Weekly Data

WHAT THE DATA SAY: 45% of young people say the job market is broken

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from Stagwell. Among the highlights of our weekly consumer sentiment tracking:

LINGERING INFLATION CONCERNS

Fewer Americans say the country is on the right track, and inflation concerns remain high, based on our July Harvard CAPS / Harris Poll.

- 40% say the country is on the right track – down from 41% in June.

- 38% say the U.S. economy is on the right track – down from 39% in June.

- 43% say their personal financial situation is getting worse (up 4 points since May).

- Democrats, Independents, women, older, Black and rural Americans are more likely to say their finances are getting worse.

- Inflation (32%) and immigration (29%) remain the top two issues, consistent with June.

- 24% say healthcare is the most important issue – up from 18% in June.

- 45% say inflation is the most important issue to them personally – up from 39% last month.

- Americans are split on how the Big Beautiful Bill will affect the economy (52% say it will make the economy worse, and 48% say it will improve it).

- See also: Half of Active Duty Military Report “Just Getting By” Financially

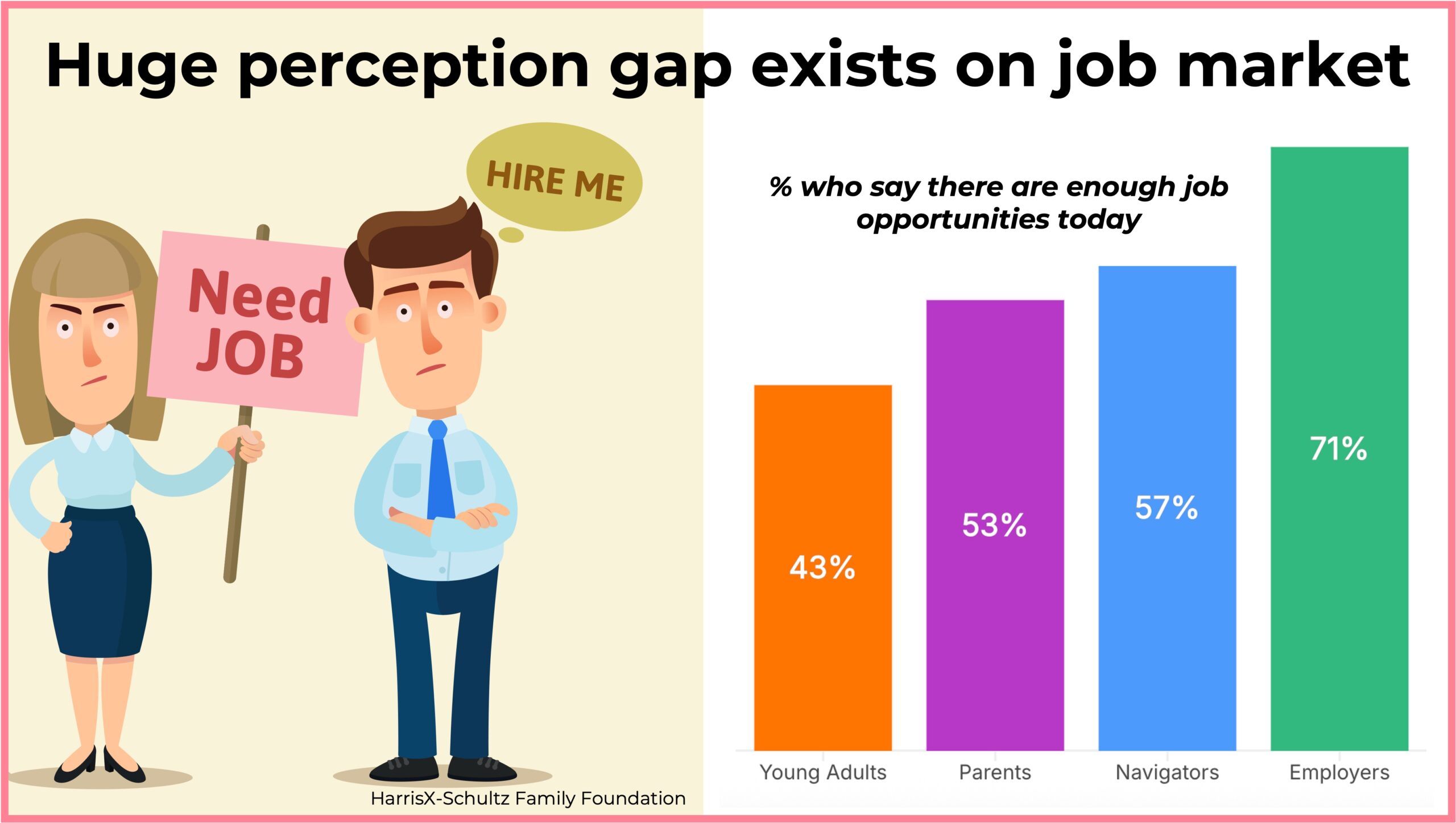

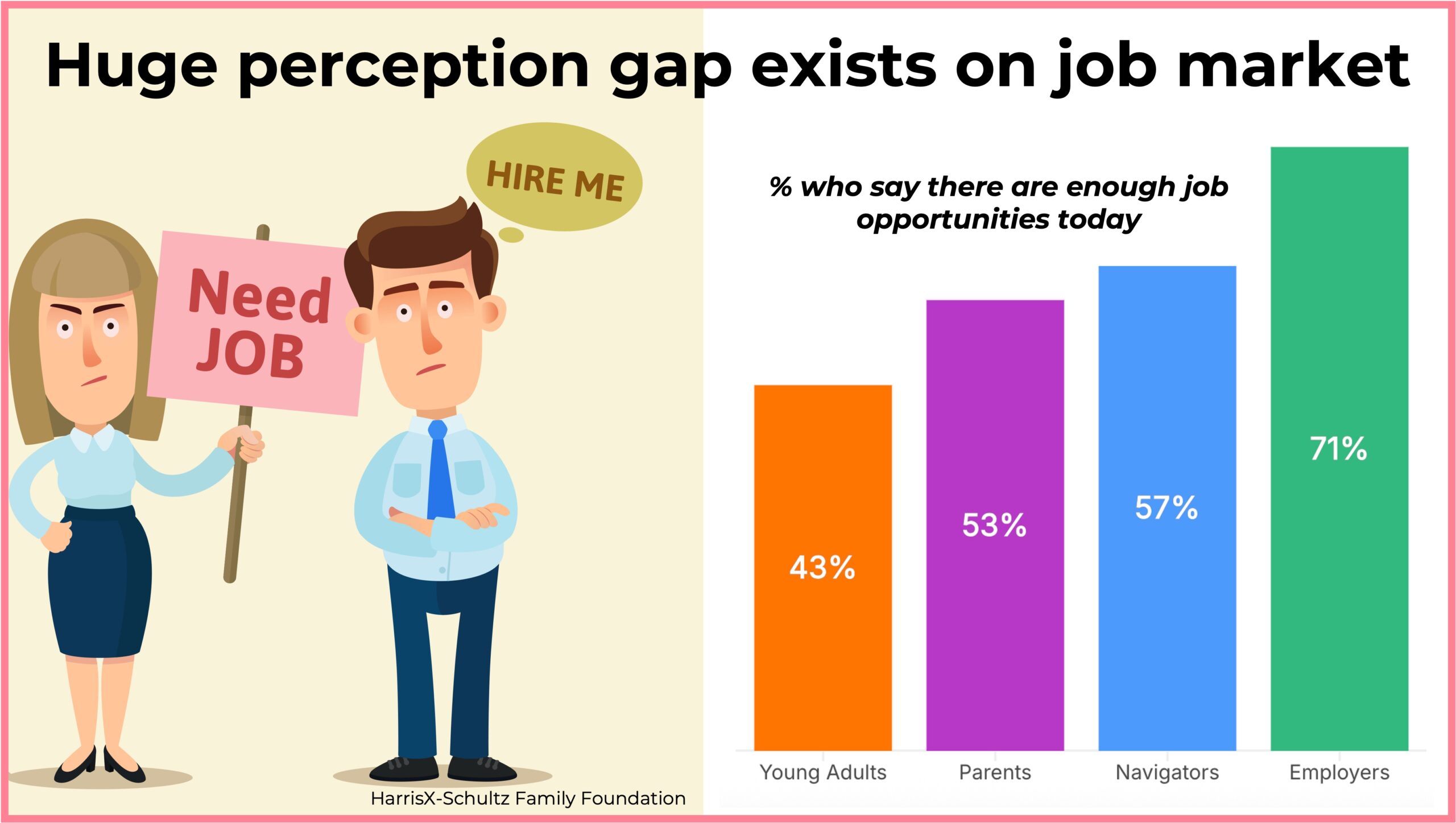

NO JOBS FOR YOUNG PEOPLE

Young Americans are facing uncertain futures as they feel unprepared, unsupported and anxious about navigating today’s career landscape, according to our HarrisX study with the Schultz Family Foundation.

- 1 in 3 young adults say a career is the area in life most important to their success.

- 57% are concerned or unsure whether there will be enough job opportunities in the market.

- 46% feel unprepared for jobs of the future.

- 54% are concerned about whether AI will replace the jobs they seek.

- 45% describe the job market as broken and lacking meaningful guidance.

- 48% say they don’t know where to look for educational and career opportunities.

- 65% are still trying to discover what motivates them or where their passions lie.

- Parents and young people are disconnected: 71% of parents say their child had an easy time finding a job, while only 52% of young adults say the same.

- 40% of young adults and 66% of parents believe the American Dream is achievable.

TALKING FINANCE ON THE FIRST DATE?

Americans, especially younger generations, are prioritizing positive financial habits over looks in prospective romantic partners, according to our Harris Poll survey with the Current.

- Low or no debt (33%) and a strong credit score (30%) are more powerful attractors than physical appearances.

- Gen Z (19%) and Millennials (22%) say bad credit is a bigger turnoff than bad hygiene.

- 33% of Gen Z and Millennials say a potential partner’s emergency savings is more attractive than their looks (23% of Gen X and 18% of Boomers).

- Younger generations are more likely to end a relationship due to debt: 19% for Gen Z and 17% for Millennials versus 8% for Gen X and 5% for Boomers.

- 39% of Americans think improving their credit score could bolster a couple’s bonds.

FRUGAL BACK-TO-SCHOOL

Tariff-related price increases multiply the economic stress anticipated by families during the back-to-school shopping season, according to our Harris Poll report with NerdWallet.

- 56% of parents say the back-to-school season is financially stressful.

- 23% say they’ll use “Buy Now, Pay Later” services for back-to-school purchases.

- 26% have already purchases tech items for the school year to avoid tariff price increases.

- Other saving strategies include buying different brands (39%), shopping with different retailers (35%) and cutting back on clothing (27%) and supplies (25%) purchases.

- 25% say they’ll seek out free options for this year’s school supplies.

ICYMI: In case you missed it, check out the thought-leadership and happenings around Stagwell making news:

Newsletter

Sign Up

Related

Articles

In the News, Press Releases

Jul 14, 2025

JULY HARVARD CAPS / HARRIS POLL: OPINIONS ON “BIG BEAUTIFUL BILL” SPLIT WITH 44% OF VOTERS SUPPORTING IT, BUT MOST POLICIES HAVE MAJORITY SUPPORT WITH MANY POPULAR TAX CUTS

Weekly Data

Jul 10, 2025

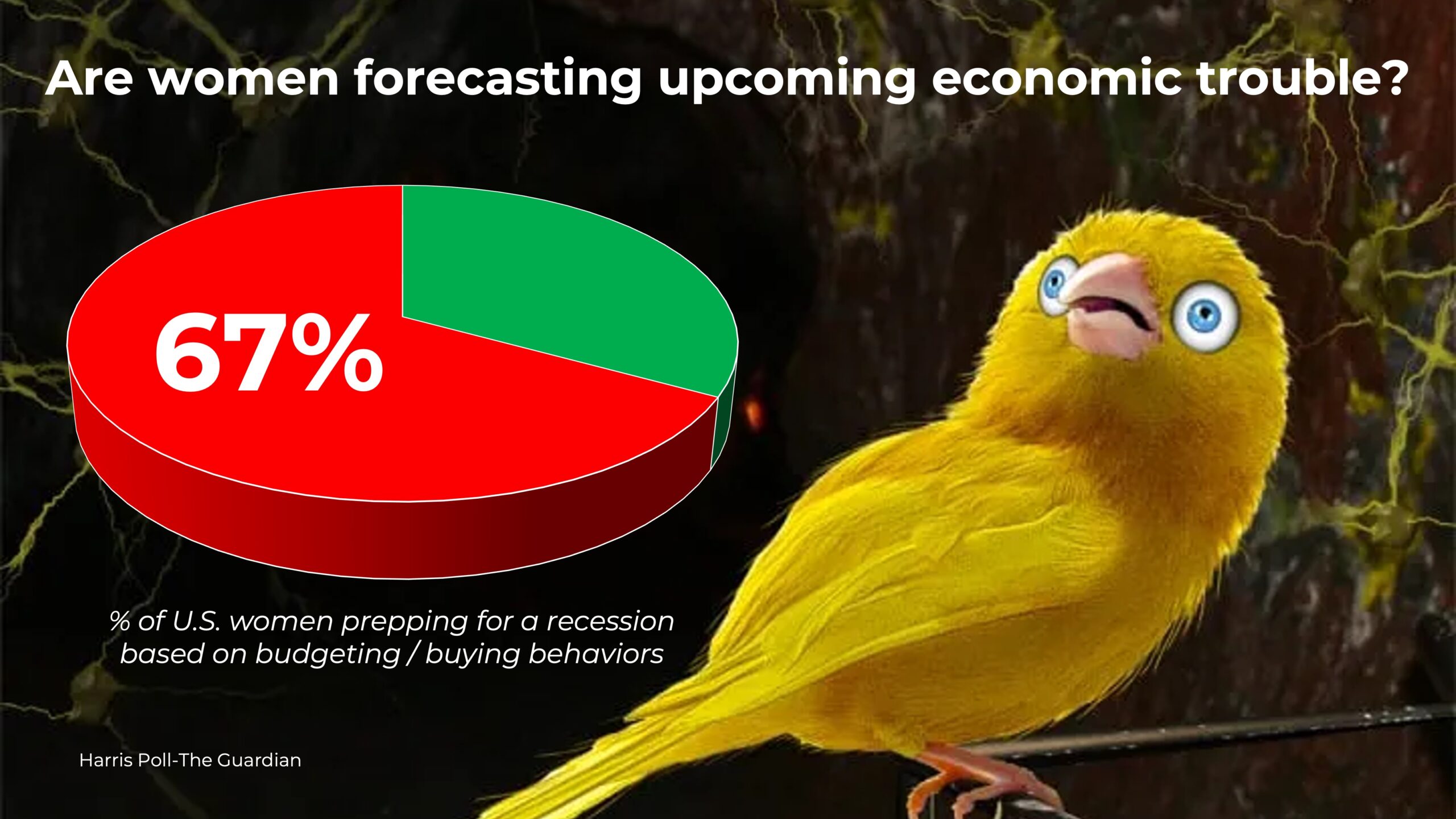

WHAT THE DATA SAY: 62% of women say the economy is worsening, versus 47% of men