Q4 YoY Revenue Growth of 20%, With 22% Growth in Digital Transformation

Q4 YoY Net Revenue Growth of 14%, Organic Net Revenue Growth of 10%, Digital Transformation Net Revenue Growth of 15%

Q4 Net Income Attributable to Stagwell Inc. Common Shareholders of $3 million

Q4 Adjusted EBITDA of $123 million; Adjusted EBITDA Margin of 20%

Q4 EPS of $0.03; Adjusted EPS of $0.24

Eighth Consecutive Quarter of Record LTM Net New Business

Net New Business of $102 million in Q4; LTM Net New Business of $382 million

Introduce Guidance for 2025 of Total Net Revenue Growth of ~8%; Adjusted EBITDA of $410 million to $460 million; Free Cash Flow Conversion in excess of 45%

Stagwell To Host Investor Day on April 2nd 2025

New York, NY, February 27, 2025 (NASDAQ: STGW) – Stagwell Inc. (“Stagwell”) today announced financial results for the year ended December 31, 2024.

FOURTH QUARTER RESULTS:

- Q4 Revenue of $789 million, an increase of 20% versus the prior year period; Full Year Revenue of $2.8 billion, an increase of 12% versus the prior year

- Q4 Net Revenue of $630 million, an increase of 14% versus the prior year period; Full Year Net Revenue of $2.3 billion, an increase of 7% versus the prior year

- Q4 Organic Net Revenue increased 10% versus the prior year period; Full Year Organic Net Revenue increased 5% versus the prior year

- Q4 Net Income attributable to Stagwell Inc. Common Shareholders of $3 million versus $1 million in the prior year period; Full Year Net Income attributable to Stagwell Inc. Common Shareholders of $2 million versus $0.1 million in the prior year

- Q4 Adjusted EBITDA of $123 million, an increase of 30% versus the prior year period; Full Year Adjusted EBITDA of $411 million, an increase of 14% versus the prior year

- Q4 Adjusted EBITDA Margin of 20% on net revenue; Full Year Adjusted EBITDA Margin of 18% on net revenue

- Q4 Earnings Per Share Attributable to Stagwell Inc. Common Shareholders of $0.03 versus $0.00 in the prior year period; Full Year Earnings Per Share Attributable to Stagwell Inc. Common Shareholders of $0.02 versus $0.00 in the prior year

- Q4 Adjusted Earnings Per Share attributable to Stagwell Inc. Common Shareholders of $0.24 versus $0.12 in the prior year period; Full Year Adjusted Earnings Per Share attributable to Stagwell Inc. Common Shareholders of $0.77 versus $0.57 in the prior year

- Net new business of $102 million in the fourth quarter, last twelve-month net new business of $382 million

See “Non-GAAP Financial Measures” below for explanations and reconciliations of the Company’s non-GAAP financial measures.

Mark Penn, Chairman and CEO of Stagwell, said, “2024 was a breakthrough year for Stagwell and has fueled a strong start to 2025. We re-established ourselves as the fastest growing business in the industry, accelerated rapidly in Digital Transformation, took advantage of an unprecedented U.S. election cycle, and made strategic investments to expand our capabilities and geographical reach. I’m looking forward to a strong 2025.”

Frank Lanuto, Chief Financial Officer, commented: “Stagwell posted strong results in the fourth quarter with double-digit revenue growth in 4 of our 5 principal capabilities. We delivered fourth quarter revenue of $789 million. Simultaneously, we grew our adjusted EBITDA to $123 million, representing a 20% margin on net revenue, an improvement of approximately 230 bps over the prior year period, as we lowered our comp to revenue ratio to 57.5%, a company record. These results give us confidence in the year ahead.”

Financial Outlook

2025 financial guidance is announced as follows:

- Total Net Revenue growth of approximately 8%

- Adjusted EBITDA of $410 million to $460 million

- Free Cash Flow Conversion in excess of 45%

- Adjusted EPS of $0.75 – $0.88

- Guidance includes anticipated impact from acquisitions or dispositions.

| * The Company has excluded a quantitative reconciliation with respect to the Company’s 2025 guidance under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. See “Non-GAAP Financial Measures” below for additional information. |

Video Webcast

Management will host a video webcast on Thursday, February 27, 2025, at 8:30 a.m. (ET) to discuss results for Stagwell Inc. for the year ended December 31, 2024. The video webcast will be accessible at https://bit.ly/3EVAIAk. An investor presentation has been posted on our website at www.stagwellglobal.com and may be referred to during the webcast.

A recording of the webcast will be accessible one hour after the webcast and available for ninety days at www.stagwellglobal.com.

Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Contacts

For Investors:

Ben Allanson

IR@stagwellglobal.com

For Press:

Beth Sidhu

PR@stagwellglobal.com

Non-GAAP Financial Measures

In addition to its reported results, Stagwell Inc. has included in this earnings release certain financial results that the Securities and Exchange Commission (SEC) defines as “non-GAAP Financial Measures.” Management believes that such non-GAAP financial measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company’s results. Such non-GAAP financial measures include the following:

(1) Organic Net Revenue: “Organic net revenue growth” and “Organic net revenue decline” reflects the year-over-year change in the Company’s reported net revenue attributable to the Company’s management of the entities it owns. We calculate organic net revenue growth (decline) by subtracting the net impact of acquisitions (divestitures) and the impact of foreign currency exchange fluctuations from the aggregate year-over-year increase or decrease in the Company’s reported net revenue. The net impact of acquisitions (divestitures) reflects the year-over-year change in the Company’s reported net revenue attributable to the impact of all individual entities that were acquired or divested in the current and prior year. We calculate impact of an acquisition as follows: (a) for an entity acquired during the current year, we present the entity’s prior year net revenue for the same period during which we owned it in the current year as impact of the acquisition in the current year; and (b) for an entity acquired in the prior year, we present the entity’s prior year net revenue for the period during which we did not own the entity in the prior year as impact of the acquisition in the current year. We calculate impact of a divestiture as follows: (a) for a divestiture in the current year, we present the entity’s prior year net revenue for the same period during which we no longer owned it in the current year as impact of the divestiture in the current year; and (b) for a divestiture in the prior year, we present the entity’s prior year net revenue for the period during which we owned it in the prior year as impact of the divestiture in the current year. We calculate the impact of any acquisition or divestiture without adjusting for foreign currency exchange fluctuations. The impact of foreign currency exchange fluctuations reflects the year-over-year change in the Company’s reported net revenue attributable to changes in foreign currency exchange rates. We calculate the impact of foreign currency exchange fluctuations for the portion of the reporting period in which we recognized revenue from a foreign entity in both the current year and the prior year. The impact is calculated as the difference between (1) reported prior period net revenue (converted to U.S. dollars at historical foreign currency exchange rates) and (2) prior period net revenue converted to U.S. dollars at current period foreign exchange rates.

(2) Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period.

(3) Adjusted EBITDA: defined as Net income excluding non-operating income or expense to achieve operating income, plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, and other items. Other items include restructuring costs, acquisition-related expenses, and non-recurring items.

(4) Adjusted Diluted EPS is defined as (i) Net income (loss) attributable to Stagwell Inc. common shareholders, plus net income attributable to Class C shareholders, excluding amortization expense, impairment and other losses, stock-based compensation, deferred acquisition consideration adjustments, discrete tax items, and other items, divided by (ii) (a) the per weighted average number of common shares outstanding plus (b) the weighted average number of Class C shares outstanding, (if dilutive). Other items includes restructuring costs, acquisition-related expenses, and non-recurring items, and subject to the anti-dilution rules.

(5) Free Cash Flow: defined as Adjusted EBITDA less capital expenditures, change in net working capital, cash taxes, interest, and distributions to minority interests, but excludes contingent M&A payments. Free Cash Flow Conversion is the percentage of adjusted EBITDA.

Included in this earnings release are tables reconciling reported Stagwell Inc. results to arrive at certain of these non-GAAP financial measures.

This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company’s representatives may also make forward-looking statements orally or in writing from time to time. Statements in this document that are not historical facts, including, statements about the Company’s beliefs and expectations, future financial performance, growth, and future prospects, the Company’s strategy, business and economic trends and growth, technological leadership and differentiation, potential and completed acquisitions, anticipated and actual operating efficiencies and synergies and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Forward-looking statements, which are generally denoted by words such as “ability,” “aim,” “anticipate,” “assume,” “believe,” “build,” “consider,” “continue,” “could,” “create,” “develop,” “drive,” “estimate,” “expect,” “focus,” “forecast,” “foresee,” “future,” “goal,” “guidance,” “in development,” “intend,” “likely,” “look,” “maintain,” “may,” “ongoing,” “opportunity,” “outlook,” “plan,” “possible,” “potential,” “predict,” “probable,” “project,” “should,” “target,” “will,” “would” or the negative of such terms or other variations thereof and terms of similar substance used in connection with any discussion of current plans, estimates and projections are subject to change based on a number of factors, including those outlined in this section.

Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company. Although the management of the Company believes that the expectations and assumptions on which such forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. The material assumptions upon which such forward-looking statements are based include, among others, assumptions with respect to general business, economic and market conditions, the competitive environment, anticipated and unanticipated tax consequences and anticipated and unanticipated costs. These forward-looking statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any.

Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statements. Such risk factors include, but are not limited to, the following:

- risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients;

- demand for the Company’s services, which may precipitate or exacerbate other risks and uncertainties;

- inflation and actions taken by central banks to counter inflation;

- the Company’s ability to attract new clients and retain existing clients;

- the impact of a reduction in client spending and changes in client advertising, marketing and corporate communications requirements;

- financial failure of the Company’s clients;

- the Company’s ability to retain and attract key employees;

- the Company’s ability to compete in the markets in which it operates;

- the Company’s ability to achieve its cost saving initiatives;

- the Company’s implementation of strategic initiatives;

- the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration;

- the Company’s ability to manage its growth effectively;

- the Company’s ability to identify and complete acquisitions or other strategic transactions that complement and expand the Company’s business capabilities and successfully integrate newly acquired businesses into the Company’s operations, retain key employees, and realize expected cost savings, synergies and other related anticipated benefits within the expected time period;

- the Company’s ability to identify and complete divestitures and to achieve the anticipated benefits therefrom;

- the Company’s ability to develop products incorporating new technologies, including augmented reality, artificial intelligence, and virtual reality, and realize benefits from such products;

- the Company’s use of artificial intelligence, including generative artificial intelligence;

- adverse tax consequences for the Company, its operations and its stockholders, that may differ from the expectations of the Company, including that future changes in tax laws, potential increases to corporate tax rates in the United States and disagreements with tax authorities on the Company’s determinations that may result in increased tax costs;

- adverse tax consequences in connection with the business combination that formed the Company in August 2021, including the incurrence of material Canadian federal income tax (including material “emigration tax”);

- the Company’s ability to maintain an effective system of internal control over financial reporting, including the risk that the Company’s internal controls will fail to detect misstatements in its financial statements;

- the Company’s ability to accurately forecast its future financial performance and provide accurate guidance;

- the Company’s ability to protect client data from security incidents or cyberattacks;

- economic disruptions resulting from war and other geopolitical tensions (such as the ongoing military conflicts between Russia and Ukraine and in the Middle East), terrorist activities, natural disasters, and public health events;

- stock price volatility; and

- foreign currency fluctuations.

Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors outlined in more detail in our 2023 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 11, 2024, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings.

For realtime insights, follow us on LinkedIn

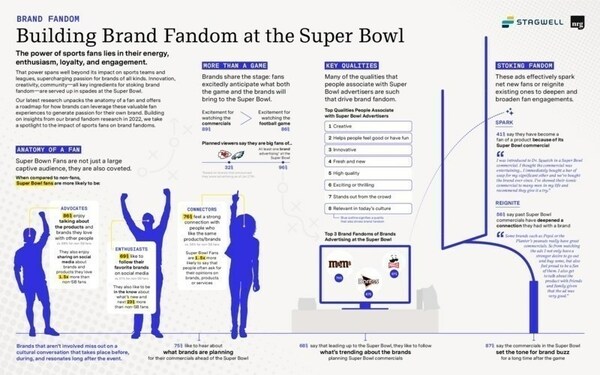

A roundup of Stagwell’s work at Super Bowl 2023:

Stagwell agencies Anomaly and 72andSunny flexed their creative chops at Super Bowl LVII for clients Bud Light, Diageo, Dunkin’, and the National Football League. The work represents 10% of advertising spots, more than any other global marketing services network, and some of the best-reviewed campaigns – including three of the top 10 highest-rated commercials in the USA TODAY Ad Meter. This milestone comes amid Stagwell’s year-long focus on brand fandom and the power of sport as it gears up for Sport Beach at Cannes Lions Festival of Creativity 2023.

“For another year, Stagwell commands the field at the Big Game,” said Stagwell Chairman and CEO Mark Penn. “Our agencies helped legacy brands like Bud Light position themselves as fun, approachable and relatable, introduced new entrants like Crown Royal to make a name for themselves, and empowered influential brands like the NFL to deliver powerful, progressive messages. From the advertisements to original research, our work reinforces the magnetic power of sport and its ability to create brand fandom among people from all walks of life.”

From the advertisements to original research, our work reinforces the magnetic power of sport and its ability to create brand fandom among people from all walks of life

The Big Game

National ads from Stagwell agencies make up 10% of Super Bowl spots.

NFL x 72andSunny

Two spots produced by 72andSunny took center stage: “NFL Cares,” featuring several players delivering an uplifting message, “We see you,” toward mothers, veterans and other communities; “Run With It” was unveiled at halftime, a humorous spot highlighting the future of women in football. It featured Diana Flores, the quarterback for Mexico’s national flag football team, in which everyone – and her mom – tries to grab her flags.

Bud Light x Anomaly

“Hold” features actor Miles Teller, his wife, Keleigh, and their French Bulldog, Bugsy, making light out of being on hold on a phone call, as part of the brand’s shift to the fun in everyday life and new tagline, “Easy to Drink. Easy to Enjoy.”

Dunkin’ x Anomaly

Dunkin’ made its debut at the Big Game in a spot featuring Ben Affleck, who surprised customers as the drive-thru attendant.

Diageo x Anomaly

Crown Royal also joined the slate of ads for the first time with a spot that plugs the whiskey’s Canadian heritage and longtime marketing positioning around gratitude.

Off the Field

Outside of the national stage, clients and agencies made a splash.

United Airlines x 72andSunny

Opting out of a national buy, United Airlines aired a local :30 spot in Denver and Colorado Springs, Colo., taking an inadvertent aim at Southwest Airlines, highlighting a family “Who got to be together for the holidays.” Denver International Airport saw the most cancelations on Dec. 27, the majority from Southwest.

Dexcom x Allison+Partners

Allison + Partners supported Dexcom’s return to the Super Bowl, with a spot that introduced the new G7 device featuring singer Nick Jonas, who has type 1 diabetes.

CommonSpirit Health x Allison+Partners

The agency also helped to develop messaging around hospital system CommonSpirit Health’s regional big game spot, which showcases a grandmother teaching her infant grandchild how to sign “grandma” in ASL.

Brand Fandom x NRG

A survey from National Research Group unpacked the anatomy of a fan and proved the value for brand activation at major sporting events like the Super Bowl, with new insights comparing Super Bowl fans to non-Super Bowl fans responses to questions around their excitement for the game, the advertisements, viewing habits, social media consumption, perceptions of the brands involved, and more.

Brand Innovators Sports Marketing Upfronts

Stagwell’s EVP, Global Chief Marketing Officer Ryan Linder , NRG’s EVP, Brand Strategy and Innovation Fotoulla Damaskos, Diageo SV of Whiskeys Portfolio in North America Sophie Kelly, and United Airlines Global Sponsorships and Inclusive Partnerships Jennifer Entenman, unpacked the brand fandom research and what it means for marketers on the ground in Arizona.

Related

Articles

In the News, Press Releases

Jun 13, 2025

Stagwell (STGW) Unveils Official News Network as an Extension of its Future of News Initiative, Allowing Clients Direct Access to Leading News Publishers

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows

Newsletter

Sign Up

Originally released on

NEW YORK, May 24, 2022 /PRNewswire/ — Grocery stores are riding reputational highs two years after the start of COVID-19 – with regional chains in particular being recognized for weathering the supply-chain storm. At the same time, the pandemic-era halo many industries enjoyed are beginning to normalize.

Those are among the insights of the Axios-Harris Poll 100, an annual ranking of the reputations of the most visible U.S. companies, which was released today.

Trader Joe’s, HEB Grocery, Patagonia, Hershey and Wegmans have the top-five best reputations in America on the 2022 Axios-Harris Poll 100 list.

Social media platforms and companies with missteps on social issues are the ones with the poorest reputations or that suffered the steepest declines. This year, The Trump Organization, Wish.com, Twitter, Facebook and Fox Corporation are at the bottom of the 23rd annual list, with poor reputations.

“As Americans move on from COVID, they are looking at corporate reputation through a more practical lens,” said John Gerzema, CEO of The Harris Poll. “Companies delivering on time and keeping their promises despite supply-chain issues are being held in high regard. Businesses that also do their part to create a better world – whether through sustainability or taking a stand on authentic social issues – also are being rewarded.”

The Axios-Harris Poll 100 has ranked reputation since 1999. The survey’s Reputation Quotient (RQ) ranking is based on companies that are most visible to the general population and on their performance in seven key areas:

- Trust – “Is this a company I trust?”

- Vision – “Does this company have a clear vision for the future?”

- Growth – “Is this a growing company?”

- Products and Services – “Does this company develop innovative products and services that I want and value?”

- Culture – “Is this a good company to work for?”

- Ethics – “Does this company maintain high ethical standards?”

- Citizenship – “Does this company share my values and support good causes?”

“It’s back to basics with companies that offer quality products and are guided by steadfast values riding to the top,” said Stagwell Chairman and CEO Mark Penn. “Those that became enmeshed in political quagmires tended to be set back.”

This year, grocery dominates the top 100 list. Three grocers (Trader Joe’s, HEB Grocery and Wegmans) are in the top five. Two other grocery chains (Publix and Kroger) are among the top 25.

“The poll reinforces what we have seen on the ground with our local news product Axios Local,” said Jim VandeHei, co-founder and CEO of Axios. “To reestablish trust with a skeptical population, you have to start closer to home, making a real impact within local communities. Consumers reward brands that deliver a trusted product on time and as promised.”

Among the insights from this year’s study:

- Most visible: Amazon and Walmart are once again the two most visible companies in America, followed by Apple, Facebook, Google, Target, Nike, Microsoft, McDonald’s and AT&T.

- New to the list: Newly added to the 100 most visible companies list for the first time ever are Trader Joe’s, Spotify, Big Lots, Shein and Subway.

- Top 10: The most visible and most reputable companies – Trader Joe’s, HEB Grocery, Patagonia, Hershey, Wegmans, Samsung, Toyota, Amazon and Honda – are separated by only small degrees. All but Patagonia and Honda improved their reputations from last year’s highs.

- Industry movement: As the world moves out of the crisis phase of the pandemic, industries that saw massive reputations boosted by the crisis have returned to pre-pandemic levels. Consumer products dropped 12 points from 2021, returning to 2019 levels (2022: 62% positive, 2021: 74%, 2019: 61%). Meanwhile, while the halo surrounding the pharmaceutical and health insurance industries is fading, both remain significantly above pre-pandemic levels (pharma 2022: 49% positive, 2021: 60%, 2019: 31%) and (health insurance 2022: 49% positive, 2021: 60%, 2019: 32%).

- Perils of speaking out, or not: The economic and reputational loss from polarization hit companies once immune to politics and controversy. Disney fell significantly from last year – with the impact of being caught in a fight between politics and company values. Patagonia – which was number one on the list last year – continues its reputational high with great products combined with a strong societal view.

- Biggest improvements: Companies with at least a good reputation and the strong year-over-year improvement include AT&T (up 6.3%), Google (6.1%), Starbucks (6.0%), Yum! Brands (5.4%), General Motors (4.7%) and The Home Depot (4.5%)

- Biggest declines: Companies with the biggest reputational declines from last year include Stellantis (down 8.0%), Twitter (-4.9%), Pfizer (-4.7%), Disney (-4.3%), Trump Organization (-4.3%), Chick-fil-A (-3.7%), PepsiCo (-3.5%), eBay (-3.3%), ExxonMobil (-3.3%) and Electronic Arts (-3.2%).

“To excel at reputation, companies must deliver high marks on business performance, corporate character and trust,” said Ray Day, vice chair of Stagwell, which includes The Harris Poll. “While you can build a brand, you earn a reputation. Companies with strong reputations have a price advantage, a competitive advantage and a talent advantage. That’s why reputation needs to be a priority from the board room to the C-suite.”

The Axios Harris Poll 100 is based on a survey of 33,096 Americans in a nationally representative sample conducted March 11-April 3, 2022. The two-step process starts fresh each year by surveying the public’s top-of-mind awareness of companies that either excel or falter. These 100 “most visible companies” are then ranked by a second group of Americans across the seven key dimensions of reputation to arrive at the ranking. If a company is not on the list, it did not reach a critical level of visibility to be measured.

For information on all companies and their ranking on the 2022 Axios-Harris Poll 100, click here and here for an interactive graphic.

About The Harris Poll

The Harris Poll is one of the longest-running surveys in the U.S., tracking public opinion, motivations and social sentiment since 1963. It is now part of Harris Insights & Analytics, a global consulting and market research firm that delivers social intelligence for transformational times. We work with clients in three primary areas: building 21st century corporate reputation, crafting brand strategy and performance tracking, and earning organic media through public relations research. Our mission is to provide insights and advisory to help leaders make the best decisions possible. Learn more by visiting www.harrispoll.com and follow Harris Poll on Twitter and LinkedIn.

About Axios

Axios is a digital media company launched in 2017. Axios – which means “worthy” in Greek – helps you become smarter, faster with news and information across politics, tech, business, media, science and the world. Subscribe to our newsletters at axios.com/newsletters and download our mobile app at axios.com/app.

About Stagwell

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 10,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Related

Articles

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

In the News, Press Releases, Talent & Awards

May 19, 2025

Stagwell (STGW) Appoints Connie Chan as Chief Growth Officer for Asia Pacific

Newsletter

Sign Up

Stagwell is the challenger network built to transform marketing, deliver excellence for the world’s most ambitious brands by connecting culture-moving creativity with leading-edge technology. That’s why Stagwell loves SXSW, which is all about the intersection of technology, innovation and culture – a great fit for a global company committed to transforming marketing, content, and experiences.

Here’s a roundup of Stagwell showed up at SXSW, what we learned, and what it means for marketers:

The 5 Things You Missed at SXSW

From NFTs and the evolving Web3 landscape to the transformative power of digital audio, Stagwell’s experts share the top five trends and brand takeaways from SXSW 2022.

Get Smart with Matt Maher

Stagwell contributor Matt Maher provided “Get Smart” videos throughout the week, making sure those watching from home didn’t miss a single thing, and that those on the ground could keep up with the hours of programming SXSW put forward this year.

Matt brought his experience as a marketing and technology expert to bear, sifting through the flash to determine which of the new trends and technology have staying power – and how marketers should be parcing them to make the most of every platform.

MATT’S KEY SXSW 2022 TAKEAWAYS:

- THIS WAS NFT’S YEAR AT SXSW but most brands haven’t fully connected the dots to turn NFTs into a sustainable, relevant, brand-building moment. Look to the Doodle x Shopify activation for the most successful implementation.

- CONTENT CREATION ISNT A NUMBERS GAME ANYMORE – from gaming to Instagram, it’s more important to have a dedicating following of 10k than an apathetic community of a million.

- THE METAVERSE CONVERSATION IS MORPHING from enthusiasm to skepticism as it runs against ongoing tech debates – data, privacy and the psychological impact on users over time. We havent’ written it off yet, but brands have some big decisions to make before jumping in.

Matt walks us thorugh all this in more in his Get Smart series from the festival, check them our below and on the Stagwell @ SXSW YouTube playlist.

Stagwell’s on the Ground Recap with Nick Fuller

Why brave the Austin heat (or cold, as it was this year) when you have digital transformation expert Nick Fuller, Managing Partner of Digital Transformation at Stagwell, on the ground to make sense of it all for you? He’s our sherpa for all things technology x marketing, and his takeaways from a weekend on the ground show a bias towards first-mover advantage when it comes to all things Web3. There is also a new interpretation of the age old question of authenticity – whether its in creator partnerships or buy-in on new tech platforms, there’s a huge upside for brands who are operating with a clear vision of their message and where they fit in the market.

Driving the Future of Marketing with Stagwell

Marketing moves fast – and we’re ahead of the curve. On Monday March 14, Stagwell held an invite-only event at Circuit of the Americas, the US’ first and only purpose-built F1 track, to give this industry’s saviest competitors a once-in-a-lifetime experience.

The day started with a panel featuring Bennett Richardson, President of Protocol, Gayle Troberman, CMO of iHeart Media and Sally Shin, Chief Strategy Officer at UnitedMasters, discussing the future of audio marketing. They touched on core themes unearthed by Stagwell’s March Marketing Frontier on the Future of Audio, including the power fo audio and a connective device and the untapped potential of audio as an avenue for first-party data collection.

The group then broke up to make some noise themselves, rotating through a half-day racing school taught by the legendary Skip Barber Racing School. In no time, our marketing pros became driving pros, learning the fundementals for open-wheel race car driving from Skip Barber instructors who among them boasted half a dozen top-place finishes in racing classes across the board. It was an unforgettable day, and a reminder of why pushing the limits and moving quick can transformt he way you see a problem – and see the world.

Originally released on

CONTACT

Lorem Ipsum

FEATURING

Related

Articles

Events, In the News, Investments & Financials, Press Releases

Jun 09, 2025

Stagwell (STGW) CEO and Chairman Mark Penn to Host Ask Me Anything (AMA) on Reddit to Discuss the Future of Marketing

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

Newsletter

Sign Up

CONTACT

ir@stagwellglobal.com

SIGN UP FOR OUR IR BLASTS

Record first full-year financial results as Stagwell Inc. were fueled by fast growing digital transformation and digital marketing services, expansion of global media and large client wins.

Earnings: The Movie

Earnings

Materials

Related

Articles

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Newsletter

Sign Up

For realtime insights, follow us on LinkedIn

A roundup of Stagwell’s work at Super Bowl 2022:

Stagwell’s agencies are transforming marketing – on one of the most captive fields for national marketing, the Super Bowl. Several of our agencies are showing up at the Big Game this year: Anomaly for Meta, Vroom and Expedia; 72andSunny for the NFL; Forsman & Bodenfors for Polestar; and more. Off the TV screen, our agencies are innovating with omnichannel efforts that tap into the fever and fandom of the big game to drive powerful consumer moments for their brand partners.

We believe that there’s a new definition of success for advertisers at the Super Bowl, and it’s driven by digital transformation and changing consumer expectations around brands and experiences. Stagwell is leading the charge in supporting brands as they navigate this new dynamic – explore Stagwell’s presence at The Game, both traditional and less so, below.

But before you dive in:

Captain Morgan x Anomaly

Captain Morgan’s high-tech punch bowl syncs with real-time game data to keep fans in the loop, even when they’re getting a refill.

Meet the Super Bowl snack table addition you never knew you needed: the Captain Morgan Super Bowl Punch Bowl. Anomaly worked with the Captain Morgan team to bring to life the bowl, featuring stadium-inspired lights and sound, Bluetooth speakers, subwoofers and LED graphic equalizers that sync with real-time game data to create an immersive brand experience.

Plus, don’t miss it’s apperance on Jimmy Fallon.

Cenex x Colle McVoy

Colle McVoy created a new campaign for Cenex that celebrates the quirky, charming and often humorous moments of connection that people experience at their local convenience stores. The campaign shows how its 1,500 locations in 19 states power communities while helping to connect people. It’s the next evolution of the brand’s successful Powered Locally platform and includes six :15 spots, two debuting in a few weeks during Super Bowl 56 in 20 Midwest regional markets.

Crosstown Rivals (premiering 2/13/22)

Local Entertainment (premiering 2/13/22)

CUE Health x Doner

Like COVID itself, at home testing company CUE is quick to adapt, putting together a spot in just eight days with Doner. Voiced by Gal Gadot, the ad positions the smart at home testing technology in conversation with a family’s other smart home devices – just another addition to the growing suite of at technologies that keep us safe, run more efficiently, and provide peace of mind. And while COVID is top of mind now, CUE promises that they’re just getting started.

How COVID Testing Brand CUE Put Together a Super Bowl Ad in 8 Days (AdAge)

Expedia x Anomaly

Ewan McGregor gives a convincing plug for the power of experiences over ‘stuff’

As the travel industry looks to continue to gain footing and recover from COVID-drivel losses, Expedia is leading the pack in its commitment to the Big Game with a spot created by Anomaly. With an emphasis on experiences over things, the spot aims to redefine the relationship between the platform and its customers, while challenging the expectations that travelers may have for Expedia and its sister brand, Vrbo.

‘Ewan McGregor and Expedia have Teamed Up to Give Away Free ‘Trips’ on Super Bowl Sunday’ (Forbes)

‘Why the 2022 Super Bowl Makes Sense for Brands’ (AdAge)

‘Can Super Bowl Ads Make Expedia Group the Nike of Travel?’ (AdWeek)

Groupon x Allison+Partners

Gronk is getting out of town… and opening his hope to one lucky winner for the experience of the lifetime.

Allison+Partners led PR for Groupon’s “Party Like a Player” Super Bowl sweepstakes campaign featuring Rob Gronkowski that underscored the brand’s positioning as the go-to experience marketplace. The team secured coverage in USA Today, TMZ Sports, ABC Audio, Travel + Leisure and many more resulting in 3.7B impressions (and counting) in its first week.

LikeMeat x 72andSunny

LikeMeat is celebrating the Big Game with a TikTok scavenger hunt, created by 72andSunny and Blue Hour Studios. To promote its plant-based Chick’n Wings product launch, LikeMeat has invited TikTok users to hunt for digital clues that crack a secret code. Those who unlock the code have a chance to win two free tickets to the Super Bowl as well as other LikeMeat-branded prizes. It’s yet another example of brands going digital-first for the big day, eschewing traditional spots for lower-budget, higher impact activations to connect with their audiences.

Why a plant-based food company started the first TikTok scavenger hunt featuring Gronk just in time for the Super Bowl (Digiday)

Got Milk? x GALE

The milk industry is making a statement at this year’s Super Bowl – that what you’re seeing on the field is not the whole picture. Their spot, airing on the NFL Network and created by GALE, is an inclusive look at the power of women in sport, even (and especially) where they aren’t expected. Featuring women from across the Women’s Football Alliance, the tagline “Football is Football” encourages a broader look at the game and the powerful changemakers behind it.

NFL x 72andSunny

After topping the USA Today Ad Meter last year, 72andSunny + NFL are returning to the screens this year just before halftime with another spot that aims to capture the magic, legacy and power of the game. Featuring cutting edge puppetry and CGI technology from experts at Swaybox, the ad features legendary NFL talent in unexpected places and spaces – bringing the game right into viewers homes. Get ready to bring down the house.

‘

”They Will Be Blown Away’: NFL’s Next Step in ‘Future-Proofing’ Audience Begins with a Super Bowl Ad’ (USA Today)

‘Behind the NFL’s Super Bowl Ad Plans, Which Include Puppetry and CGI’ (AdAge)

Polestar x Forsman & Bodenfors

In it’s first Super Bowl ad, Polestar, the high-end EV company with roots in Sweden, joined a spate of automakers – with a very different approach. The minimalist 30-second spot, executed by F&B, places a focus on what it doesn’t have – gimmicks, punchlines, scandals and distractions. It’s all about the future, driven by electric.

‘Swedish EV Startup Polestar Makes Super Bowl Debut with a “No Cliche” Approach’ (Ad Age)

Quest Oculus for Meta x Anomaly

In it’s first Super Bowl as the newly-rebranded Meta, Oculus Quest is doubling down on the metaverse, with a clear message to the audience – the metaverse is already here, and we’re waiting for you. The full spot, created by Anomaly and premiered on Good Morning America on Feb. 10, shows a metaverse in full swing – including a very-real post-game concert that will be headlined by the Foo Fighters. Its giving people a reason to visit the virtual reality world Meta is building – and pulling viewers into the future they are creating.

‘Inside Meta’s Super Bowl Commercial for the Metaverse’ (AdAge)

‘Meta’s Super Bowl Commerical Depicts Old Brand’s New Life in the Metaverse’ (AdAge)

Tillamook x 72andSunny

72andSunny created a shoppable, digital only music video, Chedderbration to mark National Cheddar Day coinciding with the Super Bowl. The multimedium campaign includes limited edition merch, unique cheddar-based recipes, and coupons accessible only through the Cheddarbration homepage.

Vroom x Anomaly

Vroom’s Super Bowl 2022 commercial sings the praises of a reliable broker – literally

Anomaly makes a return Super Bowl appearance with Vroom, the online car retailer who is literally singing the praises of having a reliable dealer on your side during the car selling process. The 30 second spot again features high-tempo choreography from celebrity choreograper Mandy Moore.

‘Vroom Releases Super Bowl 56 Ad ‘Flake: The Musical” (AdAge)

Related

Articles

In the News, Press Releases

Jun 13, 2025

Stagwell (STGW) Unveils Official News Network as an Extension of its Future of News Initiative, Allowing Clients Direct Access to Leading News Publishers

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows

Newsletter

Sign Up

What are the forces at work reshaping the way brands and marketers connect with today’s consumers? The next decade of marketing innovation will be driven by the emerging technology piquing consumer, brand, and investor interest today: new mediums of storytelling unlocked by mixed-reality, new methods of communicating powered by social commerce, and problems to pre-empt driven by convergent social forces and the enduring digital acceleration.

Stagwell is all about transforming marketing – and we’re spending the year working with our agencies to explore how the most innovating and compelling opportunities in new frontiers will transform the way brands and marketers do business.

We’ll…

explore the practical, helping you understand things like if and how your brand should integrate virtual influencers in digital marketing efforts.

probe the conceptual…with questions like what responsibility brands have as they begin to imagine marketing and brand identity in space?

offer strategies for making sense of the monumental…with perspectives on how and when brands should get involved in the bourgeoning metaverse.

Meet Marketing Frontiers – Stagwell’s new content series that will unpack these blue-sky ideas before today’s brands, simplifying the future and helping leaders understand how these concepts will change the way we do business today and tomorrow.

Originally released on

CONTACT

Lorem Ipsum

FEATURING

Related

Articles

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows

Artificial Intelligence, In the News, Press Releases, Stagwell Marketing Cloud

May 22, 2025

PRophet, a Stagwell (STGW) Company, Releases AI Agentic Search for InfluencerMarketing.AI, Revolutionizing Influencer and Creator Discovery

Newsletter

Sign Up

Originally released on

CONTACT

John Gerzema

FEATURING

A study conducted on behalf of Protocol by the Harris Poll found that while most U.S. adults have not used augmented reality or virtual reality technology, a notable portion are interested in trying AR and VR. The study also found younger U.S. adults were more familiar with the metaverse than older U.S. adults, and that Americans are unsure about the future of the metaverse’s regulation.

While most U.S. adults have not used AR or VR tech, many are still interested in adopting the technology. Early adopters of AR and VR tech skew younger.

Three quarters (72%) of U.S. adults have not used any augmented reality technology.

Currently, 16% of U.S. adults have not heard of AR technology. Part of this may be due to current product hesitancy or disinterest: only a quarter (25%) of U.S. adults have no interest in using AR technology. On the other hand, younger adults are more willing to embrace AR, especially Millennials. One in three (32%) Millennials currently uses AR technology (compared to 23% of Gen Z, 14% of Gen X, 6% of Baby Boomers).

Although more hesitant, other “young” generations are also open to AR. 38% of Gen Z and 38% of Gen X have not used AR technology, but say they are interested in doing so.

Two-thirds (68%) of U.S. adults have not used any virtual reality technology.

Currently, 12% of U.S. adults have not heard of VR technology. Hesitancy and disinterest in VR is similar to AR. Again, just a quarter (26%) are not at all interested in trying VR. Youth interest is also higher for VR. Three in five (61%) Gen Zers and 45% of Millennials have used VR technology at least once (compared to just 31% of Gen X and 10% of Boomers).

Users of AR and VR technology have had enjoyable experiences with some of the more common products. The most used VR and AR technologies are:

VR headsets (e.g., Oculus, HTC Vive) (61% used; of those, 88% had a positive experience)

Mobile VR apps (33% used; of those, 66% had a positive experience)

AR social media tools (31% used; of those, 81% had a positive experience)

VR motion controllers (e.g., standard hand controllers, wands, wheels) (30% used; of those, 77% had a positive experience)

Unsurprisingly, younger people are more familiar with the metaverse than their older counterparts. Younger people also say more often that the metaverse will enrich their lives.

Two in three (62%) U.S. adults said they were not familiar with the concept of the metaverse before taking this survey.

That said, younger generations are more familiar with the metaverse. 55% of Gen Z and 60% of Millennials are at least somewhat familiar with the concept of the metaverse (compared to just 35% of Gen Xers and 17% of Boomers).

Regardless of familiarity levels, even after reading a description defining the metaverse, 52% of U.S. adults feel overwhelmed by the concept. Similar to other new technologies – most notably NFTs – such sentiment reveals a population that needs a seemingly complex and abstract topic to become more simplified and relatable in order for adults to embrace it.

Four in ten (37%) U.S. adults agree that the metaverse would be more fun than real life, and 38% agree that the metaverse would make their life better.

These numbers climb for Millennials. 53% agree that the metaverse would be more fun than real life, and 51% agree that the metaverse would make their lives better. These numbers also climb for people who were familiar with the metaverse before taking this survey. 54% agree that the metaverse would be more fun than real life, and 61% agree that the metaverse would make their life better.

U.S. adults are unsure about the future regulation of the metaverse. That said, a noteworthy share agrees that no one company should own all of the metaverse.

Overall, three in ten (27%) U.S. adults are not at all sure what group should regulate the metaverse, and another one in ten (9%) do not think the metaverse should be regulated. However, the vast majority of those previously familiar with the metaverse before taking this survey have an opinion of who should regulate the industry (92%).

Compared to just 19% of all U.S. adults, 28% of people who were familiar with the metaverse before taking this survey think metaverse and technology industry leaders should regulate the metaverse.

Those familiar with the metaverse say more often that regulation should be in the hands of users themselves. Compared to 14% of all U.S. adults, 21% of people who are familiar with the metaverse think metaverse users should be in charge of regulation. Across awareness levels, the U.S. government (11% all adults) and independent oversight committees (14%) were less popular regulatory options.

Despite controversy around the expanding power of big tech firms, only one in three U.S. adults (37%) say the metaverse should not be owned by any one company. Perhaps surprisingly, even fewer of those familiar with the metaverse before this survey feel this way (19%).

However, 63% of U.S. adults can see one company owning the metaverse. When asked who that one company would be, the top choices were Google (13%), Amazon (12%), Meta (11%), and Apple (10%).

For people previously familiar with the metaverse, the top choices shuffled slightly with Meta (17%) in the top spot followed by Google (16%), Amazon (15%), and Apple (13%). This could indicate a branding win for Meta among metaverse users and potential users.

The following companies had little support for ownership of the metaverse from U.S. adults:

Microsoft (7%)

Roblox (1%)

Snap Inc. (0%)

The Sandbox (0%)

Microsoft (7%)

For less established brands or brands that target younger audiences, a lack of overall brand awareness likely played a role in their lower position.

Methodology:

This survey was conducted online by The Harris Poll on behalf of Protocol during January 14-18, 2022, among 1,060 U.S. adults ages 18 and older. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. Figures for age, sex, race/ethnicity, education, region, and household income were weighted where necessary to bring them into line with their actual proportions in the U.S. population. Propensity score weighting was used to adjust for respondents’ propensity to be online. For more information, please contact Madelyn Franz or Andrew Laningham.

Download the full data tables here.

Related

Articles

In the News, Press Releases

Jun 13, 2025

Stagwell (STGW) Unveils Official News Network as an Extension of its Future of News Initiative, Allowing Clients Direct Access to Leading News Publishers

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows

Newsletter

Sign Up

This week marked the National Retail Federation’s 2022 conference, the premiere summit of the world’s largest retailers. Stagwell was listening in, as well as talking with lead retail experts and practitioners from brands like Johnson & Johnson, AERIN, Bayer, Snap, and more.

So what do marketers need to know? We recap the top five trends and takeaways to emerge from the week below.

If you’d like to learn more, email Beth Sidhu. Interested in more retail insights? Click here for our retail report card and please sign up for more insights here.

1. Blended Retail Experience is Here to Stay

The pandemic accelerated a new template for the shopper journey that sees consumers move frequently across brick-and-mortar and digital touchpoints. Consumers want to shop, browse, and discover on their own terms, using the full range of devices, delivery mechanisms, and in-store ecosystems available to them. Expect retail to continue to trend towards convenience – defined on the consumer’s terms – that is supported by digital layers that add function, streamline experiences, or collapse multiple aspects of the purchasing funnel. Marketers need to invest in seamless handoffs between touchpoints urgently.

2. Safety Will Keep Driving In-Store Shopping Behavior

With variants extending the pandemic for who-knows-how long, health and safety will continue to be top of mind for consumers. Telegraphing your brand’s investment into COVID-19 protocols without veering into the realm of pandemic theater/fearmongering is one way brands can remain in favor with today’s consumers. Marketers should ensure their messaging around safety connects with reality for employees, as the employee-as-brand-ambassador trend popularized by big box retailers like Walmart continues.

3. If Your Commerce Isn’t Connected, What Are You Doing?

Enduring supply chain disruptions will put additional pressure on retail shops to adapt technology and digital tools to further connect their enterprises. To keep apace with customer expectations for faster delivery and order fulfilment, brands need to adapt sophisticated inventory tracking and real-time retail dashboards, as well as look to further synchronize marketing and sales activities.

4. Social Commerce Gets a Lift From Live Streaming

Live commerce – a staple abroad but gaining traction across the U.S. – will mainstream in 2022 as brands need to bridge consumers’ platform and content experiences with their shopping habits. The models abound, from the 24-hour shopping livestreams that drive billions in sales during China’s major retail holiday, Double 11, to more curated influencer streams that tap into micro and nano influencers to tell the stories behind products in more authentic ways. This engagement renaissance will be powered by integrated payment portals, QR codes picture-in-picture digital displays, and other technology enabling a seamless step-through discovery to purchase.

5. Retail Cautiously Experiments with the “M” Word

In the absence of the technology infrastructure to support the much-buzzed about Metaverse, retailers are experimenting with what’s available now – mixed reality tools — to power exciting new experiences that tie the physical world to the digital world. Live events and retail supported by augmented reality can power more engaging shared experiences for consumers, while virtual tokens, avatar outfits, and other digital tokens can extend a brand’s product suite into this burgeoning new dimension of the web.

Related

Articles

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Newsletter

Sign Up

FEATURING

As we reflect on the marketing implications of CES 2022, Web 3.0 is by far the most impactful development that showed up across industries, technologies and capabilities. While in some ways it may be another victim of CES’ shiny veneer versus reality, there are components that are impossible to ignore – namely, the influx of and investment in the metaverse and NFTs.

Stagwell is one of the first movers when it comes to helping brands activate in this nacent space, having supported the launch of MilkPeP’s activation in the Roblox metaverse. On Thursday, January 6, Stagwell convened a lunch and learn, moderated by Axios’ Sara Fischer, to discuss the tactical and theoretical challenges and opportinities presented by Web 3.0. Here are our top 5 takeaways from the conversation:

- COVID WAS A CATALYST, bringing the metaverse into the real world

- BRANDS WILL PLAY A KEY ROLE IN BUILDING TRUST with these technologies and platforms

- NOT EVERY BRAND SHOULD BE IN THE METAVERSE, and not every metaverse is created equal

- METAVERSE + IRL should be a seamless experience

- NFTS are here to stay

Web 3.0 is a nuanced topic, and one that is the opposite of a one-size-fits-all approach. Depending on brand, product, buyer demographic and existing marketing activity, the metaverse and NFTs can fill a very important role (which may be… no role at all. More on that later). Learn more about what it means for brands, creative and the future of the online/offline world.

Praesent rutrum gravida consectetur. Cras vitae pretium urna. Phasellus aliquet, lacus dictum consequat tempor.

1. COVID was a catalyst, bringing the metaverse into the real world

The metaverse would have come eventually (in fact it’s already been here…hello, gaming community!), but the pandemic undoubtedly accelerated the timeline. With the majority of the world going digital, tech companies were pushed to develop products, tools and software that allowed us to do so much more from a virtual setting, exposing a more urgent demand for expanded virtual experiences and capabilities from brands.

the role of brands, as it has always been, is to create culture and pioneer what could be coming and help people imagine the art of the possible. They create links for consumers and act as educators for navigating the new space.

2. Brands will play a key role in building trust with these technologies and platforms

|

There’s a significant opportunity to live your brand values in the metaverse. If done well, brands will ensure their presence is connected and consistent with the way they show up in the real world, ultimately leading to greater consumer loyalty and retention. |

3. Not every brand should be in the metaverse, and not every metaverse is created equal

|

Direct-to-consumer relationships are more important than ever as we move into a cookieless world, so there are real business reasons that support having a presence in the metaverse. But it comes down to understanding your brand’s role, identifying your objectives, and how entering this space would aid in achieving those, and finally, implementing a process for facilitating, tracking, and measuring success. |

4. Metaverse + IRL should be a seamless experience

|

Let’s face it, some consumers are nearing a point of digital saturation. So, it’s important to note that the metaverse is not meant to be all-consuming. People value in-person experiences – there will be points in time that make sense to utilize the metaverse in addition to other consumer touchpoints, while there will be moments where we can come together in the real world and physically be a part of something. Blending the two seamlessly: now that’s a real win. |

5. NFTs are here to stay

|

As these advancements become more democratized in their accessibility, brands will start to use them more, whether it’s for loyalty, or to reignite an old concept or product. Industries will adopt NFTs as a creative means to build community and connect with people who support and protect their brands. |

Originally released on

CONTACT

Lorem Ipsum

FEATURING

Related

Articles

In the News, Press Releases

Jun 13, 2025

Stagwell (STGW) Unveils Official News Network as an Extension of its Future of News Initiative, Allowing Clients Direct Access to Leading News Publishers

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows