NEW YORK, Aug. 16, 2024 /PRNewswire/ — Stagwell Inc. (NASDAQ: STGW), the challenger network built to transform marketing, will host a virtual fireside chat at the Rosenblatt Securities 4th Annual Technology Summit on August 20, 2024. The session will feature Mark Penn, Chairman and CEO, discussing the impact of AI on marketing innovation, as well as product development within the company’s AI-enabled Stagwell Marketing Cloud. Management will be available for 1×1 meetings with investors upon request.

Visit this page to view upcoming investor events and programming from Stagwell. Reach out to ir@stagwellglobal.com with questions.

About Stagwell

Stagwell (NASDAQ: STGW) is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. www.stagwellglobal.com.

Related

Articles

In the News, Investments & Financials, Press Releases, Talent & Awards

Jul 08, 2025

Stagwell (STGW) Advances Executive Team with Four Key Appointments

In the News, Press Releases, Thought Leadership

Jun 10, 2025

Stagwell (STGW) Chairman and CEO Mark Penn to Discuss the Irreplaceable Power of Human Creativity on the Main Stage of Cannes Lions

Events, In the News, Press Releases, Talent & Awards

Jun 05, 2025

Code and Theory Named ANA B2B Agency of the Year After Transforming the World’s Leading Brands

Newsletter

Sign Up

CONTACT

hello@stagwellglobal.com

SIGN UP FOR OUR INSIGHTS BLASTS

As we reflect on the Cannes Lions International Festival of Creativity, it’s evident that while technology evolves, creativity remains the linchpin. Despite AI’s buzz on the Croisette, the actual impact in the Lions’ jury rooms was minimal. The focus instead was on diverse marketing transformations—from hidden consumer forces reshaping business strategies, to sports’ role in brand-building, to the power of entertainment-led advertising.

Whether you’re winding down from the excitement of Stagwell’s SPORT BEACH or you’re absorbing Cannes’ big ideas from home, here are Three Quick Things you need to know. Find more Cannes insights here and here.

- YOU CAN’T SPELL BUSINESS TRANSFORMATION WITHOUT CREATIVITY: The future of the CMO is always a hot topic at Cannes. Marketing leaders are tasked with driving initiatives as impactful as their C-Suite peers. Good news—CMOs’ creative problem-solving skills equip them well. Emerging from the Creative Business Transformation jury room, Michael Treff, CEO of Code and Theory, emphasizes: “Business transformation must work across most company functions, or it isn’t truly transformation.” Looking ahead, Treff says marketers will miss out if they assume AI is the only opportunity for business transformation. “There are seismic changes in human behaviors happening…and ontological questions for a lot of businesses in categories that are going through disruption. What is the meaning of a financial services institution? What is the role of institutional education? What is the future of media?” Hear more from Treff here.

- ATHLETES AS RENAISSANCE ENTREPRENEURS: “As an athlete, I was always being told to just play basketball,” said NBA All-Star Carmelo Anthony at Stagwell’s SPORT BEACH, discussing the challenges of breaking into the exclusive wine and spirits industry. Now, “I’m kicking the door down and saying…give us a chance, let us come in and be creative, and let’s make magic.” Athletes like Anthony are diversifying into industries such as fashion, media, and philanthropy, proving pivotal in creating new economic opportunities. “We’re not made to be one-dimensional, we’re human – we’re made to do so many things,” said LSU Tigers basketball star and rapper, Flau’jae Johnson. Athletes are not just being sponsored by brands; they’re shaping them, suggests alpine skier and Olympian Mikaela Shiffrin, who advised brands on stage that equity-based collaborations are “one of the most surefire ways to create a really authentic connection and partnership” with this new class of renaissance entrepreneurs. But don’t just chase the biggest names. Both Johnson and Mark Kirkham, CMO of Pepsi International, spoke on stage about the need for more “grassroots” partnerships, or brands partnering early with up-and-coming stars. Watch all sessions from SPORT BEACH here.

- DEBUNKING MARKETING’S EMERGING TECH PROBLEM: “Entertainment is a reflection of culture,” says GALE Managing Director, Creative and Entertainment Lions Jury President Geoff Edwards. So as culture changes and moves, so entertainment changes and progresses, and the category evolves as well. With consumers rebelling against intrusive ads, the focus on branded entertainment at Cannes has been on the rise in recent years. “But getting entertainment right requires more than being entertaining,” Edwards reminds us. Successful entertainment finds narratives that are captivating and uniquely convey the brand’s message. And the impact of technology in this realm is profound, with each year introducing new platforms, partnerships, and ways to experience content. “When it’s done well, [entertainment] is the most powerful force on Earth. Plus, it changes every year, because the entertainment industry changes every year. Technology, film, episodic, documentary, live experiences, gaming and music make this an exciting and interesting category.” Learn more from Geoff here.

ALL THE ACTION, NONE OF THE SWEAT

Relive every moment from Stagwell’s SPORT BEACH at the Cannes Lions International Festival of Creativity – without moving an inch. Stream mainstage sessions and interviews from the Content Studio on YouTube here.

Related

Articles

In the News, Press Releases

Jul 09, 2025

STAGWELL LAUNCHES STAGWELL MEDIA PLATFORM (SMP), A CENTRALIZED TEAM OF GLOBAL MEDIA, TECHNOLOGY AND DATA INVESTMENT EXPERTS

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows

Newsletter

Sign Up

CONTACT

hello@stagwellglobal.com

SIGN UP FOR OUR INSIGHTS BLASTS

Bonjour again! As Cannes Lions continues, we’ve witnessed (and announced) exciting partnerships, creative gambits taking top awards, and a surge in conversations about how technology is redefining the advertising and creative landscape. From the narratives shared at the Palais to the electrifying energy at SPORT BEACH, here are the Three Quick Things shaping the future of our industry.

Let’s dive in,

Beth Sidhu

Chief Brand Officer, Stagwell

- THE MAGIC IN THE MACHINE: Marketing thrives on the “magic” of renegade creative ideas. But with consumers spread across an ever-expanding matrix of channels, the best marketing now delivers adaptive, surround-sound brand experiences that meet consumers wherever they are. Achieving this without breaking the bank on overhead costs can be a nightmare if organizations haven’t built scalable production machines that enable the creation of thousands, if not millions, of assets underpinned by strong consumer insights. As the Lions roll in, campaigns like Pedigree’s “Adoptable”—which won the Grand Prix for Outdoor by leveraging AI to turn photos of shelter dogs near you into billboard-quality advertising—are leading the charge this week. Learn more about the interplay between “magic” and machines from Stagwell President of Global Solutions Julia Hammond in our recent webinar, “STGW: CURATED – The Next Five Years of Marketing.”

- ATHLETE COLLABORATION vs. ATHLETE MANAGEMENT: “The best campaigns I’ve ever done, and had the best outcomes for brands, are the ones where we all had creative input and really collaborated,” said Manchester United Lioness goalkeeper Mary Earps at SPORT BEACH. Sponsorships are a two-way street, helping athletes build their personal brands while driving exceptional business outcomes for companies. The value of brand sponsorships, especially with the growing fandom for women’s sports, is evident in the data: on Mary Earps’ TikTok, each post is worth an average of $39K!So, how can brands unlock the true potential of sponsorships? It’s all about generating conversations, sharing values, and placing the content in the right context, while ensuring authenticity shines through in the campaign. To learn more about the future of sponsorships between athletes and brands, watch “It’s a Win-Win: Why Sponsorships Make Sense.”

- DEBUNKING MARKETING’S EMERGING TECH PROBLEM: Advertising is a trend-centric industry, and for every trend, there’s a counter-trend. At our Cannes Lions keynote, Chairman and CEO Mark Penn reminded marketers about the power of nonconformist thinking when confronting emerging technology. His “Newtonian law of trends” suggests that for every consumer fad, there’s an opportunity waiting in the margins; i.e. for every metaverse, there’s a consumer craving in-person experiences; for every AI optimist, there’s a creative custodian wary of AI; for every social shopper, there’s an in-store enthusiast. These Newtonian forces can disorient companies, but they also shape opportunities. Have your strategists interrogate the “counter trends” around your core consumer insights; they might find a brewing market or a consumer set that could become a platform for growth

ALL THE ACTION, NONE OF THE SWEAT

Relive every moment from Stagwell’s SPORT BEACH at the Cannes Lions International Festival of Creativity – without moving an inch. Stream mainstage sessions and interviews from the Content Studio on YouTube here. Keep up with the remainder of SPORT BEACH by visiting our site, or downloading the official SPORT BEACH app

Related

Articles

In the News, Press Releases

Jul 09, 2025

STAGWELL LAUNCHES STAGWELL MEDIA PLATFORM (SMP), A CENTRALIZED TEAM OF GLOBAL MEDIA, TECHNOLOGY AND DATA INVESTMENT EXPERTS

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows

Newsletter

Sign Up

CONTACT

cannescomms@stagwellglobal.com

SIGN UP FOR OUR INSIGHTS BLASTS

Keeping Score: What You Missed at the BEACH

SPORT BEACH Day 1 did not disappoint. Five-time Olympian Shaun White discussed his new launch of the Snow League, the first ever professional winter sports league for snowboarding and free-skiing halfpipe competition. We caught up with Shaun and other athlete partners like Alex Honnold, Akbar Gbajabiamila, and Patrick Mouratoglou in the Stagwell Content Studio at SPORT BEACH. View their interviews here.

SPORT BEACH Play-by-Play

Get the download on today’s activities on the beach – stop by, say hello, and maybe break a sweat. You can always view the full SPORT BEACH schedule here.

- Runner’s World x Saucony Monday Run Club | 7:30 AM – 8:30 AM | Off-site | Shake off the jet lag with a 3-mile loop through the heart of Cannes, led by Runner’s World’s Runner-in-Chief and Team Saucony.

- Breakfast Hosted by the Ad Council: What CMOs Need to Know About The Mental Health Crisis | 9:00 AM -10:30 AM | Sky Deck | Join SPORT BEACH and Hearst for an exclusive look at the Ad Council’s Mental Health Initiative, featuring Heidi Arthur, Rich Dorment, Todd Haskell, Ryan Linder, and NFL great Brandon Marshall.

- Pickleball Clinic with Patrick Mouratoglou | 9:30 AM -10:30 AM | Main Court | Sharpen your pickleball skills with legendary tennis coach Patrick Mouratoglou, who has coached greats like Serena Williams and Holger Rune.

- Dirt is Good: Resilience as a Key Success Driver | 11:00 AM – 11:30 AM | Stage | Join Unilever in conversation with Real Madrid great Roberto Carlos and legendary tennis coach Patrick Mouratoglou to discuss resilience and its correlation to success in life, sports, and business.

- Let’s Get Loud: The Sound of Sport, from Fans to Brands | 11:30 AM – 12:00 PM | Court | No matter what sport, what city or what country, the sound of sport is unmistakable – and essential to the experience as a fan. Learn how brands are supporting this element of sport, and how its evolving for an elevated consumer.

- The Future of Winter Sports Competition | 12:00 PM – 12:30 PM | Stage | Five-time Olympian Shaun White will be joined by business partner Jim Miller to discuss snowboarding’s growing cultural prominence and provide a sneak peek into some exciting snow-based news.

- It’s a Win-Win: Why Sponsorships Make Sense | 12:30 PM – 1:00 PM | Stage | Hear from top brands on why their sports partnerships make sense, and how they measure KPIs. Lioness goalkeeper Mary Earps will bring the athlete POV, digging into how brands can best leverage athletes to bring these partnerships to life for fans.

- Guinness x Sport: Building Vibrant Communities with The Premier League and Guinness Six Nations | 1:00 PM – 1:30 PM | Stage | Hear the perspective of an iconic brand (Guinness) & athlete (Frank Lampard) on how to capture the infectious passion of football and rugby to bring communities together and how Guinness is using sport as a creative force for good.

- #UnitedbySnapdragon: Manchester United and Qualcomm Level Up | 1:30 PM – 2:00 PM | Stage | Join Manchester United legend Eric Cantona and Qualcomm CMO Don McGuire ahead of the Snapdragon brand’s debut on the front of Manchester United’s kit for the upcoming season.

- Whose Job Is It Anyways? Driving Equity in Sport | 2:00 PM – 2:30 PM | Stage | This panel will explore the specific role brands can and should play as we drive for equity in sport, featuring WNBA legend Sue Bird in conversation with State Farm, Marriott and Amazon.

- We Play Different: Alex Honnold x The North Face | 2:30 PM – 3:00 PM | Stage | This conversation will delve into how the “Playing Different” mantra dictates how both The North Face and Honnold approach exploration.

- The Halfway Line: The Brands & Athletes Driving Women’s Sport Forward | 3:00 PM – 3:30 PM | Stage | The greateast female ski racer of all time Mikaela Shiffrin and Mark Kirkham from PepsiCo will share their perspectives on how we can cover more ground for women in sports today.

- Business of Sports w/ AJ Andrews | 4:00 PM – 5:00 PM | Content Studio | Join ReachTV’s AJ Andrews as she takes a deep dive into the trillion dollar business of sports. From athletes to executives, each guest will share their unique business perspective on how sports has evolved beyond the game.

- Open Play x Epidemic Sound | 4:00 PM – 6:00 PM | Court | Join us to wrap up your first day of Cannes with Open Play, soundtracked by Epidemic Sound, including a live guest DJ and musical guest from their catalogue of royalty-free artists.

- Cocktails with BxP | 4:00 PM – 6:00 PM | Fan Zone | Cocktail reception hosted by Stagwell’s Brand Performance Network. Please note, this event is invite only.

- Clio Sports Honorary Awards Dinner | 7:30 – 10:30 PM | Main Court | Please note, this event is invite only.

Beyond the Court: Check Out Stagwell Speakers Around Cannes

Victory Lap: Lions in Focus

Stay Connected

Team Stagwell is on the ground at Cannes, ready to cover the Palais, fringe stages, and maybe even a yacht or two, bringing you the latest insights from the festival. Keep up with the latest, and reach out if you have questions or requests.

- Email the Stagwell Team

- Follow us on LinkedIn

- Follow us on Twitter

- Follow us on Instagram

- Stream SPORT BEACH content on demand on YouTube

Related

Articles

In the News, Press Releases

Jul 09, 2025

STAGWELL LAUNCHES STAGWELL MEDIA PLATFORM (SMP), A CENTRALIZED TEAM OF GLOBAL MEDIA, TECHNOLOGY AND DATA INVESTMENT EXPERTS

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows

Newsletter

Sign Up

CONTACT

cannescomms@stagwellglobal.com

SIGN UP FOR OUR INSIGHTS BLASTS

Game on. Welcome to Cannes Lions, home of Stagwell’s SPORT BEACH, where everybody wins.

Every morning for SPORT BEACH attendees and interested parties at home, we’ll recap the biggest moments from the day prior and break down today’s most impactful events so you can plan your schedule.

Questions? Reach Team Stagwell at cannescomms@stagwellglobal.com. It’s Monday, June 17, and here is what you can look forward to today..

Download the Official SPORT BEACH App

Stay in the loop on all things SPORT BEACH 2024 by downloading our app today. The app allows you to view events, create your personalized schedule, browse the star-studded speaker line-up, and find all the information you need. There is even an AI-powered chatbot to help you make every moment count.

Three Quick Things: Our Cannes Lions Predictions

Brace yourself for discussions around the festival with our quick primer on the three trends (not named AI…) that we expect to dominate Cannes Lions this year. Click the image below to read the article.

SPORT BEACH Play-by-Play

Get the download on today’s activities on the beach – stop by, say hello, and maybe break a sweat. You can always view the full SPORT BEACH schedule here.

- Runner’s World x Saucony Monday Run Club | 7:30 AM – 8:30 AM | Off-site | Shake off the jet lag with a 3-mile loop through the heart of Cannes, led by Runner’s World’s Runner-in-Chief and Team Saucony.

- Breakfast Hosted by the Ad Council: What CMOs Need to Know About The Mental Health Crisis | 9:00 AM -10:30 AM | Sky Deck | Join SPORT BEACH and Hearst for an exclusive look at the Ad Council’s Mental Health Initiative, featuring Heidi Arthur, Rich Dorment, Todd Haskell, Ryan Linder, and NFL great Brandon Marshall.

- Pickleball Clinic with Patrick Mouratoglou | 9:30 AM -10:30 AM | Main Court | Sharpen your pickleball skills with legendary tennis coach Patrick Mouratoglou, who has coached greats like Serena Williams and Holger Rune.

- Dirt is Good: Resilience as a Key Success Driver | 11:00 AM – 11:30 AM | Stage | Join Unilever in conversation with Real Madrid great Roberto Carlos and legendary tennis coach Patrick Mouratoglou to discuss resilience and its correlation to success in life, sports, and business.

- Let’s Get Loud: The Sound of Sport, from Fans to Brands | 11:30 AM – 12:00 PM | Court | No matter what sport, what city or what country, the sound of sport is unmistakable – and essential to the experience as a fan. Learn how brands are supporting this element of sport, and how its evolving for an elevated consumer.

- The Future of Winter Sports Competition | 12:00 PM – 12:30 PM | Stage | Five-time Olympian Shaun White will be joined by business partner Jim Miller to discuss snowboarding’s growing cultural prominence and provide a sneak peek into some exciting snow-based news.

- It’s a Win-Win: Why Sponsorships Make Sense | 12:30 PM – 1:00 PM | Stage | Hear from top brands on why their sports partnerships make sense, and how they measure KPIs. Lioness goalkeeper Mary Earps will bring the athlete POV, digging into how brands can best leverage athletes to bring these partnerships to life for fans.

- Guinness x Sport: Building Vibrant Communities with The Premier League and Guinness Six Nations | 1:00 PM – 1:30 PM | Stage | Hear the perspective of an iconic brand (Guinness) & athlete (Frank Lampard) on how to capture the infectious passion of football and rugby to bring communities together and how Guinness is using sport as a creative force for good.

- #UnitedbySnapdragon: Manchester United and Qualcomm Level Up | 1:30 PM – 2:00 PM | Stage | Join Manchester United legend Eric Cantona and Qualcomm CMO Don McGuire ahead of the Snapdragon brand’s debut on the front of Manchester United’s kit for the upcoming season.

- Whose Job Is It Anyways? Driving Equity in Sport | 2:00 PM – 2:30 PM | Stage | This panel will explore the specific role brands can and should play as we drive for equity in sport, featuring WNBA legend Sue Bird in conversation with State Farm, Marriott and Amazon.

- We Play Different: Alex Honnold x The North Face | 2:30 PM – 3:00 PM | Stage | This conversation will delve into how the “Playing Different” mantra dictates how both The North Face and Honnold approach exploration.

- The Halfway Line: The Brands & Athletes Driving Women’s Sport Forward | 3:00 PM – 3:30 PM | Stage | The greateast female ski racer of all time Mikaela Shiffrin and Mark Kirkham from PepsiCo will share their perspectives on how we can cover more ground for women in sports today.

- Business of Sports w/ AJ Andrews | 4:00 PM – 5:00 PM | Content Studio | Join ReachTV’s AJ Andrews as she takes a deep dive into the trillion dollar business of sports. From athletes to executives, each guest will share their unique business perspective on how sports has evolved beyond the game.

- Open Play x Epidemic Sound | 4:00 PM – 6:00 PM | Court | Join us to wrap up your first day of Cannes with Open Play, soundtracked by Epidemic Sound, including a live guest DJ and musical guest from their catalogue of royalty-free artists.

- Cocktails with BxP | 4:00 PM – 6:00 PM | Fan Zone | Cocktail reception hosted by Stagwell’s Brand Performance Network. Please note, this event is invite only.

- Clio Sports Honorary Awards Dinner | 7:30 – 10:30 PM | Main Court | Please note, this event is invite only.

On the Mainstage: Navigating Emerging Tech with Chairman and CEO Mark Penn

Off the beach, Stagwell Chairman and CEO Mark Penn will take the Rotonde Stage on the Cannes Lions Innovation track for a keynote on how marketers can apply contrarian thinking to navigate emerging technology hype. Get all the details here.

Catch other speakers from across the Stagwell network around the festival today:

- 72andSunny’s Damaune Journey at Playing to Win: Made on Culture @ Culture Mix | 1:00 PM | Culture Mix Cannes | Learn More.

- Code and Theory’s Dan Gardner at ADWEEK House: You’re Using AI for That, Right? Delivering Creative Excellence with Artificial and Human Intelligence | 2:00 PM | 3.14 Rooftop | Explore the balance between data-driven decision-making and emotional connection. | Register

Stay Connected

Team Stagwell is on the ground at Cannes, ready to cover the Palais, fringe stages, and maybe even a yacht or two, bringing you the latest insights from the festival. Keep up with the latest, and reach out if you have questions or requests.

- Email the Stagwell Team

- Follow us on LinkedIn

- Follow us on Twitter

- Follow us on Instagram

- Stream SPORT BEACH content on demand on YouTube

Related

Articles

In the News, Press Releases

Jul 09, 2025

STAGWELL LAUNCHES STAGWELL MEDIA PLATFORM (SMP), A CENTRALIZED TEAM OF GLOBAL MEDIA, TECHNOLOGY AND DATA INVESTMENT EXPERTS

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows

Newsletter

Sign Up

CONTACT

hello@stagwellglobal.com

SIGN UP FOR OUR INSIGHTS BLASTS

Bonjour! Team Stagwell is headed to Cannes Lions, ready to cover the Palais, fringe stages, and maybe even a yacht or two, bringing you the latest insights from the Festival. We’ll also be bringing sports and business icons like Carmelo Anthony, Sue Bird, Joe Burrow, Jason and Travis Kelce, Megan Rapinoe, and JuJu Watkins to SPORT BEACH for some exciting action.

Ahead of the Festival, we’re sharing three predictions to track as the programming unfolds. While AI will undoubtedly be a hot topic, in this edition we’re focusing on everything else – though you won’t want to miss our Monday mainstage session on “The Contrarian’s Compass: Navigating Emerging Tech Hype.”

Let’s dive in,

Beth Sidhu

Chief Brand Officer, Stagwell

- ALL ROADS WILL LEAD BACK TO SOCIAL: At Cannes, two key discussions will shape future investments in the social media space, where ad spend is set to surge in 2024, led by TikTok (anticipated to grow 38%) and Instagram. First is the future of social video. As the popularity of bite-sized videos diminishes and Gen Z gravitates towards longer-form content (although this mainly just means 90-second videos), expect significant discussions about new monetization and creative opportunities in social video. We’ll also be keeping an eye on how marketers view the viability of “challenger” platforms like TikTok, which have built incredible momentum in recent years but face a shifting regulatory and consumer landscape in the U.S. and abroad. Learn more about what social-savvy brands can do to prepare for the future in this blog from Movers+Shakers CEO Evan Horowitz.

- BRANDS WILL GET SCHOOLED ON THE RIGHT ATHLETE SPONSORSHIP PLAYS: Today’s athletes are multi-hyphenate leaders and aspirational figures who excel in business, media, nonprofits, and more, far beyond their achievements on the field. As the Cannes spotlight turns to sports, be sure to attend SPORT BEACH panels such as “It’s a Win-Win: Why Sponsorships Make Sense” with Channel Factory and Relo Metrics, and mainstage events such as “The Rapid Evolution of Athletes as Brand Builders” with the NFL. These sessions will guide brands on shifting from a brand ambassador approach to a true partnership mindset when collaborating with athletes. By involving athletes in product development, marketing strategies, experiential initiatives, and impact-driven projects, brands can benefit from their unique perspectives and vast audiences. Brush up on this shifting dynamic by streaming our SXSW 2024 talk, “Athlete as a Brand: Creating Authentic Connections.”

- MARKETERS WILL TRULY PLUG INTO GAMING: Marketers are no longer overlooking gaming and e-sports, which boast 3.3 billion gamers globally and will reach $4.3 billion in global ad revenue this year. With immersive consumer experiences now a priority for brands, gaming is the perfect market. Keep an eye out at Cannes for insights emerging from campaigns that win big at the Entertainment Lions for Gaming and Brand Experience & Activation categories. Their success will demystify the nascent big-C creative and performance media opportunities. You also won’t want to miss Stagwell’s GALE in conversation with Lenovo, Activision Blizzard, and the National Women’s Soccer League at SPORT BEACH on Tuesday on the future of consoles and community. One other thing to track: 2023 was a big year for the convergence of gaming, marketing, and branded entertainment, as massive titles like the Super Mario Bros. movie and “The Last of Us” translated into branding opportunities galore. Brush up on the insights with National Research Group’s whitepaper, “Why Video Games are the New Frontier for Hollywood.”

Follow the Buzz from SPORT BEACH

Join us on LinkedIn, Twitter, Instagram, and YouTube as the Stagwell network hits the ground at Cannes Lions and brings to life SPORT BEACH, our flagship activation home to 50+ of the most renowned athletes, brands and cultural icons coming together around the power of sport and its massive global impact on business and culture.

Learn more and register at https://www.sportbeach.com/.

Related

Articles

In the News, Press Releases

Jul 09, 2025

STAGWELL LAUNCHES STAGWELL MEDIA PLATFORM (SMP), A CENTRALIZED TEAM OF GLOBAL MEDIA, TECHNOLOGY AND DATA INVESTMENT EXPERTS

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows

Newsletter

Sign Up

Frontiers in Focus

Want to explore more of the frontiers of marketing? View more of our work on the cutting edge of AI and immersive brand experiences here.

SIGN UP FOR OUR INSIGHTS BLASTS

At Stagwell, AI isn’t just the next shiny thing – our agencies view it as an opportunity to fundamentally advance our organizations, improving the speed and efficacy at which we can produce transformative marketing for clients. As a network of digital experts – one in 10 Stagwell employees globally are engineers – we are eagerly addressing the challenge of creating custom AI solutions that empower our teams to be better at what they do.

“When you implement AI across diverse domains from marketing and product development to workplace optimization and investment strategies, remember the goal is to optimize for better decision-making by the humans upstream,” said Mark Penn, Chairman and CEO, Stagwell. “The best AI will teach people how to fish.”

We believe every company should embrace the Three Es of AI: enablement, efficiency and engagement, which promise to drive more speed, scale and accuracy for modern business. This will kickstart exponential value growth – if you leverage it the right way. Here are some of the ways Stagwell’s agencies are implementing the Three Es of AI.

ENGAGEMENT WITH CONSUMERS: HARNESSING ‘FOURTH PARTY’ DATA

A eureka moment while developing a game-changing campaign for Tipico is driving a new approach to capturing “fourth-party data” at Code and Theory, Stagwell’s digital transformation network. When tasked by European brand Tipico to break into the Ohio sports betting market, Code and Theory leveraged ChatGPT to create living personas. These synthetic humans not only answered the agency’s questions, they delivered real-time, effective “fourth-party data” that helped Tipico beat every one of their campaign goals. Code and Theory defines “fourth-party data” as a dataset made synthetically by AI from pre-existing first- and third-party data. The new data is essential to anticipating what consumers will want in the future, as opposed to reflecting what they have already wanted.

“AI’s power and real opportunity is enabling businesses to make better decisions and anticipate customer needs. AI can study your behaviors, actions and patterns and anticipate what you might want, in seconds,” said Dan Gardner, Founder and Executive Chairman, Code and Theory network. “It also allows businesses to reduce the friction and pain points we all experience when we are trying to book a service or buy an item. The steps to getting what you want will simply fall away.”

EFFICIENCY IN MARKETING: HOMEGROWN STORI TOOL ENHANCES SALES RATE

Stori innovates the case study creation process for Instrument’s delivery teams, employing advanced language models and integrations with Google Cloud services to streamline and accelerate the production of tailored case studies. The tool contributed to a record win streak of 50+ new clients for Instrument in 2023.

“Case studies are the essential proof points for our products and services. Stori enabled us to democratize the case study creation process across the agencies,” said Mike Creighton, Instrument’s Director of AI Research and Development. “Its deployment brought efficiency, quality and consistency to the case study creation process; helped boost enthusiasm for generative AI across the company; and ultimately let teams focus on what truly matters – delivering exceptional results for our clients.”

ENABLEMENT ACROSS OPERATIONS: REARCHITECTING A TOP PERFORMER WITH AI AT ITS CORE

GALE — our fast-growing business agency — has revolutionized its offering with AI at its core. Called Alchemy.Ai, the private enterprise cloud platform is trained on all aspects of data at the agency and reduces the time spent on critical tasks across all disciplines. The tool can improve the output efficiency of core workflows like audience insight development by as much as 80%.

“The unveiling of Alchemy.Ai reshapes GALE as we know it, marking a massive shift in how we work and the democratization of data across all teams,” GALE CEO Brad Simms says. “When GALE was founded in 2014, we were first-to-market with our unique blend of creative and consultancy centered around data. While we’ve continued to build our model over the last decade to become one of the most celebrated agencies in North America, Alchemy.Ai is the most significant product update we’ve ever made.”

Related

Articles

In the News, Press Releases

Jul 09, 2025

STAGWELL LAUNCHES STAGWELL MEDIA PLATFORM (SMP), A CENTRALIZED TEAM OF GLOBAL MEDIA, TECHNOLOGY AND DATA INVESTMENT EXPERTS

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows

Newsletter

Sign Up

ABOUT GALE

GALE is a Business Agency. Founded in 2014, the agency currently has offices in New York, Singapore, Toronto, Denver, Los Angeles, London, Austin, Kansas City, and Bengaluru. GALE has received top industry awards including Ad Age’s A-List, Ad Age’s Data & Analytics Agency of the Year, Adweek’s Fastest Growing Agency, the Grand Effie and Adweek’s Breakthrough Media Agency of the Year.

Frontiers in Focus

Want to explore more of the frontiers of marketing? View more of our work on the cutting edge of AI and immersive brand experiences here.

SIGN UP FOR OUR INSIGHTS BLASTS

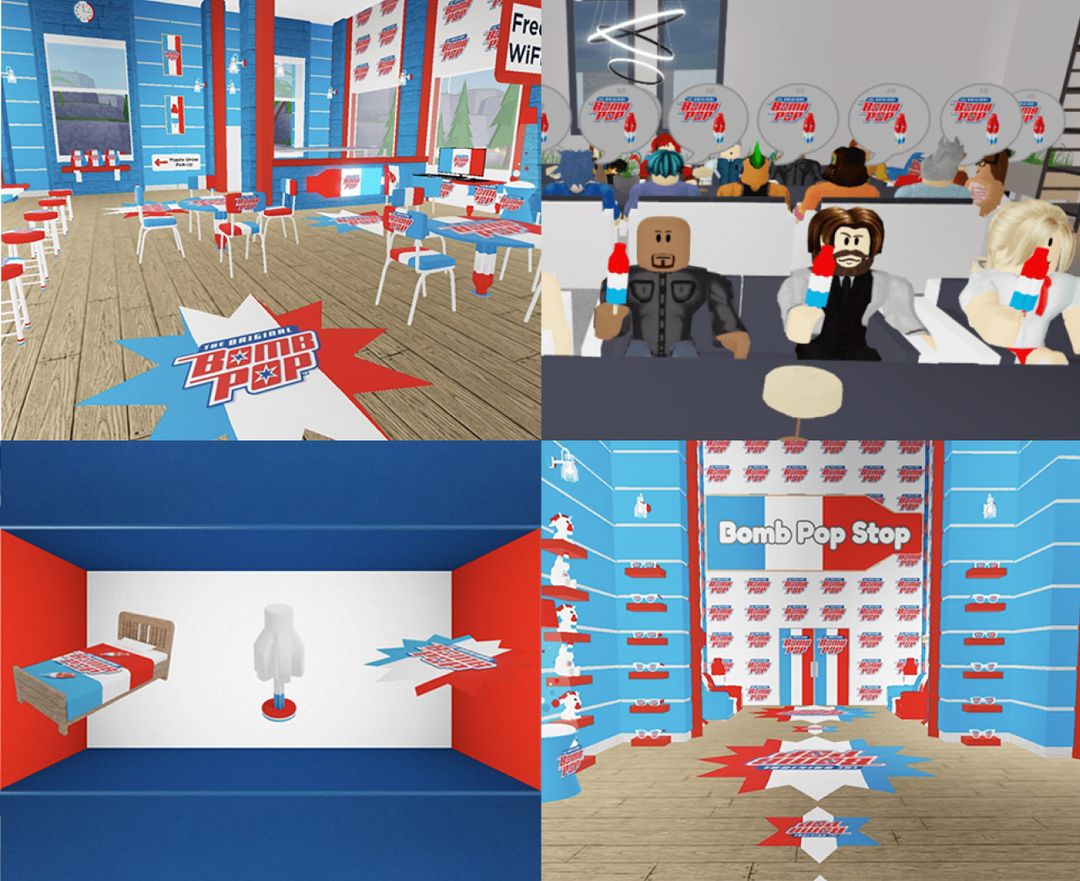

Bomb Pop is the most popular ice pop that nobody can remember. GALE’s mission was simple: get tweens to remember the brand’s name. The team brought the favorite summertime snack into the virtual world of Restaurant Tycoon 2 in Roblox, where Roblox restaurant owners could serve eight virtual Bomb Pop flavors to their customers. Gamers served 48.5 million Bomb Pops — making it the #1 selling food item in Roblox history.

Our Approach to Transformation

Introducing the Bomb Pop Update in Restaurant Tycoon 2. For two weeks, Roblox restaurant owners could serve virtual bomb pops to their hungry customers and earn limited edition gear to upgrade their restaurants – turning Restaurant Tycoon into a red, white, and blue bonanza, and making restaurant owners within the platform our very own virtual brand ambassadors, interior designers, and architects. In the process, using our limited-edition items, players completely transformed the restaurants into gaming lounges, family style buffets, and even high-end beach clubs with an average of 28 minutes engaged across the experience.

Our Impact

Time spent was 133% beyond Roblox branded experience benchmarks. We also had over 500,000 unique users enlist as virtual bomb pop distributors who sold over 48.5 million bomb pops, making it the most sold food item in Roblox ever. Even more significantly, sales in the real world were also up with an immediate 28.6% increase. We proved that the virtual world can spur epic real world business results.

Wondering where to begin with immersive experience implementation in your organization?

Email Beth Sidhu, Chief Brand and Communications Officer at Stagwell, to discuss how we can support your organization’s digital goals.

Related

Articles

In the News, Press Releases

Jul 09, 2025

STAGWELL LAUNCHES STAGWELL MEDIA PLATFORM (SMP), A CENTRALIZED TEAM OF GLOBAL MEDIA, TECHNOLOGY AND DATA INVESTMENT EXPERTS

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows

Newsletter

Sign Up

ABOUT COLLE MCVOY

Colle McVoy (CM) is a full-service creative agency that builds enduring relationships between forward-thinking brands and people. We believe this time of rapid change is filled with opportunities, so we constantly strive to push the boundaries of creativity, pressure-test best practices and create new brand futures. As a Certified B Corporation, we believe a better future means we have a responsibility to use our expertise as a force for good to benefit all people, communities and the planet.

Frontiers in Focus

Want to explore more of the frontiers of marketing? View more of our work on the cutting edge of AI and immersive brand experiences here.

SIGN UP FOR OUR INSIGHTS BLASTS

We’re sure you’ve heard about JOMO (the joy of missing out). Here’s the reality: It’s one thing to miss out, it’s an entirely different thing to find the joy in it.

To reinforce La-Z-Boy’s new platform, Long Live the Lazy, Colle McVoy’s creative technology team designed and fabricated “The Decliner,” a first-of-its-kind recliner allowing owners to AI-generate a cancellation excuse via SMS simply by pulling the handle. 36,000+ people signed up for a chance to win their own Decliner just in time for National Lazy Day as part of the earned creative brand act.

Our Approach to Transformation

For a chance to put their feet up with AI assistance and La-Z-Boy style, people were asked to submit the most creative excuses they’ve ever used to protect their JOMO. And, influencers created content to amplify attention to the contest. The innovation was a technological hack—with 225 lines of code directing the AI server and 344 lines for each fabricated chair. An indicator of sorts had to be fashioned to let people know requests were processing, which took the form of an LED-lined puck at the handle base. The tech choices needed to be as reliable as the chairs themselves and couldn’t disrupt La-Z-Boy’s comfort and durability standards.

Our Impact

Colle McVoy drove 1.1B media impressions across 317 placements in the likes of USA Today, Better Homes & Gardens, Architectural Digest and more. People definitely put their feet up, juicing La-Z-Boy’s website traffic by 200% and increasing brand sales by 50% during the first weekend of the campaign.

The La-Z-Boy Decliner has gone on to win several awards, including Best in Technology at the 2023 PRWeek Awards and Best in Research & Consumer Insights in MediaPost’s Planning & Buying Awards. Nearly 13,000 cancellations have been sent by Decliner owners, giddy with AI-assisted JOMO.

Wondering where to begin with AI implementation in your organization?

Email Beth Sidhu, Chief Brand and Communications Officer at Stagwell, to discuss how we can support your organization’s digital goals.

Related

Articles

In the News, Press Releases

Jul 09, 2025

STAGWELL LAUNCHES STAGWELL MEDIA PLATFORM (SMP), A CENTRALIZED TEAM OF GLOBAL MEDIA, TECHNOLOGY AND DATA INVESTMENT EXPERTS

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows

Newsletter

Sign Up

ABOUT LEFT FIELD LABS

Left Field Labs is a digital agency dedicated to solving our common challenges through uncommon creativity. Our team of over 100 designers, developers, and strategists has launched hundreds of digital products and experiences – from VR and websites to apps and experiential installations – for clients, such as Google, Discovery, Android, Estée Lauder, Uber, and Disney.

Frontiers in Focus

Want to explore more of the frontiers of marketing? View more of our work on the cutting edge of AI and immersive brand experiences here.

SIGN UP FOR OUR INSIGHTS BLASTS

Google set out to create a 360° event-scale augmented reality (AR) experience at CES that would help attendees experience its presence in a whole new dimension. Google partnered with Left Field Labs to blend its physical booth location with a digital overlay, focused on bringing helpful and contextual information to attendees, as well as delightful moments.

Our Approach to Transformation

LFL leveraged Google’s latest AR technologies in partnership with Adobe to inspire developers, creators, and brands at Google’s CES booth. The team aimed to demonstrate how AR has the potential to solve everyday challenges, whether orienting yourself around a busy environment, getting the scoop on more demos to see, finding transportation, or helping with decision making.

First, LFL used Google’s Geospatial Creator, powered by ARCore and Google Maps Platform, in Adobe Aero to create an effective storyboard that integrated physical and digital elements seamlessly for the AR experience. LFL then built Google’s beloved Android Bot into the AR experience as a guiding figure with simple yet richly expressive interactions. Taking an agile approach, LFL iterated and tested on a wide range of Android and iOS mobile devices to ensure smooth performance for attendees.

Our Impact

The AR guide to Google on Android at CES 2024 was a successful “show rather than tell” experience that helped attendees enjoy the space with immersive surprises along the way. The experience was activated nearly 9,000 times over the four-day event.

Wondering where to begin with immersive experience implementation in your organization?

Email Beth Sidhu, Chief Brand and Communications Officer at Stagwell, to discuss how we can support your organization’s digital goals.

Related

Articles

In the News, Press Releases

Jul 09, 2025

STAGWELL LAUNCHES STAGWELL MEDIA PLATFORM (SMP), A CENTRALIZED TEAM OF GLOBAL MEDIA, TECHNOLOGY AND DATA INVESTMENT EXPERTS

Artificial Intelligence, In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 12, 2025

PRophet, a Stagwell (STGW) Company, Completes Integration of UNICEPTA, Launches Unified Brand and Enhanced Media Intelligence Offering

In the News, Marketing Frontiers, Press Releases, Stagwell Marketing Cloud, Tech

Jun 11, 2025

The Marketing Cloud Launches Cutting-Edge Platform to Simplify Marketing Workflows