45% OF VOTERS SAY INFLATION AND AFFORDABILITY IS THE MOST IMPORTANT ISSUE TO THEM PERSONALLY, UP 6 POINTS FROM JUNE

69% OF VOTERS SAY BIDEN’S OPEN BORDER WAS A DELIBERATE POLICY

80% OF VOTERS SUPPORT THE U.S. TAKING ALL ACTIONS NECESSARY TO PREVENT IRAN FROM OBTAINING A NUCLEAR WEAPON

NEW YORK and CAMBRIDGE, Mass., July 14, 2025 /PRNewswire/ — Stagwell (NASDAQ: STGW) today released the results of the July Harvard CAPS / Harris poll, a monthly collaboration between the Center for American Political Studies at Harvard (CAPS) and the Harris Poll and HarrisX.

President Donald Trump’s approval rating is at 47% (+1 pt., June 2025), with highest approval among Republican, male, 35-44 y.o., white, and rural voters. Trump’s job approval continues to be strongest on immigration (50%) and returning America to its values (50%), and weakest on tariffs and trade policy (42%) and handling inflation (42%). This month’s poll also covered public opinion on the economy, immigration, the “Big Beautiful Bill,” tariffs, conflicts in the Middle East, and the war in Ukraine. Download the key results here.

“Trump’s approval rating has stabilized, but it’s a split electorate and the administration will ultimately rise or fall based on his ability to handle inflation,” said Mark Penn, Co-Director of the Harvard CAPS / Harris poll and Stagwell Chairman and CEO. “But the administration has a lot to work with in terms of gaining support for the ‘Big Beautiful Bill’ with many individual policy proposals and tax cuts in the bill popular across political parties.”

VOTERS WHO STRONGLY DISAPPROVE OF TRUMP TICKS UP BUT DEMOCRATIC PARTY APPROVAL RATING REMAINS UNDERWATER

- 38% of voters say they strongly disapprove of the job Trump is doing as President, up 6 points from February 2025. But the Democratic Party approval rating remains low at 40% (-2 pts., June 2025), while the Republican Party approval rating is at 48% (+1).

- 56% of voters say the economy is on the wrong track.

- 43% of voters say their personal financial situation is getting worse (+4 pts., May 2025). Democrats, Independents, women, 55-64 y.o., Black, and rural voters are more likely than not to say it is getting worse.

- Inflation, immigration, the economy, and healthcare are the top important issues for voters today, with 24% prioritizing healthcare (+6).

- Among key political figures, Trump has the highest favorability at 47% (0 net favorable), followed by Robert F. Kennedy Jr. (+5 net favorable). Voters have a more unfavorable view of Elon Musk (-16 net unfavorable) and Chuck Schumer (-15 net unfavorable). Most voters have not heard of or have no opinion of Zohran Mamdani (-8 net unfavorable).

VOTERS SUPPORT MOST OF TRUMP’S POLICIES FROM HIS FIRST SIX MONTHS BUT ARE MORE PESSIMISTIC ON TRADE DEALS AND FOREIGN CONFLICTS

- The large majority of Trump’s policies continue to have majority support, with 85% of voters supporting lowering prescription drug prices for Medicare recipients and low-income patients, and 79% of voters supporting deporting illegal immigrants who have committed crimes. On the other hand, 56% of voters oppose making cost cuts to Medicaid by adding work requirements, and 49% of voters oppose placing tariffs on China, Mexico, and Canada.

- 55% of voters support the decision of the Supreme Court to limit the ability of individual federal judges to issue nationwide injunctions, including 33% of Democrats.

- 43% of voters, a plurality, say Trump is doing worse than expected (Democrats: 70%; Republicans: 14%; Independents: 47%).

- 49% of voters believe Trump is making good deals on behalf of the country (-3 pts., June 2025).

- 59% of voters say Trump will not solve the Israel-Hamas conflict (-6).

17 OUT OF 21 POLICY PROPOSALS WITHIN THE “BIG BEAUTIFUL BILL” HAVE MAJORITY SUPPORT AMONG THOSE WHO HAVE HEARD OF THE BILL

- 80% of voters have heard of the “Big Beautiful Bill” (+13).

- 44% of voters support the bill (+4), while 44% oppose it (+2). Among those who have heard of the bill, 48% of voters oppose it (+2 net oppose; Democrats: 70%; Republicans: 19%; Independents: 45%).

- Policy proposals within the bill like expanding health savings accounts for farmers (76%), reducing federal spending by $1.3 trillion (69%), increasing the child tax credit (67%), eliminating taxes on tips (66%), boosting military and naval spending (66%), and investing in rural broadband (66%) are the most popular, with majority support across political parties and among those who have heard of the bill.

- Taxing remittances sent abroad (43%) and removing tax and registration for firearm silencers (31%) have the lowest support among the bill’s policies.

- 52% of voters say making 2017 tax cuts permanent will increase federal debt (+12 pts., June 2025).

VOTERS NOW SEE THE ECONOMY SOLIDLY IN TRUMP’S HANDS

- 62% of voters say Trump is mostly responsible for the state of the economy today (+7), including a majority across political parties.

- 53% of voters trust the Trump administration and Republicans more than Democrats in Congress to manage the economy (+3).

- 56% of voters say Trump is losing the battle against inflation and that his tariffs are harming the economy.

- 56% of voters say the U.S. is not in a recession, though 59% of Democrats say we are in a recession.

- 46% of voters, a plurality, say recent economic news is mostly negative, though more voters say they’ve seen mostly positive news stories in the last few weeks (31%; +7 pts., June 2025).

TRUMP IMMIGRATION POLICIES RECEIVE STRONG SUPPORT, WITH TWO-THIRDS OF VOTERS ATTRIBUTING OPEN BORDER TO BIDEN ADMINISTRATION

- 60% of voters support the Trump administration’s efforts to close the southern border (-3 pts., June 2025; Democrats: 34%; Republicans: 89%; Independents: 55%), and 75% support the administration’s efforts to deport criminals who are here illegally, including a majority across political parties.

- 67% of voters say the border was open rather than secure under the Biden administration, and 69% say it was a deliberate policy (Democrats: 48%; Republicans: 88%; Independents: 60%).

- 79% of voters say convicted criminals who are here illegally should be deported after their sentence is over, including a majority across parties.

- 65% of voters oppose allowing cities and towns to block the deportation of convicted criminals (Democrats: 52%; Republicans: 72%; Independents: 69%).

- 59% say more due process is needed to prevent unfair deportations, and 52% of voters say Democrats are fighting for human rights in defending deportations.

- 55% of voters support automatic citizenship for the children of those who are here illegally, and 65% say the Constitution requires birthright citizenship (Democrats: 77%; Republicans: 54%; Independents: 66%).

U.S. STRIKE ON IRAN SEES MAJORITY SUPPORT; VOTERS WANT THE U.S. TO DEFEND ISRAEL IF IRAN RETALIATES

- 78% of voters support Israel over Iran in the Israel–Iran conflict, including a majority across political parties and age groups.

- 58% of voters support the Trump administration’s strike on Iran’s nuclear sites last month, including a majority of voters over 25 y.o., and 54% say it was a major accomplishment of the U.S. military.

- 51% of voters say the strike did severe damage to Iran’s nuclear program.

- 61% of voters support the U.S. defending Israel if Iran retaliates (Democrats: 51%; Republicans: 76%; Independents: 55%), and 86% say Iran should not be allowed to obtain a nuclear weapon.

- 61% of voters favor a permanent deal preventing nuclear weapons development over a temporary deal.

MAJORITY OF VOTERS WANT HAMAS TO LEAVE GAZA

- 77% of voters support Israel over Hamas in the Israel-Hamas conflict, and 80% say Hamas must release all remaining hostages without any conditions, including a majority across political parties and age groups.

- 56% of voters say Israel should only make a deal with Hamas if Hamas leaves Gaza (Democrats: 48%; Republicans: 62%: Independents: 56%).

- 53% of voters support Trump’s handling of the Israel-Hamas conflict (+2).

VOTERS WANT TRUMP TO BE TOUGHER ON PUTIN WITH CONTINUED SUPPORT FOR PROVIDING WEAPONRY TO UKRAINE

- 60% of voters say Trump has not been tough enough with Putin (Democrats: 73%; Republicans: 48%; Independents: 58%).

- 53% of voters say they are not satisfied with Trump’s handling of Ukraine–Russia talks (+6 net unsatisfied).

- 65% of voters support continuing to provide weaponry to Ukraine and sanctioning Russia (+3 pts., June 2025), including a majority across political parties.

- 72% of voters say America’s relationship with Ukraine is more valuable than with Russia (+4).

- 73% of voters say Russian President Vladimir Putin is playing games and stalling with the West rather than genuinely wanting to end the war in Ukraine.

The July Harvard CAPS / Harris poll survey was conducted online within the United States on July 6-8, 2025, among 2,044 registered voters by The Harris Poll and HarrisX. Follow the Harvard CAPS / Harris poll podcast at https://www.markpennpolls.com/ or on iHeart Radio, Apple Podcasts, Spotify, and other podcast platforms.

About The Harris Poll & HarrisX

The Harris Poll is a global consulting and market research firm that strives to reveal the authentic values of modern society to inspire leaders to create a better tomorrow. It works with clients in three primary areas: building twenty-first-century corporate reputation, crafting brand strategy and performance tracking, and earning organic media through public relations research. One of the longest-running surveys in the U.S., The Harris Poll has tracked public opinion, motivations, and social sentiment since 1963, and is now part of Stagwell, the challenger holding company built to transform marketing.

HarrisX is a technology-driven market research and data analytics company that conducts multi-method research in the U.S. and over 40 countries around the world on behalf of Fortune 100 companies, public policy institutions, global leaders, NGOs and philanthropic organizations. HarrisX was the most accurate pollster of the 2020 U.S. presidential election.

About the Harvard Center for American Political Studies

The Center for American Political Studies (CAPS) is committed to and fosters the interdisciplinary study of U.S. politics. Governed by a group of political scientists, sociologists, historians, and economists within the Faculty of Arts and Sciences at Harvard University, CAPS drives discussion, research, public outreach, and pedagogy about all aspects of U.S. politics. CAPS encourages cutting-edge research using a variety of methodologies, including historical analysis, social surveys, and formal mathematical modeling, and it often cooperates with other Harvard centers to support research training and encourage cross-national research about the United States in comparative and global contexts. More information at https://caps.gov.harvard.edu/.

Contact:

Carrie Hsu

pr@stagwellglobal.com

Related

Articles

In the News, Investments & Financials, Press Releases, Talent & Awards

Jul 08, 2025

Stagwell (STGW) Advances Executive Team with Four Key Appointments

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

Newsletter

Sign Up

Matt Adams, current Chief Operating Officer of Assembly Global, will lead as Global CEO alongside Marissa Jiminez who will join the Stagwell Media Platform as Global Chief Trading and Solutions Officer

NEW YORK and LONDON, July 9, 2025 /PRNewswire/ — Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, today announced the launch of the Stagwell Media Platform (SMP), its centralized team of global media, technology and data experts designed to create client advantage through a smarter use of scale in a fully addressable world. Powered by agentic principles, the team optimizes trading and investment product solutions for Stagwell’s global network and media partners.

Matt Adams will serve as Global CEO of SMP in addition to his role as Global Chief Operating Officer of Assembly Global. Marissa Jimenez will take on the role of Global Chief Trading and Solutions Officer at SMP, effective July 14, 2025. She will be based in New York City and report to Adams. Jimenez brings 20 years of industry experience and joins from Dentsu US, where she served as EVP, Commercial.

The SMP sits across all Stagwell agencies worldwide to bring together the efficiency of scale, collaboration and the ability to go deep with media and technology partners. The team utilizes Stagwell’s scale, technology, and partnerships to model, forecast, and optimize towards outstanding efficiency and outcomes for clients. Also, SMP offers a suite of solutions across creative, media and digital transformation services, all designed to benefit Stagwell partners and clients.

“The Stagwell Media Platform is a big step forward in making the capabilities of our media and data investment solutions readily available for our partners and clients worldwide. We set out to streamline operations across Stagwell agencies, and this is one of the ways we’re delivering on that promise,” said Mark Penn, Chairman and CEO of Stagwell.

“This suite of solutions repositions, matures, and expands the way we do business with our valued partners in a consolidating, addressable world, making it accessible to the entire Stagwell network,” added Matt Adams, Global CEO of the Stagwell Media Platform. “Marissa and I look forward to making a difference for our clients in a world that is open for opportunity.”

About Stagwell

Stagwell is the challenger holding company built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 45+ countries are unified under a single purpose: to drive effectiveness and improve business results for our clients. Join us at www.stagwellglobal.com.

Contact

Quinn Werner

PR@stagwellglobal.com

Related

Articles

In the News, Investments & Financials, Press Releases, Talent & Awards

Jul 08, 2025

Stagwell (STGW) Advances Executive Team with Four Key Appointments

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

Newsletter

Sign Up

NEW YORK, July 8, 2025 /PRNewswire/ – Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, will report financial results for the three months ended June 30, 2025, on Thursday, July 31, 2025, before market open.

Stagwell will host a video webcast to review those results the same day at 8:30 AM (ET). Register here to attend the webcast.

A replay of the webcast will be available following the event at Stagwell’s website, https://www.stagwellglobal.com/investors/.

About Stagwell

Stagwell is the challenger holding company built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 45+ countries are unified under a single purpose: to drive effectiveness and improve business results for our clients. Join us at www.stagwellglobal.com.

Related

Articles

In the News, Investments & Financials, Press Releases, Talent & Awards

Jul 08, 2025

Stagwell (STGW) Advances Executive Team with Four Key Appointments

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

Newsletter

Sign Up

NEW YORK, July 8, 2025 – Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, today announced the appointments of Ryan Greene as Chief Financial Officer, Frank Lanuto as EVP, Finance, Jason Reid as Chief Strategy Officer and Niels Laurberg as Chief Investment Officer.

“These moves strategically advance our executive team and are aimed at building the most effective, efficient and forward-looking leadership group to tackle the industry’s behemoths head on,” said Mark Penn, Chairman and CEO of Stagwell. “Ryan, Frank, Jason and Niels have each demonstrated strong leadership and contributed to efficiency gains over years of service to Stagwell, and we believe this change will help us achieve our 5×5 plan: $5 billion in revenue in the next 5 years.”

“As COO, Ryan has spearheaded Stagwell’s achievement of $65 million in cost synergies since 2021, while leading our operations, IT and real estate consolidation. He will now bring that drive to the entire finance organization and lead the effort to attain $80 to 100 million in AI-led efficiencies announced at our April Investor Day,” Penn added. Before the 2021 merger, Greene served as CFO of Stagwell Media and The Stagwell Group.

As EVP, Finance, Lanuto will continue to play a key role in managing the tax, finance and public accounting of the company.

Reid has spearheaded the merger and acquisitions area of the company and previously served in that role for The Stagwell Group. Over the last decade he has run over 50 deals and now moves to a role to define the strategic direction of the company in an industry making critical transitions to the next leap of technology.

Laurberg has worked closely with Reid for the last 7 years, rising up to number two in the department, and will now move up to head all mergers and acquisitions for the company.

“Jason will focus on new growth strategies for our lines of business and evaluate new frontiers to differentiate our client offerings worldwide. And Niels, who has been part of our M&A team since 2018, will now lead this critical part of our company’s global expansion,” continued Penn.

Greene, Lanuto, Reid and Laurberg will each report to Penn in their new roles and be part of the Senior Leadership Committee. Prior to these appointments, Greene served as Chief Operating Officer, Lanuto as Chief Financial Officer, Reid as Chief Investment Officer, and Laurberg as Vice President, Investments.

“It’s been extremely rewarding to serve as CFO alongside Stagwell’s incredible leadership team, and as I move into the role of EVP, Finance, I look forward to continuing to support and work with the whole Stagwell team and its next chapter of growth,” Lanuto said.

About Stagwell

Stagwell is the challenger holding company built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 45+ countries are unified under a single purpose: to drive effectiveness and improve business results for our clients. Join us at www.stagwellglobal.com.

Forward-Looking Statements

This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements can generally be identified by words such as “ability,” “aim,” “anticipate,” “assume,” “believe,” “build,” “continue,” “drive,” “estimate,” “expect,” “focus,” “forward,” “future,” “look,” “may,” “opportunity,” “plan,” “positioned,” “potential,” “predict,” “target,” “will” or the negative of such terms or other variations thereof and terms of similar substance used in connection with any discussion of current plans, estimates and projections. Forward-looking statements in this document include, but are not limited to, statements about the effects of senior leadership changes and the effectiveness and efficiency of the Company’s leadership team, the Company’s beliefs and expectations, the Company’s future financial performance (including its ability to achieve its long-term financial targets), anticipated AI-led efficiencies, the Company’s strategies, including with respect to artificial intelligence and M&A activity, technological leadership and differentiation, potential and completed acquisitions, anticipated and actual cost saving opportunities, and long-term growth and value-led innovation.

These forward-looking statements are subject to change based on a number of factors and are based on certain key expectations and assumptions made by the Company. Although the management of the Company believes that the expectations and assumptions on which such forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. The material assumptions upon which such forward-looking statements are based include, among others, assumptions with respect to general business, economic and market conditions, the competitive environment, anticipated and unanticipated tax consequences and anticipated and unanticipated costs. These assumptions are based on current plans, estimates and projections, and are subject to change based on a number of factors.

These forward-looking statements are also subject to various risks and uncertainties, many of which are outside the Company’s control, including but not limited to risks related to the Company’s ability to execute on its strategy and the other risks and uncertainties discussed in the Company’s most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, in particular under the captions “Forward-Looking Statements” and “Risk Factors,” and in the Company’s other filings with the Securities and Exchange Commission, accessible on the SEC’s website at www.sec.gov. Therefore, you should not place undue reliance on such statements. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to publicly update or revise forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed herein might not occur.

Contact

Stagwell

PR@stagwellglobal.com

Related

Articles

In the News, Investments & Financials, Press Releases, Talent & Awards

Jul 08, 2025

Stagwell (STGW) Advances Executive Team with Four Key Appointments

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

Newsletter

Sign Up

The Stagwell News Network launches in partnership with eight premier publishers

New study of 7,000+ U.S. adults finds rising news consumption and greater ad lift among the most engaged news audiences, reinforcing the value of advertising in news.

Research to be built upon throughout Future of News programming at Cannes Lions

NEW YORK, June 13, 2025 /PRNewswire/ — Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, today announced the launch of the Stagwell News Network, a private marketplace (PMP) associated with its Future of News initiative. As Stagwell continues to drive greater investment into news by bringing together leaders from marketing and news media around data and forward-looking discussions, the News Network will give Stagwell clients unique access to publishers – strengthening Stagwell’s ability to deliver premium news inventory and performance-driven solutions for clients.

The News Network’s launch partners are Newsweek, Nexstar, NPR, Ozone, RealClear Politics, The Associated Press, The Washington Post, and TIME.

This announcement coincides with Stagwell and the Future of News initiative’s expanded presence at the Cannes Lions International Festival of Creativity 2025. Leading up to the festival, Stagwell today unveiled new ad performance-based research, conducted by Stagwell’s research consultancy HarrisX among 7,126 U.S. adults, that reveals a clear loss in campaign reach and effectiveness when foregoing news advertising.

Key findings from the study include:

News Consumers are High-Impact Audiences

- News Junkies — roughly 80.4 million U.S. adults who follow the news ‘very closely’ — view brands more positively than less engaged audiences across seven key brand and reputation metrics, including purchase intent, favorability, likelihood to recommend, and trustworthiness.

- Among News Junkies, a key target group for advertisers, the average purchase intent for 20 brand ads tested across technology, travel/hospitality, CPG, financial services, and automotive, was 66%— compared to 50% among the rest of the general population.

- 13.8% of U.S. adults, or approximately 36.8 million individuals, are Exclusive News Junkies, defined as those who follow the news ‘very closely’ but do not closely follow sports or entertainment.

- Exclusive New Junkies show greater post-ad exposure lift than the rest of the general population, making it clear they are an underserved advertising audience who responds to ads.

News Engagement is Growing

- Since 2024, Exclusive News Junkies have grown in population size by approximately 7.2 million U.S. adults, now making up 13.8% of the general population compared to 11.1% a year ago.

- Nearly 60% of News Junkies and Exclusive News Junkies now follow the news more closely than they did a year ago.

- News Junkies and Exclusive News Junkies are now paying particularly more attention to political, international, and economic news than a year ago.

“This research shows that campaigns including news in the media mix consistently outperform those that forego news, and as the population of Exclusive News Junkies expands, brands that ignore news advertising are missing the opportunity to drive real results,” said Stagwell Chairman and CEO Mark Penn.

Since beginning news-focused testing in the second half of 2023, Stagwell has seen 2024 campaigns deliver three times the average return on ad spend (ROAS). According to Stagwell agency Assembly’s Media Mix Model, news delivers commercial impact, with three times higher ROAS than other paid media channels, and 136% transaction growth for a leading global logistics business.

“We’re turning insight into action–from debuting new research for Cannes that proves the power of news audiences, to launching the Stagwell News Network with eight leading publishers, and hosting the first-ever NewsFronts event this October. We’re doubling down on the power of news as a critical platform for marketers and advertisers,” added Alexis Williams, Chief Corporate Affairs Officer at Stagwell.

Join the Future of News team for programming throughout Cannes Lions:

- RTL AdAlliance Beach | The Business of News | Monday, June 16, 10:30 AM CEST

- WSJ’s Journal House | Hard Truths, Real Results: How News Unlocks Advertising ROI | | Monday, June 16, 4:15 PM CEST

- ADWEEK House | The Business of News | Tuesday, June 17, 1:30PM CEST

- SPORT BEACH | Future of News Breakfast Roundtable | Wednesday, June 18, 9:00 AM CEST

- SPORT BEACH | Future of News: Why News Junkies are the Real MVPs | Wednesday, June 18, 1:00 PM CEST

To learn more about Stagwell’s Future of News Initiative, please reach out to futureofnews@stagwellglobal.com. To request a copy of the latest research, please visit https://www.stagwellglobal.com/future-of-news/.

About Stagwell

Stagwell is the challenger holding company built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 45+ countries are unified under a single purpose: to drive effectiveness and improve business results for our clients. Join us at www.stagwellglobal.com.

Contact

Madison Wick

PR@stagwellglobal.com

Related

Articles

In the News, Investments & Financials, Press Releases, Talent & Awards

Jul 08, 2025

Stagwell (STGW) Advances Executive Team with Four Key Appointments

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

Newsletter

Sign Up

Originally Released On

Contact:

Alyssa Bourne-Peters

PRophet, US

Alyssa.Bourne-Peters@prprophet.ai

+1 917 592 9795

Sarah Schulze

PRophet, EMEA

Sarah.Schulze@prprophet.ai

+49 16090815945

UNICEPTA’s Media Intelligence Capabilities Now Operate as ‘PRophet Media Intelligence’ Within the Comprehensive PRophet Comms Tech Suite

NEW YORK and COLOGNE, Germany, June 12, 2025 /PRNewswire/ — PRophet, a comms tech suite of essential, award-winning AI-powered software and services for modern communicators, today announced it has fully integrated UNICEPTA into the PRophet comms tech suite, following its acquisition of UNICEPTA in December 2024. UNICEPTA’s offerings will now operate under the PRophet brand family as “PRophet Media Intelligence,” joining a unified brand and enhanced suite of AI-powered software and services, positioning PRophet now as the third largest comms tech suite in the world.

The full PRophet Suite now houses three AI-powered SaaS and human-powered analytics solutions that empower PR and social media professionals to maximize their performance and productivity.

- PRophet Media Intelligence (F/K/A UNICEPTA): Offers comprehensive global media monitoring, market intelligence, and social listening tools, delivering unmatched insights and analysis to communicators worldwide.

- PRophet Earn: Deploys predictive, cognitive, and generative AI to help discover, target, and engage with the most relevant and interested high-authority journalists. and leading influencers.

- PRophet Influence: Powered by influencermarketing.ai, uses agentic-AI to power influencer discovery, analytics, brand safety, and tracking to inform and manage influencer marketing campaigns.

“Fully integrating UNICEPTA into PRophet allows us to provide clients with the technology, expertise and data they need to grow, protect and lead their enterprise communications,” said Aaron Kwittken, Founder and Global CEO of PRophet. “Not only does this rebrand mark a major milestone for client offerings and services but also realizes our global vision of ushering in and empowering a new generation of communications engineers with the unified tools they need in today’s complex media landscape.”

This integration will also bring new roles to UNICEPTA’s co-CEO’s, Sebastian Rohwer and Alexander Peinemann. Sebastian will become Chief Client Services Officer and Managing Director, Central Europe of PRophet and Alexander will become Chief Operating Officer and Chief Transformation Officer of PRophet.

As part of this integration and brand migration, PRophet launched a new website and refreshed visual identity, reflecting the brand’s evolution and commitment to innovation in the communications technology space.

With this integration and rebranding, PRophet enters a new phase of growth—firmly uniting global talent and markets, rapidly accelerating our mission to redefine what’s possible and deliver what’s next in modern communications.

For more information, visit www.prprophet.ai.

About PRophet

PRophet is a suite of AI-powered SaaS software and services designed to empower and support the next generation of human-led, AI-fed “communications engineers” working in the PR, social and influencer marketing community.

PRophet Media Intelligence (F/K/A UNICEPTA) is the largest provider of global media, market intelligence and social listening tools, delivering unmatched insights and analysis to communicators worldwide.

PRophet Earn harnesses predictive, cognitive and generative AI to help users discover, target and engage with high-authority journalists and leading influencers. This media relations solution creates and tests “mediable” PR content to predict journalist interest and sentiment.

PRophet Influence, powered by influencermarketing.ai, combines influencer discovery, analytics, brand safety and tracking technologies to inform and manage influencer campaigns with precision and performance in mind.

PRophet was awarded PRovoke Media’s Innovation SABRE in 2023-2025, a 2024 Webby Award, and was included in PR News’ 2024 Tech Hotlist. PRophet is headquartered in New York City with offices in Washington DC, London, Cologne, Berlin, Zurich, São Paulo and Shanghai and is part of The Marketing Cloud (TMC), a suite of data-driven SaaS solutions built for the modern marketer. Visit prprophet.ai to learn more.

Media Contacts:

Alyssa Bourne-Peters

PRophet, US

Alyssa.Bourne-Peters@prprophet.ai

+1 917 592 9795

Sarah Schulze

PRophet, EMEA

Sarah.Schulze@prprophet.ai

+49 16090815945

Logo – https://mma.prnewswire.com/media/2693566/PRophet_Logo.jpg

Related

Articles

In the News, Investments & Financials, Press Releases, Talent & Awards

Jul 08, 2025

Stagwell (STGW) Advances Executive Team with Four Key Appointments

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

Newsletter

Sign Up

Originally Released On

Contact:

Amy Guenel

VP Product Marketing, The Marketing Cloud

Amy.guenel@stagwellglobal.com

The Marketing Cloud, formerly known as Stagwell Marketing Cloud, launches its next chapter with a new name

New platform delivers seamless access to AI-powered solutions in a single dashboard

NEW YORK, June 11, 2025 /PRNewswire/ — Today, The Marketing Cloud (formerly known as Stagwell Marketing Cloud) announced the launch of its new platform. This dynamic, centralized experience makes it easy for marketers to discover AI-powered products across market research, communications, creative, and media—boosting collaboration and driving results with the latest tech.

Designed to cut through the complexity of today’s fragmented martech ecosystem, The Marketing Cloud Platform helps marketers focus on impact—not tool management.

The Marketing Cloud includes products like QuestBrand and QuestDIY from The Harris Poll, the PRophet suite of tools for comms professionals, The People Platform, CUE, and SmartAssets—all supported by an underlying ID Graph that enables streamlined data connectivity. The new name reflects the company’s evolution toward greater simplicity, integration, and AI-driven performance.

Key benefits of The Marketing Cloud Platform include:

- AI-powered solutions: Explore a curated marketplace of products designed to meet diverse marketing needs.

- Supercharged team collaboration: Centralized workspaces and flexible data-sharing tools help teams work faster and smarter.

- Seamless integrations: Combine solutions seamlessly to amplify performance and results.

- Unified, hassle-free workflows: Save time with single sign-on and streamlined account management across products.

- The power of proprietary data: Stagwell’s wealth of attitudinal and behavioral data provides a foundational, competitive edge for all of our products.

“Our vision for the Platform is to harness the full power of our data—the oxygen that fuels AI—making it accessible and actionable for every marketer. By integrating AI into every facet of the Platform, we aim to streamline repetitive tasks, scale high-performance content creation, and ultimately build a 24/7 marketing experience with AI agents that empower marketers to achieve more, wherever they are,” said Elspeth Rollert, CEO of The Marketing Cloud.

“Data is the backbone of the Platform—it’s not just vast, it’s uniquely actionable,” added Mansoor Basha, The Marketing Cloud’s CTO. “This foundation gives our AI models context and clarity. By infusing our tools with integrated attitudinal and behavioral insights proprietary to the Stagwell network, we enable marketers to make decisions grounded in how real people think, feel, and act.”

Early adopters of The Marketing Cloud Platform have found significant improvements in efficiency, cost savings, and marketing performance—demonstrating the platform’s potential to transform how teams work.

“By utilizing Propellers and SET through The Marketing Cloud Platform, we’ve reduced our expenses on external creative agencies by 70%, enabling us to eliminate agency fees and high production costs,” shared Julie Marchant-Houle, CEO of ESTYLE. “As a result, we have become more efficient, reallocating more funds into working dollars and providing us with a wealth of content that we wouldn’t have otherwise.”

The Marketing Cloud Platform is now available to marketers worldwide. To learn more or request a demo, visit www.themarketingcloud.com.

About The Marketing Cloud

The Marketing Cloud (formerly Stagwell Marketing Cloud) is a suite of AI-powered solutions built for the modern marketer. Born out of Stagwell’s (NASDAQ: STGW) award-winning network that delivers scaled creative performance for the world’s most ambitious brands, The Marketing Cloud empowers brands to drive measurable business impact through intuitive solutions enriched with unique, actionable data.

The Marketing Cloud’s solutions harness advanced technology—generative and predictive AI, machine learning, augmented reality, and more—to revolutionize market research, communications, creative, and media strategies for global brands. Get your head in the cloud at www.themarketingcloud.com.

About Stagwell

Stagwell is the challenger holding company built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 45+ countries are unified under a single purpose: to drive effectiveness and improve business results for our clients. Join us at www.stagwellglobal.com.

Contact

Amy Guenel

VP Product Marketing, The Marketing Cloud

Amy.guenel@stagwellglobal.com

Related

Articles

In the News, Investments & Financials, Press Releases, Talent & Awards

Jul 08, 2025

Stagwell (STGW) Advances Executive Team with Four Key Appointments

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

Newsletter

Sign Up

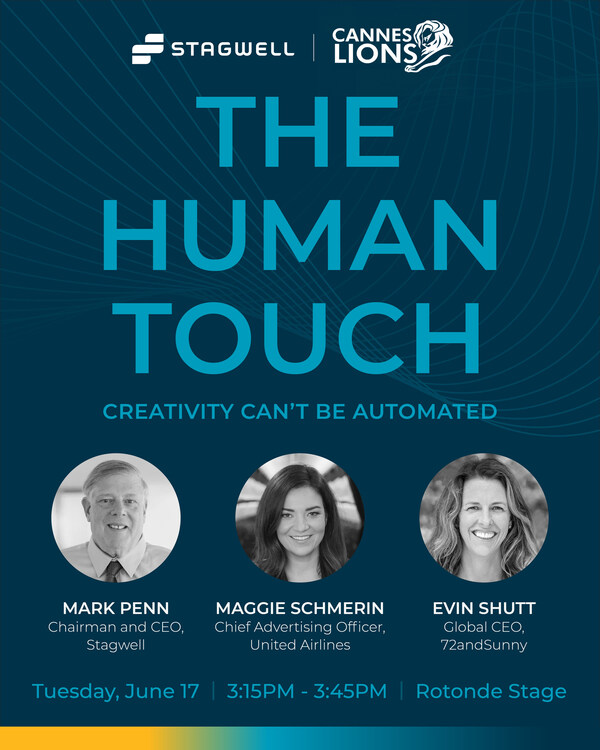

Penn will take the main stage alongside United Airlines’ Chief Advertising Officer Maggie Schmerin and 72andSunny’s Global CEO Evin Shutt

“The Human Touch: Creativity Can’t Be Automated” to run on Innovation Unwrapped track at Cannes Lions International Festival of Creativity

NEW YORK, June 10, 2025 /PRNewswire/ — Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, today announced Chairman and CEO Mark Penn will take the main stage at the 2025 Cannes Lions International Festival of Creativity, the advertising world’s most esteemed awards and celebration, to present “The Human Touch: Creativity Can’t Be Automated.”

Penn’s presentation on the value of human creativity in an industry becoming increasingly automated builds on his four decades of experience at the intersection of technology and creativity.

The Human Touch: Creativity Can’t Be Automated

Cannes Lions | Rotonde Stage, Rotonde | Tuesday, June 17, 3:15 PM CEST

Join this session where leaders from Stagwell, United Airlines, and 72andSunny will prove that the secret to breakthrough branding lies in blending cutting-edge technology with the irreplaceable power of human creativity. You’ll learn how to turn data into story-driven insights, build culturally resonant messages that stick, and avoid the creative rut when relying too heavily on automation. Featured speakers will share frameworks, lessons and creative tactics for marketers ready to lead with boldness and originality.

Featuring:

- Maggie Schmerin, Chief Advertising Officer, United Airlines

- Evin Shutt, Global CEO, 72andSunny

- Mark Penn, Chairman and CEO, Stagwell

Elsewhere around Cannes, Penn will present:

Hard Truths, Real Results: How News Unlocks Advertising ROI

WSJ’s Journal House | Monday, June 16, 4:15 PM CEST

Forget the fear. Explore how brands are finding success by aligning with credible journalism—even in challenging news environments. This session shares real, data-driven stories and practical strategies that reveal the untapped potential of advertising alongside hard news. Gain insights and confidence to approach this space with fresh perspective and informed creativity. Featuring:

- Jeff Green, CEO, The Trade Desk

- Phillipa Leighton – Jones, SVP, The Trust, WSJ | Barron’s

- Tracy-Ann Lim, Chief Media Officer, JPMorgan Chase & Co.

- Mark Miller, Chief Strategy Officer, Team One

- Mark Penn, Chairman and CEO, Stagwell

Business of Sport Fireside Chat

Private Dinner hosted by Bloomberg Media | Monday, June 16, 8:30pm CEST

Bloomberg Media is hosting an invite-only dinner for key clients and partners. The gathering will featuring a fireside chat led by Mishal Husain, Editor-at-Large of Bloomberg Weekend with Mark Penn, Chairman and CEO of Stagwell, and Olympic gold medalists Tara Davis-Woodhall and Hunter Woodhall. They will explore how sports can open the door to conversations shaping today’s business landscape.

Featuring:

- Tara Davis-Woodhall, Olympic Gold Medalist & 2024 World Champion

- Hunter Woodhall, Paralympic Gold Medalist & three-time Paralympian

- Mishal Husain, Editor at Large, Bloomberg Weekend

- Mark Penn, Chairman and CEO, Stagwell

Future of News: Why News Junkies are the Real MVPs

SPORT BEACH | Wednesday, June 18, 1:00 PM CEST

News is the future – and we’re bringing new data to prove it. Join us for a C-Suite conversation unpacking the business case for investing in the high-quality media environments of news. Spoiler alert: if you’re not including “news junkies” in your media strategy, you’re missing some of your most engaged and influential consumers. Featuring:

- Meredith Kopit Levien, CEO, The New York Times

- Almar Latour, CEO, Dow Jones

- Tracy-Ann Lim, Chief Media Officer, JPMorgan Chase & Co.

- Mike Reed, CEO, Gannet | USA Today Network

- Mark Penn, Chairman and CEO, Stagwell

Stagwell

Stagwell is the challenger holding company built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 45+ countries are unified under a single purpose: to drive effectiveness and improve business results for our clients. Join us at www.stagwellglobal.com.

Press Contact

Maggie Axford

PR@stagwellglobal.com

NEW YORK, June 9, 2025 /PRNewswire/ — Stagwell (NASDAQ:STGW), the challenger network built to transform marketing, today announced CEO and Chairman Mark Penn will join the Reddit community for a live Ask Me Anything (AMA) session on Thursday, June 12th from 3:00 – 4:00pm ET.

Participants are encouraged to submit questions in advance and join the conversation live to engage with Penn on Stagwell’s growth trajectory, unique positioning in the industry, and more.

How to Access the AMA

Interested parties can join the conversation by creating a Reddit login and navigating to the /r/marketing sub-Reddit between 3:00 – 4:00pm ET on Thursday, June 12th.

About Stagwell

Stagwell is the challenger holding company built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 45+ countries are unified under a single purpose: to drive effectiveness and improve business results for our clients. Join us at www.stagwellglobal.com.

Contact

Ben Allanson

IR@stagwellglobal.com

Related

Articles

In the News, Investments & Financials, Press Releases, Talent & Awards

Jul 08, 2025

Stagwell (STGW) Advances Executive Team with Four Key Appointments

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

Newsletter

Sign Up

The Stagwell agency’s 12 ANA B2 award wins highlight its transformative impact for clients Amazon Ads, ETS, Thomson Reuters and Qualcomm

NEW YORK, June 5, 2025 /PRNewswire/ — Code and Theory has been named Business-to-Business (B2B) Agency of the Year at the prestigious Association of National Advertisers (ANA) B2 Awards, marking its sixth major agency honor in 2025 alone. This recognition reflects Code and Theory’s unmatched ability to deliver technology-first, transformative solutions that meet the demands of today’s rapidly evolving B2B landscape.

At the ANA B2 Awards, Code and Theory earned 12 award wins across clients Qualcomm, ETS, Amazon Ads and Thomson Reuters. These wins highlight the agency’s ability to blend technology, creativity and collaboration to drive measurable business impact. Notable results include:

- Rebranding Thomson Reuters as a B2B tech leader, boosting unaided awareness by 40%. Explore the work.

- Redefining Qualcomm’s developer experience, achieving a 425% increase in engagement. Explore the work.

- Repositioning ETS as the global authority in workforce readiness, driving a 78% increase in qualified leads. Explore the work.

- Introducing Amazon Ads to small businesses that didn’t sell on Amazon, increasing unaided brand awareness by 13%. Explore the work.

This latest honor adds to a string of top-tier industry recognitions for Code and Theory, including:

- Fast Company: Named one of the World’s Most Innovative Companies for both Design and Teamwork

- Ad Age: B2B Agency of the Year

- Campaign: Digital Innovation Agency of the Year

- Shorty Awards: Large Agency of the Year

- The Drum: Agency to Watch

These accolades directly result from Code and Theory’s transformational changes, evolving its client offerings to include:

- The launch of the Enterprise Experience Transformation Practice (EXT). Led by former Adobe exec Cory Haldeman, EXT architects unified brand foundations that turn artificial intelligence into relationship acceleration.

- The debut of Media Experience Practice, led by former Cosmopolitan editor-in-chief Jessica Giles, dedicated to helping publishers survive and thrive.

- Naming James O’Brien as its first-ever global CMO, tasked with harnessing the consolidated power of the Code and Theory Network in service of its clients.

Bill Zengel, ANA Senior Vice President, says: “The ANA B2 Awards have long been a benchmark for excellence, recognizing the most creative, effective and innovative work in business marketing. At the ANA, our mission is to fuel growth for brands and marketers. ANA B2 Agency of the Year winner Code and Theory embodies that spirit with bold storytelling and a technology-first mindset critical to the future of B2B marketing.”

Dan Gardner, co-founder of Code and Theory, says: “This is a defining moment for businesses and B2B marketing is where real change often begins. New technologies and rising expectations are reshaping the landscape faster than ever. Tech and creativity must now work together to meet the moment. We design, build and market to drive true business transformation. We’re honored that work for our great clients was recognized by the ANA. We’re just getting started as more and more CMOs, CIOs and CTOs recognize us as the place where they can come to experience change.”

Code and Theory will also have a significant presence at Cannes Lions 2025, joining the world’s most ambitious marketers, athletes and creatives at Sport Beach. The event will offer hands-on workshops, on-stage thought leadership and the debut of some of the agency’s latest technological advancements. Learn more here.

About The Code and Theory Network

The Code and Theory Network is the only technology and creative network with a balance of 50% creative and 50% engineers. Our unique makeup makes us the place where CMOs, CTOs and CIOs come together to drive results for their businesses. We partner with our clients to redefine what is possible to create lasting impact and drive long-term growth. Part of Stagwell, Code and Theory offers a global footprint and the capabilities to work across the entirety of the customer-facing journey and implement the technology that powers it. The network includes the flagship agency Code and Theory as well as Kettle, Instrument, Left Field Labs, Truelogic, Create. Group, Rhythm and Mediacurrent. Code and Theory clients include Amazon, JPMorganChase, Microsoft, NBC, NFL and Yeti. For more, visit codeandtheory.com

Media Contact

Kenneth Hein