Originally released on

FY22 Revenue rises to record $2.7B following sixth-consecutive quarter of double-digit growth; company doubles stock buyback program to $250M

FY22 Revenue rises to record $2.7B following sixth-consecutive quarter of double-digit growth; company doubles stock buyback program to $250M

- FY22 Pro Forma revenue growth of 21%; 16% in Q4

- FY22 Pro Forma organic net revenue growth of 14%; 8% in Q4

- Adjusted EBITDA of $451M in FY22, a 20.3% margin on net revenue

- Adjusted EBITDA of $123M in Q4, a 21.1% margin on net revenue

- FY22 Adjusted net income of $268M; $63M in Q4

- FY22 Adjusted EPS of $0.90; $0.22 in Q4

- FY22 Free Cash Flow of $270M; $268M in Q4

- FY22 Net New Business of $213M; $42M in Q4

- Reduced net debt by $47M versus prior year, ending with a net leverage ratio of 2.17x

- Issues 2023 Organic Net Revenue growth guidance of 7.5%-10% and 10%-14% ex-Advocacy

- Issues 2023 Adjusted EBITDA guidance of $450M-$490M and Free Cash Flow conversion of 50%-60%

New York, NY, March 2, 2023 (NASDAQ: STGW) – Stagwell Inc. (“Stagwell”) today announced financial results for the three months and year ended December 31, 2022.

FOURTH QUARTER AND FULL YEAR HIGHLIGHTS:

- Q4 revenue of $708 million, an increase of 16% versus the prior year period; FY22 revenue of $2,688 million, an increase of 83% versus the prior year period

- Q4 revenue growth of 16% versus the prior year period and 13% ex-Advocacy; Pro Forma FY22 revenue growth of 21% versus the prior year period and 17% ex-Advocacy

- Q4 net revenue of $583 million, an increase of 12% versus the prior period; FY22 net revenue of $2,222 million, an increase of 75% versus the prior year period

- Q4 net revenue growth of 12% versus the prior year period and 10% ex-Advocacy; Pro Forma FY22 net revenue growth of 15% versus the prior year period and 13% ex-Advocacy

- Q4 organic net revenue growth of 8% versus the prior year period and 6% ex-Advocacy; Pro Forma FY22 organic net revenue growth of 14% versus the prior year period and 12% ex-Advocacy

- Q4 Adjusted EBITDA of $123 million, an increase of 19% versus the prior year period; FY22 Adjusted EBITDA of $451 million, an increase of 78% versus the prior year period

- Q4 Adjusted EBITDA growth of 19% versus the prior period and 10% ex-Advocacy; Pro Forma FY22 Adjusted EBITDA growth of 19% versus the prior period and 12% ex-Advocacy

- Q4 Adjusted EBITDA Margin of 21.1% on net revenue; FY22 Adjusted EBITDA Margin of 20.3% on net revenue

- Q4 net loss of $28 million versus net income of $5 million in the prior year period; FY22 net income of $66 million versus $36 million in the prior year period

- Q4 net loss attributable to Stagwell Inc. common shareholders of $6 million versus net income of $1 million in the prior year period; FY22 net income attributable to Stagwell Inc. common shareholders of $27 million versus $21 million in the prior year period

- Q4 Adjusted net income of $63 million; FY22 Adjusted net income of $268 million

- Q4 Adjusted earnings per share for Stagwell Inc. common shareholders of $0.22; FY22 Adjusted earnings per share of $0.90

- Q4 net new business of $42 million; FY22 net new business of $213 million

“Stagwell closed out 2022 with industry-leading double-digit growth, strong margin expansion, record free cash flow, record earnings per share, and a net debt ratio significantly below our target. We promised to transform marketing, and we have built game-changing AI and AR-driven products as we continue to grow and transform both our business and the industry,” said Mark Penn, Chairman and CEO, Stagwell. “We look forward to another year of double-digit growth outside of our advocacy businesses in 2023, continuing our momentum.”

Frank Lanuto, Chief Financial Officer, commented: “The Company reported a record $708 million of revenue in the fourth quarter, a 16% increase over the prior year and Adjusted EBITDA of $123 million. Adjusted EBITDA margin as a percentage of net revenue rose to 21.1% for the quarter and 20.3% for the year as a result of careful cost management. Free cash flows rose to $270 million driving down the Company’s net leverage ratio to 2.17x.”

Financial Outlook

2023 financial guidance is as follows:

- Organic Net Revenue growth of 7.5% – 10%

- Organic Net Revenue growth ex-Advocacy of 10% – 14%

- Adjusted EBITDA of $450 million – $490 million

- Free Cash Flow Conversion of 50% – 60%

- Adjusted EPS of $0.90 – $1.05

- Guidance assumes no impact from foreign exchange, acquisitions or dispositions.

|

* The Company has excluded a quantitative reconciliation with respect to the Company’s 2023 guidance under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. See “Non-GAAP Financial Measures” below for additional information. |

Stock Repurchase Program

On March 1, 2023, the Board authorized an extension and a $125,000,000 increase in the size of our previously approved stock repurchase program (the “Repurchase Program”). Under the Repurchase Program, as amended, we may repurchase up to an aggregate of $250,000,000 of shares of our outstanding Class A Common Stock, with any previous purchases under the Repurchase Program continuing to count against that limit. The Repurchase Program will expire on March 1, 2026.

Conference Call

Management will host a video webcast and conference call on Thursday, March 2, 2023, at 8:30 a.m. (ET) to discuss results for Stagwell Inc. for the three months and year ended December 31, 2022. The video webcast will be accessible at https://stgw.io/Q4andFYEarnings. An investor presentation has been posted on our website at www.stagwellglobal.com and may be referred to during the conference call.

A recording of the conference call will be accessible one hour after the call and available for ninety days at www.stagwellglobal.com.

Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Contacts

For Investors:

Jason Reid

Ir@stagwellglobal.com

For Press:

Beth Sidhu

Pr@stagwellglobal.com

Basis of Presentation

The acquisition of MDC Partners (MDC) by Stagwell Marketing Group (SMG) was completed on August 2, 2021. The results of MDC are included within the Statements of Operations for the period beginning on the date of the acquisition through the end of the respective period presented and the results of SMG are included for the entirety of all periods presented.

Non-GAAP Financial Measures

In addition to its reported results, Stagwell Inc. has included in this earnings release certain financial results that the Securities and Exchange Commission (SEC) defines as “non-GAAP Financial Measures.” Management believes that such non-GAAP financial measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company’s results. Such non-GAAP financial measures include the following:

Pro Forma Results: The Pro Forma amounts presented for each period were prepared by combining the historical standalone statements of operations for each of legacy MDC and SMG. The unaudited pro forma results are provided for illustrative purposes only and do not purport to represent what the actual consolidated results of operations or consolidated financial condition would have been had the combination actually occurred on the date indicated, nor do they purport to project the future consolidated results of operations or consolidated financial condition for any future period or as of any future date. The Company has excluded a quantitative reconciliation of Adjusted Pro Forma EBITDA to net income under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K.

(1) Organic Revenue: “Organic revenue growth” and “organic revenue decline” refer to the positive or negative results, respectively, of subtracting both the foreign exchange and acquisition (disposition) components from total revenue growth. The acquisition (disposition) component is calculated by aggregating prior period revenue for any acquired businesses, less the prior period revenue of any businesses that were disposed of during the current period. The organic revenue growth (decline) component reflects the constant currency impact of (a) the change in revenue of the partner firms that the Company has held throughout each of the comparable periods presented, and (b) “non-GAAP acquisitions (dispositions), net”. Non-GAAP acquisitions (dispositions), net consists of (i) for acquisitions during the current year, the revenue effect from such acquisition as if the acquisition had been owned during the equivalent period in the prior year and (ii) for acquisitions during the previous year, the revenue effect from such acquisitions as if they had been owned during that entire year (or same period as the current reportable period), taking into account their respective pre-acquisition revenues for the applicable periods, and (iii) for dispositions, the revenue effect from such disposition as if they had been disposed of during the equivalent period in the prior year.

(2) Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period.

(3) Adjusted EBITDA: defined as Net income excluding non-operating income or expense to achieve operating income, plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, and other items. Other items include restructuring costs, acquisition-related expenses, and non-recurring items.

(4) Adjusted Diluted EPS is defined as (i) Net income (loss) attributable to Stagwell Inc. common shareholders, plus net income attributable to Class C shareholders, excluding amortization expense, impairment and other losses, stock-based compensation, deferred acquisition consideration adjustments, discrete tax items, and other items, divided by (ii) (a) the per weighted average number of common shares outstanding plus (b) the weighted average number of Class C shares outstanding (if dilutive). Other items includes restructuring costs, acquisition-related expenses, and non-recurring items, and subject to the anti-dilution rules.

(5) Free Cash Flow: defined as Adjusted EBITDA less capital expenditures, change in net working capital, cash taxes, interest, and distributions to minority interests, but excludes contingent M&A payments.

(6) Financial Guidance: The Company provides guidance on a non-GAAP basis as it cannot predict certain elements which are included in reported GAAP results.

Included in this earnings release are tables reconciling reported Stagwell Inc. results to arrive at certain of these non-GAAP financial measures.

This document contains forward-looking statements. within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company’s representatives may also make forward-looking statements orally or in writing from time to time. Statements in this document that are not historical facts, including, statements about the Company’s beliefs and expectations, future financial performance and future prospects, business and economic trends, potential acquisitions, and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Forward-looking statements, which are generally denoted by words such as “anticipate,” “assume,” “believe,” “continue,” “could,” “create,” “estimate,” “expect,” “focus,” “forecast,” “foresee,” “future,” “guidance,” “intend,” “look,” “may,” “opportunity,” “outlook,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” or the negative of such terms or other variations thereof and terms of similar substance used in connection with any discussion of current plans, estimates and projections are subject to change based on a number of factors, including those outlined in this section.

Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company. Although the management of the Company believes that the expectations and assumptions on which such forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. The material assumptions upon which such forward-looking statements are based include, among others, assumptions with respect to general business, economic and market conditions, the competitive environment, anticipated and unanticipated tax consequences and anticipated and unanticipated costs. These forward-looking statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any.

Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statements. Such risk factors include, but are not limited to, the following:

- risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients;

- inflation and actions taken by central banks to counter inflation;

- the Company’s ability to attract new clients and retain existing clients;

- the impact of a reduction in client spending and changes in client advertising, marketing and corporate communications requirements;

- financial failure of the Company’s clients;

- the Company’s ability to retain and attract key employees;

- the Company’s ability to compete in the markets in which it operates;

- the Company’s ability to achieve its cost saving initiatives;

- the Company’s implementation of strategic initiatives;

- the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration;

- the Company’s ability to manage its growth effectively, including the successful completion and integration of acquisitions that complement and expand the Company’s business capabilities;

- the Company’s ability to develop products incorporating new technologies, including augmented reality, artificial intelligence, and virtual reality, and realize benefits from such products;

- an inability to realize expected benefits of the combination of the Company’s business with the business of MDC; (the “Business Combination” and, together with the related transactions, the “Transactions”);

- adverse tax consequences in connection with the Transactions for the Company, its operations and its shareholders, that may differ from the expectations of the Company, including that future changes in tax law, potential increases to corporate tax rates in the United States and disagreements with the tax authorities on the Company’s determination of value and computations of its attributes may result in increased tax costs;

- the occurrence of material Canadian federal income tax (including material “emigration tax”) as a result of the Transactions;

- the Company’s unremediated material weaknesses in internal control over financial reporting and its ability to establish and maintain an effective system of internal control over financial reporting;

- the Company’s ability to protect client data from security incidents or cyberattacks;

- economic disruptions resulting from war and other geopolitical tensions, terrorist activities and natural disasters;

- stock price volatility; and

- foreign currency fluctuations.

Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors outlined in more detail in our 2021 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 17, 2022, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings.

Related

Articles

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

In the News, Press Releases, Talent & Awards

May 19, 2025

Stagwell (STGW) Appoints Connie Chan as Chief Growth Officer for Asia Pacific

Newsletter

Sign Up

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from The Harris Poll, a Stagwell agency.

Among the highlights of our weekly consumer sentiment tracking (fielded Jan. 6-8):

ECONOMIC WORRIES MODERATE:

Today, 84% of Americans are concerned about the economy and inflation – down 4 points from last week.

- 81% worry about a potential U.S. recession (down 3 points)

- 80% about U.S. crime rates (down 4 points)

- 77% about political divisiveness (no change)

- 72% about affording their living expenses (down 3 points)

- 72% about the War on Ukraine (down 1 point)

- 60% about a new COVID-19 variant (down 1 point)

- 50% about losing their jobs (down 4 points)

IN-PERSON SHOPPERS RETURN:

Nearly half of Americans are looking for a bargain – and more are planning to shop in person this year versus last. Those are among the insights in our survey with DailyPay and Dollar Tree.

- 44% are more likely to prioritize shopping for bargains in store compared to last year.

- Overall, 67% of Americans plan to spend either the same or more in 2023 as they did in 2022 on retail purchases.

- 73% plan to shop the same or more in person this year.

- When it comes to Americans’ preferences regarding purchasing items in-store versus online: 81% prefer in-store for furniture, 69% in-store for home goods, 65% in-store for apparel, 65% in-store for sporting goods and 59% in-store for electronics.

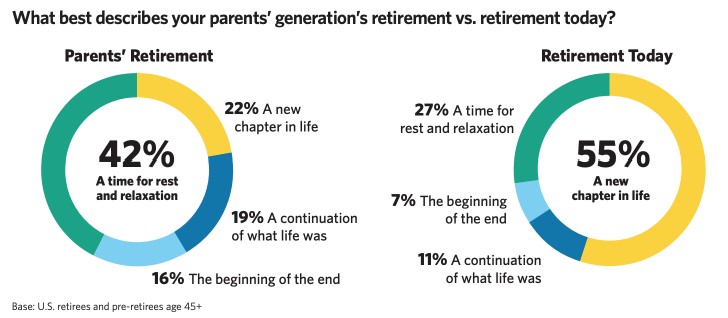

NOT YOUR PARENTS’ RETIREMENT:

To most Americans, retirement is not their parents’ retirement. Rather than a destination, it’s become a new journey, based on our survey with Edward Jones and Age Wave.

- 55% of pre-retirees and retirees ages 45 and older say that retirement today is best described as “a new chapter in life” versus the 27% who view it as “a time for relaxation.”

- When asked how today’s retirees view their parents’ retirement, 42% said it was “a time for relaxation” and only 22% described it as “a new chapter in life.”

- Half of retirees say they are “reinviting themselves in their retirement,” particularly women (53% versus men at 47%).

- 72% say they are now “able to realize their hopes and dreams.”

- At the same time, retirement isn’t without worries: Pre-retirees and retirees ages 45+ are worried about their physical health (49%), healthcare costs (34%), unexpected expenses (32%) and economic conditions (32%).

DRY JANUARY GROWS:

Dry January continues to grow in popularity – with better health and weight loss the prime motivators, according to our survey with Go Brewing.

- 79% of Americans who consume alcohol said they considered participating in Dry January this year.

- The top motivators include a desire to be healthier (52%), lose weight (35%) and the ability to focus better on personal or work goals (33%).

AIR TRAVEL TURBULENCE:

Southwest Airlines has some work to do to repair its reputation after cancelling flights during the busy holiday travel season, our survey with AdAge

- 45% of Americans have a worse opinion of the airline since before the meltdown.

- That dissatisfaction rises to 52% among people who have recently traveled with Southwest.

- 41% of respondents say they are less likely to travel with Southwest now compared to before the mass cancellations

ICYMI:

In case you missed it, check out some of the thought-leadership and happenings around Stagwell making news:

- Zillow CEO: Traditional offices are as outdated as typewriters. Employers need to adapt. (based on Harris Poll data)

- Quick Quitting: A New Trend Among Deskless Workers?

- Most employers would sack workers for improper social media posts: Poll

- 2023 predictions for communicators (#2)

As always, if helpful, we would be happy to provide more info on any of these data or insights. Please do not hesitate to reach out.

Thank you.

Related

Articles

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

In the News, Press Releases, Talent & Awards

May 19, 2025

Stagwell (STGW) Appoints Connie Chan as Chief Growth Officer for Asia Pacific

Newsletter

Sign Up

NEW YORK, Jan. 6, 2023 /PRNewswire/ — Stagwell (NASDAQ: STGW) announced today that Chairman and CEO Mark Penn will present at the upcoming 25th Annual Needham Growth Conference on Wednesday, Jan. 11, 2022, from 2:15 to 2:55 PM ET. Penn will also be available for 1:1 investor meetings. To schedule a meeting, please reach out to ir@stagwellglobal.com.

Visit this page to view upcoming investor events and programming from Stagwell, and this page for the latest news and announcements from Stagwell.

About Stagwell

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

For more information on Stagwell, please visit www.stagwellglobal.com

Related

Articles

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

In the News, Press Releases, Talent & Awards

May 19, 2025

Stagwell (STGW) Appoints Connie Chan as Chief Growth Officer for Asia Pacific

Newsletter

Sign Up

By: Ray Day

CONTACT:

- JOB, COST-OF-LIVING WORRIES UP AGAIN: Today, 86% of Americans are concerned about the economy, inflation and jobs – moderating from last week. Yet worries about affording living expenses and losing a job are on the rise again.

- 86% are concerned about the economy and inflation (down 4 points from last week)

- 82% about a potential U.S. recession (down 4 points)

- 81% about U.S. crime rates (down 1 point)

- 73% about political divisiveness (down 1 point)

- 73% about affording their living expenses (up 1 point)

- 73% about the War on Ukraine (no change)

- 57% about a new COVID-19 variant (down 2 points)

- 48% about losing their jobs (up 3 points)

- 47% about the Monkeypox outbreak (up 2 points)

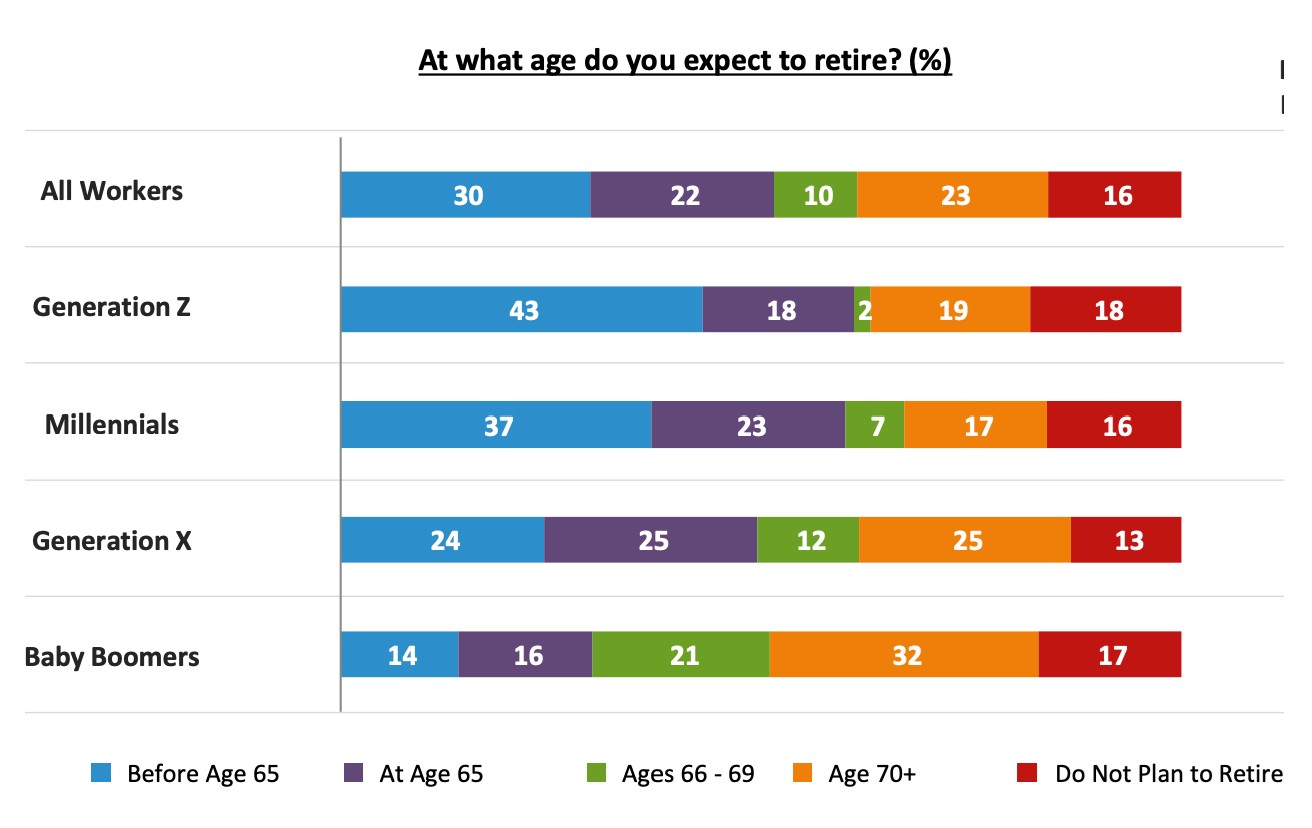

- GEN Z NOT BANKING ON SOCIAL SECURITY: Of the four generational groups currently in the working world, Gen Z is the least likely to depend on Social Security to fund their retirement – and the most likely to retire early. That’s according to the “Emerging From the COVID-19 Pandemic: Four Generations Prepare for Retirement” survey released this week with the Transamerica Center for Retirement Studies.

- Gen Z workers (43%) are more likely than older generations to expect to retire before age 65 (versus 30% of all workers expecting to retire before age 65, 37% for Millennials, 24% for Gen X and 14% for Baby Boomers).

- 67% of Gen Z workers are saving for retirement through employer-sponsored 401(k) or similar retirement plans or outside the workplace.

- The median age at which Gen Z is starting to save – 19 years old – is much younger than the median starting age for Millennials (age 25), Gen X (30) and Boomers (35).

- Among Gen Z and Millennials, 73% said they are concerned that Social Security will not be there when they are ready to retire.

- That compares with 40% of Boomers who expect Social Security to be their primary source of retirement income.

- Gen X workers have the least faith in Social Security, with 78% saying they are concerned that Social Security will not be there for them when they are ready to retire.

- HIGH SCHOOLERS WANT MORE CAREER HELP: High school students across the country are frustrated with the lack of support they are receiving in preparing for a future career. Our survey with the Data Quality Campaign and Kentucky Student Voice Team found:

- 54% say the pandemic has changed how they think about what they might do after graduation.

- Only 35% say their school informed them of which postsecondary or career paths are available to them.

- 80% of students agree they would feel more confident about their career path if they had better access to information to determine their options after graduation.

- This lack of career preparation already is showing up in the workplace. Of Gen Z members who interned or started a job this past year, 49% say that they did not feel like their training and onboarding were done well.

- 58% of interns also report feeling lost at work without anyone to reach for questions and support.

- LESS THAN HALF OF VOTING AMERICA WATCHES TRADITIONAL TV: When it comes to reaching Americans this election season, less than half of voters (49%) have a traditional TV, according to a new HarrisX survey with Samba TV.

- 1 in 4 of those who do still have traditional TV plan to cancel in the next six months.

- Independents (42%) are the least likely to have traditional TVs.

- Millennial and Gen Z voters are more than twice as likely to stream than they are to have a traditional linear subscriptions today. The gap is even wider for younger voters in battleground states.

- Facebook remains the most used platform by registered voters nationally but has less of an impact in key battleground states.

- Democrat voters are significantly more likely to use TikTok than Republicans nationally –with 37% of Democratic voters using it weekly compared with 27% of Republican voters.

- MANY WOMEN STILL MISS DEADLY BREAST CANCER SIGNS: October is National Breast Cancer Awareness Month, and most women are unaware of the unusual symptoms of a particularly aggressive and deadly form of the disease, according to our survey with The Ohio State University Comprehensive Cancer Center.

- The good news: 78% of women recognize a lump in the breast as a sign of breast cancer.

- However, less than half of women would flag redness of the breast (44%), pitting/thickening of the skin (44%) or one breast feeling warmer or heavier than the other (34%) as possible symptoms of breast cancer – specifically the rare and highly aggressive form of the disease known as inflammatory breast cancer.

- ICYMI: In case you missed it, check out some of the thought-leadership and happenings around Stagwell making news:

As always, if helpful, we would be happy to provide more info on any of these data or insights. Please do not hesitate to reach out.

Related

Articles

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

In the News, Press Releases, Talent & Awards

May 19, 2025

Stagwell (STGW) Appoints Connie Chan as Chief Growth Officer for Asia Pacific

Newsletter

Sign Up

Challenger marketing services network will report financial results for the three months ended Sept. 30, 2022

NEW YORK – Oct. 7, 2022 – Stagwell, the challenger network built to transform marketing, today announced it will report financial results for the three months ended Sept. 30, 2022, on Thursday, Nov. 3, before market open.

Stagwell will host a webcast to review those results the same day at 8:30 a.m. ET. To register and view the webcast, visit this link.

A replay of the webcast will be available following the event on Stagwell’s investor website: https://www.stagwellglobal.com/investors/

About Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

IR Contact:

Michaela Pewarski

ir@stagwellglobal.com

646-429-1812

PR Contact:

Beth Sidhu

pr@stagwellglobal.com

202-423-4414

Related

Articles

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

In the News, Press Releases, Talent & Awards

May 19, 2025

Stagwell (STGW) Appoints Connie Chan as Chief Growth Officer for Asia Pacific

Newsletter

Sign Up

CONTACTS

PR Contact

Beth Sidhu

pr@stagwellglobal.com

202-423-4414

IR Contact

Michaela Pewarski

ir@stagwellglobal.com

646-429-1812

New York – Sept. 15, 2022 – Stagwell (NASDAQ: STGW) announced today that Chairman and CEO Mark Penn will present at the upcoming Sidoti Small-Cap Virtual Conference on Thursday, September 22, 2022 at 10:45 AM ET. Penn will be available for 1:1 investor meetings. To schedule a meeting, please reach out to ir@stagwellglobal.com.

Visit this page to view upcoming investor events and programming from Stagwell.

About Stagwell

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Related

Articles

Events, In the News, Investments & Financials, Press Releases

Jun 09, 2025

Stagwell (STGW) CEO and Chairman Mark Penn to Host Ask Me Anything (AMA) on Reddit to Discuss the Future of Marketing

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

Investments & Financials, Press Releases

May 22, 2025

Stagwell Inc. (STGW) Reports Equity Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)

Newsletter

Sign Up

CONTACTS

PR Contact

Beth Sidhu

pr@stagwellglobal.com

202-423-4414

IR Contact

Michaela Pewarski

ir@stagwellglobal.com

646-429-1812

New York – Aug. 25, 2022– Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, announced today that Chairman and CEO Mark Penn, will join a fireside chat at Citi’s 2022 Global Technology Conference on Thursday, Sept. 8, from 2:30-3:10 p.m. EDT. For more information, visit this link.

Penn will also be available for 1:1 investor meetings. To inquire about a meeting, please reach out to ir@stagwellglobal.com.

About Stagwell

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Related

Articles

Events, In the News, Investments & Financials, Press Releases

Jun 09, 2025

Stagwell (STGW) CEO and Chairman Mark Penn to Host Ask Me Anything (AMA) on Reddit to Discuss the Future of Marketing

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

Investments & Financials, Press Releases

May 22, 2025

Stagwell Inc. (STGW) Reports Equity Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)

Newsletter

Sign Up

CONTACTS

PR Contact

Beth Sidhu

pr@stagwellglobal.com

202-423-4414

IR Contact

Michaela Pewarski

ir@stagwellglobal.com

646-429-1812

New York – Aug. 23, 2022 – Stagwell (NASDAQ: STGW) announced today that Chairman and CEO Mark Penn will attend the upcoming Benchmark Company 2022 Consumer/Media/Entertainment Conference in New York on Wednesday, Sept. 7, 2022. Penn will be available for 1:1 investor meetings. To schedule a meeting, please reach out to ir@stagwellglobal.com.

About Stagwell

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Related

Articles

Events, In the News, Investments & Financials, Press Releases

Jun 09, 2025

Stagwell (STGW) CEO and Chairman Mark Penn to Host Ask Me Anything (AMA) on Reddit to Discuss the Future of Marketing

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

Investments & Financials, Press Releases

May 22, 2025

Stagwell Inc. (STGW) Reports Equity Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)

Newsletter

Sign Up

CONTACTS

PR Contact

Beth Sidhu

pr@stagwellglobal.com

202-423-4414

IR Contact

Michaela Pewarski

ir@stagwellglobal.com

646-429-1812

NEW YORK, Aug. 19, 2022 /PRNewswire/ — Stagwell Inc. (the “Company”) announced today the grant of equity inducement awards of Class A common stock to three new employees in connection with their joining the Company. The Company granted a total of 27,974 shares of restricted stock. The grants are effective August 17, 2022, and will each vest in two installments, with one-third vesting on the second anniversary of the grant date and two-thirds vesting on the third anniversary of the grant date. The Company granted these awards as a material inducement to employment in accordance with Nasdaq Listing Rule 5635(c)(4).

For more information on Stagwell, please visit www.stagwellglobal.com

About Stagwell

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Related

Articles

Events, In the News, Investments & Financials, Press Releases

Jun 09, 2025

Stagwell (STGW) CEO and Chairman Mark Penn to Host Ask Me Anything (AMA) on Reddit to Discuss the Future of Marketing

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

Investments & Financials, Press Releases

May 22, 2025

Stagwell Inc. (STGW) Reports Equity Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)

Newsletter

Sign Up

By

CONTACT

hello@stagwellglobal.com

SIGN UP FOR OUR INSIGHTS BLASTS

The holding company grew 16% organically in Q2 thanks largely to digital services and integration between creative and media.

Stagwell is further integrating media into its creative agencies as the new holding company kid on the block looks to sustain growth over legacy industry peers.

On its second quarter 2022 earnings call on Thursday, Stagwell leadership spoke about a growth in integrated client opportunities across the network, specifically in accessing media and digital services through its creative agencies.

As a result, CFO Frank Lanuto disclosed that the holding company – formally created one year ago by the combination of Stagwell Marketing Group Holdings and MDC Partners – has reorganized its reporting segments “to more closely bring together media and creative.”

Stagwell will shift creative agencies Crispin Porter + Bogusky, Forsman & Bodenfors, Observatory and Vitro under the Stagwell Media Network. Observatory CEO Jae Goodman stepped down from his role shortly before the change.

Additionally, the holding company is standing up Stagwell Media Studio capabilities in all of its creative agencies, allowing them to tap into the network’s media capabilities more easily and at scale.

Stagwell’s other creative agencies are split across different networks at the holding company that aim to bring digital closer to creative. 72andSunny, for instance, is part of the Constellation Network, which includes digital agency Instrument and research company The Harris Poll. The Doner Partners Network combines the creative agency with PR and influencer marketing shops such as Veritas and HL Group.

“After years of procurement separating media from creative, the demands of the digital world are bringing them together again and we are responding to these trends,” CEO Mark Penn told investors on the earnings call.

The Stagwell Media Network, which launched one year ago and includes agencies Assembly and ForwardPMX, grew 28% in Q2 to $36 million, thanks in part to a few $10 million-plus contract wins.

Performance media and data, which makes up 19% of Stagwell’s business, grew 17% organically year over year. Digital services grew 37% organically year over year and contributed to 57% of net revenues in the quarter.

Strong performance in the media business is driving growth in pure creative services, which are growing inline with GDP at 3% to 5% annually. Integrated assignments, on the other hand, are growing 10% to 15% year over year, Penn said.

“That is a way to spearhead the growth of creative: integrate it more closely with [media] and consumer online experiences,” he added.

Overall Stagwell grew 16% organically in Q2, bringing in $556 million in net revenue. That’s on top of 29% growth in Q2 2021, bringing its “two-year growth stack” to 45%, Penn said.

As Stagwell leans into integration, its average client size grew 30% year over year, from $4.5 million to $6 million, the result of a “land and expand” strategy that is helping extend its services with existing clients. Johnson & Johnson, for instance, grew its remit with Stagwell from four to 12 brands over the past year. Stagwell’s top 25 clients work on average with five agencies across the network.

“We’re seeing a spillover effect,” Penn said. “People are also pitching more jointly across services, which, two or three years ago, they didn’t do at all.”

Unlike its legacy peers in the category which increased their projections, Stagwell reaffirmed its outlook for the quarter, projecting 18% to 22% organic growth for the year.

No recession here

Amid concerns about inflation and an impending recession, and a slowdown in the ad businesses of the largest tech platforms, Penn said Stagwell is seeing strong appetite from clients and “a flood of new business pitches.”

The holding company is also benefiting from the travel industry rebound this summer. Business with travel brands nearly doubled in Q2, contributing to growth in the media network.

“We’re seeing a very strong travel and entertainment summer rebound and what looks like it’s going to be a market competitive holiday season,” Penn said. “If and when I see something different, I’ll report it. It’s just not what we’re seeing in terms of how clients are acting.”

Penn pointed to more competition in the media space, from players such as TikTok and Netflix, as a contributor to Big Tech’s slowing ad businesses.

“People have more than two choices now in their placements,” he said. “The market will be increasingly spread out and harder to read.”

But if the economy does take a turn for the worse, Penn said Stagwell’s focus on digital and performance media will insulate it from client cutbacks.

“It’s less likely that companies are going to cut revenue producing media,” he said.

By Alison Weissbrot. Published August 04,2022

Related

Articles

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions