Weekly Data

WHAT THE DATA SAY: 45% say personal finances becoming worse – up from 41% in March and February

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from Stagwell. Among the highlights of our weekly consumer sentiment tracking:

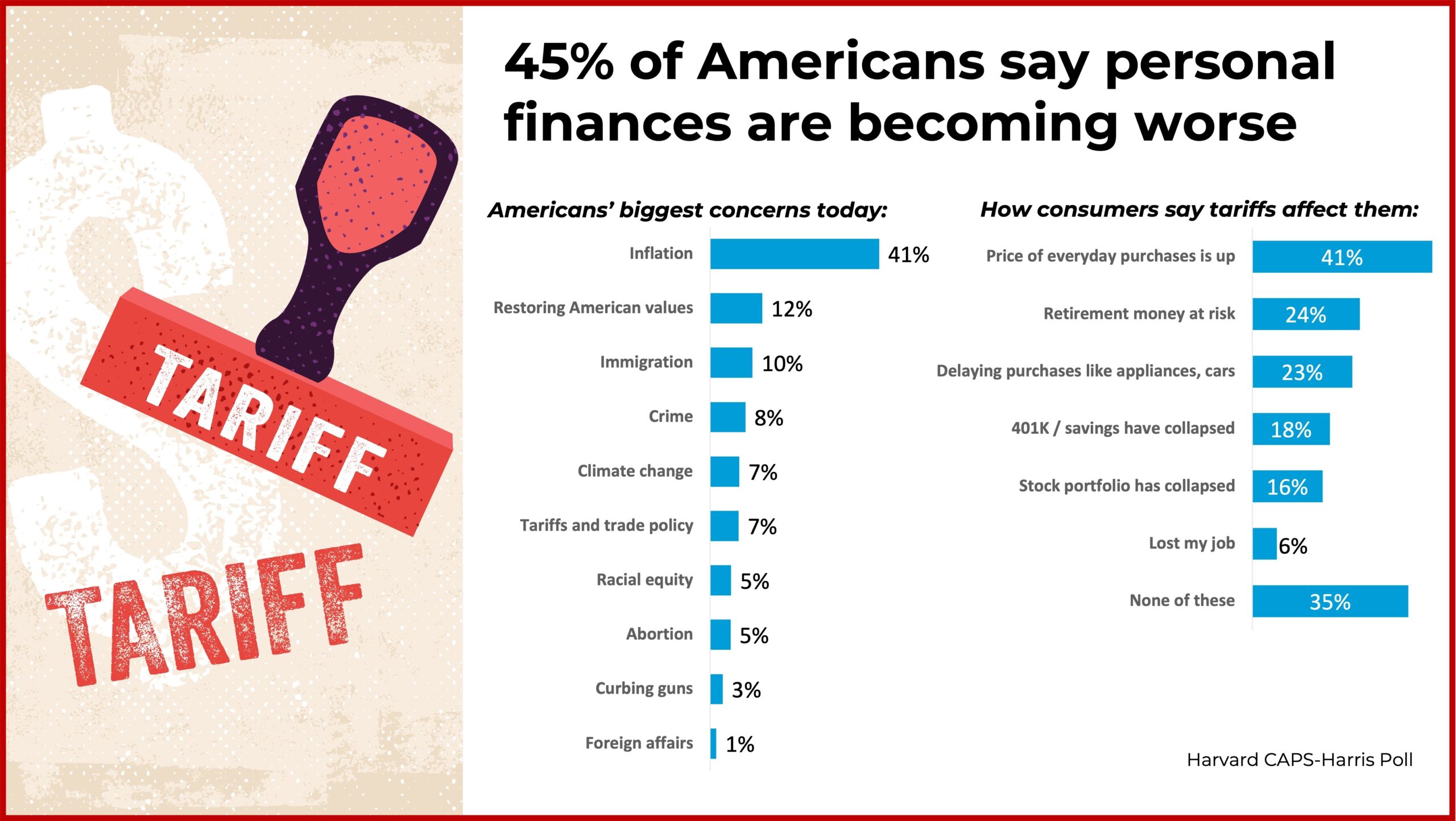

AMERICANS GROW MORE NEGATIVE

U.S. consumers are growing more negative about the macro economy and their personal financial situation, based on our April Harvard CAPS / Harris Poll.

- 39% say the country is on the right track overall – down from 41% in March and 42% in February.

- 37% say the economy is on the right track, down from 38% in March and February.

- 45% say their personal financial situation is becoming worse – up sharply from 41% in March and February.

- Price increases and inflation (38%, steady with last month) and the economy/jobs (33%, up 1 point) remain the country’s two major issues.

- 47% oppose President Trump’s tariff program, while 45% support it.

- Americans cite increases in prices of everyday purchases (41%) and their retirement money being at risk (24%) as the top ways tariff policies already have affected them.

- 39% expect the U.S. economy to grow worse in the next 12 months.

- 67% support the goal of cutting $1 trillion of government expenditures.

- 57% do not believe Elon Musk and DOGE will be able to hit the goal by the end of the year.

- 55% say Musk and DOGE have gone about making government spending cuts in the wrong way.

- 58% believe Musk should resign after his six-month special government employee status ends.

- See also: PRSA forum gives education and advice on the economy and tariffs

GROCERY PRICES AFFECT EVERYTHING

The pressures inflation puts on the retail industry is causing a disconnect between shoppers and business operators, according to our Harris Poll study with Rakuten.

- 55% of shoppers are looking for the lowest prices when shopping.

- 77% think prices will continue to increase throughout 2025.

- 19% cannot afford to pay their household bills.

- 17% cannot afford necessities like food and gas.

- 36% say they can afford all their daily expenses in addition to non-essential items.

- 41% plan to shop less than in previous years, and 39% cite inflation as having the most impact on their 2025 shopping plans.

- 57% say rising grocery prices has caused them to cut back on non-essential shopping.

- 41% are spending more at the grocery store to purchase from the same brands they’re accustomed to, while 39% are shifting to cheaper alternatives.

- 13% say they are completely avoiding buying products affected by large price hikes, such as eggs.

RETIREMENT WOES

The burden of retirement is affecting single people more than partnered investors, according to our Harris Poll research with Nationwide.

- 1 in 4 single investors say they did not plan to be alone in retirement.

- 22% are scared to grow old alone.

- 37% say they experience more strain or financial hardship compared to their married or partnered peers.

- 18% of non-retired single investors don’t know if they’ll ever be able to retire.

ICYMI: In case you missed it, check out the thought-leadership and happenings around Stagwell making news:

- Buying a car before tariffs hit prices? What you need to know.

- Nervous about flying? How the FAA is addressing air safety

- From Booking to Loyalty: How AI Shapes the Travel Experience

- How long do you generally leave items in your shopping cart before completing the purchase?

- Canadian pride is no longer just a feeling—it’s a national call to action

- How can your brand embrace pop culture and Gen Z? Learn from Gap.

Related

Articles

In the News, Press Releases

Jul 14, 2025

JULY HARVARD CAPS / HARRIS POLL: OPINIONS ON “BIG BEAUTIFUL BILL” SPLIT WITH 44% OF VOTERS SUPPORTING IT, BUT MOST POLICIES HAVE MAJORITY SUPPORT WITH MANY POPULAR TAX CUTS

Weekly Data

Jul 10, 2025

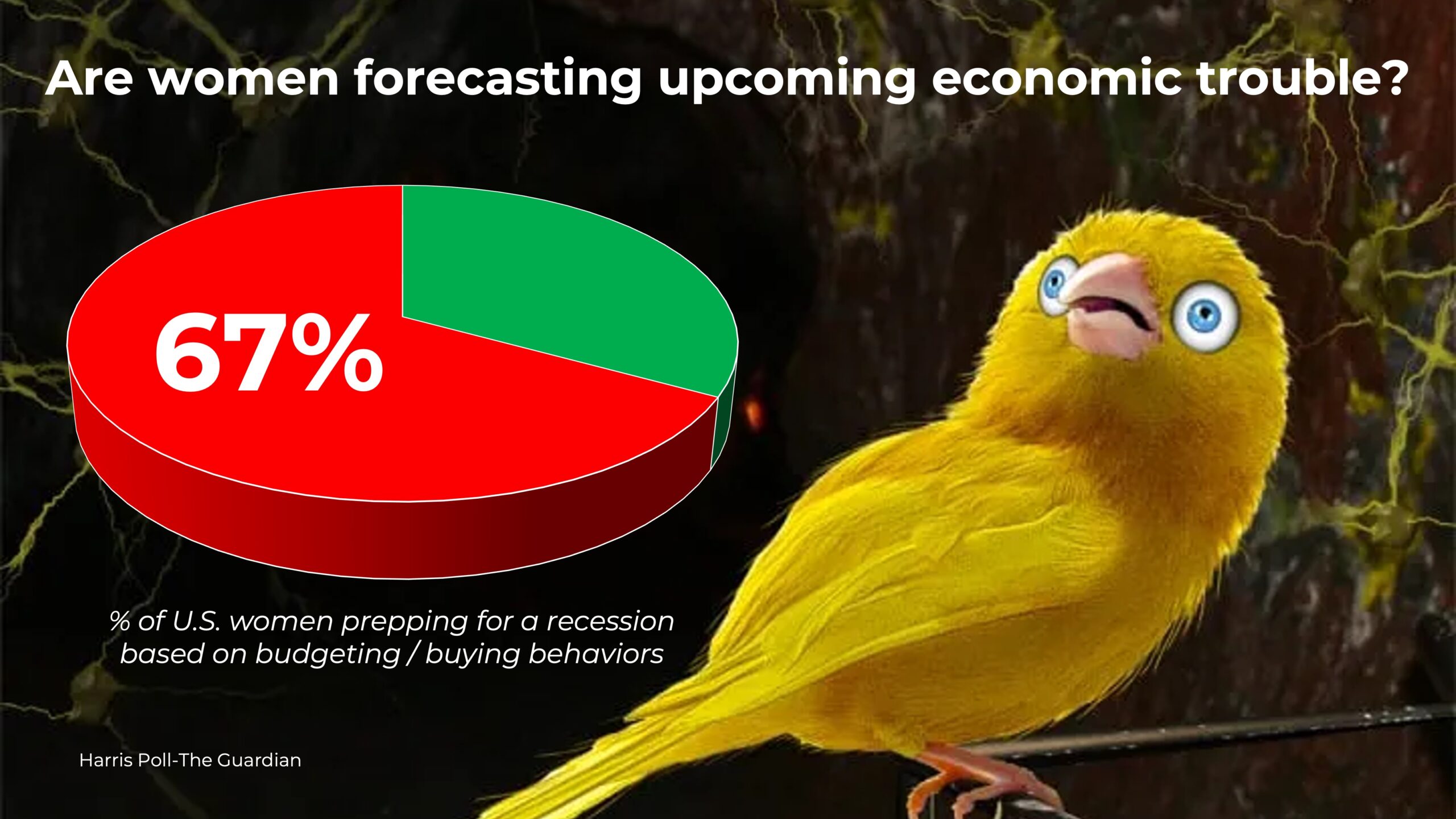

WHAT THE DATA SAY: 62% of women say the economy is worsening, versus 47% of men