ever NewsFronts event this October. We’re doubling down on the power of news as a critical platform for marketers and advertisers,” added Alexis Williams, Chief Corporate Affairs Officer at Stagwell.

Join the Future of News team for programming throughout Cannes Lions:

- RTL AdAlliance Beach | The Business of News | Monday, June 16, 10:30 AM CEST

- WSJ’s Journal House | Hard Truths, Real Results: How News Unlocks Advertising ROI | | Monday, June 16, 4:15 PM CEST

- ADWEEK House | The Business of News | Tuesday, June 17, 1:30PM CEST

- SPORT BEACH | Future of News Breakfast Roundtable | Wednesday, June 18, 9:00 AM CEST

- SPORT BEACH | Future of News: Why News Junkies are the Real MVPs | Wednesday, June 18, 1:00 PM CEST

To learn more about Stagwell’s Future of News Initiative, please reach out to futureofnews@stagwellglobal.com. To request a copy of the latest research, please visit https://www.stagwellglobal.com/future-of-news/.

About Stagwell

Stagwell is the challenger holding company built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 45+ countries are unified under a single purpose: to drive effectiveness and improve business results for our clients. Join us at www.stagwellglobal.com.

Contact

Madison Wick

PR@stagwellglobal.com

Related

Articles

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

In the News, Press Releases, Talent & Awards

May 19, 2025

Stagwell (STGW) Appoints Connie Chan as Chief Growth Officer for Asia Pacific

Newsletter

Sign Up

Originally Released On

Contact:

Alyssa Bourne-Peters

PRophet, US

Alyssa.Bourne-Peters@prprophet.ai

+1 917 592 9795

Sarah Schulze

PRophet, EMEA

Sarah.Schulze@prprophet.ai

+49 16090815945

UNICEPTA’s Media Intelligence Capabilities Now Operate as ‘PRophet Media Intelligence’ Within the Comprehensive PRophet Comms Tech Suite

NEW YORK and COLOGNE, Germany, June 12, 2025 /PRNewswire/ — PRophet, a comms tech suite of essential, award-winning AI-powered software and services for modern communicators, today announced it has fully integrated UNICEPTA into the PRophet comms tech suite, following its acquisition of UNICEPTA in December 2024. UNICEPTA’s offerings will now operate under the PRophet brand family as “PRophet Media Intelligence,” joining a unified brand and enhanced suite of AI-powered software and services, positioning PRophet now as the third largest comms tech suite in the world.

The full PRophet Suite now houses three AI-powered SaaS and human-powered analytics solutions that empower PR and social media professionals to maximize their performance and productivity.

- PRophet Media Intelligence (F/K/A UNICEPTA): Offers comprehensive global media monitoring, market intelligence, and social listening tools, delivering unmatched insights and analysis to communicators worldwide.

- PRophet Earn: Deploys predictive, cognitive, and generative AI to help discover, target, and engage with the most relevant and interested high-authority journalists. and leading influencers.

- PRophet Influence: Powered by influencermarketing.ai, uses agentic-AI to power influencer discovery, analytics, brand safety, and tracking to inform and manage influencer marketing campaigns.

“Fully integrating UNICEPTA into PRophet allows us to provide clients with the technology, expertise and data they need to grow, protect and lead their enterprise communications,” said Aaron Kwittken, Founder and Global CEO of PRophet. “Not only does this rebrand mark a major milestone for client offerings and services but also realizes our global vision of ushering in and empowering a new generation of communications engineers with the unified tools they need in today’s complex media landscape.”

This integration will also bring new roles to UNICEPTA’s co-CEO’s, Sebastian Rohwer and Alexander Peinemann. Sebastian will become Chief Client Services Officer and Managing Director, Central Europe of PRophet and Alexander will become Chief Operating Officer and Chief Transformation Officer of PRophet.

As part of this integration and brand migration, PRophet launched a new website and refreshed visual identity, reflecting the brand’s evolution and commitment to innovation in the communications technology space.

With this integration and rebranding, PRophet enters a new phase of growth—firmly uniting global talent and markets, rapidly accelerating our mission to redefine what’s possible and deliver what’s next in modern communications.

For more information, visit www.prprophet.ai.

About PRophet

PRophet is a suite of AI-powered SaaS software and services designed to empower and support the next generation of human-led, AI-fed “communications engineers” working in the PR, social and influencer marketing community.

PRophet Media Intelligence (F/K/A UNICEPTA) is the largest provider of global media, market intelligence and social listening tools, delivering unmatched insights and analysis to communicators worldwide.

PRophet Earn harnesses predictive, cognitive and generative AI to help users discover, target and engage with high-authority journalists and leading influencers. This media relations solution creates and tests “mediable” PR content to predict journalist interest and sentiment.

PRophet Influence, powered by influencermarketing.ai, combines influencer discovery, analytics, brand safety and tracking technologies to inform and manage influencer campaigns with precision and performance in mind.

PRophet was awarded PRovoke Media’s Innovation SABRE in 2023-2025, a 2024 Webby Award, and was included in PR News’ 2024 Tech Hotlist. PRophet is headquartered in New York City with offices in Washington DC, London, Cologne, Berlin, Zurich, São Paulo and Shanghai and is part of The Marketing Cloud (TMC), a suite of data-driven SaaS solutions built for the modern marketer. Visit prprophet.ai to learn more.

Media Contacts:

Alyssa Bourne-Peters

PRophet, US

Alyssa.Bourne-Peters@prprophet.ai

+1 917 592 9795

Sarah Schulze

PRophet, EMEA

Sarah.Schulze@prprophet.ai

+49 16090815945

Logo – https://mma.prnewswire.com/media/2693566/PRophet_Logo.jpg

Related

Articles

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

In the News, Press Releases, Talent & Awards

May 19, 2025

Stagwell (STGW) Appoints Connie Chan as Chief Growth Officer for Asia Pacific

Newsletter

Sign Up

Originally Released On

Contact:

Amy Guenel

VP Product Marketing, The Marketing Cloud

Amy.guenel@stagwellglobal.com

The Marketing Cloud, formerly known as Stagwell Marketing Cloud, launches its next chapter with a new name

New platform delivers seamless access to AI-powered solutions in a single dashboard

NEW YORK, June 11, 2025 /PRNewswire/ — Today, The Marketing Cloud (formerly known as Stagwell Marketing Cloud) announced the launch of its new platform. This dynamic, centralized experience makes it easy for marketers to discover AI-powered products across market research, communications, creative, and media—boosting collaboration and driving results with the latest tech.

Designed to cut through the complexity of today’s fragmented martech ecosystem, The Marketing Cloud Platform helps marketers focus on impact—not tool management.

The Marketing Cloud includes products like QuestBrand and QuestDIY from The Harris Poll, the PRophet suite of tools for comms professionals, The People Platform, CUE, and SmartAssets—all supported by an underlying ID Graph that enables streamlined data connectivity. The new name reflects the company’s evolution toward greater simplicity, integration, and AI-driven performance.

Key benefits of The Marketing Cloud Platform include:

- AI-powered solutions: Explore a curated marketplace of products designed to meet diverse marketing needs.

- Supercharged team collaboration: Centralized workspaces and flexible data-sharing tools help teams work faster and smarter.

- Seamless integrations: Combine solutions seamlessly to amplify performance and results.

- Unified, hassle-free workflows: Save time with single sign-on and streamlined account management across products.

- The power of proprietary data: Stagwell’s wealth of attitudinal and behavioral data provides a foundational, competitive edge for all of our products.

“Our vision for the Platform is to harness the full power of our data—the oxygen that fuels AI—making it accessible and actionable for every marketer. By integrating AI into every facet of the Platform, we aim to streamline repetitive tasks, scale high-performance content creation, and ultimately build a 24/7 marketing experience with AI agents that empower marketers to achieve more, wherever they are,” said Elspeth Rollert, CEO of The Marketing Cloud.

“Data is the backbone of the Platform—it’s not just vast, it’s uniquely actionable,” added Mansoor Basha, The Marketing Cloud’s CTO. “This foundation gives our AI models context and clarity. By infusing our tools with integrated attitudinal and behavioral insights proprietary to the Stagwell network, we enable marketers to make decisions grounded in how real people think, feel, and act.”

Early adopters of The Marketing Cloud Platform have found significant improvements in efficiency, cost savings, and marketing performance—demonstrating the platform’s potential to transform how teams work.

“By utilizing Propellers and SET through The Marketing Cloud Platform, we’ve reduced our expenses on external creative agencies by 70%, enabling us to eliminate agency fees and high production costs,” shared Julie Marchant-Houle, CEO of ESTYLE. “As a result, we have become more efficient, reallocating more funds into working dollars and providing us with a wealth of content that we wouldn’t have otherwise.”

The Marketing Cloud Platform is now available to marketers worldwide. To learn more or request a demo, visit www.themarketingcloud.com.

About The Marketing Cloud

The Marketing Cloud (formerly Stagwell Marketing Cloud) is a suite of AI-powered solutions built for the modern marketer. Born out of Stagwell’s (NASDAQ: STGW) award-winning network that delivers scaled creative performance for the world’s most ambitious brands, The Marketing Cloud empowers brands to drive measurable business impact through intuitive solutions enriched with unique, actionable data.

The Marketing Cloud’s solutions harness advanced technology—generative and predictive AI, machine learning, augmented reality, and more—to revolutionize market research, communications, creative, and media strategies for global brands. Get your head in the cloud at www.themarketingcloud.com.

About Stagwell

Stagwell is the challenger holding company built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 45+ countries are unified under a single purpose: to drive effectiveness and improve business results for our clients. Join us at www.stagwellglobal.com.

Contact

Amy Guenel

VP Product Marketing, The Marketing Cloud

Amy.guenel@stagwellglobal.com

Related

Articles

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

In the News, Press Releases, Talent & Awards

May 19, 2025

Stagwell (STGW) Appoints Connie Chan as Chief Growth Officer for Asia Pacific

Newsletter

Sign Up

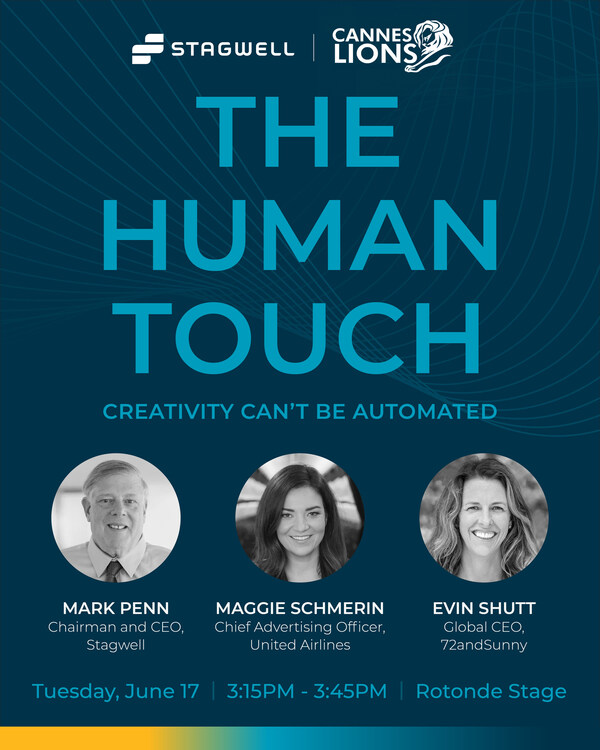

Penn will take the main stage alongside United Airlines’ Chief Advertising Officer Maggie Schmerin and 72andSunny’s Global CEO Evin Shutt

“The Human Touch: Creativity Can’t Be Automated” to run on Innovation Unwrapped track at Cannes Lions International Festival of Creativity

NEW YORK, June 10, 2025 /PRNewswire/ — Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, today announced Chairman and CEO Mark Penn will take the main stage at the 2025 Cannes Lions International Festival of Creativity, the advertising world’s most esteemed awards and celebration, to present “The Human Touch: Creativity Can’t Be Automated.”

Penn’s presentation on the value of human creativity in an industry becoming increasingly automated builds on his four decades of experience at the intersection of technology and creativity.

The Human Touch: Creativity Can’t Be Automated

Cannes Lions | Rotonde Stage, Rotonde | Tuesday, June 17, 3:15 PM CEST

Join this session where leaders from Stagwell, United Airlines, and 72andSunny will prove that the secret to breakthrough branding lies in blending cutting-edge technology with the irreplaceable power of human creativity. You’ll learn how to turn data into story-driven insights, build culturally resonant messages that stick, and avoid the creative rut when relying too heavily on automation. Featured speakers will share frameworks, lessons and creative tactics for marketers ready to lead with boldness and originality.

Featuring:

- Maggie Schmerin, Chief Advertising Officer, United Airlines

- Evin Shutt, Global CEO, 72andSunny

- Mark Penn, Chairman and CEO, Stagwell

Elsewhere around Cannes, Penn will present:

Hard Truths, Real Results: How News Unlocks Advertising ROI

WSJ’s Journal House | Monday, June 16, 4:15 PM CEST

Forget the fear. Explore how brands are finding success by aligning with credible journalism—even in challenging news environments. This session shares real, data-driven stories and practical strategies that reveal the untapped potential of advertising alongside hard news. Gain insights and confidence to approach this space with fresh perspective and informed creativity. Featuring:

- Jeff Green, CEO, The Trade Desk

- Phillipa Leighton – Jones, SVP, The Trust, WSJ | Barron’s

- Tracy-Ann Lim, Chief Media Officer, JPMorgan Chase & Co.

- Mark Miller, Chief Strategy Officer, Team One

- Mark Penn, Chairman and CEO, Stagwell

Business of Sport Fireside Chat

Private Dinner hosted by Bloomberg Media | Monday, June 16, 8:30pm CEST

Bloomberg Media is hosting an invite-only dinner for key clients and partners. The gathering will featuring a fireside chat led by Mishal Husain, Editor-at-Large of Bloomberg Weekend with Mark Penn, Chairman and CEO of Stagwell, and Olympic gold medalists Tara Davis-Woodhall and Hunter Woodhall. They will explore how sports can open the door to conversations shaping today’s business landscape.

Featuring:

- Tara Davis-Woodhall, Olympic Gold Medalist & 2024 World Champion

- Hunter Woodhall, Paralympic Gold Medalist & three-time Paralympian

- Mishal Husain, Editor at Large, Bloomberg Weekend

- Mark Penn, Chairman and CEO, Stagwell

Future of News: Why News Junkies are the Real MVPs

SPORT BEACH | Wednesday, June 18, 1:00 PM CEST

News is the future – and we’re bringing new data to prove it. Join us for a C-Suite conversation unpacking the business case for investing in the high-quality media environments of news. Spoiler alert: if you’re not including “news junkies” in your media strategy, you’re missing some of your most engaged and influential consumers. Featuring:

- Meredith Kopit Levien, CEO, The New York Times

- Almar Latour, CEO, Dow Jones

- Tracy-Ann Lim, Chief Media Officer, JPMorgan Chase & Co.

- Mike Reed, CEO, Gannet | USA Today Network

- Mark Penn, Chairman and CEO, Stagwell

Stagwell

Stagwell is the challenger holding company built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 45+ countries are unified under a single purpose: to drive effectiveness and improve business results for our clients. Join us at www.stagwellglobal.com.

Press Contact

Maggie Axford

PR@stagwellglobal.com

NEW YORK, June 9, 2025 /PRNewswire/ — Stagwell (NASDAQ:STGW), the challenger network built to transform marketing, today announced CEO and Chairman Mark Penn will join the Reddit community for a live Ask Me Anything (AMA) session on Thursday, June 12th from 3:00 – 4:00pm ET.

Participants are encouraged to submit questions in advance and join the conversation live to engage with Penn on Stagwell’s growth trajectory, unique positioning in the industry, and more.

How to Access the AMA

Interested parties can join the conversation by creating a Reddit login and navigating to the /r/marketing sub-Reddit between 3:00 – 4:00pm ET on Thursday, June 12th.

About Stagwell

Stagwell is the challenger holding company built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 45+ countries are unified under a single purpose: to drive effectiveness and improve business results for our clients. Join us at www.stagwellglobal.com.

Contact

Ben Allanson

IR@stagwellglobal.com

Related

Articles

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

In the News, Press Releases, Talent & Awards

May 19, 2025

Stagwell (STGW) Appoints Connie Chan as Chief Growth Officer for Asia Pacific

Newsletter

Sign Up

The Stagwell agency’s 12 ANA B2 award wins highlight its transformative impact for clients Amazon Ads, ETS, Thomson Reuters and Qualcomm

NEW YORK, June 5, 2025 /PRNewswire/ — Code and Theory has been named Business-to-Business (B2B) Agency of the Year at the prestigious Association of National Advertisers (ANA) B2 Awards, marking its sixth major agency honor in 2025 alone. This recognition reflects Code and Theory’s unmatched ability to deliver technology-first, transformative solutions that meet the demands of today’s rapidly evolving B2B landscape.

At the ANA B2 Awards, Code and Theory earned 12 award wins across clients Qualcomm, ETS, Amazon Ads and Thomson Reuters. These wins highlight the agency’s ability to blend technology, creativity and collaboration to drive measurable business impact. Notable results include:

- Rebranding Thomson Reuters as a B2B tech leader, boosting unaided awareness by 40%. Explore the work.

- Redefining Qualcomm’s developer experience, achieving a 425% increase in engagement. Explore the work.

- Repositioning ETS as the global authority in workforce readiness, driving a 78% increase in qualified leads. Explore the work.

- Introducing Amazon Ads to small businesses that didn’t sell on Amazon, increasing unaided brand awareness by 13%. Explore the work.

This latest honor adds to a string of top-tier industry recognitions for Code and Theory, including:

- Fast Company: Named one of the World’s Most Innovative Companies for both Design and Teamwork

- Ad Age: B2B Agency of the Year

- Campaign: Digital Innovation Agency of the Year

- Shorty Awards: Large Agency of the Year

- The Drum: Agency to Watch

These accolades directly result from Code and Theory’s transformational changes, evolving its client offerings to include:

- The launch of the Enterprise Experience Transformation Practice (EXT). Led by former Adobe exec Cory Haldeman, EXT architects unified brand foundations that turn artificial intelligence into relationship acceleration.

- The debut of Media Experience Practice, led by former Cosmopolitan editor-in-chief Jessica Giles, dedicated to helping publishers survive and thrive.

- Naming James O’Brien as its first-ever global CMO, tasked with harnessing the consolidated power of the Code and Theory Network in service of its clients.

Bill Zengel, ANA Senior Vice President, says: “The ANA B2 Awards have long been a benchmark for excellence, recognizing the most creative, effective and innovative work in business marketing. At the ANA, our mission is to fuel growth for brands and marketers. ANA B2 Agency of the Year winner Code and Theory embodies that spirit with bold storytelling and a technology-first mindset critical to the future of B2B marketing.”

Dan Gardner, co-founder of Code and Theory, says: “This is a defining moment for businesses and B2B marketing is where real change often begins. New technologies and rising expectations are reshaping the landscape faster than ever. Tech and creativity must now work together to meet the moment. We design, build and market to drive true business transformation. We’re honored that work for our great clients was recognized by the ANA. We’re just getting started as more and more CMOs, CIOs and CTOs recognize us as the place where they can come to experience change.”

Code and Theory will also have a significant presence at Cannes Lions 2025, joining the world’s most ambitious marketers, athletes and creatives at Sport Beach. The event will offer hands-on workshops, on-stage thought leadership and the debut of some of the agency’s latest technological advancements. Learn more here.

About The Code and Theory Network

The Code and Theory Network is the only technology and creative network with a balance of 50% creative and 50% engineers. Our unique makeup makes us the place where CMOs, CTOs and CIOs come together to drive results for their businesses. We partner with our clients to redefine what is possible to create lasting impact and drive long-term growth. Part of Stagwell, Code and Theory offers a global footprint and the capabilities to work across the entirety of the customer-facing journey and implement the technology that powers it. The network includes the flagship agency Code and Theory as well as Kettle, Instrument, Left Field Labs, Truelogic, Create. Group, Rhythm and Mediacurrent. Code and Theory clients include Amazon, JPMorganChase, Microsoft, NBC, NFL and Yeti. For more, visit codeandtheory.com

Media Contact

Kenneth Hein

Special programming to include the second annual Wine & Spirits Festival, an exclusive speakeasy honoring Hall of Fame inductees Carmelo Anthony and Sue Bird, and daily workouts including a pickleball competition, swim club and guided run with Olympic Gold Medalist Sir Mo Farah

NEW YORK, June 3, 2025 /PRNewswire/ — Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, returns to the Cannes Lions International Festival of Creativity as the official LIONS Sport Partner of 2025. New partners including 2X Olympic Medalist and US National Champion in Figure Skating Nancy Kerrigan, actor and entrepreneur Ryan Reynolds, Grand Slam champion Sloane Stephens, and NBA Champion and Hall of Famer Dwyane Wade recently joined the SPORT BEACH 2025 roster and will participate in programming throughout the week.

To register and view the full programming calendar, visit sportbeach.com.

New 2025 Athlete and Speaker Partners

- Nancy Kerrigan (Figure Skating) – Nancy Kerrigan has been one of America’s most recognizable sports icons for over 25 years as a two-time Olympic medalist and US National Champion in Figure Skating. In addition to her work on the ice, the two time Olympic medalist is an author, has regularly appeared on television and in movies as an actor, has been a sports commentator, was instrumental in the creation of key figure skating shows and has been a motivational speaker and advocate for issues related to infertility. The Nancy Kerrigan Foundation has raised significant funds for the vision impaired in honor of her legally blind mother and she has been recognized for her excellence on and off the ice.

- Ryan Reynolds (Actor and Entrepreneur) – Canadian actor, producer, screenwriter and entrepreneur. Reynolds is the star of the Deadpool franchise which has grossed over 2 billion dollars worldwide. The latest film, Deadpool & Wolverine, is the highest grossing R-rated film in history. He is also the co-creator and star of the Emmy Award-winning docuseries Welcome to Wrexham, which follows the journey of Wrexham AFC. He is a successful entrepreneur and award-winning marketer, creating breakthrough campaigns for multiple brands. He has been recognized as one of the most creative people in business by Fast Company, The Hollywood Reporter, Wall Street Journal and Adweek among others. He is an owner of Aviation Gin, Mint Mobile, Wrexham Football Club, Chief Creative Officer of MNTN, and a co-founder of Maximum Effort, a production company and marketing firm. He also launched The Group Effort Initiative and The Creative Ladder, nonprofits that help make creative careers more accessible to all – especially those from underrepresented communities.

- Sloane Stephens (Tennis) – Sloane Stephens is an American professional tennis player, Grand Slam champion, and Olympian. Off the court, Sloane is the founder of Doc & Glo, a clean body care brand designed for “bodies in motion.” She also serves as an active investor and advisor in the consumer, wellness, and tech spaces. Through the Sloane Stephens Foundation, she impacts over 15,000 youth annually through programs in Compton, CA, and South Florida.

- Dwyane Wade (Basketball) – Dwyane Wade is an NBA Champion, Hall of Famer, entrepreneur, and philanthropist. Wade won Olympic gold in 2008 and was named one of the NBA’s 75 greatest players. Wade’s entrepreneurial investments and business partnerships include The Wy Network (digital content network), Wade Cellars, Proudly Baby Care, TMRW Sports, Utah Jazz, Chicago Sky, and more. Wade executive produced several acclaimed films and documentaries, including Oscar-winning animated short Hair Love, Sports Emmy-winning documentary The Redeem Team, Emmy award-winning documentary short The Dads, and Oscar-nominated short documentary The Barber of Little Rock. Wade also co-founded the Social Change Fund United and Translatable, a platform for LGBTQIA+ youth. Wade recently joined Amazon Prime Video’s NBA Coverage team for the upcoming season.

New 2025 Brand and Media Partners

- Boardroom is a media brand co-founded by Kevin Durant and Rich Kleiman that focuses on the intersection of sports, entertainment, and business. Boardroom’s media arm produces daily and weekly newsletters along with premium content showcasing how athletes, executives, musicians, and creators are moving the business world forward. Boardroom’s network reaches over 52 million unique visitors each month, delivering a powerful blend of premium content and immersive experiences.

- Integral Ad Science (IAS) is a leading global media measurement and optimization platform that delivers the industry’s most actionable data to drive superior results for the world’s largest advertisers, publishers, and media platforms. IAS’s software provides comprehensive and enriched data that ensures ads are seen by real people in safe and suitable environments while improving return on ad spend for advertisers and yield for publishers. Our mission is to be the global benchmark for trust and transparency in digital media quality. For more information, visit integralads.com.

- Life Time (NYSE: LTH) is a modern lifestyle brand that blends wellness, nutrition, and long-term well-being into one holistic offering. With more than 180 Athletic Country Clubs across the U.S. and Canada, a robust digital platform, and nearly 30 premier athletic events, Life Time offers more than gym. It offers a way of life. Designed for members from 90 days to 90-plus years, Life Time’s ecosystem supports healthy living, aging, and connection through programs, classes and activities that span performance, recovery, nutrition, and entertainment. Its LTH supplement line reflects a legacy of excellence, rooted in science, delivered through trust. Recently named one of Fast Company’s Most Innovative Companies of 2025 and certified as a Great Place to Work, Life Time continues to redefine what wellness looks and feels like through thoughtful design, and meaningful experiences. They are committed to not only help people live long, but to thoroughly enjoy all the days of their lives.

- Minute Media – Minute Media is a global technology and content company specializing in sports and culture. Minute Media’s proprietary tech platform enables the creation, distribution and monetization of digital content experiences. They own and operate leading sports content brands, including The Players’ Tribune, FanSided, and 90min, and serve as the publisher of Sports Illustrated and Sports Illustrated Swimsuit across digital and print platforms. Minute Media also provides sports highlight rights through their recent technology acquisition of STN Video. The company reaches 200M monthly users, powering 1,500+ content creators and 400+ distribution partners across 14 global markets in 10 languages. They also reach a robust print subscriber base through the publication of Sports Illustrated, Sports Illustrated Swim and Sports Illustrated Kids magazines. Minute Media has offices in New York, London, Tel-Aviv, São Paulo and Asia. For more information, visit www.MinuteMedia.com.

- NBA 2K League is a joint venture between the NBA and Take-Two Interactive. Driven by a bold new vision, the NBA and Take-Two Interactive are reimagining the league into a global digital entertainment business. The future business will level up the NBA and Take-Two Interactive’s long standing partnership and seek to engage consumers who live and play where pop culture, gaming and basketball collide. The venture will feature a digital media brand, immersive live events and a revamped 2K league. Through these channels, the new venture will build, engage and activate a broader fan base that is immersed in basketball and culture.

- Øpus Intelligence is the world’s first AI-native Tribal Knowledge Marketing platform—an enterprise-grade system built to create blinding speed and efficiency for marketers with automation powered by human expertise that LLM’s cannot replicate. Founded by Omar Johnson—former CMO of Beats by Dre and VP of Marketing at Apple—Øpus uniquely blends machine learning with deeply embedded cultural and creative instinct. The platform combines proprietary retrieval architecture with exclusive, expert-sourced knowledge collections across marketing, media, sport, fashion, and entertainment. Øpus is currently powering brand campaigns, athlete partnerships, and audience personas for some of the most influential companies and creators in the world. It is redefining the future of marketing—where deep tribal knowledge, not prompts, fuels automation at scale. For more, visit opusintelligence.com.

- PepsiCo (PEP) products are enjoyed more than one billion times a day in over 200 countries and territories around the world. As one of the world’s leading food and beverage companies with iconic brands like Lay’s, Gatorade and Pepsi, PepsiCo is deeply committed to the power of sport to unite and inspire. From serving as a premier sponsor of the NBA and NFL, to celebrating a decade-long partnership with UEFA, to fueling the thrill of Formula 1 through a new global alliance, PepsiCo continues to bring fans closer to the moments and athletes they love, on and off the field.

- SMAC Entertainment – Founded in 2011, SMAC Entertainment, a multi-dimensional talent management, music, branding and production company, brings together former NFL strategist and marketing executive, Constance Schwartz-Morini, and Pro Football Hall of Famer and Emmy Award-winning television host, Michael Strahan, to create a major presence in the sports and entertainment arena. In addition to representing globally recognized talent, SMAC produces a diversified slate of film and television content, with projects set up at primetime cable and broadcast networks including HBO, DIRECTV, Showtime, ABC, CBS, E!, NFL Network, Audience Network, and Nickelodeon, as well as Prime Video. In addition, SMAC has engineered multiple clothing brands including Collection and MSX by Michael Strahan, two men’s clothing and accessory lines available at Men’s Warehouse and JCPenny; MSX by Michael Strahan for NFL as well as Erin Andrews’ licensed sportswear collection, WEAR by Erin Andrews.

- The Trade Desk™ is a technology company that empowers buyers of advertising. Through its self-service, cloud-based platform, ad buyers can create, manage, and optimize digital advertising campaigns across ad formats and devices. Integrations with major data, inventory, and publisher partners ensure maximum reach and decisioning capabilities, and enterprise APIs enable custom development on top of the platform. Headquartered in Ventura, CA, The Trade Desk has offices across North America, Europe, and Asia Pacific. To learn more, visit thetradedesk.com.

- Visa is a global leader in digital payments, empowering individuals and businesses through secure, convenient, and trusted transactions. Built on the belief that anyone can make it, Visa helps unlock potential and supports the journey toward becoming who you want to be. Learn more at Visa.com.

Previously announced SPORT BEACH brand partners include: Ad Results Media (ARM), Adobe, The Athletic, Business Insider, Channel Factory, The Chicago Bulls, Clio Sports, Diageo, Dirt is Good, DoubleVerify, e.l.f. Beauty, Epidemic Sound, Fanatics, La Fete Wine Company, Fortune, InMobi, Jeff Hamilton, LG Ad Solutions, LOVB, Meta, Microsoft Advertising, Movember, NBCUniversal, New York Life Insurance Company, Nexxen, NFL Players Inc., NGLmitú, NHL, NHLPA, Nielsen, Official AI, Overtime, Page Six, PayPal, Peloton, Premion, Qualcomm Technologies Inc., Scripps Sports, Sephora, Snap Inc., STAPLE, Strava, TransUnion, TripleLift, Unrivaled, Vacation Inc., VII(N) The Seventh Estate, Wilson Sporting Goods Co. and Zillow Group Inc.

For the full roster of leaders, innovators, and cultural influencers joining SPORT BEACH 2025, visit sportbeach.com. For more information on Cannes Lions, including the Awards and the Festival, please visit www.canneslions.com.

Stagwell invites brands, athletes, sports leagues, media platforms and other interested parties to reach out to sportbeach@stagwellglobal.com to get involved.

About Stagwell

Stagwell is the challenger holding company built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 45+ countries are unified under a single purpose: to drive effectiveness and improve business results for our clients. Join us at www.stagwellglobal.com.

Contact

Kara Gelber

PR@stagwellglobal.com

Registration now open for SPORT BEACH 2025 at sportbeach.com

NEW YORK, April 9, 2025 /PRNewswire/ — Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, today launched registration for SPORT BEACH 2025 at sportbeach.com and announced an expanded lineup of athletes and brand partners.

Notable new additions to this year’s roster include sports broadcaster Erin Andrews, long-distance runner and Olympic Gold Medalist Sir Mo Farah, NBA legend Chris Paul, MLB All-Star Alex Rodriguez, and George Russell, Mercedes-AMG PETRONAS Formula One Team driver, who will participate in featured programming throughout the week.

Back in its third year, SPORT BEACH will serve as the premiere destination for sport at the Cannes Lions International Festival of Creativity (Cannes Lions) from June 16-19, 2025.

Newly Announced 2025 Athlete & Media Partners

- Erin Andrews (Media) – Entrepreneur and broadcaster Erin Andrews is most widely known for her work as a member of FOX Sports’ A Team, reporting on “FOX NFL Sunday” each week. In addition to being a trailblazer in the sports world, Andrews co-hosts the popular iHeartRadio podcast “Calm Down with Erin and Charissa” for iHeartRadio, which features unfiltered conversations between two girlfriends about life, sports, and pretty much every random topic that needs to be dissected. She was honored with a Gracie Award in 2021, which recognizes exemplary programming created by women, for women, and about women in all facets of media and entertainment. In 2019, Andrews added “creator” to her long list of titles with the launch of her women’s apparel line WEAR by Erin Andrews. Andrews designed the collection to help women express their fandom in a way that fits their everyday style and has since expanded her products to include contemporary NBA, NCAA, NHL, and MLB pieces. The sports pioneer has garnered notable attention as an entrepreneur, growing WEAR by Erin Andrews into one of the top NFL women’s only brands since it launched.

- Sir Mo Farah (Running) – Sir Mo Farah, CBE, is a multiple Olympic, World and European gold medalist. For many, he is Britain’s greatest ever athlete, having accumulated 10 global titles which includes the ‘double double’ of gold medals over 5,000m and 10,000m at both the 2012 and 2016 Olympic Games. He holds numerous European and British records and has the World Best distance for the One Hour Run (21,330m). Sir Mo was knighted in the 2017 New Year Honours for services to athletics. At the start of 2024, he became the National School Sport Champion for the Youth Sport Trust, embarking on ‘Mo’s Mission’ to encourage young people to be physically active for at least 60 minutes each day. In January 2025 Mo announced his new YouTube series ‘Run with Mo’, taking celebrities from across the world out for a run chatting about life, their careers, fitness and everything in between.

- Chris Paul (Basketball) – Chris Paul is a legendary NBA superstar, known for his competitive spirit and leadership both on and off the court. A 12-time NBA All-Star and two-time Olympic gold medalist, Chris has played for teams such as the Los Angeles Clippers, Phoenix Suns and currently the San Antonio Spurs. Off the court, he is a dedicated father, husband, and philanthropist, and makes significant contributions through the Chris Paul Family Foundation. Chris is also a successful businessman and minority owner of the Indian Premier League’s Rajasthan Royals and Tiger Woods’ TGL club, Jupiter Links. A New York Times Bestselling author, Chris actively supports educational initiatives and HBCUs, continuing to build a powerful legacy in the space.

- Alex Rodriguez (Baseball) – Alex Rodriguez is the Chairman and Chief Executive Officer of A-Rod Corp, an investment firm that backs world-class startups and partners with leading global companies across real estate, sports, and entertainment. While best known as one of the world’s greatest athletes (a 14x MLB All-Star and a 2009 World Series Champion with the New York Yankees), Alex is now an owner of the Minnesota Timberwolves and Lynx and leads a team of experts building high-growth businesses. He is also an Emmy Award-winning MLB analyst for Fox Sports, has been an investor on ABC’s Shark Tank, and co-hosts the video series The Deal with Bloomberg Originals’ chief correspondent Jason Kelly, interviewing CEOs, entrepreneurs, and sports legends.

- George Russell (F1) – Qualcomm Technologies, Inc., in support of its Snapdragon® processor brand, is bringing George Russell, Mercedes-AMG PETRONAS Formula One Team driver, to SPORT BEACH. George Russell is a three-time Grand Prix winning Formula 1 driver for the Mercedes-AMG PETRONAS F1 Team. Having risen through the ranks as part of the Mercedes junior programme, he made his debut in the top tier of motorsport with the storied Williams team in 2019. Now, as the senior works driver for the iconic three-pointed star, George is one of the leading figures of the current generation. He also plays a significant role in leading change in the sport through his role as Director of the Grand Prix Drivers’ Association, the body that represents F1 racers. The youngest driver to ever hold the position, George has a particular passion for advancing racing safety in his role. He is also an advocate for mental health awareness, contributing significantly through various global initiatives.

- Charissa Thompson (Media) – Charissa Thompson is a dynamic Los Angeles-based TV host and reporter, widely recognized for her role across FOX’s NFL KICKOFF, the lead-in to FOX NFL SUNDAY, NFL Films Presents on FS1 and Prime Video’s Thursday Night Football. When she’s not behind the mic, Charissa channels her creative energy into interior design as the founder of House & Home Design, where she brings innovative style to life. Passionate about living an active lifestyle, Charissa frequently shares glimpses of her vibrant daily routine, often alongside her two beloved dogs, Daisy and Willis, as well as her cherished rescue animals at her very own Ruby Ranch. Charissa has also teamed up with well-known brands such as Mercedes-Benz, AG1, and Sam Adams, expanding her influence across the entertainment and lifestyle sectors.

Newly Announced 2025 Program Host

- Ben Lyons – Emmy Award Winning Television Host, Producer, and Strategic Brand Advisor at the intersection of sports, culture, and media.

Newly Announced 2025 Brand Partners

- Business Insider, a leading global news brand renowned for its coverage of business, technology, and innovation, returns to Stagwell’s SPORT BEACH for its third annual CMO Insider Breakfast on Tuesday, June 17, at 9 a.m. with founding sponsor Boston Consulting Group (BCG). During this exclusive, invite-only event, global CMOs will convene for a morning of industry-defining insights and high-level peer discussions as technology, media, and marketing converge like never before. Attendees will also hear from marketing leaders who are taking risks, learning on the fly, and creating brands built to win.

- Diageo, a returning partner, is a global leader in beverage alcohol with an outstanding collection of brands including Johnnie Walker, Crown Royal, Bulleit and Buchanan’s whiskies, Smirnoff, CÎROC and Ketel One vodkas, Casamigos, DELEÓN and Don Julio tequilas, Captain Morgan, Baileys, Tanqueray and Guinness. The “Don Julio Paloma” will be the official cocktail of SPORT BEACH 2025 and be served throughout the week. SPORT BEACH attendees will be able to sip on this refreshing cocktail of tequila, grapefruit soda, lime, and a hint of sweetness as they soak up the sun and enjoy the ultimate beach vibes. DIAGEO is listed on both the New York Stock Exchange (DEO) and the London Stock Exchange (DGE) and our products are sold in more than 180 countries around the world. For more information about DIAGEO, our people, our brands, and performance, visit www.diageo.com. Visit DIAGEO’s global responsible drinking resource, www.DRINKiQ.com, for information, initiatives, and ways to share best practice.

- La Fête Wine Company: Launched in 2019 as a fresh, modern, and inclusive wine brand geared toward drinkers of all backgrounds, La Fête is a modern lifestyle brand redefining the wine industry by breaking past tradition to create an inclusive, vibrant experience. La Fête is luxury without pretension: aspirational yet accessible. Recognized as one of the fastest-growing luxury Rosé brands, La Fête quickly gained momentum: In 2021, the company introduced La Fête du Blanc, followed by the launch of La Fête du Rouge in 2023. According to Circana, La Fête has been the fastest-growing luxury imported Rosé label since 2021 and now ranks #3 in the US. La Fête seamlessly blends approachability with aspiration, capturing the attention of a discerning, experience-driven audience rooted in today’s culture. La Fête believes wine should bring people together – no matter their background – through shared moments of joy, culture, and connection. In January 2022, 12-time NBA All-Star Chris Paul (CP3) became an equity partner in the company, further amplifying La Fête’s mission. Since its inception, La Fête has donated a portion of proceeds from every bottle sold to various organizations championing international and professional opportunities in wine and hospitality for BIPOC and underrepresented communities. All La Fête wines are produced in the iconic Gulf of St. Tropez, in the heart of the famed Côtes de Provence region of Southern France. For more information or to purchase online, please visit LaFeteWine.com

- LG Ad Solutions is a global leader in connected TV and cross-screen advertising, helping brands find hard-to-get unduplicated reach at optimal frequency across the fragmented streaming TV landscape. We bring together LG’s years of experience in delivering world-class smart TVs to consumers worldwide, with big TV audience data and Video AI designed to connect brands with audiences across all screens.

- Movember is a global movement changing the way the world talks about, thinks about, and invests in men’s health. Since 2003, this bristly charity has connected with millions of men around the globe – raising vital funds and shattering the silence surrounding men’s health issues. But their impact goes far beyond fundraising. Movember is showing up in culture – partnering with brands, creators, and platforms to redefine what it means to be a man today. They are also tapping into the passions that matter to men – like sport, fitness, and gaming – to create year-round impact. From boardrooms to barbershops to the beaches of Cannes, Movember is sparking conversations that push boundaries and drive real change. They’re teaming up with brands that shape identity, media platforms that influence behavior, and voices men trust — from locker rooms to livestreams, from social feeds to sports broadcasts. With unmatched global reach and a proven ability to inspire action, Movember is the partner of choice for anyone looking to engage the hard-to-reach male demographic and drive meaningful social change. Learn more at movember.com

- Nielsen is a global leader in audience measurement, media data and analysis. Through our understanding of people and their behavior across all channels and platforms, we provide our clients an independent source of insights so they can and will engage their audiences – now and in the future. Nielsen operates worldwide. For more information, please visit www.nielsen.com.

- Official AI empowers brands and athletes to create and collaborate on authentic AI-powered images, video, and audio for commercial use in minutes instead of months – all while ensuring proper consent, credit, and compensation. Through secure vaults and authenticated provenance, Official AI transforms how brands join cultural conversations in real-time, enabling unlimited content creation across every channel while maintaining brand consistency. As cultural relevance can’t wait for traditional production timelines, Official AI bridges the gap between creative vision and real-time execution, helping brands scale authentic content and transform creator collaborations from one-off projects to ongoing partnerships – reducing content creation costs by up to 90% while increasing speed-to-market by the same margin.

- Qualcomm Technologies, Inc., in support of its Snapdragon processor brand, is bringing George Russell, the Mercedes-AMG PETRONAS Formula One Team driver, to SPORT BEACH. Snapdragon processors power many of the devices you love, from smartphones to laptops, XR devices, vehicles, and so much more. George Russell and Don McGuire, Qualcomm Incorporated SVP and CMO, will discuss the successful brand collaboration between Snapdragon and the Mercedes F1 team, the role of technology in Formula One, and more.

- STAPLE, born from the streets of New York in 1997, is a globally recognized brand that blends street culture, design, and the spirit of New York City. It all started when jeffstaple—then a student at Parsons School of Design—walked into a downtown NYC boutique wearing a self-printed tee from his silkscreen class. He wasn’t trying to start a brand. But he walked out with a 12-piece order. That moment lit the spark — and STAPLE was born. What began as a handmade T-shirt line quickly evolved into a movement. In 2005, Nike tapped jeffstaple to design a sneaker that captured the essence of New York City. The result—the STAPLE x Nike SB “Pigeon” Dunk — set off streetwear history. The drop introduced sneaker culture to the mainstream. And it made the Pigeon an icon. 25+ years in, STAPLE continues to fly. The Pigeon is more than a logo — it’s a symbol of grit, resilience, and creativity. Just like the city that raised it. From graphic tees to full lifestyle collections, STAPLE draws inspiration from all corners of street culture—music, sport, art, and global youth energy. Our collaborations span continents and categories—from legendary names to emerging voices—always pushing culture forward. Whether it’s a limited sneaker, a capsule with a global brand, or a community-driven project, STAPLE brings an unmistakable energy and authenticity to everything it touches.

- TripleLift is the world’s leading Creative SSP, transforming standard ad placements into high-performing, scalable experiences across desktop, mobile, CTV, and Retail Media. The company’s integrated platform seamlessly unites premium supply, creative technology, and data into one seamless, integrated programmatic platform. Through its focus on creative, TripleLift empowers publishers, drives better outcomes for advertisers, and builds better experiences for consumers, delivering value across the entire digital advertising ecosystem. As part of the Vista Equity Partners portfolio, TripleLift is NMSDC certified, qualifies for diverse spending goals, and remains deeply committed to people, culture, and community.

- Zillow Group, Inc. (Nasdaq: Z and ZG), a returning SPORT BEACH partner, is reimagining real estate to make home a reality for more and more people. As the most visited real estate website in the United States, Zillow and its affiliates help people find and get the home they want by connecting them with digital solutions, dedicated partners and agents, and easier buying, selling, financing and renting experiences.

Previously announced SPORT BEACH brand partners include: Ad Results Media (ARM), The Athletic, Channel Factory, The Chicago Bulls, Clio Sports, Epidemic Sound, Fanatics, Meta, Microsoft Advertising, NBCUniversal, New York Life Insurance Company, Peloton, Premion, Scripps Sports and VII(N) The Seventh Estate.

For the full roster of leaders, innovators, and cultural influencers joining SPORT BEACH 2025, visit sportbeach.com. For more information on Cannes Lions, including the Awards and the Festival, please visit www.canneslions.com.

Stagwell invites brands, athletes, sports leagues, media platforms and other interested parties to reach out to sportbeach@stagwellglobal.com to get involved.

About Stagwell

Stagwell is the challenger holding company built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 40+ countries are unified under a single purpose: to drive effectiveness and improve business results for our clients. Join us at www.stagwellglobal.com.

Contact:

Kara Gelber

PR@stagwellglobal.com

*Snapdragon is a product of Qualcomm Technologies, Inc. and/or its subsidiaries. Snapdragon is a trademark or registered trademark of Qualcomm Incorporated.

Related

Articles

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

In the News, Press Releases, Talent & Awards

May 19, 2025

Stagwell (STGW) Appoints Connie Chan as Chief Growth Officer for Asia Pacific

Newsletter

Sign Up

New York, NY, May 22, 2025 — Stagwell Inc. (the “Company”) announced today the grant of equity inducement awards. Effective May 20, 2025, the Company granted a total of 45,832 restricted stock units to four new employees. Each restricted stock unit represents the right to receive one share of the Company’s Class A common stock. The restricted stock units will vest in two installments, with one-third vesting on the second anniversary of the grant date and two-thirds vesting on the third anniversary of the grant date. The restricted stock units are subject to accelerated vesting upon (i) termination of employment by the Company without Cause or (ii) death or disability. The Company granted these awards as a material inducement to employment in accordance with Nasdaq Listing Rule 5635(c)(4).

For more information on Stagwell, please visit www.stagwellglobal.com

About Stagwell

Stagwell is the challenger holding company built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 45+ countries are unified under a single purpose: to drive effectiveness and improve business results for our clients. Join us at www.stagwellglobal.com.

Contact:

Beth Sidhu

Originally Released On

Contact:

Alyssa Bourne-Peters

PRophet

Alyssa.bourne-peters@prprophet.ai

+1 917 592 9795

New AI-powered assistant redefines how marketers search, filter, and connect with influencers and creators conversationally

NEW YORK, May 22, 2025 /PRNewswire/ — PRophet’s InfluencerMarketing.AI (IMAI) software platform, today announced the launch of AI Agentic Search – a next generation conversational search assistant designed to fundamentally transform how brands and agencies discover and engage with influencers and creators. Embedded inside the InfluencerMarketing.AI platform, the AI agentic search assistant moves beyond keywords and filters to deliver dynamic, human-like conversations that help marketers identify the right creators faster, more intuitively, and with greater accuracy.

This launch follows on the heels of IMAI’s enhanced 12-year brand safety look-back and advanced performance measurement capabilities. Those updates marked a bold step in the brand’s efforts to address two of the industry’s most urgent pain points, and now, with AI agentic search, the platform continues to push the boundaries of what AI can do for marketers looking for precision, speed, and strategic insight in creator discovery.

Key Features of AI Agentic Search:

- Conversational Search Interface: Users can ask natural-language queries like “Show me fashion influencers in Paris with high engagement on TikTok” and receive real-time, accurate results.

- Smart Filtering: The AI assistant automatically applies the most relevant filters based on user input, reducing manual work and guesswork.

- Memory & Context Awareness: Remembers past searches and preferences to deliver increasingly personalized recommendations.

- Seamless Integration: Embedded natively within the IMAI platform no training or onboarding needed.

“This is not just a search bar – it’s an intelligent agent that understands what you’re looking for and helps you discover the right creators in seconds,” said Eran Nizri, Founder and CEO of IMAI. “AI agentic search natively and naturally integrates human-like interaction throughout the entire influencer discovery process.”

Powered by the technology’s proprietary language models and industry-leading creator database, AI agentic search offers unmatched usability and performance, setting a new standard for discovery tools in the influencer marketing space.

This innovation underscores PRophet’s commitment to leading the AI-driven transformation of marketing and communications.

“With Agentic Search, we’re advancing PRophet’s mission to empower communicators with smarter, more human-centric AI tools,” said Aaron Kwittken, Global CEO and Founder of PRophet. “Influencer marketing is no longer about spreadsheets and guesswork – it’s about intelligent, predictive technology that can understand your goals and guide you to the right decisions in real time.”

AI agentic search is now available to all InfluencerMarketing.AI users. For more information, visit www.InfluencerMarketing.AI and www.PRProphet.ai.

About InfluencerMarketing.AI

InfluencerMarketing.AI, now part of PRophet, is a leading influencer marketing platform that leverages advanced AI, machine learning, and data-driven insights to help brands drive performance, ensure brand safety, and protect intellectual property. We provide a full suite of tools for brands to scale their influencer campaigns with confidence, aligning their content with the highest standards of integrity and brand safety. With our cutting-edge technology, we continue to set new benchmarks for innovation and trust in the influencer marketing industry. Visit https://influencermarketing.ai/ to learn more.

About PRophet

PRophet is a comms tech suite of AI-powered SaaS tools and services designed to empower modern communicators. Purpose-built for PR and marketing professionals, PRophet harnesses predictive, cognitive and generative AI to help users discover, target and engage with high-authority journalists and leading influencers. The media relations solution creates and tests “mediable” PR content to predict journalist interest and sentiment. The influencer marketing solution, influencermarketing.ai, combines influencer discovery, analytics, brand safety and tracking technologies to inform and manage influencer campaigns with precision. The suite also encompasses the largest provider of global media, market intelligence and social listening tools, delivering unmatched insights and analysis to communicators worldwide.

PRophet was awarded PRovoke Media’s Innovation SABRE in 2023-2025, a 2024 Webby Award, and was included in PR News’ 2024 Tech Hotlist. PRophet is headquartered in New York City with offices in Washington DC, London, Cologne, Berlin, Zurich, São Paulo and Shanghai and is part of the Stagwell Marketing Cloud (SMC), a suite of data-driven SaaS solutions built for the modern marketer. Visit prprophet.ai to learn more.

Media Contact:

Alyssa Bourne-Peters

PRophet

Alyssa.bourne-peters@prprophet.ai

+1 917 592 9795

Originally Released On

Contact:

John Gerzema

jgerzema@harrispoll.com

Drew Higham

Drew.Higham@harrispoll.com

Jacklyn Cooney

Jacklyn.Cooney@harrispoll.com

Many companies fail to fulfill consumer needs as inflation has shifted America’s focus and priorities toward seeking value and spending more carefully.

This, according The Axios-Harris Poll 100 Rankings on Corporate Reputation released this morning, is why Trader Joe’s ranked first – followed by other value-prioritizing brands like Toyota and Arizona Beverage Company – among the top 10 most reputable companies in the country this year.

NEW YORK, May 20, 2025 /PRNewswire/ — Americans, fatigued by a third year of inflation, high interest rates, and tariff uncertainty, gave nearly half of all businesses poorer marks in the 27th annual study of corporate reputation conducted by Harris’ (RQ) Reputation Quotient Survey. Among the top 100 index of companies, more declined (46%) than improved (37%), as consumers criticized businesses for passing along higher costs, delivering poorer perceived quality for their stretched dollars, and even capitalizing on tariffs to pad profit margins.

Of note:

- 77% of Americans say companies often sell lower-quality products and services while charging higher prices.

- 70% believe companies are taking further advantage of inflation to increase their profit margins.

- 60% feel companies will use tariffs as an opportunity to raise prices more than needed to boost profits.

This comes as Americans are split over whether the economy is improving and whom to blame for their personal financial situation. Among those who feel stuck (39%) and falling behind (28%) – a quarter (26%) fault business for their predicament. Among those with a declining opinion of business, their number one reason cited was “companies not doing enough to keep prices fair from inflation”. And over half of all Americans said they had recently stopped doing business with a company due to unreasonably high prices (63%) and quality falling below expectations (54%).

“As opposed to COVID, when corporate reputations surged with breakthrough vaccines and reliable package delivery, businesses haven’t answered this moment,” says John Gerzema, CEO of The Harris Poll. “Americans don’t see business with a solve for inflation. They want an ally.”

Other key findings:

- Inflation fighters come out on top: Prioritizing the consumer paid off for some companies with Trader Joe’s experience the sixth largest increase in score (+3.5) to take the top spot. New-comer Arizona Beverage Co. (99 cent price policy) emerges at #7.

- Perceived quality is falling: Consumers are twice as likely to say the quality of goods and services is falling behind their current prices than exceeding them (48% v. 22%). Especially as two-thirds (69%) report a noticeable decline in the quality of their everyday items.

- AI is still more hype than utility for most: More Americans today than last year don’t find it important for companies to integrate AI into their products and services (47%, +5%-pts from May 2024), saying companies often overestimate their interest in AI-infused products (71%). With over two in five (43%) even against companies marketing that they use AI.

- Businesses should go back to the basics: American consumers point to quality as the most important consideration when considering company reputations today, followed by customer service, employee treatment and prices. As over three-quarters (79%) say brands with the best reputation are the ones prioritizing consumer wallets.

The Axios Harris Poll 100 is based on a survey of nearly 25,000 Americans in a nationally representative sample conducted January through March. The two-step process starts fresh each year by surveying the public’s top-of-mind awareness of companies that either excel or falter. These 100 “most visible companies” are then ranked by a second group of Americans across the seven key dimensions of reputation to arrive at the ranking. If a company is not on the list, it did not reach a critical level of visibility to be measured.

For information on all companies and their ranking on the 2025 Axios-Harris Poll 100, or to purchase an in-depth analysis of a company’s reputation, click here.

About The Harris Poll

The Harris Poll is one of the longest-running surveys in the U.S., tracking public opinion, motivations and social sentiment since 1963. It is now part of Harris Insights & Analytics, a global consulting and market research firm that delivers social intelligence for transformational times. We work with clients in three primary areas: building 21st century corporate reputation, crafting brand strategy and performance tracking, and earning organic media through public relations research. Our mission is to provide insights and advisory to help leaders make the best decisions possible. Learn more by visiting www.harrispoll.com and follow Harris Poll on Twitter and LinkedIn.

About Axios

Axios is a digital media company launched in 2017. Axios – which means “worthy” in Greek – helps you become smarter, faster with news and information across politics, tech, business, media, science and the world. Subscribe to our newsletters at axios.com/newsletters and download our mobile app at axios.com/app.

About Stagwell

Stagwell is the challenger holding company built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 45+ countries are unified under a single purpose: to drive effectiveness and improve business results for our clients. Join us at www.stagwellglobal.com.

Contact

John Gerzema

jgerzema@harrispoll.com

Drew Higham

Drew.Higham@harrispoll.com

Jacklyn Cooney

Jacklyn.Cooney@harrispoll.com